Italy Commercial Vehicles Lubricants Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Trucks, Buses, Construction Equipment), By Oil Type (Conventional, Synthetic, Synthetic Blend), By Application (Engine Oil, Transmission Fluid, Gear Oil, Hydraulic Fluid), and Italy Commercial Vehicles Lubricants Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsItaly Commercial Vehicles Lubricants Market Size Insights Forecasts to 2035

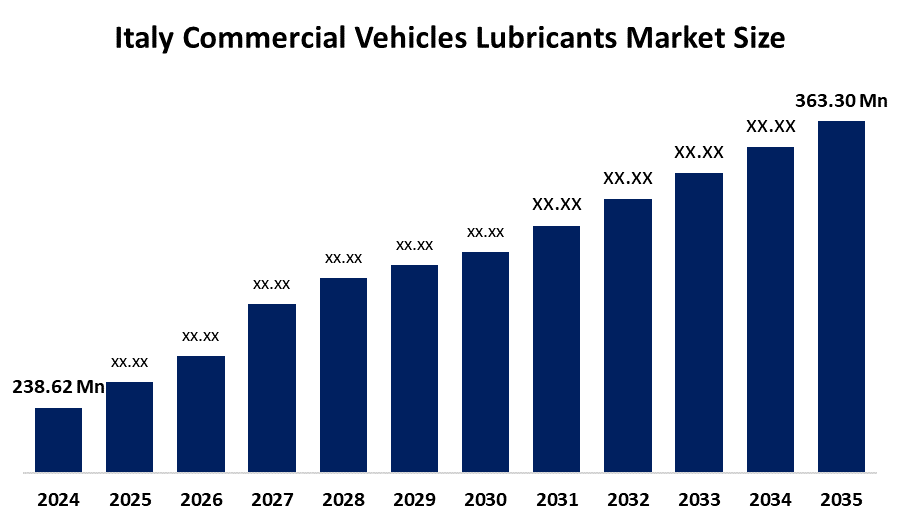

- The Italy Commercial Vehicles Lubricants Market Size Was Estimated at USD 238.62 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.9% from 2025 to 2035

- The Italy Commercial Vehicles Lubricants Market Size is Expected to Reach USD 363.30 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Italy Commercial Vehicles Lubricants Market Size is anticipated to Reach USD 363.30 Million by 2035, Growing at a CAGR of 3.9% from 2025 to 2035. The Italy commercial vehicles lubricants market is driven by rising freight transportation, growth in logistics and e-commerce, increasing commercial vehicle fleet size, stringent emission norms requiring high-performance lubricants, extended vehicle service intervals, and growing focus on fuel efficiency and engine durability.

Market Overview

Commercial vehicle lubricants are specialized oils and greases used in trucks, buses, vans, and heavy-duty vehicles to reduce friction, control wear, dissipate heat, and prevent corrosion in engines, transmissions, axles, and hydraulic systems. They enhance fuel efficiency, ensure smooth operation, extend component life, and support reliable performance under heavy loads and demanding operating conditions. Furthermore, The Italy commercial vehicles lubricants market is growing due to increasing commercial vehicle production, rising freight and logistics activities, stringent emission regulations, demand for high-performance and fuel-efficient lubricants, and expanding vehicle maintenance services supporting long-term engine reliability.

Tariffs on Italy commercial vehicles and lubricants can significantly influence both domestic and international markets. They often lead to higher prices for imported goods, which can increase production costs for businesses and reduce consumer purchasing power. While tariffs may protect local industries from foreign competition, they can also spark trade tensions and retaliatory measures from other countries. Over time, this may disrupt supply chains, slow down market growth, and affect global competitiveness. Ultimately, the impact of tariffs on Italy Commercial Vehicles Lubricants Market depends on the industry’s dependency on imports and its ability to adapt to shifting trade dynamics.

The increasing adoption of advanced engine technologies in commercial vehicles is driving the demand for high-performance lubricants designed to maximize engine life, enhance fuel efficiency, and support emission control. These lubricants include synthetic-based oils and formulations enriched with advanced additive packages to reduce friction, prevent wear, and ensure optimal performance under demanding operating conditions.

Report Coverage

This research report categorizes the market for the Italy commercial vehicles lubricants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy commercial vehicles lubricants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy commercial vehicles lubricants market.

