Italy Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Method (Cash, Cards, Digital Wallets, Bank Transfers, Mobile Payments), By End-User (Retail, E-Commerce, Hospitality, Travel), By Technology (POS Terminals, Mobile POS, Online Payment Gateways), and Italy Payments Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialItaly Payments Market Insights Forecasts To 2035

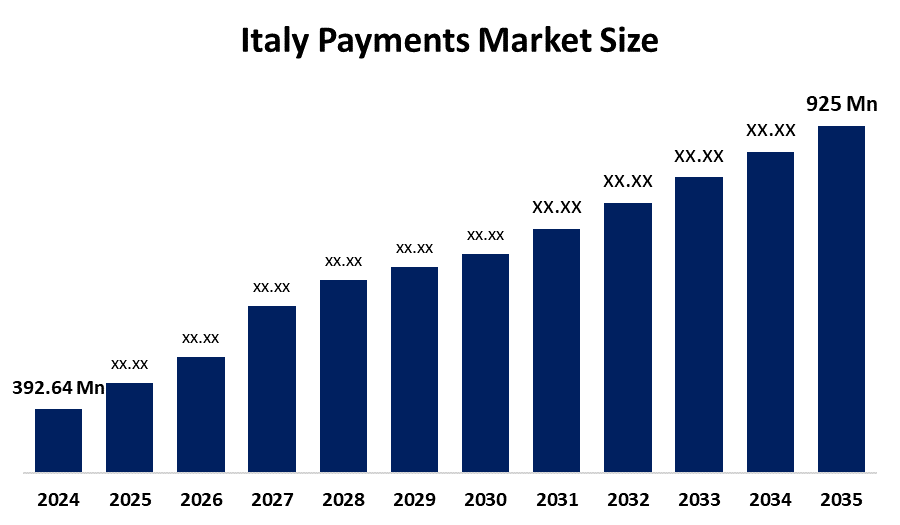

- The Italy Payments Market Size Was Estimated At USD 392.64 Billion In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 8.1% From 2025 To 2035

- The Italy Payments Market Size Is Expected To Reach USD 925 Billion By 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Italy Payments Market Size Is Anticipated To Reach USD 925 Billion By 2035, Growing At A CAGR Of 8.1% From 2025 To 2035. Italy’s payments market is driven by rapid digitalization, rising e-commerce transactions, widespread smartphone and internet usage, government support for cashless payments, growth of contactless cards, fintech innovation, and increasing consumer preference for fast, secure, and convenient digital payment solutions.

Market Overview

Payments Refer To The Transfer Of Money Or Value From One Party To Another To Settle Transactions For Goods, Services, Or Obligations. They can be made using cash, cards, bank transfers, digital wallets, or online platforms, enabling individuals and businesses to conduct secure, timely, and efficient financial transactions. Furthermore, growth in Italy’s payments market is fueled by expanding digital infrastructure, rising adoption of contactless and mobile payments, growth of e-commerce, fintech innovation, supportive government policies promoting cashless transactions, and increasing consumer trust in secure, fast, and convenient digital payment methods.

The Italian Government Has Implemented Several Initiatives To Promote A Cashless Economy, Including The "Cashless Italy" Program, Which Aims To Reduce Cash Transactions By 50% In The Future. In the future, the government allocated €1 billion to incentivize digital payments, resulting in a 40% increase in cashless transactions. These initiatives are crucial in fostering a secure and efficient payment ecosystem, encouraging both consumers and businesses to adopt digital solutions.

Technology In Italy’s Payments Market Size Includes Contactless NFC Cards, Mobile Wallets, QR Code Payments, And Real-Time Bank Transfers. Advanced cybersecurity, biometric authentication, AI-based fraud detection, cloud platforms, and open banking APIs support secure, fast, and interoperable digital payment systems across retail, e-commerce, and financial services.

Report Coverage

This Research Report Categorizes The Market For The Italy Payments Market Size Based On Various Segments And Regions, And Forecasts Revenue Growth And Analyses Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy payments market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy payments market.

