Italy Sealants Market Size, Share, and COVID-19 Impact Analysis, By End User Industry (Aerospace, Automotive, Building and Construction, Healthcare), By Resin (Acrylic, Epoxy, Polyurethane, Silicone), and Italy Sealants Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsItaly Sealants Market Insights Forecasts to 2035

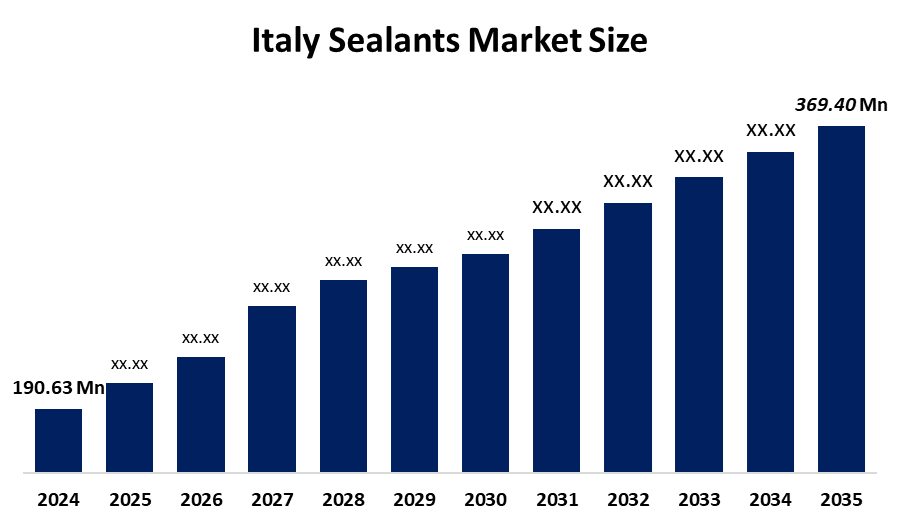

- The Italy Sealants Market Size Was Estimated at USD 190.63 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.2% from 2025 to 2035

- The Italy Sealants Market Size is Expected to Reach USD 369.40 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Italy Sealants Market Size is anticipated to reach USD 369.40 Million by 2035, Growing at a CAGR of 6.2% from 2025 to 2035. The Italy sealants market is driven by rapid construction and renovation activities, growing demand for durable and weather-resistant materials, increasing use in automotive and industrial applications, rising awareness of energy-efficient sealing solutions, and government regulations promoting building safety and sustainability.

Market Overview

Sealants refer to substances that close off spaces, fissures, or joints between surfaces to prevent water, air, dust, or dirt from permeating. They enable buildings, vehicles, and equipment to be their stronger selves and, at the same time, more durable. The most common are silicone, polyurethane, and acrylic. Sealants are everywhere, in the building industry, in household repairs, and in the safety and durability industrial applications. In addition, the market for such products is booming as a result of the construction and infrastructure projects, renovation activities, energy, efficient and weather-resistant buildings demand, automotive and industrial applications, and adoption of advanced, durable sealant technologies leading to sustainability and long-term performance.

The Italian construction market was down 23% in 2020 as Italy was among the countries that suffered most from the COVID-19 pandemic. In 2021, the market came back to life and grew by 16.59%. The Italian government, according to the European Commission, announced some measures to revitalize the residential and housing sector. Italy has prolonged the super bonus, a tax deduction of 110%, until June 30, 2022, under its 2021 Budget Law. Besides, the government is actively promoting construction subsidies by investing at least USD 20, 000 per house in certain cities, to encourage population growth through the support of residents' stays. These measures are expected to boost housing construction, especially as construction costs in Italy are significantly lower than in many other parts of Europe, particularly for vacation homes.

the year 2021 witnessed continued growth in the Italian EV market. In recent years, electric vehicle sales increased sixfold in just three years. Similarly, the market share of electric vehicles increased to 4.6% in 2021. Thus, it is expected to improve the market for adhesives and sealants in the country.

Report Coverage

This research report categorizes the market for the Italy sealants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy sealants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy sealants market.

