Italy Feed Additives Market Size, Share, and COVID-19 Impact Analysis, By Additive Type (Antibiotics, Vitamins, Antioxidants, Amino Acids, Enzymes, Mycotoxin Detoxifiers, Prebiotics, Probiotics, Flavors and Sweeteners, Pigments, Binders, Minerals) By Animal Type (Ruminants, Poultry, Swine, Other), and Italy Feed Additives Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesItaly Feed Additives Market Insights Forecasts To 2035

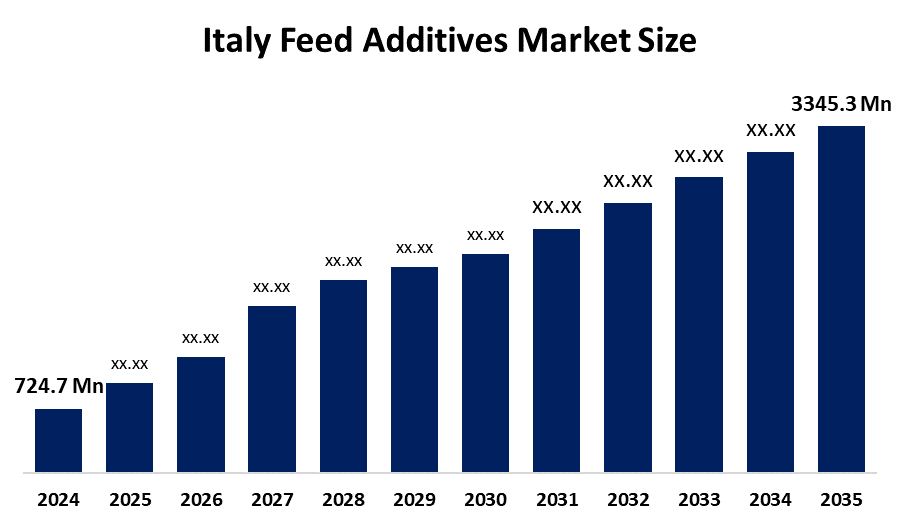

- The Italy Feed Additives Market Size Was Estimated At USD 724.7 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 14.92% From 2025 To 2035

- The Italy Feed Additives Market Size Is Expected To Reach USD 3345.3 Million By 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Italy Feed Additives Market Size Is Anticipated To Reach USD 3345.3 Million By 2035, Growing At A CAGR Of 14.92% From 2025 To 2035. The Italy feed additives market is driven by increasing demand for high-quality animal nutrition, rising livestock production, focus on enhancing animal health and productivity, growing awareness of sustainable farming practices, and adoption of innovative feed additive solutions by farmers.

Market Overview

The Italy Feed Additives Market Size refers to the sector involved in the production and supply of substances added to animal feed to improve nutritional value, enhance growth, prevent diseases, and boost overall livestock productivity.These additives include vitamins, amino acids, enzymes, probiotics, antioxidants, and other functional ingredients that ensure optimal animal health. The market has witnessed steady growth due to increasing demand for high-quality animal protein, rising livestock farming activities, and a growing emphasis on improving feed efficiency. Moreover, changing dietary preferences, urbanization, and rising awareness about animal welfare and sustainable farming practices have further fueled market expansion.

One major trend is the increasing adoption of natural and organic feed additives as farmers shift away from synthetic products due to regulatory pressure and consumer preference. Another trend is the rising use of probiotics and prebiotics to enhance gut health and immunity in livestock. Thirdly, the integration of precision feeding techniques allows farmers to optimize feed formulations for improved productivity. Lastly, there is a growing focus on environmentally sustainable additives that reduce methane emissions and minimize the ecological footprint of livestock farming.

Technological Advancements Play A Crucial Role In The Italy Feed Additives Market Size. innovations in enzyme technology, microbial formulations, and nutrient delivery systems have improved feed efficiency and animal growth rates. Digital tools, such as feed management software and IoT-based monitoring systems, enable precision feeding and real-time tracking of animal health. Additionally, government initiatives promoting research in sustainable feed solutions support the development of eco-friendly additives that enhance productivity while reducing environmental impact. Advanced fermentation technologies and bioengineering methods are also being utilized to produce high-quality additives at lower costs, strengthening the market’s growth potential.

