Italy Metal Packaging Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Cans, Bulk Containers, Drums and Barrels, Caps and Closures, and Other), By Coating Type (Epoxy Phenolic, Acrylic, Polyester, BPA-Free Alternatives, and Other), and Italy Metal Packaging Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsItaly Metal Packaging Market Insights Forecasts to 2035

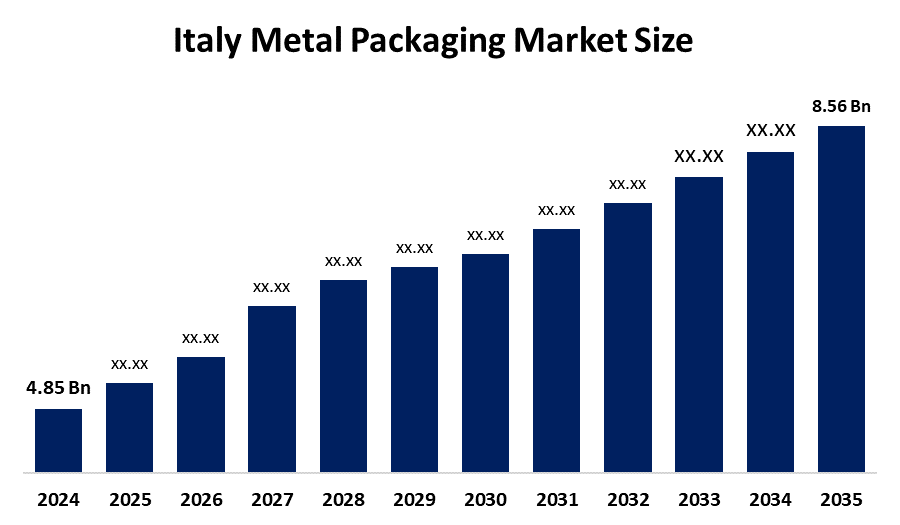

- The Italy Metal Packaging Market Size Was Estimated at USD 4.85 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.3% from 2025 to 2035

- The Italy Metal Packaging Market Size is Expected to Reach USD 8.56 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Italy metal packaging market size is anticipated to reach USD 8.56 million by 2035, growing at a CAGR of 5.3% from 2025 to 2035. Italy metal packaging market is driven by rising demand for sustainable and recyclable packaging, growth in food and beverage consumption, increasing use of metal cans for longer shelf life, strong recycling infrastructure, and supportive EU regulations promoting circular economy practices.

Market Overview

The Italy Metal Packaging Market Size encompasses the production and sale of metal containers such as aluminum and steel cans, drums, tins, and closures used across food, beverage, industrial, and consumer sectors. The market is experiencing steady growth, driven by rising demand for durable, recyclable, and long-shelf-life packaging solutions. Italy’s strong food and beverage industry, coupled with export-oriented manufacturing, supports this expansion. Additionally, European Union regulations encouraging sustainability and circular economy practices are accelerating the shift from plastic to metal packaging. Consumers increasingly prefer eco-friendly options, while manufacturers benefit from metals’ superior preservation properties, which further boost adoption across multiple industries.

One major trend is sustainability and recycling, as metal packaging is highly recyclable and aligns with both consumer expectations and EU policies. Another trend is premiumization, where brands use metal packaging to enhance aesthetic appeal and convey quality, particularly in beverages, gourmet foods, and cosmetics. Digital printing is also rising, enabling cost-effective customization, short runs, and faster product launches. Finally, industrial bulk packaging expansion is notable, with demand growing for reusable metal drums and containers in chemicals, automotive, and industrial sectors due to their robustness and safety features.

Technological innovations are transforming the market. Advanced digital printing allows high-quality, customizable designs on cans and tins without the high cost of traditional methods. Eco-friendly coating technologies, including BPA-free coatings, improve consumer safety and regulatory compliance. Smart sensors integrated into industrial containers enhance traceability and real-time monitoring of goods, particularly hazardous or high-value products. Additionally, lightweight design and material optimization reduce raw material usage and energy consumption, lowering production costs and carbon footprints. Collectively, these technologies enhance efficiency, sustainability, and consumer appeal, driving the market toward more innovative and environmentally responsible solutions.

Report Coverage

This research report categorizes the market for the Italy metal packaging market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy metal packaging market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy metal packaging market.

