Italy Food Colorants Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Natural Color and Synthetic Color), By Application (Beverages, Dairy & Frozen Products, Bakery, Meat, Poultry, Seafood, Confectionery, and Others), and Italy Food Colorants Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesItaly Food Colorants Market Insights Forecasts to 2035

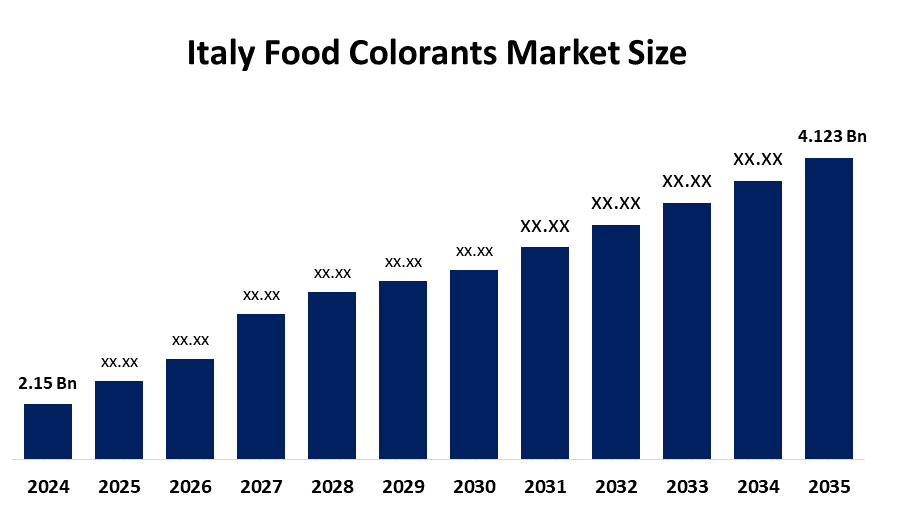

- The Italy Food Colorants Market Size Was Estimated at USD 2.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The Italy Food Colorants Market Size is Expected to Reach USD 4.123 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Italy Food Colorants Market Size is anticipated to reach USD 4.123 Billion by 2035, Growing at a CAGR of 6.1% from 2025 to 2035. Italy food colorants market is driven by rising demand for processed and packaged foods, growth in the bakery and confectionery sector, increasing consumer preference for natural and clean-label ingredients, and strict food safety regulations encouraging the use of approved, high-quality colorants.

Market Overview

The Italy food colorants market encompasses the production and supply of color additives used to enhance or restore the visual appeal of food and beverage products. These colorants include natural, synthetic, and nature-identical pigments applied across beverages, dairy products, bakery and confectionery items, sauces, snacks, and processed foods. The market in Italy has demonstrated steady growth, driven by strong demand from the expanding food processing and packaged foods sector, increasing consumption of visually appealing products, and a growing consumer preference for health-oriented and natural ingredients. In 2023, the market was valued at approximately USD 1.5 billion and is expected to expand at a moderate compound annual growth rate (CAGR) through the latter part of the decade, reflecting resilience despite ongoing regulatory challenges.

Key trends shaping this market include a clear shift toward natural and clean-label food colorants as Italian consumers increasingly avoid artificial additives due to health concerns. Natural color sources such as beetroot, paprika, curcumin and spirulina are gaining share, with natural segments often outperforming synthetic ones in growth. Sustainability and eco-friendly production practices are also rising in importance, with manufacturers investing in greener extraction technologies and transparent labeling to meet evolving consumer demands. In beverages and plant-based foods, vibrant and exotic hues are particularly popular, reinforcing product differentiation and market segmentation efforts.

Technology developments in the Italy market increasingly focus on enhanced extraction, stability and formulation techniques that improve color performance while meeting safety standards. Advanced quality control systems and novel plant-derived pigment platforms boost consistency and appeal. On the regulatory front, stringent EU food safety rules govern permissible additives with only approved colorants allowed and restrictions on several synthetic dyes shaping product innovation and compliance. According to Italian statistical data, food and beverage processing growth and rising organic sector preferences underpin steady long-term opportunities for both natural and compliant synthetic colorants.

Report Coverage

This research report categorizes the market for the Italy food colorants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy food colorants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy food colorants market.

