Italy OTC Drugs Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Cough, Cold, and Flu Products, Analgesics, Dermatology Products, Gastrointestinal Products, and Other), By Route of Administration (Oral, Topical, and Parenteral), By Distribution Channel (Retail Pharmacy, Hospital Pharmacy, and E-Pharmacy), and Italy OTC Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareItaly OTC Drugs Market Insights Forecasts to 2035

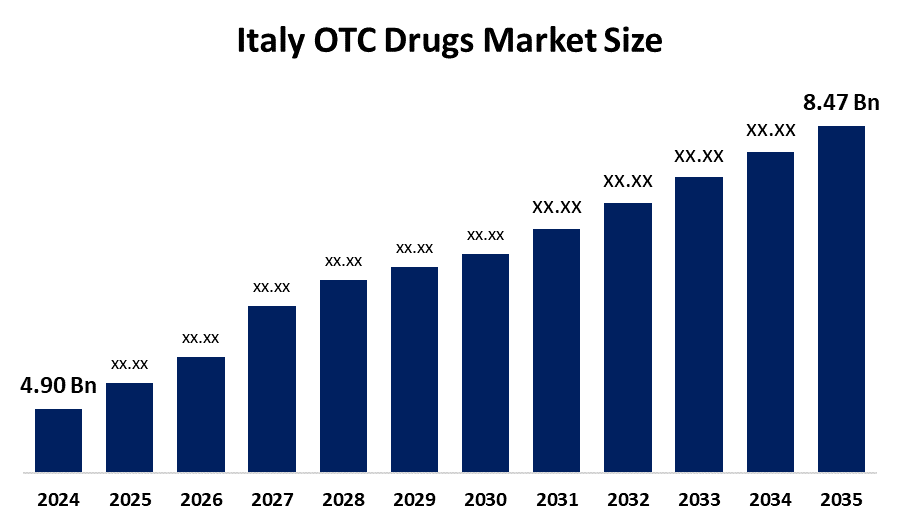

- The Italy OTC Drugs Market Size Was Estimated at USD 4.90 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.1% from 2025 to 2035

- The Italy OTC Drugs Market Size is Expected to Reach USD 8.47 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Italy OTC Drugs Market Size Is Anticipated To Reach USD 8.47 Billion By 2035, Growing At A CAGR of 5.1% From 2025 To 2035. The Italy OTC Drugs Market is driven by rising self-medication trends, increasing consumer health awareness, growing prevalence of chronic and lifestyle-related diseases, easy product availability, expanding e-commerce channels, and government initiatives supporting preventive healthcare and wellness products.

Market Overview

Over-the-counter (OTC) drugs are medications that individuals can purchase without a doctor's prescription. They are meant for treating common health problems such as headaches, colds, allergies, or minor pain. Such drugs are safe when consumers follow the directions, and thus, people can manage their symptoms at home without the need to visit a healthcare professional. Besides that, trending self-care, increasing chronic disease cases, expanding retail and e, commerce channels, old generation, health awareness campaigns, and OTC (over, the, counter) product innovations in safe, effective, and convenient forms, are all factors that contribute to market growth.

The rising number of cases of diseases such as flu, pain, and other common ailments has led to an increase in the practice of self-medication. Italy, for example, witnessed a surge in demand for over, the, counter medicines during the 2020 winter period when there were nearly three million cases of the flu. Italy’s healthcare expenditure for 2022 is expected to be around USD 35.6 billion. This huge spending would probably result in better development and availability of OTC medicines, which in turn will be conducive to market growth.

OTC drugs that contain natural and herbal products are really popular, showing that people want organic and environmentally friendly healthcare solutions. This trend is pushing companies to broaden their product range with plant-based medicines. Moreover, to enhance the customer experience, makers are coming up with novel forms like quick-dissolving tablets, gummies, and sprays. Besides that, easy, to, use and green packaging solutions are becoming more popular, thus, they are in line with the trend of sustainability.

Report Coverage

This research report categorizes the market for the Italy OTC Drugs Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy OTC Drugs Market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy OTC drugs market.