Italy Metal Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.85 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.3% |

| 2035 Value Projection: | USD 8.56 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product Type ,By Coating Type |

| Companies covered:: | Ardagh Metal Packaging Italy S.r.l., Ball Beverage Packaging Italia S.r.l., Crown Packaging, Silgan Holdings Inc., Gruppo ASA S.p.A., Tecnocap S.p.A., Nespak S.p.A., Trivium Packaging Italy S.p.A., Verallia Italia S.p.A., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy Metal Packaging Market Size is primarily driven by the increasing demand for sustainable and recyclable packaging solutions across food, beverage, and industrial sectors. Rising consumer awareness about environmental impact encourages brands to adopt metal over plastic. The strong domestic food and beverage industry, along with export-oriented manufacturing, fuels consistent growth. Metal packaging’s ability to extend product shelf life, maintain quality, and ensure product safety further boosts adoption. Supportive European Union regulations promoting circular economy practices and eco-friendly materials also play a crucial role in accelerating market expansion.

Restraining Factors

The Italy Metal Packaging Market Size faces restraints from high production and raw material costs, particularly aluminum and steel. Competition from lightweight and cheaper plastic packaging limits adoption in price-sensitive segments. Additionally, complex recycling processes for coated metals and stringent regulatory compliance increase operational challenges for manufacturers, slowing market growth despite rising demand for sustainable packaging solutions.

Market Segmentation

The Italy Metal Packaging Market share is classified into product type and coating type.

- The cans segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy Metal Packaging Market Size is segmented by product type into cans, bulk containers, drums and barrels, caps and closures, and other. Among these, the cans segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of the cans segment in the market is driven by its versatility and widespread use in the food and beverage industry. Cans provide excellent product protection, extend shelf life, and maintain flavor and quality, which is crucial for beverages and processed foods. Their lightweight and recyclable nature aligns with sustainability trends and EU regulations. Additionally, growing consumer preference for convenient, ready-to-consumer products further boosts demand, making cans the preferred choice over bulk containers, drums, and closures.

- The epoxy phenolic segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy Metal Packaging Market Size is segmented by coating type into epoxy phenolic, acrylic, polyester, BPA-Free alternatives, and other. Among these, the epoxy phenolic segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of the epoxy phenolic coating segment in the market is due to its superior corrosion resistance and ability to preserve product quality over time. It effectively prevents metal contact with food and beverages, ensuring safety and extending shelf life. Epoxy phenolic coatings are also cost-effective, widely tested, and compatible with existing production processes, making them the preferred choice for manufacturers. While BPA-free alternatives are growing, epoxy phenolic remains the most trusted and widely used coating type.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy Metal Packaging Market Size , along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ardagh Metal Packaging Italy S.r.l.

- Ball Beverage Packaging Italia S.r.l.

- Crown Packaging

- Silgan Holdings Inc.

- Gruppo ASA S.p.A.

- Tecnocap S.p.A.

- Nespak S.p.A.

- Trivium Packaging Italy S.p.A.

- Verallia Italia S.p.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy Metal Packaging Market Size based on the below-mentioned segments:

Italy Metal Packaging Market, By Product Type

- Cans

- Bulk Containers

- Drums and Barrels

- Caps and Closures

- Other

Italy Metal Packaging Market, By Coating Type

- Epoxy Phenolic

- Acrylic

- Polyester

- BPA-Free Alternatives

- Other

Frequently Asked Questions (FAQ)

-

What types of metals are commonly used in Italy’s packaging?Aluminum and steel dominate Italy’s metal packaging, offering durability, corrosion resistance, recyclability, and suitability for food, beverage, and industrial applications.

-

Which product type is most preferred by Italian food and beverage companies?Cans are widely preferred due to their durability, long shelf life, recyclability, and compatibility with beverages and processed foods.

-

How are sustainable practices influencing metal packaging choices in Italy?Sustainability trends drive the adoption of recyclable metals, lightweight designs, and eco-friendly coatings, aligning with EU circular economy policies.

-

What coatings are predominantly used for food-grade metal packaging?Epoxy phenolic coatings are dominant, protecting metal surfaces, preventing corrosion, and maintaining food and beverage safety over long storage periods.

-

How is digital printing transforming Italy’s metal packaging market?Digital printing enables customization, short-run production, faster branding changes, and improved aesthetics, supporting marketing strategies and consumer engagement.

Need help to buy this report?