Italy Food Emulsifier Market Size, Share, and COVID-19 Impact Analysis, By Type (Lecithin, Monoglyceride, Diglyceride, and Derivatives, Sorbitan Ester, Polyglycerol Ester, and Other), By Application (Dairy and Frozen Products, Bakery, Meat, Poultry, Seafood, Beverage, Confectionery, and Other), and Italy Food Emulsifier Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesItaly Food Emulsifier Market Size, Insights, Forecasts to 2035

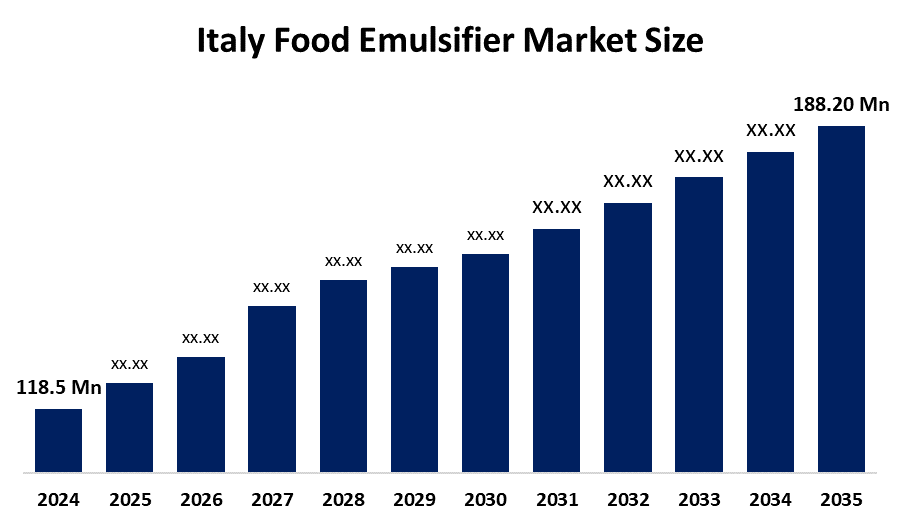

- The Italy Food Emulsifier Market Size Was Estimated at USD 118.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.3% from 2025 to 2035

- The Italy Food Emulsifier Market Size is Expected to Reach USD 188.20 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Italy Food Emulsifier Market Size Is Anticipated To Reach USD 188.20 Million By 2035, Growing At A CAGR Of 4.3% From 2025 To 2035. The Italy food emulsifier market is driven by rising demand for processed and convenience foods, growing bakery and confectionery industries, increasing health-consciousness promoting clean-label emulsifiers, and expanding use in sauces, dressings, and dairy products to improve texture and shelf life.

Market Overview

The Italy Food Emulsifier Market Size refers to the market for substances used to stabilize and blend immiscible ingredients like oil and water in food products. These emulsifiers enhance texture, extend shelf life, and improve product consistency across a wide range of foods such as bakery items, dairy products, sauces, and confectionery. The market is witnessing significant growth due to increasing consumption of processed and convenience foods, rising demand for bakery and confectionery products, and a growing preference for clean-label and functional ingredients. Additionally, changing lifestyles and urbanization are driving the adoption of ready-to-eat and processed foods, further fueling demand for emulsifiers.

Several key trends are shaping the Italy Food Emulsifier Market Size. First, the demand for natural and plant-based emulsifiers is rising as consumers prefer clean-label and healthier alternatives over synthetic additives. Second, functional emulsifiers that provide health benefits, such as improved digestion or cholesterol management, are gaining popularity. Third, the growth of the bakery and confectionery sector is driving higher emulsifier consumption to enhance product texture and shelf life. Fourth, innovation in dairy and frozen foods is encouraging the use of advanced emulsifiers to improve stability, creaminess, and freeze-thaw resistance. These trends reflect both consumer preferences and industry innovation toward healthier, convenient, and high-quality food products.

Technological advancements are playing a crucial role in this market. Encapsulation technology allows emulsifiers to improve the stability and controlled release of flavors and nutrients in processed foods. High-performance emulsifiers are being developed for specific applications in bakery, dairy, and confectionery products to enhance texture, volume, and shelf life. Furthermore, enzyme-based and bio-emulsifiers are emerging as sustainable alternatives, offering improved functionality while reducing reliance on chemical additives. These innovations ensure consistent quality, longer shelf life, and greater product appeal, reinforcing market growth and technological evolution in the Italy food emulsifier sector.

Report Coverage

This research report categorizes the market for the Italy Food Emulsifier Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy food emulsifier market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy food emulsifier market.

