Italy Home Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product (Major Appliances, Small Appliances, and Other), Distribution Channel (Multi-Brand Stores, Exclusive Brand Outlets, Online, and Other), and Italy Home Appliances Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsItaly Home Appliances Market Insights Forecasts to 2035

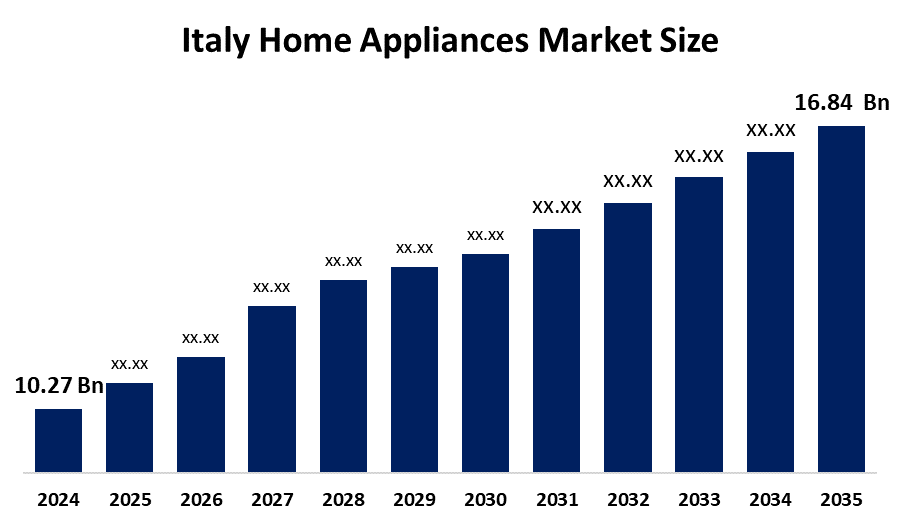

- The Italy Home Appliances Market Size Was Estimated at USD 10.27 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.6% from 2025 to 2035

- The Italy Home Appliances Market Size is Expected to Reach USD 16.84 Billion by 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Italy Home Appliances Market Size Is Anticipated To Reach USD 16.84 Billion By 2035, Growing At A CAGR Of 4.6% From 2025 To 2035. The Italy home appliances market is driven by rising urbanization, increasing disposable incomes, demand for energy-efficient and smart appliances, renovation of housing stock, and strong consumer preference for premium, design-oriented products supported by technological innovation.

Market Overview

The Italy home appliances market includes major and small household electrical appliances such as refrigerators, washing machines, dishwashers, ovens, air conditioners, and kitchen appliances used in residential settings. The market has shown steady growth due to rising disposable incomes, urban lifestyle expansion, and increasing replacement demand for outdated appliances. Growth is further supported by consumer awareness of energy efficiency, demand for technologically advanced products, and the renovation of Italy’s aging housing stock. The strong preference for aesthetically designed, durable, and high-performance appliances also reflects Italy’s focus on quality and innovation, contributing positively to market expansion.

Several key trends are shaping the Italian home appliances market. Smart and connected appliances are gaining traction as consumers seek greater convenience, remote control, and energy monitoring through IoT and AI-enabled features. Sustainability is a major trend, with growing demand for energy-efficient appliances that reduce electricity and water consumption while lowering household costs. Premiumization is another trend, as consumers increasingly prefer high-end appliances with advanced functions, elegant designs, and longer lifespans. Additionally, the expansion of online retail channels is transforming purchasing behavior, offering easy price comparisons, wider product availability, and doorstep delivery, which supports higher sales volumes.

Government policy and support play a crucial role in the market’s development. Italy follows strict European Union regulations on energy efficiency, eco-design, and product labeling, pushing manufacturers to innovate and comply with sustainability standards. Incentive programs such as Ecobonus and Superbonus encourage households to replace old appliances with energy-efficient models by offering tax deductions and financial benefits. These initiatives not only promote environmental sustainability but also stimulate consumer spending on modern home appliances, strengthening long-term market growth.

Report Coverage

This research report categorizes the market for the Italy home appliances market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy home appliances market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy home appliances market.

