Italy Biopesticides Market Size, Share, and COVID-19 Impact Analysis, By Product (Bioherbicides, Bioinsecticides, Bio Fungicides, Other), By Ingredient Type (Microbial Pesticide, Plant Biopesticide, Biochemical Pesticide), By Application (Crop-Based and Non-Crop-Based), and Italy Biopesticides Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureItaly Biopesticides Market Insights Forecasts To 2035

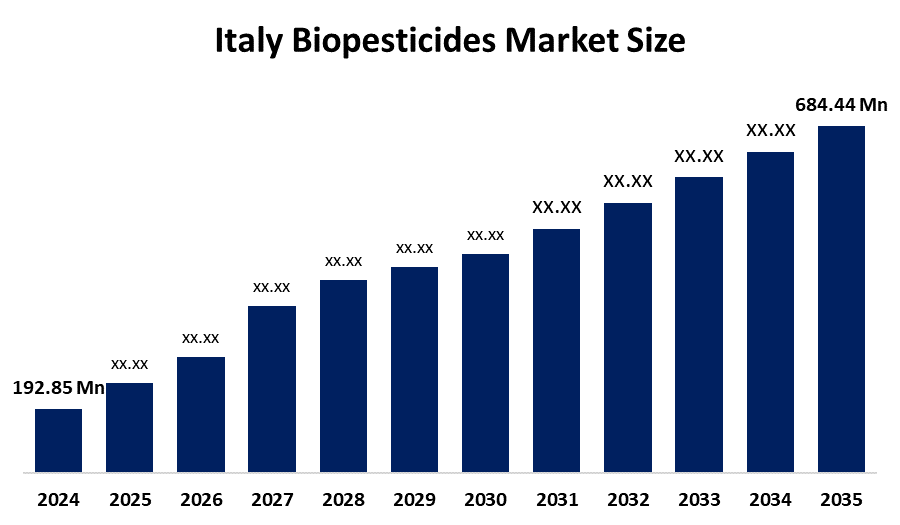

- The Italy Biopesticides Market Size Was Estimated At USD 192.85 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 12.2% From 2025 To 2035

- The Italy Biopesticides Market Size Is Expected To Reach USD 684.44 Million By 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Italy Biopesticides Market Size Is Anticipated To Reach USD 684.44 Million By 2035, Growing At A CAGR Of 12.2% From 2025 To 2035. The Italy biopesticides market is driven by rising demand for organic farming, strict regulations on chemical pesticides, growing environmental awareness, government support for sustainable agriculture, and increasing adoption of eco-friendly crop protection solutions by farmers.

Market Overview

The Italy Biopesticides Market Size refers to the production and use of pest control products derived from natural sources such as microorganisms, plants, minerals, and beneficial insects. The market is growing steadily due to increasing adoption of organic and sustainable farming practices, strict European regulations limiting chemical pesticide use, and rising consumer demand for residue-free food. Government support for eco-friendly agriculture and the need to protect soil health and biodiversity are also key growth drivers supporting market expansion in Italy.

One major trend is the rising use of biopesticides in organic farming, as farmers seek certified solutions that comply with eu organic standards.Another trend is the growing preference for biofungicides, driven by increasing fungal disease pressure in fruits, vegetables, and vineyards. The third trend is integrated pest management (IPM) adoption, where biopesticides are combined with conventional methods to reduce chemical dependence. Lastly, increasing awareness among farmers through training programs and advisory services is boosting acceptance and correct usage of biopesticide products.

technological advancements are improving the effectiveness and shelf life of biopesticides through better formulation techniques such as microencapsulation and controlled-release systems. Recent innovations include the development of strain-specific microbial pesticides that target pests more precisely while minimizing impact on beneficial organisms. Advances in biotechnology and fermentation processes are enabling large-scale production with consistent quality. Additionally, digital agriculture tools and precision spraying technologies are supporting optimized application, improving efficacy and encouraging wider adoption of biopesticides across Italy.

Market Overview

The Italy Biopesticides Market Size refers to the production and use of pest control products derived from natural sources such as microorganisms, plants, minerals, and beneficial insects.The market is growing steadily due to increasing adoption of organic and sustainable farming practices, strict European regulations limiting chemical pesticide use, and rising consumer demand for residue-free food. Government support for eco-friendly agriculture and the need to protect soil health and biodiversity are also key growth drivers supporting market expansion in Italy.

one major trend is the rising use of biopesticides in organic farming, as farmers seek certified solutions that comply with EU organic standards.Another trend is the growing preference for biofungicides, driven by increasing fungal disease pressure in fruits, vegetables, and vineyards. The third trend is integrated pest management (IPM) adoption, where biopesticides are combined with conventional methods to reduce chemical dependence. Lastly, increasing awareness among farmers through training programs and advisory services is boosting acceptance and correct usage of biopesticide products.

technological advancements are improving the effectiveness and shelf life of biopesticides through better formulation techniques such as microencapsulation and controlled-release systems. Recent innovations include the development of strain-specific microbial pesticides that target pests more precisely while minimizing impact on beneficial organisms. Advances in biotechnology and fermentation processes are enabling large-scale production with consistent quality. Additionally, digital agriculture tools and precision spraying technologies are supporting optimized application, improving efficacy and encouraging wider adoption of biopesticides across Italy.