Italy OTC Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.90 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 5.1% |

| 2035 Value Projection: | USD 8.47 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type |

| Companies covered:: | Sanofi S.A. Johnson & Johnson Consumer Inc. Bayer AG GlaxoSmithKline plc (GSK) Pfizer Inc. Reckitt Benckiser Group plc Novartis AG Boehringer Ingelheim GmbH Takeda Pharmaceutical Co. Ltd. Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy OTC Drugs Market Size is primarily driven by rising health awareness and a growing preference for self-medication among consumers seeking convenient healthcare solutions. The increasing prevalence of chronic and lifestyle-related conditions, such as diabetes and allergies, fuels demand. Easy availability through pharmacies, supermarkets, and online platforms enhances accessibility. An aging population and government initiatives promoting preventive care further boost consumption. Additionally, product innovations in safe, effective, and easy-to-use formulations encourage frequent use, supporting consistent market growth in Italy.

Restraining Factors

The Italy OTC Drugs Market Size faces restraints from strict government regulations on drug safety and advertising, which can limit product launches. Misuse or overuse of OTC medications may lead to health risks, deterring some consumers. Additionally, high competition from prescription drugs and generic alternatives, along with limited consumer awareness about certain OTC products, can slow market growth.

Market Segmentation

The Italy OTC drugs market share is classified into product type, route of administration, and distribution channel.

- The analgesics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy OTC Drugs Market Size is segmented by product type into cough, cold, and flu products, analgesics, dermatology products, gastrointestinal products, and other. Among these, the analgesics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Analgesics dominate because pain is a common health issue affecting people of all ages. These medicines provide quick relief from headaches, muscle pain, joint pain, and fever, making them highly in demand. They are easily available in pharmacies, supermarkets, and online stores, and are generally safe for self-medication. Consumers prefer analgesics for their convenience and effectiveness, which leads to frequent and repeated purchases. This consistent demand drives the segment’s market dominance in Italy.

- The oral segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy OTC Drugs Market Size is segmented by route of administration into oral, topical, and parenteral. Among these, the oral segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The oral segment dominates because taking medicine by mouth is simple, convenient, and familiar to most people. Tablets, capsules, and syrups are easy to store, dose, and carry, making them suitable for home use. They effectively treat common conditions like pain, cold, flu, and digestive problems. Compared to topical creams or injections, oral medicines are preferred for quick relief without medical supervision. This ease of use and accessibility drives the oral segment’s market leadership in Italy.

- The retail pharmacy segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy OTC Drugs Market Size is segmented by distribution channel into retail pharmacy, hospital pharmacy, and e-pharmacy. Among these, the retail pharmacy segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Retail pharmacies dominate because they are easily accessible in cities and towns, allowing consumers to buy medicines quickly and conveniently. People trust pharmacists for guidance on the right product and dosage, which increases confidence in purchases. Retail pharmacies stock a wide variety of OTC products, including painkillers, cold remedies, and skincare medicines. Compared to hospital pharmacies, which serve mainly patients, and e-pharmacies, which depend on online ordering, retail outlets remain the most convenient and preferred channel.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy OTC Drugs Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sanofi S.A.

- Johnson & Johnson Consumer Inc.

- Bayer AG

- GlaxoSmithKline plc (GSK)

- Pfizer Inc.

- Reckitt Benckiser Group plc

- Novartis AG

- Boehringer Ingelheim GmbH

- Takeda Pharmaceutical Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy OTC drugs market based on the below-mentioned segments:

Italy OTC Drugs Market, By Product Type

- Cough

- Cold and Flu Products

- Analgesics

- Dermatology Products

- Gastrointestinal Products

- Other

Italy OTC Drugs Market, By Route of Administration

- Oral

- Topical

- Parenteral

Italy OTC Drugs Market, By Distribution Channel

- Retail Pharmacy

- Hospital Pharmacy

- E-Pharmacy

Frequently Asked Questions (FAQ)

-

What does OTC mean?OTC stands for over-the-counter medicines that can be bought without a prescription for everyday health issues

-

Which medicines sell the most?Pain relief drugs are the most popular because people often need quick treatment for headaches, muscle, or joint pain

-

How are these medicines taken?Most people prefer oral forms like tablets, capsules, and syrups due to ease of use

-

Where do people usually buy OTC drugs?Retail pharmacies are the top choice for easy access and advice from pharmacists

-

Why is this market growing?Growth comes from rising self-care habits, health awareness, more pharmacies, and easy online availability

-

What limits market growth?Strict rules, misuse risks, and competition from prescription drugs or generics slow down growth

-

Can people buy OTC drugs online?Yes, online pharmacies are growing, but most consumers still trust local stores

-

Are OTC medicines safe?They are safe if used correctly, but overuse or wrong use may cause health issues

-

What are the current trends?More convenient formulations, e-commerce growth, focus on prevention, and rising self-care practices

Need help to buy this report?