Italy Sealants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 190.63 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.2% |

| 2035 Value Projection: | USD 369.40 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Resin |

| Companies covered:: | Sika AG, Mapei S.p.A., Henkel AG & Co. KGaA, 3M Company, Bostik (Arkema Group), Dow Inc., H.B. Fuller Company, Soudal Holding N.V., Tremco CPG, Master Builders Solutions, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy sealants market is driven by strong growth in the construction and renovation sectors, fueled by government initiatives like the extended super bonus for residential projects and subsidies promoting housing development. Rising demand for durable, weather-resistant, and energy-efficient buildings, along with increased use of sealants in automotive and industrial applications, further boosts the market. Additionally, advancements in sealant technologies, such as eco-friendly and high-performance formulations, are encouraging adoption across commercial, residential, and infrastructure projects, supporting long-term market growth.

Restraining Factors

The Italy sealants market faces restraints from the high cost of advanced sealant materials, volatile raw material prices, and stringent environmental regulations. Limited awareness of modern sealant technologies among small-scale builders, coupled with competition from traditional construction methods, slows adoption. Economic uncertainties and disruptions in the construction sector, such as those caused by pandemics or labor shortages, also hinder market growth.

Market Segmentation

The Italy sealants market share is classified into end-user industry and resin.

- The building and construction segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy sealants market is segmented by end-user industry into aerospace, automotive, building and construction, and healthcare. Among these, the building and construction segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The building and construction segment dominates because construction activities, including residential, commercial, and infrastructure projects, drive the highest demand for sealants. Government initiatives such as the extended 110% super bonus and housing subsidies encourage renovations and new constructions, further boosting demand. Sealants are essential for ensuring durability, weather resistance, and energy efficiency in buildings. Compared to other industries like automotive, aerospace, or healthcare, the volume of sealant usage in construction is significantly higher, making it the leading segment.

- The silicone segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy sealants market is segmented by resin into acrylic, epoxy, polyurethane, and silicone. Among these, the silicone segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The silicone segment dominates the market because silicone sealants offer superior flexibility, durability, and resistance to extreme temperatures, UV radiation, and moisture, making them ideal for construction, building maintenance, and industrial applications. They provide long-lasting sealing solutions for joints, windows, doors, and facades, ensuring energy efficiency and structural integrity. Compared to acrylic, epoxy, and polyurethane sealants, silicone’s versatility, ease of application, and low maintenance requirements drive higher adoption, solidifying its position as the leading resin type in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy sealants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sika AG

- Mapei S.p.A.

- Henkel AG & Co. KGaA

- 3M Company

- Bostik (Arkema Group)

- Dow Inc.

- H.B. Fuller Company

- Soudal Holding N.V.

- Tremco CPG

- Master Builders Solutions

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy sealants market based on the below-mentioned segments:

Italy Sealants Market, By End User Industry

- Aerospace

- Automotive

- Building and Construction

- Healthcare

Italy Sealants Market, By Resin

- Acrylic

- Epoxy

- Polyurethane

- Silicone

Frequently Asked Questions (FAQ)

-

Why are sealants important in Italian construction?Sealants prevent leaks, improve building longevity, and ensure energy efficiency, making them essential in Italy’s growing renovation and residential construction projects

-

How has government policy affected the sealants market?Initiatives like the 110% super bonus and housing subsidies have increased demand for high-quality sealants in new builds and renovations

-

Which material type is most preferred by Italian builders?Silicone is favored for its durability, flexibility, and resistance to extreme weather and UV exposure.

-

Are sealants used outside construction in Italy?Yes, industries like automotive, aerospace, and manufacturing use sealants for bonding, insulation, and protective coatings.

-

What limits small players from adopting modern sealants?High product costs, limited awareness, and complex application methods restrict adoption among smaller contractors

-

Is Italy moving toward eco-friendly sealants?Yes, low-VOC and environmentally safe sealants are increasingly popular due to sustainability trends and stricter building regulations.

-

How did COVID-19 impact the sealants market?Construction slowdowns in 2020 temporarily reduced demand, but the recovery in 2021 boosted sealant usage significantly.

-

What are future opportunities for the market?Growth in green building projects, affordable housing, and infrastructure upgrades will expand sealant demand in Italy.

-

Are imported sealants popular in Italy?Both domestic and international brands are used, with a preference for high-performance products meeting European standards.

-

Can sealants improve energy efficiency in buildings?Yes, proper sealing reduces air leakage, enhancing insulation and lowering heating and cooling costs in Italian homes.

Need help to buy this report?