Italy Cookware Market Size, Share, and COVID-19 Impact Analysis, By Product (Pots and Pans, Spoon, Wok Turner, Whisk, Soup Ladle, Other), By Material (Stainless Steel, Aluminium, Glass, Other), By Application (Residential, Commercial), and Italy Cookware Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsItaly Cookware Market Insights Forecasts to 2035

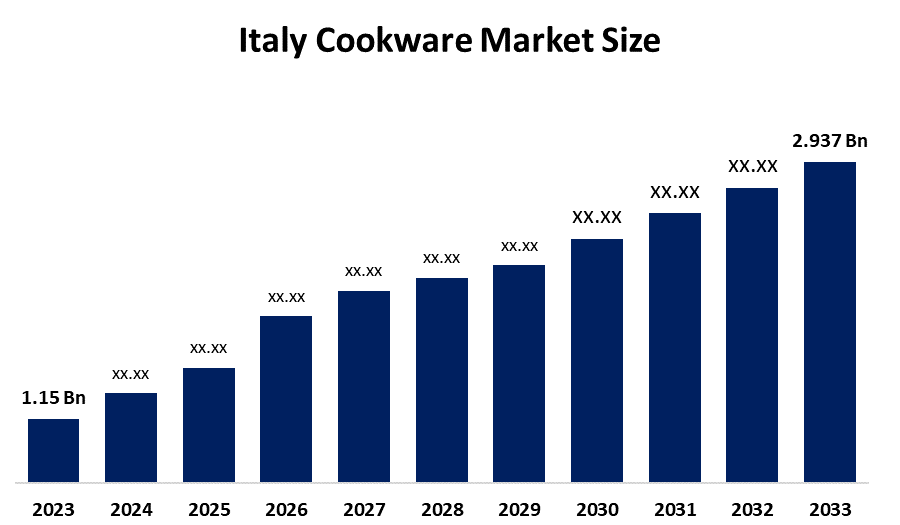

- The Italy Cookware Market Size Was Estimated at USD 1.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.9% from 2025 to 2035

- The Italy Cookware Market Size is Expected to Reach USD 2.937 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Italy cookware market size is anticipated to reach USD 2.937 billion by 2035, growing at a CAGR of 8.9% from 2025 to 2035. The Italy cookware market is driven by strong culinary traditions, rising home cooking trends, demand for premium and durable cookware, growth of e-commerce, innovation in non-stick and eco-friendly materials, and increasing consumer focus on aesthetics, quality, and healthy cooking solutions.

Market Overview

Cookware is the general term used for kitchen utensils and equipment that are used for preparing, cooking, and heating food. It mainly comprises of pots, pans, skillets, saucepans, and baking dishes, etc., which are made of materials like stainless steel, aluminum, cast iron, ceramic, or non, stick coatings, and are intended to allow efficient heat distribution and safe food preparation. Moreover, the factors leading to the growth of the Italian cookware market are increasing the popularity of home cooking, raising disposable incomes, the desire for premium and innovative products, the expansion of online sales channels, the impact of culinary culture and cooking shows, and a focus on sustainable, non-toxic materials.

The technological innovation in the production of cookware products is one of the ways that the Italian cookware market is propelled. According to the Italian Trade Agency, specialist cookware exports rose by 15.7% in 2022, which was primarily due to new developments in non-stick coatings, energy, efficient materials, and multi-functional designs. Temperature-controlled smart cookware and eco-friendly manufacturing methods are also leading to more market demand. As Italian manufacturers adopt automation and sustainable materials, the industry is expanding, which in turn, attracts local and overseas customers looking for top-quality, durable cookware solutions.

Advanced manufacturing infrastructure is one of the factors through which the Italy cookware market is being flooded with new products by making production more efficient and product innovation. According to the Confindustria 2023 economic report, Lombardy, Emilia, and Romagna together account for 42% of Europe's specialist cookware manufacture, thus highlighting Italy's leading position in the sector. The implementation of small and medium-sized enterprises (SMEs) with the most innovative technologies, which result in high-quality, precision, engineered cookware products are the two major advantages to the market. Thanks to this tech advantage, Italian companies are not only able to satisfy the rising global demand but also to increase their domestic sales and exports.

Report Coverage

This research report categorizes the market for the Italy cookware market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy cookware market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy cookware market.

