Italy Diabetes Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Oral Antidiabetic Drugs, Insulin), By Type of Diabetes (Type 2 Diabetes, Type 1 Diabetes), By End-User (Hospitals, Outpatient), and Italy Diabetes Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareItaly Diabetes Drugs Market Insights Forecasts to 2035

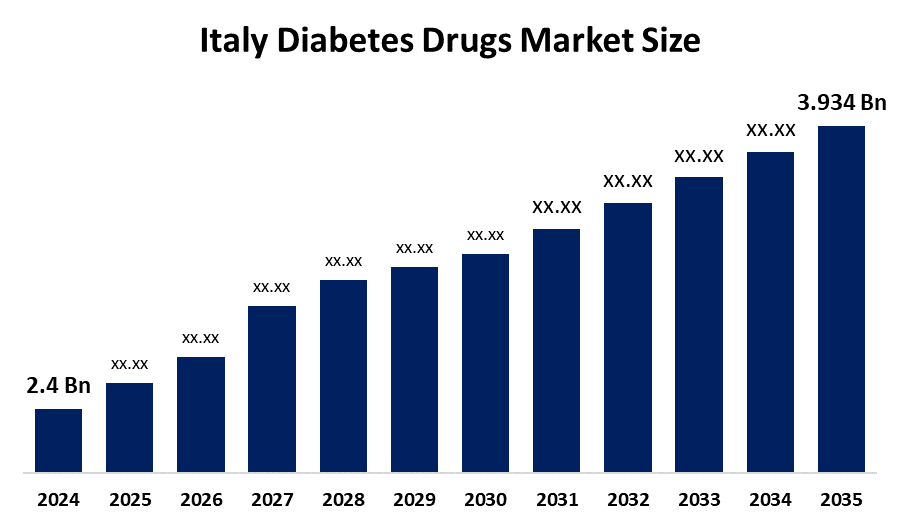

- The Italy Diabetes Drugs Market Size Was Estimated at USD 2.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.6% from 2025 to 2035

- The Italy Diabetes Drugs Market Size is Expected to Reach USD 3.934 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Italy diabetes drugs market size is anticipated to reach USD 3.934 billion by 2035, growing at a CAGR of 4.6% from 2025 to 2035. The Italy diabetes drugs market is driven by the rising prevalence of diabetes, increasing geriatric population, growing awareness about disease management, government healthcare initiatives, advancements in drug formulations, and the adoption of innovative therapies for better glycemic control.

Market Overview

The Italy Diabetes Drugs Market Size consists of medications for managing Type 1 and Type 2 diabetes, including insulin, oral hypoglycemic agents like metformin and DPP 4 inhibitors, GLP 1 receptor agonists, and SGLT2 inhibitors. These drugs help control blood glucose levels and prevent complications. Market growth is driven by the rising prevalence of diabetes, fueled by an aging population, sedentary lifestyles, and unhealthy diets. Increased awareness of early diagnosis, better disease management, and support from Itals universal healthcare system have further boosted adoption. The market is expected to continue growing steadily as demand for effective diabetes therapies rises.

Several trends are shaping the Italian diabetes drugs market. First, there is a shift toward innovative therapies like GLP receptor agonists and SGLT inhibitors because of improved efficacy and cardiovascular benefits. Second, personalized medicine is gaining traction, with treatments increasingly tailored to patient-specific needs for better adherence and outcomes. Third, integration with digital health tools such as continuous glucose monitoring systems and telemedicine is enhancing patient engagement and disease management. Finally, combination therapies and fixed-dose drug formulations are becoming popular, offering convenience and improved glycemic control.

The Italian government actively supports diabetes care through the National Health Service SSN, which ensures universal coverage and reimburses essential medications, reducing patient costs. Policies facilitating local pharmacy distribution and telemedicine infrastructure have improved access to therapies. Furthermore, government-backed research and investments encourage innovation in drug development, including expedited approvals for new antidiabetic drugs and domestic manufacturing initiatives. These efforts, combined with industry-led innovations, strengthen the availability of advanced therapies and foster continuous growth in the diabetes drugs market in Italy.

Report Coverage

This research report categorizes the market for the Italy Diabetes Drugs Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy diabetes drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub segment of the Italy diabetes drugs market.

Italy Diabetes Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.4 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.6% |

| 2035 Value Projection: | USD 3.934 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Drug Class, By Type of Diabetes |

| Companies covered:: | Novo Nordisk AS,Sanofi S.A,Eli Lilly and Company,AstraZeneca plc,Boehringer Ingelheim,Merck Co., Inc,Takeda Pharmaceutical Company,Pfizer Inc,Novartis International AG And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy diabetes drugs market is primarily driven by the increasing prevalence of diabetes, particularly Type , due to aging populations, sedentary lifestyles, and unhealthy diets. Rising awareness of disease management, early diagnosis, and the importance of glycemic control encourages the adoption of effective therapies. Government initiatives, including reimbursement policies under the National Health Service NHS, enhance accessibility to medications. Additionally, the introduction of innovative drugs such as GLP receptor agonists and SGLT inhibitors, along with advanced combination therapies and digital health integration, supports market growth and improved patient outcomes.