Italy Food Emulsifier Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 118.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.3% |

| 2035 Value Projection: | USD 188.20 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Cargill, Incorporated, DuPont de Nemours, Inc. (IFF Inc.), Palsgaard A/S, Corbion N.V., Ingredion Incorporated, BASF SE, Lonza Group Ltd., Kerry Group plc, Archer Daniels Midland Company (ADM), and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy Food Emulsifier Market Size is primarily driven by the growing demand for processed and convenience foods, as consumers increasingly prefer ready-to-eat and easy-to-prepare meals. Rising consumption of bakery, confectionery, dairy, and frozen products further boosts emulsifier usage to improve texture, consistency, and shelf life. Additionally, the shift toward clean-label and natural ingredients is encouraging manufacturers to adopt plant-based and functional emulsifiers. Urbanization, changing lifestyles, and increased awareness of high-quality food products are also key factors fueling market growth in Italy.

Restraining Factors

The Italy Food Emulsifier Market Size faces restraints due to growing consumer concerns over synthetic additives and chemical-based emulsifiers, which may impact health. Strict government regulations on food additives and labeling also limit the use of certain emulsifiers. Additionally, the higher cost of natural and clean-label emulsifiers compared to conventional options can restrict adoption, especially among small and medium-sized food manufacturers.

Market Segmentation

The Italy food emulsifier market share is classified into type and application.

- The lecithin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy food emulsifier market is segmented by type into lecithin, monoglyceride, diglyceride, and derivatives, sorbitan ester, polyglycerol ester, and others. Among these, the lecithin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Lecithin dominates the market because it is a natural, plant-based ingredient, aligning with the growing consumer preference for clean-label and healthier food products. It offers excellent emulsifying properties, improves texture, prevents ingredient separation, and extends shelf life, making it ideal for bakery, confectionery, dairy, and chocolate applications. Its multifunctionality, ease of use, and ability to enhance product quality while meeting regulatory and health standards make it the preferred choice for manufacturers, driving its strong market presence.

- The bakery segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy food emulsifier market is segmented by application into dairy and frozen products, bakery, meat, poultry, seafood, beverage, confectionery, and other. Among these, the bakery segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The bakery segment dominates the market because emulsifiers play a critical role in improving dough stability, texture, and volume, while extending the shelf life of baked goods. With rising consumer demand for ready-to-eat and high-quality bakery products, manufacturers increasingly rely on emulsifiers to maintain product freshness, softness, and consistency. The growing bakery and confectionery industry, combined with the popularity of artisanal and packaged baked items, ensures sustained and high emulsifier consumption, making bakery the leading application segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy food emulsifier market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Incorporated

- DuPont de Nemours, Inc. (IFF Inc.)

- Palsgaard A/S

- Corbion N.V.

- Ingredion Incorporated

- BASF SE

- Lonza Group Ltd.

- Kerry Group plc

- Archer Daniels Midland Company (ADM)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy food emulsifier market based on the below-mentioned segments:

Italy Food Emulsifier Market, By Type

- Lecithin

- Monoglyceride

- Diglyceride

- Derivatives

- Sorbitan Ester

- Polyglycerol Ester

- Other

Italy Food Emulsifier Market, By Application

- Dairy and Frozen Products

- Bakery

- Meat

- Poultry

- Seafood

- Beverage

- Confectionery

- Other

Frequently Asked Questions (FAQ)

-

1. What is the current market value of the Italy food emulsifier market?The Italy food emulsifier market is valued at approximately USD 118.5 million in 2024, reflecting steady growth driven by the bakery, dairy, and processed food sectors.

-

2. What is the expected CAGR of the Italy food emulsifier market?The market is projected to grow at a CAGR of around 4.3% from 2025 to 2030, supported by rising demand for natural and clean-label emulsifiers.

-

3. Which type of emulsifier is most preferred in Italy?Lecithin is the most preferred type due to its natural origin, multifunctionality, and ability to improve texture, shelf life, and stability in bakery, dairy, and confectionery products.

-

4. Which application segment dominates the Italy food emulsifier market?The bakery segment dominates, as emulsifiers enhance dough stability, texture, volume, and freshness, aligning with growing consumption of baked and ready-to-eat products.

-

5. Are natural emulsifiers gaining popularity in Italy?Yes, there is a strong shift toward natural and plant-based emulsifiers, driven by consumer preference for clean-label, healthier, and sustainable food ingredients.

-

6. How are technological advancements shaping the market?Technologies like encapsulation, enzyme-based emulsifiers, and high-performance formulations are improving functionality, product consistency, shelf life, and sustainability, boosting market growth and innovation.

Need help to buy this report?