Italy Home Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 10.27 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.6% |

| 2035 Value Projection: | USD 16.84 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 101 |

| Companies covered:: | Whirlpool, Haier, Candy Hoover, BSH (Bosch, Siemens), Electrolux, Arçelik (Beko, Grundig), Samsung, LG, Miele, DeLonghi,, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy home appliances market is primarily driven by rising disposable incomes, which allow consumers to invest in modern and high-quality appliances. Urbanization and lifestyle changes increase demand for convenient, time-saving, and smart household devices. Growing awareness of energy efficiency and environmental sustainability encourages the adoption of eco-friendly appliances with advanced technology. Renovation and replacement of aging housing stock further fuel demand. Additionally, the increasing popularity of premium and connected appliances, along with expanding e-commerce channels, ensures easier access and greater consumer uptake, sustaining market growth.

Restraining Factors

The Italy home appliances market faces restraints from high product costs, especially for premium and smart appliances, which can limit affordability for some consumers. Economic fluctuations and slow wage growth may reduce discretionary spending. Additionally, intense competition from low-cost imports and stringent regulatory compliance for energy efficiency and safety standards can increase manufacturing costs, posing challenges for market expansion.

Market Segmentation

The Italy home appliances market share is classified into product and distribution channel.

- The major appliances segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy home appliances market is segmented by product into major appliances, small appliances, and other. Among these, the major appliances segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The major appliances segment dominates the market because these products are essential for daily household functioning and have higher purchase values compared to small appliances. Consumers prioritize investing in durable, energy-efficient, and technologically advanced refrigerators, washing machines, ovens, and dishwashers. Frequent housing renovations and replacement of old units also drive demand. Additionally, government incentives for energy-saving appliances and growing awareness of sustainability encourage the adoption of high-performance major appliances, making this segment the largest contributor to market revenue.

- The multi-brand stores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy home appliances market is segmented by distribution channel into multi-brand stores, exclusive brand outlets, online, and other. Among these, the multi-brand stores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Multi-brand stores dominate the market because they provide consumers with a wide variety of brands and product options under one roof, enabling easy comparison of features, prices, and energy efficiency. Customers value the ability to physically inspect and test appliances before purchase, along with access to knowledgeable staff and reliable after-sales service. Flexible payment options, seasonal promotions, and bundled offers further enhance their appeal, making multi-brand stores the most trusted and preferred distribution channel for Italian consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy home appliances market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Whirlpool, Haier

- Candy Hoover

- BSH (Bosch, Siemens)

- Electrolux

- Arçelik (Beko, Grundig)

- Samsung

- LG

- Miele

- De’Longhi,

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent News:

In November 2024, Tineco launched its debut online Trade-Up service in Italy, allowing customers to update their cleaning machines without returning the old ones. Participants submit proof of purchase to receive a EUR 50 coupon to spend in Tineco's online store. The campaign includes goods such as PURE ONE STATION 5 and PURE ONE A50S.

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy home appliances market based on the below-mentioned segments:

Italy Home Appliances Market, By Product

- Major Appliances

- Small Appliances

- Other

Italy Home Appliances Market, By Distribution Channel

- Multi-Brand Stores

- Exclusive Brand Outlets

- Online

- Other

Frequently Asked Questions (FAQ)

-

1. Why are Italians upgrading their home appliances so often?Consumers seek modern convenience, stylish designs, and smart features that fit busy urban lifestyles.

-

2. How important is appliance design in Italy?Very many buyers consider aesthetics as much as functionality, favoring brands that match home interiors.

-

3. Are connected appliances really useful?Yes, features like remote control, energy tracking, and automation save time and reduce energy bills.

-

4. Do eco-friendly appliances sell better?Increasingly. Italian consumers prefer products that cut costs and lower environmental impact without sacrificing performance.

-

5. Where do people usually buy appliances?Multi-brand stores remain popular, though online channels are growing for variety and doorstep delivery.

-

6. Are small appliances gaining attention?items like coffee makers, blenders, and air purifiers are trending for convenience and health-conscious lifestyles.

-

7. Does government support affect buying decisions?Programs like Ecobonus and Superbonus incentivize energy-efficient purchases, making upgrades more affordable.

Need help to buy this report?