Italy Contraceptive Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Condoms, Diaphragms & Cervical Caps, Vaginal Sponges, Vaginal Rings, Intra Uterine Devices, Subdermal Implants, and Other), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies & Drugstores, E-Commerce & Tele-Pharmacies, and Family-Planning Clinics), and Italy Contraceptive Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareItaly Contraceptive Devices Market Insights Forecasts to 2035

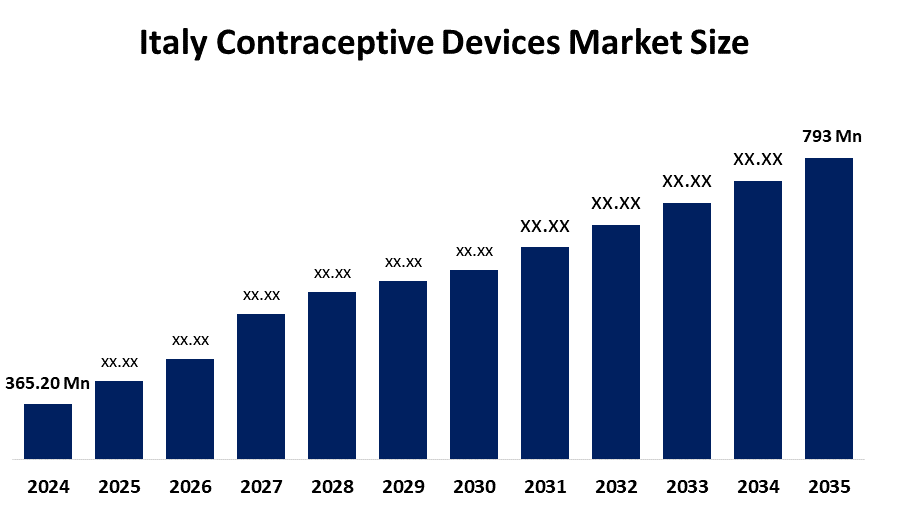

- The Italy Contraceptive Devices Market Size Was Estimated at USD 365.20 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.3% from 2025 to 2035

- The Italy Contraceptive Devices Market Size is Expected to Reach USD 793 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Italy Contraceptive Devices Market Size is anticipated to reach USD 793 Million by 2035, Growing at a CAGR of 7.3% from 2025 to 2035. The Italy contraceptive devices market is driven by rising awareness of family planning, increasing prevalence of sexually transmitted infections, government initiatives promoting reproductive health, growing demand for innovative and user-friendly contraceptive solutions, and the expanding female healthcare infrastructure.

Market Overview

The Italy contraceptive devices market refers to the sector that encompasses products designed to prevent unintended pregnancies and protect against sexually transmitted infections. These devices include condoms, intrauterine devices (IUDs), contraceptive implants, diaphragms, and other barrier or hormonal methods. The market has experienced steady growth due to increasing awareness of reproductive health, changing lifestyles, and government programs supporting family planning. Additionally, the rising prevalence of sexually transmitted infections (STIs), coupled with a growing focus on women’s health and preventive care, is boosting demand for safe and effective contraceptive solutions across Italy.

One significant trend is the rising adoption of hormonal contraceptives such as implants and IUDs, driven by convenience and long-term effectiveness. Second, eco-friendly and sustainable products, like biodegradable condoms, are gaining traction as consumers prioritize environmental responsibility. Third, digital health integration is emerging, with apps and devices providing fertility tracking and personalized contraceptive guidance. Fourth, increasing male contraceptive awareness is shaping the market, with more campaigns targeting men to participate in family planning. These trends highlight the evolving consumer behavior, emphasizing convenience, sustainability, and gender inclusivity in contraceptive choices.

Technological advancements are transforming the Italy contraceptive devices market. Modern IUDs and implants are being developed with improved biocompatible materials that reduce side effects and enhance user comfort. Innovative smart condoms equipped with sensors for STI detection and fertility tracking are also entering the market. Additionally, 3D printing technology enables customized contraceptive devices tailored to individual needs, while digital health platforms offer real-time monitoring and guidance. These innovations not only improve safety and efficacy but also expand accessibility, making contraceptive solutions more user-friendly and effective for diverse populations in Italy.

Report Coverage

This research report categorizes the market for the Italy contraceptive devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy contraceptive devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy contraceptive devices market.