Italy Cookware Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.15 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.9% |

| 2035 Value Projection: | USD 2.937 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product,By Material |

| Companies covered:: | Ballarini Industrie S.p.A,Lagostina S.p.A,Hestan,Ruffoni S.r.l,Barazzoni S.p.A, ILLA S.p.A, TVS S.p.A,Groupe SEB,Zwilling J.A. Henckels And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy cookware market is driven by a deep-rooted food culture where home cooking is part of daily life, supporting consistent demand for quality cookware. Growth in urban households, rising interest in healthy cooking methods, and preference for durable, heat-efficient materials contribute significantly. The hospitality and foodservice sector also fuels demand for professional-grade cookware. Additionally, changing consumer lifestyles, frequent kitchen upgrades, and growing awareness of safe, non-toxic cooking surfaces continue to strengthen market expansion.

Restraining Factors

The Italy cookware market faces restraints from high prices of premium and branded cookware, which limit adoption among price-sensitive consumers. Market saturation, long replacement cycles due to durable products, and competition from low-cost imports also restrict growth. Additionally, fluctuating raw material costs impact pricing and profit margins for manufacturers.

Market Segmentation

The Italy cookware market share is classified into product, material, and application.

- The pots and pans segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy cookware market is segmented by product into pots and pans, spoons, wok turner, whisk, soup ladles, and other products. Among these, the pots and pans segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Pots and pans dominate because they are fundamental to daily cooking practices deeply rooted in Italian cuisine. They are used across households, restaurants, and foodservice establishments, leading to higher purchase volumes compared to other utensils. Frequent cooking at home, demand for durable and heat-efficient materials, and consumer preference for premium, long-lasting cookware drive consistent replacement and upgrades. Additionally, a wide product variety, innovation in coatings, and a strong brand presence further reinforce their dominant market position.

- The stainless steel segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy cookware market is segmented by material into stainless steel, aluminium, glass, and other materials. Among these, the stainless steel segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Stainless steel dominates due to its durability, corrosion resistance, and suitability for traditional Italian cooking methods. Consumers prefer stainless steel for its even heat distribution, compatibility with induction cooktops, and ease of maintenance. It is widely used in both household and professional kitchens, especially in restaurants and hotels. Additionally, its non-reactive nature ensures food safety and preserves flavors, while its premium appearance aligns well with Italian consumer preference for quality and long-lasting kitchen products.

- The residential segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy cookware market is segmented by application into residential and commercial. Among these, the residential segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The residential segment dominates due to Italy’s strong home-cooking culture and daily meal preparation habits. Most households regularly invest in cookware for personal kitchens, driving higher overall sales volumes than commercial users. Growing interest in healthy home-cooked meals, frequent kitchen upgrades, and demand for aesthetically appealing and durable cookware further support residential dominance. Additionally, widespread availability through retail stores and online platforms makes cookware purchases more accessible for individual consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy cookware market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ballarini Industrie S.p.A.

- Lagostina S.p.A.

- Bialetti Industrie S.p.A.

- Hestan

- Ruffoni S.r.l.

- Barazzoni S.p.A.

- ILLA S.p.A.

- TVS S.p.A.

- Groupe SEB

- Zwilling J.A. Henckels

- Others

- Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In August 2025, Hestan launched its most luxurious line, handcrafted in Italy, which won a 2025 Red Dot Product Design Award. It features 35% greater heat conductivity and a polished stainless steel exterior.

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy cookware market based on the below-mentioned segments:

Italy Cookware Market, By Product

- Pots and Pan

- Spoon

- Wok Turner

- Whisk

- Soup Ladle

- Other

Italy Cookware Market, By Material

- Stainless Steel

- Aluminium

- Glass

- Other

Italy Cookware Market, By Application

- Residential

- Commercial

Frequently Asked Questions (FAQ)

-

1. Why is cookware demand stable in Italy?Because cooking at home remains a daily habit across regions, supporting continuous replacement demand.

-

2. What type of cookware sells the most in Italy?Basic cooking vessels, such as pans and pots, see the highest sales due to regular use.

-

3. Which material is widely accepted by Italian consumers?Stainless steel is widely accepted for its long lifespan and traditional cooking suitability

-

4. What limits market growth in Italy?High prices of premium cookware and long product replacement cycles restrict faster growth

-

5. Which sales channel is important for cookware purchases?Specialty kitchen stores and online platforms play a key role in product availability and sales.

Need help to buy this report?