Italy Food Enzymes Market Size, Share, and COVID-19 Impact Analysis, By Type (Amylases, Carbohydrases, Protease, Lipase), By Application (Bakery, Confectionery, Dairy and Frozen Desserts, Meat, Poultry and Seafood Products, Beverages), and Italy Food Enzymes Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesItaly Food Enzymes Market Insights Forecasts to 2035

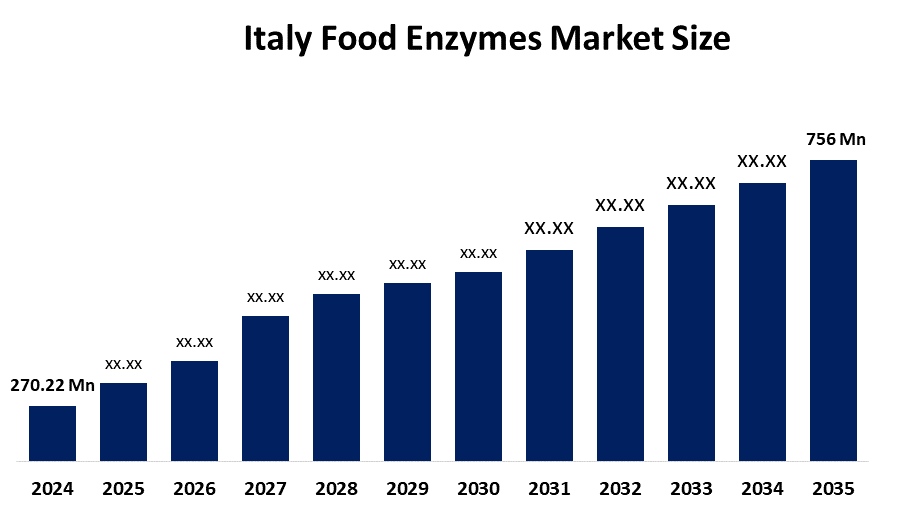

- The Italy Food Enzymes Market Size Was Estimated at USD 270.22 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.8% from 2025 to 2035

- The Italy Food Enzymes Market Size is Expected to Reach USD 756 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Italy Food Enzymes Market Size is anticipated to reach USD 756 Million by 2035, Growing at a CAGR of 9.8% from 2025 to 2035. The Italy food enzymes market is driven by rising consumer demand for convenient and processed foods, increasing adoption of enzyme-based solutions in bakery, dairy, and beverages, growing focus on clean-label products, and technological advancements enhancing food quality and shelf life.

Market Overview

The Italy food enzymes market involves the use of natural or engineered enzymes in the food and beverage industry to improve processing, texture, flavor, and shelf life. Key enzymes like proteases, amylases, and lipases are applied in bakery, dairy, meat, and beverages, enabling efficient production, consistent quality, and supporting clean-label, consumer-preferred food products across Italy. Furthermore, the growth of the market is fueled by increasing consumer demand for processed and functional foods, rising adoption of clean-label products, technological advancements in enzyme production, and expanding applications across bakery, dairy, beverages, and meat processing sectors.

The Italy food enzymes market is witnessing key trends. First, the rising demand for clean-label and natural ingredients drives the use of enzymes as alternatives to synthetic additives, maintaining quality and shelf life. Second, technological innovations in enzyme engineering improve efficiency, flavor, and texture across bakery, dairy, and beverage applications. Third, expanding applications in functional foods, plant-based products, and meat alternatives reflect changing consumer preferences, creating new growth opportunities and broadening the market’s scope in Italy’s evolving food industry.

The Italian government supports the food enzymes market through stringent food safety regulations and standards that ensure high-quality, safe enzyme use in food processing. Policies promoting innovation, research, and development encourage enzyme-based solutions, particularly for clean-label and sustainable food production. Additionally, initiatives supporting biotechnology and the broader agri-food sector provide funding, tax incentives, and collaboration opportunities for manufacturers and research institutions. These measures foster technological advancement, the adoption of enzyme applications across the bakery, dairy, meat, and beverage sectors, and overall growth of Italy’s food enzymes market.

Report Coverage

This research report categorizes the market for the Italy food enzymes market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy food enzymes market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy food enzymes market.

