Italy Self-Monitoring Blood Glucose Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Self-Monitoring Blood Glucose Meters, Testing Strips), By Application (Type 1 Diabetes, Type 2 Diabetes), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Sales), and Italy Self-Monitoring Blood Glucose Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareItaly Self-Monitoring Blood Glucose Devices Market Insights Forecasts to 2035

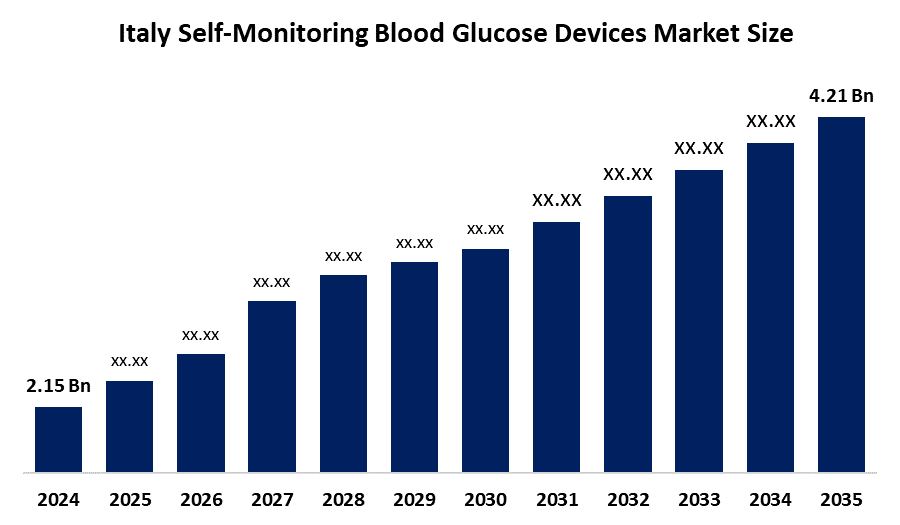

- The Italy Self-Monitoring Blood Glucose Devices Market Size Was Estimated at USD 2.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.3% from 2025 to 2035

- The Italy Self-Monitoring Blood Glucose Devices Market Size is Expected to Reach USD 4.21 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Italy self-monitoring blood glucose devices market size is anticipated to reach USD 4.21 billion by 2035, growing at a CAGR of 6.3% from 2025 to 2035. Italy self-monitoring blood glucose devices market is driven by rising diabetes prevalence, aging population, growing awareness of regular glucose monitoring, adoption of home-based healthcare, technological advances in digital glucometers, and strong government support for diabetes management and reimbursement policies.

Market Overview

The Italy self-monitoring blood glucose (SMBG) devices market includes glucose meters, test strips, lancets, and accessories that help people with diabetes monitor blood sugar levels at home or outside clinical settings. These devices support daily diabetes management, timely treatment decisions, and complication prevention. Market growth is driven by the rising prevalence of diabetes, especially Type 2 diabetes linked to an aging population, sedentary lifestyles, and changing diets. Growing patient awareness, preference for home-based self-care, favorable reimbursement policies, government diabetes programs, and a strong healthcare infrastructure further boost market adoption.

Several notable trends are shaping the Italy SMBG devices market. First, the integration of digital and connected features is expanding, with Bluetooth-enabled glucometers and mobile applications allowing users to track, store, and share glucose data easily. Second, there is a growing focus on user-friendly and compact device designs that enhance convenience, portability, and compliance among elderly patients. Third, personalized diabetes management is gaining traction, as manufacturers develop solutions tailored to individual monitoring needs, frequency, and lifestyle preferences. Fourth, the market is witnessing a shift toward preventive care, where regular monitoring is encouraged not only for diagnosed patients but also for high-risk individuals, supporting early detection and better disease control.

Technological progress is a major driver of innovation in the Italy SMBG devices market. Modern glucose meters now offer higher accuracy, faster testing times, and reduced blood sample requirements, improving patient comfort and reliability. Smart glucometers integrated with mobile apps and cloud-based platforms enable data analytics, trend visualization, and remote monitoring by healthcare professionals. Artificial intelligence and algorithm-based insights are increasingly used to support better interpretation of glucose patterns and treatment adjustments. Additionally, advancements in sensor technology and interoperability with digital health ecosystems are narrowing the gap between traditional SMBG and continuous glucose monitoring systems. These technological developments are enhancing patient engagement, improving clinical outcomes, and strengthening the overall growth potential of the market.

Report Coverage

This research report categorizes the market for the Italy self-monitoring blood glucose devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy self-monitoring blood glucose devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy self-monitoring blood glucose devices market.

Italy Self-Monitoring Blood Glucose Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.15 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.3% |

| 2035 Value Projection: | USD 4.21 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Roche Diabetes Care, Abbott Laboratories, Ascensia Diabetes Care, LifeScan (Johnson & Johnson), Sinocare, Bionime Corporation, Menarini Diagnostics, Rossmax International Ltd., Arkray Inc., Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy self-monitoring blood glucose devices market is driven by the increasing prevalence of diabetes, particularly Type 2 diabetes, due to an aging population, obesity, and sedentary lifestyles. Rising awareness about the importance of regular glucose monitoring for effective disease management supports demand. The growing shift toward home-based healthcare and self-care practices further accelerates adoption. Additionally, favorable reimbursement policies, government-supported diabetes management initiatives, and continuous technological advancements in accurate, user-friendly, and connected glucose monitoring devices contribute significantly to sustained market growth across Italy.