Italy Food Colorants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.15 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.1% |

| 2035 Value Projection: | USD 4.123 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Chr. Hansen Holding A/S, Koninklijke DSM N.V., Sensient Technologies Corporation, Döhler Group SE, BASF SE, AromataGroup SRL, Barentz International B.V., Givaudan / Naturex S.A., GNT Group B.V., Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy food colorants market is primarily driven by the growing demand for processed and packaged foods, where visually appealing products influence consumer choices. Rising health consciousness is boosting the preference for natural and clean-label colorants over synthetic alternatives. Expansion in bakery, confectionery, dairy, and beverage sectors further fuels market growth, while innovative product formulations and vibrant colors help brands differentiate their offerings. Additionally, strict food safety regulations in Italy and the EU ensure the use of high-quality, approved colorants, supporting consumer trust and long-term industry growth.

Restraining Factors

The Italy food colorants market faces restraints due to the high cost of natural colorants compared to synthetic alternatives, which can limit adoption among price-sensitive manufacturers. Strict regulatory requirements for approval and labeling also pose challenges. Additionally, stability issues, such as sensitivity to heat, light, and pH, can affect the performance of natural colorants, restricting their widespread use in certain processed foods.

Market Segmentation

The Italy food colorants market share is classified into product type and application.

- The natural color segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy food colorants market is segmented by product type into natural color and synthetic color. Among these, the natural color segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The natural color segment dominates the market due to growing consumer demand for clean-label and health-conscious products, as people increasingly avoid synthetic additives linked to health concerns. Italian manufacturers are adopting plant-based pigments such as beetroot, paprika, spirulina, and curcumin to meet these preferences. Additionally, regulatory support from the EU and Italian authorities favors the use of approved natural colorants. The rise of organic, artisanal, and visually appealing food products further reinforces the preference for natural colors over synthetic alternatives.

- The beverages segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy food colorants market is segmented by application into beverages, dairy & frozen products, bakery, meat, poultry, seafood, confectionery, and others. Among these, the beverages segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The beverages segment dominates the market because color plays a critical role in consumer perception and product appeal in drinks like juices, soft drinks, energy drinks, and flavored waters. Italian consumers increasingly prefer visually attractive and natural-colored beverages, driving manufacturers to use high-quality natural colorants. Additionally, the growing demand for flavored, functional, and ready-to-drink beverages boosts the need for consistent and vibrant coloring. This trend, combined with product differentiation strategies, ensures the beverages segment remains the largest application in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy food colorants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chr. Hansen Holding A/S

- Koninklijke DSM N.V.

- Sensient Technologies Corporation

- Döhler Group SE

- BASF SE

- AromataGroup SRL

- Barentz International B.V.

- Givaudan / Naturex S.A.

- GNT Group B.V.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy food colorants market based on the below-mentioned segments:

Italy Food Colorants Market, By Product Type

- Natural Color

- Synthetic Color

Italy Food Colorants Market, By Application

- Beverages

- Dairy & Frozen products

- Bakery

- Meat

- Poultry

- Seafood

- Confectionery

- Others

Frequently Asked Questions (FAQ)

-

1.What is the Italy food colorants market?The Italy food colorants market involves the production and sale of natural and synthetic color additives used to enhance the appearance, appeal, and uniformity of food and beverage products across bakery, beverages, dairy, confectionery, and other segments.

-

2.What are the key drivers of the Italy food colorants market?Rising demand for processed and packaged foods, increasing preference for natural and clean-label colorants, expansion of bakery, dairy, and beverage sectors, and strict food safety regulations drive market growth.

-

3.What are the major segments of the Italy food colorants market?The market is segmented by product type (natural and synthetic) and application (beverages, bakery, dairy & frozen products, meat, poultry, seafood, confectionery, and others).

-

4.Which product type dominates the Italy food colorants market?The natural color segment dominates due to health-conscious consumer preferences and regulatory support for safe, plant-based colorants.

-

5.Which application segment is the largest in the Italy food colorants market?The beverages segment leads the market, as color significantly influences consumer perception and purchase decisions in juices, soft drinks, energy drinks, and flavored waters.

-

6.What are the key trends in the Italy food colorants market?Trends include increasing use of natural and clean-label colorants, sustainability and eco-friendly production, vibrant colors for product differentiation, and growth in organic and artisanal food products.

Need help to buy this report?