Italy Paper Packaging Market Size, Share, and COVID-19 Impact Analysis, By Material (Virgin Fibre, Recycled Fibre, and Other), By End-User Industry (Food and Beverage, Healthcare and Pharmaceuticals, and Other), and Italy Paper Packaging Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsItaly Paper Packaging Market Insights Forecasts to 2035

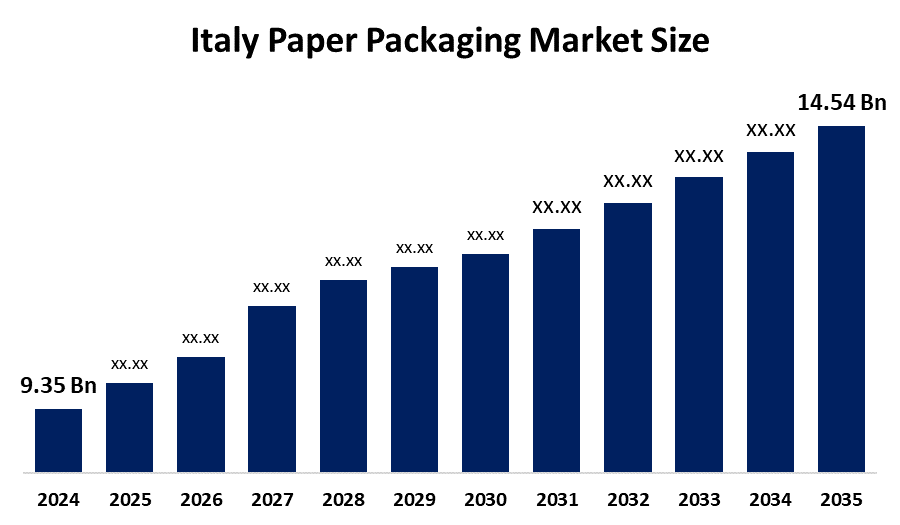

- The Italy Paper Packaging Market Size Was Estimated at USD 9.35 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.1% from 2025 to 2035

- The Italy Paper Packaging Market Size is Expected to Reach USD 14.54 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Italy paper packaging market size is anticipated to reach USD 14.54 billion by 2035, growing at a CAGR of 4.1% from 2025 to 2035. Italy’s paper packaging market is driven by rising demand for sustainable and recyclable packaging, growth of food and beverage consumption, expansion of e-commerce, strict EU environmental regulations, and increasing preference for lightweight, cost-effective packaging solutions across industries.

Market Overview

Italy's paper packaging market means the buying and selling of paper, based materials such as cartons, corrugated boxes, paper bags, and wraps that are used for packaging, transporting, and marketing goods. The market is growing gradually as a result of increased environmental awareness, the demand for recyclable and biodegradable packaging, and the food, beverage, and personal care industries being the main consumers. The growth of e-commerce and retail sectors, as well as stringent EU regulations on plastics, are additional factors that support the market. Italy's strong manufacturing base and the emphasis on premium packaging for branded products also play a part in consistent demand.

Some of the key trends driving the market are companies shifting towards sustainable packaging by using recyclable, compostable, and responsibly sourced paper to meet their environmental goals. Another trend is lightweight packaging, which is when manufacturers use less material without compromising the product's strength to reduce transportation costs and emissions. Customization and premiumization are particularly popular in the luxury food, wine, and fashion sectors, where attractive designs increase the brand's value. Besides that, the expansion of e-commerce packaging is noteworthy, and the need for paper packaging solutions that are durable, protective, and easy to handle is growing rapidly.

Technological innovation plays a crucial role in advancing Italy’s paper packaging market. Manufacturers are investing in advanced printing technologies, including digital and flexographic printing, to deliver high-quality graphics and shorter production runs. Automation and smart manufacturing improve efficiency, reduce waste, and ensure consistent quality. New barrier coating technologies enhance moisture and grease resistance, allowing paper packaging to replace plastic in more applications. Moreover, the use of recycled fibers combined with improved strength properties supports circular economy goals and drives long-term market innovation.