Report Coverage

This research report categorizes The Market Size For The Italy Feed Additives Market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy feed additives market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy feed additives market.

Italy Feed Additives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 682.35 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 5.2% |

| 2023 Value Projection: | USD 1192 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Additive Type, By Animal Type |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy Feed Additives Market Size is driven by the rising demand for high-quality animal protein and increased livestock production across the country. Growing awareness among farmers about animal health, productivity, and disease prevention encourages the use of specialized feed additives. Additionally, the shift toward sustainable and eco-friendly farming practices fuels the adoption of natural and innovative additives. Government regulations promoting safe and nutritious animal feed, coupled with technological advancements in feed formulation, further support market growth by enhancing feed efficiency, livestock performance, and overall profitability for farmers.

Restraining Factors

The Italy Feed Additives Market Size faces restraints due to high costs of advanced feed additives and fluctuating raw material prices, which can impact affordability for farmers. Strict regulatory requirements for approval and safety of feed products also slow market entry. Additionally, limited awareness among small-scale farmers about the benefits of specialized additives can hinder widespread adoption, restricting overall market growth.

Market Segmentation

The Italy feed additives market share is classified into additive type and animal type.

- The vitamins segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy Feed Additives Market Size is segmented by additive type into antibiotics, vitamins, antioxidants, amino acids, enzymes, mycotoxin detoxifiers, prebiotics, probiotics, flavors and sweeteners, pigments, binders, and minerals. among these, the vitamins segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of the vitamins segment in the market is driven by their essential role in ensuring proper growth, reproduction, and immunity in livestock. Vitamins prevent nutrient deficiencies, enhance feed efficiency, and improve overall animal health, making them a critical component of most feed formulations. Widespread use across poultry, swine, and cattle farming, combined with increasing awareness among farmers about animal nutrition and productivity, sustains consistent demand and reinforces the segment’s leading position in the market.

- The poultry segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy Feed Additives Market Size Is segmented by animal type into ruminants, poultry, swine, and other. Among these, the poultry segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The poultry segment dominates the market due to the country’s large-scale poultry farming industry, which focuses on broiler and layer production. Feed additives are extensively used to enhance growth, improve feed conversion ratios, boost immunity, and increase egg yield. High consumer demand for poultry meat and eggs drives farmers to adopt advanced nutrition strategies. Additionally, government support for poultry health and productivity, along with technological advancements in feed formulations, further reinforces the segment’s leading position in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the italy feed additives market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Incorporated

- Alltech, Inc.

- Archer Daniels Midland (ADM)

- IFF (Danisco Animal Nutrition)

- DSM Nutritional Products AG

- Elanco Italia Spa

- SHV (Nutreco NV)

- Centafarm SRL

- APSA Italia SRL

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This Study Forecasts Revenue At The Italy, Regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy feed additives market based on the below-mentioned segments:

Italy Feed Additives Market, By Additive Type

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Enzymes

- Mycotoxin Detoxifiers

- Prebiotics

- Probiotics

- Flavors and Sweeteners

- Pigments

- Binders

- Minerals

Italy Feed Additives Market, By Animal Type

- Ruminants

- Poultry

- Swine

- Other

Frequently Asked Questions (FAQ)

-

What is the Italy feed additives market?The Italy feed additives market involves the production and sale of substances added to animal feed, such as vitamins, amino acids, enzymes, probiotics, and minerals, to improve livestock health, growth, and productivity.

-

What is the market value of the Italy feed additives market?The Italy feed additives market is valued at several hundred million USD and is expected to grow steadily due to increasing livestock production and demand for high-quality animal nutrition.

-

What are the major driving factors for the Italy feed additives market?Key drivers include rising demand for animal protein, increased awareness of animal health, adoption of sustainable farming practices, and technological advancements in feed formulations.

-

Which segment dominates the Italy feed additives market by type?The vitamins segment dominates due to its essential role in livestock growth, immunity, and productivity.

-

Which animal type segment is dominant in the Italy feed additives market?The poultry segment dominates, driven by large-scale poultry farming and high demand for poultry meat and eggs.

Need help to buy this report?