Italy Office Real Estate Market Size, Share, and COVID-19 Impact Analysis, By Property Type (Grade A, Grade B, Grade C), By Business Type (Corporate, Professional Services, Government), By Transaction Type (Rental and Sales), and Italy Office Real Estate Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialItaly Office Real Estate Market Insights Forecasts to 2035

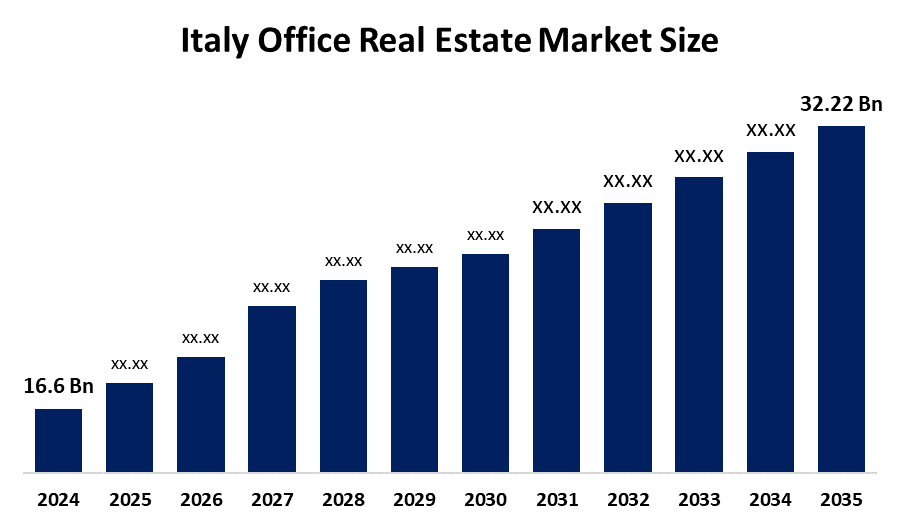

- The Italy Office Real Estate Market Size Was Estimated at USD 16.62 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.2% from 2025 to 2035

- The Italy Office Real Estate Market Size is Expected to Reach USD 32.22 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Italy office real estate market size is anticipated to reach USD 32.22 billion by 2035, growing at a CAGR of 6.2% from 2025 to 2035. The Italy office real estate market is driven by increasing demand for flexible workspaces, growth of multinational companies, urbanization, government incentives for commercial property development, and rising foreign investments, all fostering expansion and modernization of office infrastructure across major cities.

Market Overview

The Italy office real estate market refers to the sector involving the development, leasing, buying, and selling of office properties across Italy. It encompasses commercial office spaces in business districts, city centers, and suburban areas, catering to domestic and multinational companies, startups, and co-working operators, reflecting trends in corporate growth, urbanization, and workspace modernization. Furthermore, the growth of the market is driven by rising demand for modern workspaces, expansion of multinational corporations, increasing adoption of co-working spaces, urbanization trends, and government incentives promoting commercial property development and infrastructure modernization.

The key trends in Italy’s office real estate market are flight to quality, flexible office solutions, and ESG Integration. Flight to quality drives demand for Grade A offices with superior design, amenities, and accessibility, enhancing employee productivity while older buildings struggle to compete. Flexible office solutions grow as co-working spaces expand and landlords adopt hybrid, adaptable leases, especially in Milan, Rome, Turin, and Bologna. ESG Integration attracts tenants and investors to sustainable, energy-efficient, and certified buildings, commanding higher rents and influencing development and investment strategies, shaping a modern, adaptable, and sustainable market.

Government policies and support are playing a key role in boosting Italy’s office real estate market. Incentives such as tax breaks, grants, and subsidies encourage the development and renovation of modern, energy-efficient office spaces. Urban redevelopment programs promote the revitalization of city centers, while regulations favor sustainable and ESG-compliant construction. Policies supporting flexible work models and co-working infrastructure further stimulate demand. Additionally, investment-friendly frameworks attract domestic and foreign investors, collectively enhancing market growth, modernizing office stock, and ensuring competitiveness in Milan, Rome, Turin, Bologna, and other key business hubs.

Report Coverage

This research report categorizes the market for the Italy office real estate market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy office real estate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy office real estate market.