Italy Commercial Vehicles Lubricants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 238.62 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.9% |

| 2035 Value Projection: | USD 363.30 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle Type, By Oil Type and COVID-19 Impact Analysis |

| Companies covered:: | Eni S.p.A., BP PLC (Castrol), Shell (Royal Dutch Shell Plc), TotalEnergies SE, PETRONAS Lubricants International, FUCHS Petrolub SE, ExxonMobil Corporation, Q8Oils, Repsol, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The Italy commercial vehicles lubricants market is primarily driven by the increasing commercial vehicle fleet due to growing logistics, transportation, and e-commerce activities. Stringent emission regulations are compelling the adoption of high-performance and synthetic lubricants that improve fuel efficiency and engine durability. Additionally, the rise in long-haul transport, demand for extended vehicle service intervals, and the need for reliable engine performance under heavy loads are fueling market growth. Technological advancements in engine design further boost the demand for specialized lubricants.

Restraining Factors

The Italy commercial vehicles lubricants market faces restraints from the high cost of advanced synthetic lubricants, which may limit adoption among small and medium fleet operators. Additionally, fluctuating crude oil prices, economic uncertainties, and the availability of low-cost alternatives can hinder market growth. Limited awareness about the benefits of high-performance lubricants also affects widespread usage across the commercial vehicle sector.

Market Segmentation

The Italy commercial vehicles lubricants market share is classified into vehicle type, oil type, and application.

- The trucks segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy commercial vehicles lubricants market is segmented by vehicle type into trucks, buses, and construction equipment. Among these, the trucks segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of the truck segment in Italy’s commercial vehicles lubricants market is driven by the extensive use of trucks in freight, logistics, and long-haul transportation across the country. Trucks operate under high loads and cover long distances, increasing the frequency of engine and transmission maintenance, which in turn boosts lubricant consumption. Additionally, the growing e-commerce sector and expanding supply chain networks have increased truck fleet size. In contrast, buses and construction equipment have lower usage intensity, leading to comparatively lower lubricant demand.

- The synthetic segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy commercial vehicles lubricants market is segmented by oil type into conventional, synthetic, and synthetic blend. Among these, the synthetic segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of the synthetic segment in Italy’s commercial vehicles lubricants market is driven by the growing need for high-performance lubricants that can withstand extreme temperatures and heavy-duty operating conditions. Synthetic oils offer superior engine protection, reduce friction and wear, enhance fuel efficiency, and support longer service intervals, aligning with stringent emission regulations. With advanced engine technologies becoming standard in commercial vehicles, fleet operators increasingly prefer synthetic lubricants over conventional and blend oils to ensure reliability, durability, and optimal performance.

- The engine oil segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy commercial vehicles lubricants market is segmented by application into engine oil, transmission fluid, gear oil, and hydraulic fluid. Among these, the engine oil segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of the engine oil segment in Italy’s commercial vehicles lubricants market is driven by its critical role in maintaining engine performance, reducing friction, preventing wear, and enhancing fuel efficiency. Commercial vehicles, especially trucks and buses, operate for long hours under heavy loads, leading to frequent engine oil consumption and replacement. Additionally, stringent emission and performance standards require high-quality engine oils to ensure compliance. In comparison, other lubricants like transmission, gear, and hydraulic oils are used in smaller volumes, limiting their market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy commercial vehicles lubricants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eni S.p.A.

- BP PLC (Castrol)

- Shell (Royal Dutch Shell Plc)

- TotalEnergies SE

- PETRONAS Lubricants International

- FUCHS Petrolub SE

- ExxonMobil Corporation

- Q8Oils

- Repsol

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy commercial vehicles lubricants market based on the below-mentioned segments:

Italy Commercial Vehicles Lubricants Market, By Vehicle Type

- Trucks

- Buses

- Construction Equipment

Italy Commercial Vehicles Lubricants Market, By Oil Type

- Conventional

- Synthetic

- Synthetic Blend

Italy Commercial Vehicles Lubricants Market, By Application

- Engine Oil

- Transmission Fluid

- Gear Oil

- Hydraulic Fluid

Frequently Asked Questions (FAQ)

-

Q1: Why is lubricant replacement frequency high in Italy’s commercial vehicles?Long-distance transport, heavy load operations, and varying road conditions increase engine stress, leading to frequent lubricant replacement.

-

Q2: How do emission norms influence lubricant demand in Italy?Stricter emission regulations require low-ash, high-performance lubricants compatible with modern engines and after-treatment systems.

-

Q3: Which application generates steady lubricant demand?Engine oil generates consistent demand due to continuous vehicle usage and mandatory service intervals.

-

Q4: How does fleet modernization impact the market?Newer vehicles require advanced synthetic lubricants, increasing demand for premium lubricant products.

-

Q5: What role do logistics hubs play in market growth?Expanding logistics and transport hubs increase commercial vehicle movement, boosting lubricant consumption.

Need help to buy this report?