Italy Contraceptive Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 365.20 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.3% |

| 2035 Value Projection: | USD 793 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Reckitt Benckiser Group plc, The Cooper Companies / CooperSurgical, Organon & Co., Church & Dwight Co., Inc., DKT International, Okamoto Industries Inc., Pregna International Ltd., Linepharma International, LifeStyles Healthcare, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy contraceptive devices market is primarily driven by growing awareness of family planning and reproductive health among the population. The increasing prevalence of sexually transmitted infections (STIs) encourages the use of preventive devices. Government initiatives and campaigns promoting safe sex practices further support market growth. Rising demand for innovative, convenient, and user-friendly contraceptives, such as hormonal implants and intrauterine devices (IUDs), also fuels expansion. Additionally, changing lifestyles, higher female workforce participation, and a focus on women’s healthcare infrastructure contribute significantly to the increasing adoption of contraceptive devices across Italy.

Restraining Factors

The Italy contraceptive devices market faces restraints due to high costs of advanced contraceptives, limited awareness in certain regions, and cultural or religious barriers that discourage usage. Side effects associated with hormonal methods and lack of access to quality healthcare in some areas also hinder adoption. These factors collectively slow the market’s overall growth and consumer acceptance.

Market Segmentation

The Italy contraceptive devices market share is classified into product type and distribution channel.

- The condoms segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy contraceptive devices market is segmented by product type into condoms, diaphragms & cervical caps, vaginal sponges, vaginal rings, intra-uterine devices, subdermal implants, and other. Among these, the condoms segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Condoms dominate the market due to their affordability, accessibility, and dual protection against pregnancies and sexually transmitted infections (STIs). They require no medical prescription, making them convenient for all age groups. Growing awareness of safe sex practices through public health campaigns and educational programs further drives their adoption. Unlike hormonal or device-based contraceptives, condoms have minimal side effects, making them a preferred and trusted choice for both men and women across Italy.

- The retail pharmacies & drugstores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy contraceptive devices market is segmented by distribution channel into hospital pharmacies, retail pharmacies & drugstores, e-commerce & tele-pharmacies, and family-planning clinics. Among these, the retail pharmacies & drugstores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Retail pharmacies and drugstores dominate the market because they offer easy accessibility and wide product availability, allowing consumers to purchase contraceptives conveniently without a prescription. These outlets provide professional guidance from pharmacists, helping users make informed choices. Frequent promotional campaigns, in-store awareness programs, and strategic locations in urban and semi-urban areas further enhance visibility and adoption. Compared to hospitals or clinics, retail pharmacies offer quicker, more discreet, and more convenient access, making them the preferred distribution channel for most consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy contraceptive devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Reckitt Benckiser Group plc

- The Cooper Companies / CooperSurgical

- Organon & Co.

- Church & Dwight Co., Inc.

- DKT International

- Okamoto Industries Inc.

- Pregna International Ltd.

- Linepharma International

- LifeStyles Healthcare

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In December 2024, Altroconsumo launched a national campaign in Italy seeking legal redress for women harmed by Essure contraceptive devices, raising awareness about device safety, consumer rights, and accountability, and influencing public trust and regulatory scrutiny within the contraceptive devices market.

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy contraceptive devices market based on the below-mentioned segments:

Italy Contraceptive Devices Market, By Product Type

- Condoms

- Diaphragms & Cervical Caps

- Vaginal Sponges

- Vaginal Rings

- Intra-Uterine Devices

- Subdermal Implants

- Other

Italy Contraceptive Devices Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies & Drugstores

- E-Commerce & Tele-Pharmacies

- Family-Planning Clinics

Frequently Asked Questions (FAQ)

-

1.What is the Italy contraceptive devices market?The Italy contraceptive devices market includes products such as condoms, IUDs, implants, diaphragms, and vaginal rings that prevent pregnancies and protect against sexually transmitted infections (STIs).

-

2.What are the key drivers of the Italy contraceptive devices market?Rising awareness of family planning, government initiatives, increasing prevalence of STIs, demand for innovative contraceptives, and expanding women’s healthcare infrastructure drive the market.

-

3.Which product segment dominates the Italy contraceptive devices market?Condoms dominate due to their affordability, accessibility, dual protection against pregnancy and STIs, and ease of use.

-

4.Which distribution channel is most preferred in Italy?Retail pharmacies and drugstores lead, offering convenience, professional guidance, and immediate product availability.

-

5.What are the major trends in the Italy contraceptive devices market?Key trends include rising adoption of hormonal contraceptives, eco-friendly products, digital health integration, and increasing male contraceptive awareness.

-

6.What technological advancements are influencing the market?Innovations include biocompatible IUDs and implants, smart condoms with sensors, 3D-printed contraceptives, and digital health platforms for monitoring and guidance.

Need help to buy this report?