Report Coverage

This research report categorizes the market for the Italy paper packaging market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy paper packaging market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy paper packaging market.

Italy Paper Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.35 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.1% |

| 2035 Value Projection: | USD 14.54 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 162 |

| Segments covered: | By Material,By End-User Industry |

| Companies covered:: | Smurfit Kappa Italia S.p.A. DS Smith Packaging Italia S.p.A. International Paper Company Mondi plc Stora Enso Oyj Saica Group S.A. Tetra Pak International SA Carton Pack SpA Fedrigoni S.p.A. Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy paper packaging market is driven by strong demand for sustainable and eco-friendly packaging solutions, supported by strict EU regulations reducing plastic usage. Growth in food and beverage, pharmaceuticals, and personal care industries increases the need for safe and hygienic packaging. Rapid expansion of e-commerce boosts demand for corrugated boxes and protective paper packaging. Rising consumer preference for recyclable materials, along with Italy’s focus on premium branding and export-oriented manufacturing, further accelerates market growth.

Restraining Factors

The Italy paper packaging market faces restraints from fluctuating raw material prices, particularly pulp and recycled paper, which increase production costs. Limited barrier properties compared to plastic restrict certain applications. High energy costs and capital investment requirements for advanced machinery also challenge small and medium-sized manufacturers.

Market Segmentation

The Italy paper packaging market share is classified into material and end-user industry.

- The recycled fibre segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy paper packaging market is segmented by material into virgin fibre, recycled fibre, and other. Among these, the recycled fibre segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The recycled fibre segment dominates the market due to Italy’s strong recycling infrastructure and strict EU regulations promoting circular economy practices. Manufacturers prefer recycled fibre because it lowers raw material costs and reduces environmental impact. Growing demand from e-commerce, food, and retail sectors favors recycled paper for corrugated boxes and cartons. Additionally, increasing consumer awareness about sustainability encourages brands to adopt packaging made from recycled content.

- The food and beverage segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy paper packaging market is segmented by end-user industry into food and beverage, healthcare and pharmaceuticals, and other. Among these, the food and beverage segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The food and beverage segment leads the market due to continuous demand for packaged food, beverages, bakery, and confectionery products. Paper packaging is widely used for cartons, boxes, and wraps because it is lightweight, recyclable, and suitable for food contact. Italy’s strong food processing and export-oriented industry increases the need for attractive and sustainable packaging. Rising consumer preference for eco-friendly food packaging further strengthens this segment’s dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy paper packaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Smurfit Kappa Italia S.p.A.

- DS Smith Packaging Italia S.p.A.

- International Paper Company

- Mondi plc

- Stora Enso Oyj

- Saica Group S.A.

- Tetra Pak International SA

- Carton Pack SpA

- Fedrigoni S.p.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy paper packaging market based on the below-mentioned segments:

Italy Paper Packaging Market, By Material

- Virgin Fibre

- Recycled Fibre

- Other

Italy Paper Packaging Market, By End-User Industry

- Food and Beverage

- Healthcare and Pharmaceuticals

- Other

Frequently Asked Questions (FAQ)

-

1. Why do Italian brands invest heavily in paper packaging design?Italian brands value aesthetics and premium presentation, making paper packaging ideal for visual appeal and customization.

-

2. How does Italy’s recycling culture support paper packaging growth?Strong household and industrial recycling practices ensure the steady availability of recycled fibre for packaging production.

-

3. What role do exports play in paper packaging demand?Italy’s large export of food, wine, and luxury goods increases demand for durable and attractive paper packaging.

-

4. Is paper packaging suitable for high-value products in Italy?It is widely used for luxury food, cosmetics, and fashion due to its premium look.

-

5. How does urbanization affect paper packaging consumption?Urban lifestyles increase demand for packaged and takeaway food, boosting paper packaging use.

Need help to buy this report?