Italy Office Real Estate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 16.62 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.2% |

| 2035 Value Projection: | USD 32.22 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 133 |

| Segments covered: | By Property Type, By Business Type, By Transaction Type |

| Companies covered:: | Hines Italy, Generali Real Estate, Coima RES, Prelios, IGD Siiq, Covivio, BNP Paribas Real Estate Italy, CBRE Italy, JLL Italy, Knight Frank Italy,and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy office real estate market is driven by several key factors. Rising demand for modern, high-quality Grade A offices supports productivity and employee well-being. Expansion of multinational corporations and startups fuels office space requirements, while urbanization and the growth of business districts increase commercial activity. The shift toward flexible work models drives co-working and hybrid office solutions. Additionally, sustainability and ESG considerations attract tenants and investors to energy-efficient, certified buildings. Government incentives, tax benefits, and supportive policies further encourage development and renovation, collectively boosting market growth and modernization.

Restraining Factors

The Italy office real estate market faces restraining factors such as high construction and renovation costs, especially for modern or ESG-compliant buildings. Limited availability of prime city-center spaces and stringent regulatory requirements can slow development. Additionally, economic uncertainties, fluctuating demand due to hybrid work models, and competition from secondary or outdated properties may hinder rental growth and overall market expansion.

Market Segmentation

The Italy office real estate market share is classified into property type, business type, and transaction type.

- The grade A segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy office real estate market is segmented by property type into grade A, grade B, and grade C. Among these, the grade A segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Grade A properties dominate the market because they offer modern design, advanced facilities, and superior accessibility, meeting the needs of multinational corporations and high-end tenants. These offices support employee productivity, well-being, and hybrid work models, making them highly sought after. They also attract investors due to stable rental income and higher premiums. In contrast, Grade B and C buildings face lower demand and often require costly upgrades to remain competitive in the evolving market.

- The corporate segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy office real estate market is segmented by business type into corporate, professional services, and government. Among these, the corporate segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The corporate segment dominates the market because multinational and domestic companies require large, modern, and strategically located office spaces to support operations, collaboration, and hybrid work models. These organizations prioritize Grade A offices with advanced amenities, technology, and accessibility, driving strong demand and rental stability. In contrast, professional services and government offices occupy smaller, specialized spaces and have limited expansion needs. The consistent demand from corporates ensures higher occupancy rates and investment attractiveness, making this segment the primary market driver.

- The rental segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy office real estate market is segmented by transaction type into rental and sales. Among these, the rental segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rental segment dominates the market because businesses prioritize flexibility, lower upfront costs, and adaptability to evolving work models, such as hybrid arrangements. Renting allows companies to access modern, well-located, and Grade A offices without the financial burden and long-term commitment of ownership. Additionally, landlords benefit from steady rental income and higher occupancy rates. In contrast, property sales are less frequent, usually limited to large investors or corporates with long-term strategies, making rentals the primary market driver.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy office real estate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hines Italy

- Generali Real Estate

- Coima RES

- Prelios

- IGD Siiq

- Covivio

- BNP Paribas Real Estate Italy

- CBRE Italy

- JLL Italy

- Knight Frank Italy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy office real estate market based on the below-mentioned segments:

Italy Office Real Estate Market, By Property Type

- Grade A

- Grade B

- Grade C

Italy Office Real Estate Market, By Business Type

- Corporate

- Professional Services

- Government

Italy Office Real Estate Market, By Transaction Type

- Rental

- Sales

Frequently Asked Questions (FAQ)

-

1. What is the Italy office real estate market?The Italy office real estate market involves the development, leasing, buying, and management of office properties across cities like Milan, Rome, Turin, and Bologna.

-

2. What trends are shaping the Italy office real estate market?The Italy office real estate market is influenced by Flight to Quality, Flexible Office Solutions, and ESG Integration, focusing on premium, adaptable, and sustainable office spaces.

-

3. Which office grade dominates the Italy office real estate market?Grade A offices dominate the Italy office real estate market due to modern design, advanced amenities, and strategic locations.

-

4. Which business segment leads in the Italy office real estate market?The corporate segment drives the Italy office real estate market, with large companies demanding modern, flexible workspaces.

-

5. Which transaction type is most common in the Italy office real estate market?Rental transactions dominate the Italy office real estate market, offering flexibility and lower upfront costs compared to purchases.

-

6. How do government policies support the Italy office real estate market?Incentives, tax benefits, and urban redevelopment programs support growth in the Italy office real estate market, encouraging modern and ESG-compliant developments.

-

7. What challenges restrain the Italy office real estate market?High renovation costs, limited prime locations, and economic fluctuations limit growth in the Italy office real estate market.

Need help to buy this report?