Restraining Factors

The Italy self-monitoring blood glucose devices market faces restraints such as the high cost of test strips and advanced devices, which can limit frequent usage. Patient discomfort from finger-prick testing and the growing preference for continuous glucose monitoring systems also reduce reliance on traditional SMBG devices, particularly among younger users.

Market Segmentation

The Italy self-monitoring blood glucose devices market share is classified into product, application, and distribution channel.

- The testing strips segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy self-monitoring blood glucose devices market is segmented by product into self-monitoring blood glucose meters and testing strips. Among these, the testing strips segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The testing strips segment dominates the market because strips are consumable products that require frequent and continuous replacement for every glucose test, leading to recurring demand. Diabetic patients often test multiple times daily, increasing strip consumption compared to one-time meter purchases. Additionally, reimbursement support for test strips, wide availability across pharmacies, and compatibility with existing meters further strengthen their dominant market share in Italy.

- The type 2 diabetes segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy self-monitoring blood glucose devices market is segmented by application into type 1 diabetes and type 2 diabetes. Among these, the type 2 diabetes segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The type 2 diabetes segment dominates the market due to the significantly higher prevalence of type 2 diabetes compared to type 1 in Italy. Lifestyle factors such as an aging population, obesity, and physical inactivity contribute to a growing patient base requiring regular glucose monitoring. Many type 2 patients use SMBG devices for daily management, medication adjustment, and complication prevention, leading to higher overall device and consumable usage.

- The retail pharmacies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy self-monitoring blood glucose devices market is segmented by distribution channel into hospital pharmacies, retail pharmacies, and online sales. Among these, the retail pharmacies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The retail pharmacies segment dominates the market due to their widespread presence, easy accessibility, and trusted role in chronic disease management. Most patients regularly purchase glucose meters, test strips, and lancets from nearby pharmacies using prescriptions or reimbursements. Pharmacist guidance, immediate product availability, and strong integration with Italy’s healthcare reimbursement system further encourage patients to prefer retail pharmacies over hospital pharmacies or online sales.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy self-monitoring blood glucose devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Roche Diabetes Care

- Abbott Laboratories

- Ascensia Diabetes Care

- LifeScan (Johnson & Johnson)

- Sinocare

- Bionime Corporation

- Menarini Diagnostics

- Rossmax International Ltd.

- Arkray Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In January 2022, Roche launched its new point-of-care blood glucose monitor designed for hospital professionals, with a companion device shaped like a touchscreen smartphone that will run its own apps. The hand-held Cobas Pulse included an automated glucose test strip reader as well as a camera and touchscreen for logging other diagnostic results. It was designed to be used with patients of all ages, including neonates and people in intensive care.

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy self-monitoring blood glucose devices market based on the below-mentioned segments:

Italy Self-Monitoring Blood Glucose Devices Market, By Product

- Self-Monitoring Blood Glucose Meters

- Testing Strips

Italy Self-Monitoring Blood Glucose Devices Market, By Application

- Type 1 Diabetes

- Type 2 Diabetes

Italy Self-Monitoring Blood Glucose Devices Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Sales

Frequently Asked Questions (FAQ)

-

1. What is the Italy self-monitoring blood glucose devices market?It is a market for devices like glucose meters, test strips, and lancets that allow diabetic patients to measure and track blood sugar levels at home or outside clinical settings.

-

2. What are the key driving factors for this market?Rising diabetes prevalence, aging population, growing patient awareness, preference for home-based monitoring, favorable reimbursement policies, and technological advancements drive market growth.

-

3. Which product segment dominates the market?The testing strips segment dominates due to frequent consumption for daily glucose testing.

-

4. Which application segment holds the largest share?The type 2 diabetes segment leads because of its higher prevalence in Italy.

-

5. Which distribution channel is most popular?Retail pharmacies dominate, offering accessibility, pharmacist guidance, and reimbursement support.

-

6. Who are the key companies in this market?Roche Diabetes Care, Abbott Laboratories, Ascensia Diabetes Care, LifeScan (Johnson & Johnson), Sinocare, Bionime Corporation, Menarini Diagnostics, Rossmax International Ltd., Arkray Inc., Medtronic PLC, Dexcom Inc., Sanofi, B. Braun Melsungen AG, i‑Sens Inc.

-

7. What are the major trends in the market?Digital and connected devices, personalized monitoring solutions, preventive care, and eco-friendly designs are shaping the market.

-

8. What technological advancements are influencing the market?Smart glucometers, cloud integration, AI-based analytics, advanced biosensors, and interoperability with digital health platforms are enhancing accuracy and patient convenience.

Need help to buy this report?