Italy Payments Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 392.64 Billion |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 8.1% |

| 2023 Value Projection: | 925 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Payment Method By Technology |

| Companies covered:: | Nexi S.p.A., Worldline S.A. (including equensWorldline), UniCredit S.p.A., Intesa Sanpaolo S.p.A., PayPal Holdings, Inc., Stripe, Inc., Mastercard Incorporated, Visa Inc., Adyen N.V., and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Italy’s Payments Market Size Is Driven By Rapid Digital Transformation, Increasing Smartphone Penetration, And Widespread Internet Access. Growth in e-commerce, rising consumer preference for contactless and cashless transactions, and strong fintech innovation further support adoption. Government initiatives encouraging electronic payments, regulatory support for open banking, improved payment security, and merchant acceptance of digital solutions are also key driving factors accelerating market expansion.

Restraining Factors

Italy’s Payments Market Size Is Restrained By Continued Reliance On Cash, Especially Among Older Populations And Small Merchants. High transaction fees, cybersecurity concerns, data privacy issues, and limited digital literacy in some regions also slow adoption. Regulatory compliance costs further challenge smaller payment service providers and merchants.

Market Segmentation

The Italy payments market share is classified into payment method, end user, and technology.

- The cards segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy Payments Market Size Is Segmented By Payment Method Into Cash, Cards, Digital Wallets, Bank Transfers, And Mobile Payments. Among these, the cards segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Cards are widely accepted across merchants, with a strong banking infrastructure and a high penetration of debit cards. Government incentives promoting electronic payments, the growth of contactless technology, and consumer trust in card security have accelerated usage. Cards are also deeply integrated with POS systems, e-commerce platforms, and everyday transactions, making them more convenient than cash. Additionally, card networks benefit from established regulations, interoperability, and familiarity among consumers and businesses across Italy.

- The retail segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy Payments Market Size Is Segmented By End User Into Retail, E-Commerce, Hospitality, And Travel. Among these, the retail segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Retail dominates because of its high frequency of daily consumer transactions and extensive network of physical stores. Supermarkets, convenience stores, and specialty retailers widely accept card and contactless payments, supported by strong POS penetration. Government measures encouraging electronic payments and reducing cash usage have further boosted retail digital transactions. Compared with e-commerce, hospitality, and travel, retail generates higher transaction volumes, making it the leading end-user segment in Italy’s payments market.

- The POS terminals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy Payments Market Size Is Segmented By Technology Into POS Terminals, Mobile POS, And Online Payment Gateways. Among these, the POS terminals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. POS terminals dominate due to their widespread installation across retail stores, supermarkets, restaurants, and service outlets. Strong card usage, high contactless adoption, and regulatory support for electronic payments have driven merchants to maintain traditional POS systems. These terminals offer reliable, secure, and fast transaction processing and are well integrated with banking networks. Compared to mobile POS and online payment gateways, POS terminals handle a larger share of daily in-store transactions, ensuring their dominant market position.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Italy Payments Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nexi S.p.A.

- Worldline S.A. (including equensWorldline)

- UniCredit S.p.A.

- Intesa Sanpaolo S.p.A.

- PayPal Holdings, Inc.

- Stripe, Inc.

- Mastercard Incorporated

- Visa Inc.

- Adyen N.V.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy payments market based on the below-mentioned segments:

Italy Payments Market, By Payment Method

- Cash

- Cards

- Digital Wallets

- Bank Transfers

- Mobile Payments

Italy Payments Market, By End-User

- Retail

- E-Commerce

- Hospitality

- Travel

Italy Payments Market, By Technology

- POS Terminals

- Mobile POS

- Online Payment Gateways

Frequently Asked Questions (FAQ)

-

What is the Italy payments market?It refers to the ecosystem of cash, card, digital wallet, mobile, and bank transfer transactions used by consumers and businesses in Italy.

-

What are the dominant payment methods in Italy?Cards, including debit and credit, are the most widely used payment method, followed by digital wallets and cash.

-

Which end-user segment dominates the Italy payments market?Retail is the leading segment due to high transaction volumes in physical stores.

-

What technologies are most used for payments in Italy?POS terminals dominate, supported by mobile POS and online payment gateways.

-

Who are the key players in Italy’s payments market?Nexi, Worldline, Intesa Sanpaolo, UniCredit, PayPal, Stripe, Visa, Mastercard, Adyen, BANCOMAT, Poste Italiane, Satispay, and Klarna.

-

What factors are driving growth in Italy’s payments market?Digitalization, e-commerce growth, contactless payments, fintech innovation, and government initiatives promoting cashless transactions.

-

What are the main challenges in the market?Continued cash usage, cybersecurity risks, regulatory compliance costs, and limited digital literacy in some regions.

Need help to buy this report?