Report Coverage

This research report categorizes The Market Size For The Italy Biopesticides Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy biopesticides market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy biopesticides market.

Italy Biopesticides Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 192.85 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Koppert Biological System Inc, Novonesis, Lallemand Inc, BASF SE, Corteva Agriscience, Bayer AG, De Sangosse Group (Agronutrition), UAB Bioenergy, ASB Greenworld, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy Biopesticides Market Size is driven by the increasing shift toward organic and sustainable farming practices, supported by strict european union regulations that restrict chemical pesticide usage. Growing consumer demand for safe, residue-free food is encouraging farmers to adopt eco-friendly crop protection solutions. Government incentives, subsidies, and awareness programs promoting sustainable agriculture further support market growth. Additionally, rising concerns about soil health, biodiversity protection, and resistance developed by pests against chemical pesticides are accelerating the adoption of biopesticides across Italy’s agricultural sector.

Restraining Factors

The Italy Biopesticides Market Size Is restrained by higher product costs compared to conventional chemical pesticides and limited awareness among small-scale farmers.Shorter shelf life, variable effectiveness under different climatic conditions, and the need for precise application methods also reduce farmer confidence, slowing widespread adoption across Italy.

Market Segmentation

The Italy biopesticides market share is classified into product, ingredient type, and application.

- The biofungicides segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy Biopesticides Market Size is segmented by product into bioherbicides, bioinsecticides, biofungicides, and others. Among these, the biofungicides segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The biofungicides segment dominates the market due to widespread fungal disease pressure in key crops such as grapes, fruits, vegetables, and olives. Italy’s large wine and horticulture industries require effective disease management solutions that meet strict EU restrictions on chemical fungicides. Biofungicides are widely adopted in organic and integrated pest management practices, as they are environmentally safe, residue-free, and help maintain soil health, making them a preferred choice among Italian farmers.

- The microbial pesticide segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy Biopesticides Market Size is segmented by ingredient type into microbial pesticide, plant biopesticide, and biochemical pesticide. Among these, the microbial pesticide segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The microbial pesticide segment dominates the market due to its high effectiveness against diverse pests and plant diseases, especially in vineyards, fruits, and vegetable crops. Microbial products such as bacillus, trichoderma, and beauveria species are widely accepted in organic and integrated pest management systems. Their targeted action, low environmental impact, and compliance with strict EU regulations on chemical pesticides further drive strong adoption among Italian farmers.

- The crop-based segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy Biopesticides Market Size is segmented by application into crop-based and non-crop-based. among these, the crop-based segment accounted for the largest revenue share in 2024 and is expected to grow at a significant cagr during the forecast period. The crop-based segment dominates the market due to the large agricultural area under cultivation of fruits, vegetables, grapes, olives, and cereals. Italy’s strong focus on organic farming and high-value crops drives extensive use of biopesticides for pest and disease control. Strict EU regulations limiting chemical pesticide use further encourage farmers to adopt biopesticides in crop production, while non-crop applications remain comparatively limited in scale and demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the italy biopesticides market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.the overall competition within the market.

List of Key Companies

- Koppert Biological System Inc

- Novonesis

- Lallemand Inc

- BASF SE

- Corteva Agriscience

- Bayer AG

- De Sangosse Group (Agronutrition)

- UAB Bioenergy

- ASB Greenworld

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy biopesticides market based on the below-mentioned segments:

Italy Biopesticides Market, By Product

- Bioherbicides

- Bioinsecticides

- Biofungicides

- Other

Italy Biopesticides Market, By Ingredient Type

- Microbial Pesticide

- Plant Biopesticide

- Biochemical Pesticide

Italy Biopesticides Market, By Application

- Crop-Based

- Non-Crop-Based

Frequently Asked Questions (FAQ)

-

What is the Italy biopesticides market size?The Italy biopesticides market is estimated to reach USD 192.85 million in 2024 and projected to grow further by 2035.

-

What is the expected growth of the Italy biopesticides market?The market is forecasted to grow at a CAGR of around 12.2% during the period up to 2035.

-

What are the main driving factors of the Italy biopesticides market?The Italy biopesticides market is driven by the growth of organic farming, sustainable agriculture practices, and regulatory restrictions on chemical pesticides.

-

What are the challenges in the Italy biopesticides market?High costs, short shelf life, and limited awareness among small-scale farmers restrict growth in the Italy Biopesticides Market

-

Which applications dominate the Italy biopesticides market?Crop-based applications dominate the Italy Biopesticides Market.

-

Which product type leads the Italy biopesticides market?Biofungicides are the leading product type in the Italy Biopesticides Market.

-

Which ingredient type is most popular in the Italy biopesticides market?Microbial pesticides are the most widely used ingredient type in the Italy Biopesticides Market.

-

What is the future outlook of the Italy biopesticides market?The Italy biopesticides market is expected to grow steadily due to increasing demand for sustainable and eco-friendly pest control solutions.

Need help to buy this report?