Restraining Factors

The Italy diabetes drugs market is restrained by high treatment costs and limited affordability for some patients. Regulatory hurdles and complex approval processes can delay the launch of new drugs. Additionally, patient non-compliance with medication, preference for lifestyle management, and competition from alternative therapies limit the overall growth of the market.

Market Segmentation

The Italy diabetes drugs market share is classified into drug class, type of diabetes, and end user.

- The oral antidiabetic drugs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy diabetes drugs market is segmented by drug class into oral antidiabetic drugs and insulin. Among these, the oral antidiabetic drugs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Oral antidiabetic drugs dominate the market because Type 2 diabetes represents the majority of cases in the country, and these medications are typically the first-line treatment. Drugs like metformin, DPP4 inhibitors, and SGLT inhibitors are preferred for their ease of use, lower cost, and ability to be administered orally, which improves patient compliance. In contrast, insulin is primarily used for Type 1 diabetes or advanced Type 2 cases, limiting its overall market share.

- The type 2 diabetes segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy diabetes drugs market is segmented by type of diabetes into type 2 diabetes and type 1 diabetes. Among these, the type diabetes segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Type 2 diabetes dominates the market because it represents the majority of diabetes cases in the country. Factors such as aging populations, sedentary lifestyles, and unhealthy dietary habits have increased the prevalence of Type 2 diabetes. Patients with this type primarily use oral antidiabetic drugs, which are easier to administer, more convenient, and widely accessible. In contrast, Type diabetes is less common and requires insulin therapy, limiting its overall market share compared to Type 2 diabetes.

- The outpatients segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy diabetes drugs market is segmented by end user into hospitals and outpatients. Among these, the outpatients segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The outpatient segment dominates the market because diabetes is largely a chronic condition managed outside hospitals. Most patients receive their medications through clinics, pharmacies, or home based care, including oral antidiabetic drugs and insulin for daily glucose control. Hospitals mainly handle acute cases, complications, or severe disease management, representing a smaller portion of overall drug consumption. The consistent, long term demand from outpatients for routine diabetes management drives the larger market share of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy diabetes drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk AS

- Sanofi S.A.

- Eli Lilly and Company

- AstraZeneca plc

- Boehringer Ingelheim

- Merck Co., Inc.

- Takeda Pharmaceutical Company

- Pfizer Inc.

- Novartis International AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In October 2024, Eli Lilly announced encouraging findings from late-stage trials of their novel once weekly insulin, efsitora alfa. The trials showed that efsitora alfa efficiently lowers blood sugar levels in adults with Type 2 diabetes, whether they were starting insulin or transitioning from daily injections.

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy diabetes drugs market based on the below-mentioned segments:

Italy Diabetes Drugs Market, By Drug Class

- Oral Antidiabetic Drugs

- Insulin

Italy Diabetes Drugs Market, By Type of Diabetes

- Type 2 Diabetes

- Type 1 Diabetes

Italy Diabetes Drugs Market, By End-User

- Hospitals

- Outpatient

Frequently Asked Questions (FAQ)

-

Q1. What types of diabetes drugs are available in Italy?The Italy diabetes drugs market includes insulin and its analogs, oral antidiabetic medicines, and newer treatments like GLP-1 receptor agonists and SGLT2 inhibitors.

-

Q2. Who uses the drugs in the Italy diabetes drugs market?Patients with Type 1 and Type 2 diabetes, across all age groups, rely on these drugs for blood sugar management and long-term health support.

-

Q3. What factors influence drug selection in Italy?Doctors consider disease type, patient age, comorbidities, lifestyle, and response to previous treatments when prescribing drugs in the Italy diabetes drugs market.

-

Q4. How are new therapies changing the Italy diabetes drugs market?Innovative therapies like injectable GLP-1 drugs and emerging oral insulin are reshaping treatment approaches, offering more personalized and convenient options for patients.

-

Q5. What role does technology play in the Italy diabetes drugs market?Digital health tools, telemedicine, and monitoring apps help patients manage their condition, improving adherence and optimizing outcomes in the Italy diabetes drugs market.

-

Q6. Which stakeholders shape the Italy diabetes drugs market?Key stakeholders include pharmaceutical companies, healthcare providers, hospitals, pharmacies, and patient advocacy groups that drive access, innovation, and awareness.

Need help to buy this report?