Italy Food Enzymes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 270.22 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.8% |

| 2035 Value Projection: | USD 756 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Novozymes A/S, DuPont (now part of IFF), DSM (Royal DSM N.V.), AB Enzymes GmbH, Chr. Hansen Holding A/S, Kerry Group plc, BASF SE, Amano Enzyme Inc., Sinofi Ingredients, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy food enzymes market is driven by increasing consumer demand for processed, convenient, and high-quality food products. Growing awareness of health and nutrition encourages manufacturers to use enzymes to improve digestibility, flavor, and nutritional value. The strong preference for clean-label and natural ingredients further boosts enzyme adoption as alternatives to chemical additives. In addition, technological advancements in enzyme development enhance production efficiency and shelf life, while expanding applications in bakery, dairy, beverages, and meat processing continue to accelerate market growth across Italy.

Restraining Factors

The Italy food enzymes market faces restraints from high production and development costs of specialized enzymes, which increase final product prices. Strict regulatory approvals and compliance requirements can delay product launches. Additionally, limited awareness among small food manufacturers and concerns over allergen labeling and enzyme sourcing may restrict wider adoption, especially among cost-sensitive producers.

Market Segmentation

The Italy food enzymes market share is classified into type and application.

- The amylases segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy food enzymes market is segmented by type into amylases, carbohydrases, proteases, lipase. Among these, the amylases segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Amylases dominate the market due to their extensive application in bakery, brewing, and pasta production, which are key segments of Italy’s food industry. They help convert starch into sugars, improving dough consistency, fermentation efficiency, texture, and shelf life. The strong cultural preference for bread, pizza, and pasta drives continuous demand for amylases. Additionally, amylases support clean-label formulations by reducing the need for chemical additives, further strengthening their widespread adoption among food manufacturers.

- The bakery segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy food enzymes market is segmented by application into bakery, confectionery, dairy and frozen desserts, meat, poultry and seafood products, and beverages. Among these, the bakery segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The bakery segment dominates the market because bakery products such as bread, pizza, pastries, and pasta are staple foods in Italy. Food enzymes are extensively used to improve dough stability, fermentation, volume, texture, and shelf life. High daily consumption, large-scale industrial baking, and the growing demand for clean-label and high-quality baked goods encourage manufacturers to rely on enzyme solutions instead of chemical additives, reinforcing the bakery segment’s leading position in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy food enzymes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novozymes A/S

- DuPont (now part of IFF)

- DSM (Royal DSM N.V.)

- AB Enzymes GmbH

- Chr. Hansen Holding A/S

- Kerry Group plc

- BASF SE

- Amano Enzyme Inc.

- Sinofi Ingredients

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In March 2025, DSM-Firmenich launched Maxiren® EVO, a next-generation coagulant enzyme designed to enhance cheese texture, taste, yield, and processing flexibility for dairy producers.

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy food enzymes market based on the below-mentioned segments:

Italy Food Enzymes Market, By Type

- Amylases

- Carbohydrases

- Protease

- Lipase

Italy Food Enzymes Market, By Application

- Bakery

- Confectionery

- Dairy and Frozen Desserts

- Meat

- Poultry and Seafood Products

- Beverages

Frequently Asked Questions (FAQ)

-

1.Why are food enzymes important in the Italy food enzymes market?Food enzymes help Italian food producers improve product consistency, processing efficiency, taste, and shelf life while reducing the need for chemical additives.

-

2.How does Italy’s food culture influence the Italy food enzymes market?Italy’s strong bakery, pasta, and dairy traditions create steady demand for enzymes that enhance dough performance, fermentation, and product quality.

-

3.What role do clean-label trends play in the Italy food enzymes market?Clean-label preferences encourage manufacturers to replace artificial additives with enzyme-based solutions that are perceived as natural and consumer-friendly.

-

4.How do food enzymes support sustainability in the Italy food enzymes market?Enzymes reduce food waste, improve raw material efficiency, and lower energy consumption during processing.

-

5.Which industries rely most on the Italy food enzymes market?Bakery, dairy, beverages, and meat processing industries are the primary users of food enzymes in Italy.

-

6.How does innovation impact the Italy food enzymes market?Advancements in enzyme engineering allow more targeted, efficient, and cost-effective applications across food segments.

Need help to buy this report?