Global Isononanoic Acid Market Size, Share, and COVID-19 Impact Analysis, By Grade (Industrial, Cosmetic, and Food), By Application (Skin-Conditioning Agents, Cleansing Agents, Corrosion Inhibitor, Alkyd Resin, Plasticizer, Detergents, Lubricants, Herbicides, Synthetic Flavoring Agent, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Isononanoic Acid Market Insights Forecasts to 2035

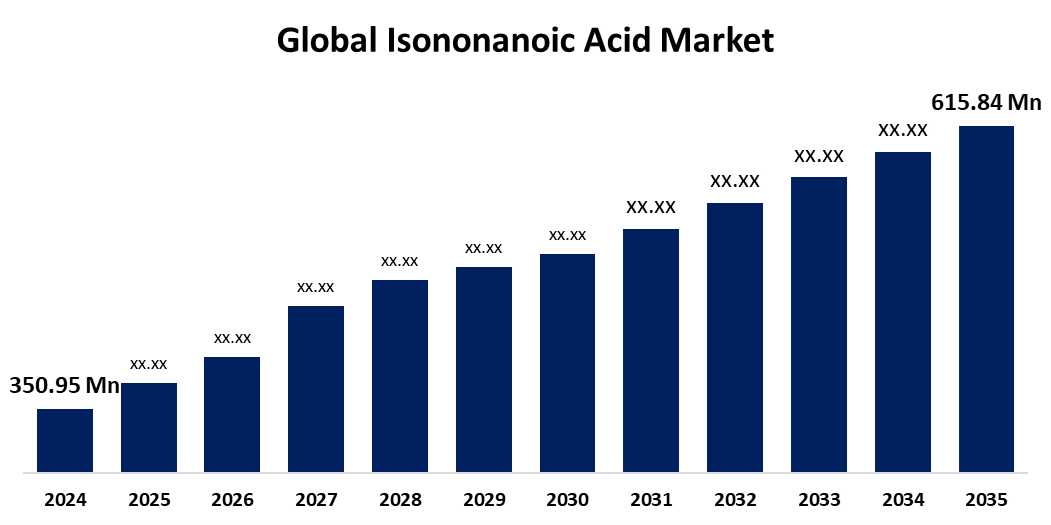

- The Global Isononanoic Acid Market Size Was Estimated at USD 350.95 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.25% from 2025 to 2035

- The Worldwide Isononanoic Acid Market Size is Expected to Reach USD 615.84 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The global isononanoic acid market size was worth around USD 350.95 million in 2024 and is predicted to grow to around USD 615.84 Million by 2035 with a compound Annual Growth rate (CAGR) of 5.25% from 2025 and 2035. The Expanding use of Bio-Based Isononanoic acid, the creation of new uses in the building and automotive sectors, and the rising demand for environmentally friendly and sustainable products are some of the major trends in the Isononanoic acid market.

Market Overview

The global industry devoted to the manufacture, distribution, and usage of isononanoic acid, a versatile carboxylic acid utilized in a variety of industries, is referred to as the isononanoic acid market. It is frequently used in industrial fluids, lubricants, coatings, and cosmetics due to its low volatility, corrosion resistance, and thermal stability. Increased use in personal care products, improvements in industrial formulations, and rising demand for synthetic polyol ester-based lubricants are driving the isononanoic acid market.

The market for isononanoic acid has enormous opportunities due to the increased demand for sustainable and eco-friendly materials. For Instance, in March 2023, OQ Chemicals launched "OxBalance Isononanoic Acid," the first isononanoic acid made from both bio-based and circular feedstock to be sold commercially. The new product offers producers a sustainable and environmentally friendly substitute for traditional isononanoic acid due to contains more than 70% bio-based material.

The market is being driven by the expanding usage of isononanoic acid in the manufacturing of plasticizers, lubricants, and perfumes. The adaptability of isononanoic acid in application areas like lubricants, coatings, and cosmetics is contributing to its steady growth in the global isononanoic acid market. The growing demand for sustainable and eco-friendly materials, government policies that support non-toxic and biodegradable products, and the growth of the automotive sector in emerging regions are some of the major factors driving the isononanoic acid market.

Report Coverage

This research report categorizes the isononanoic acid market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the isononanoic acid market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the isononanoic acid market.

Global Isononanoic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 350.95 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.25% |

| 2035 Value Projection: | USD 615.84 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 242 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Grade, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | OQ Chemicals GmbH, Isatis Corporation, BOC Sciences, Perstorp Holding AB, JYT Chemical, PT Justus Kimiaraya, BASF SE, Haihang Group, TCI Chemicals, Hairui Chemical, Angchen Co Ltd, KH Neochem Co., Ltd., Matrix Fine Chemicals, Santa Cruz Biotechnology, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for cosmetics, consumers' high disposable income, and ongoing lifestyle improvements are all likely to fuel growth in the isononanoic acid market. The growing popularity of using bio-based feedstocks to produce isononanoic acid is another factor driving the market expansion. Isononanoic acid is used as an emollient in cosmetics to prepare high-end personal care products, while the growing adoption of bio-based applications is also advantageous to propel the market. Low-VOC requirements are driving the growing use of waterborne alkyd resins and the growing need for synthetic polyol ester-based lubricants.

Restraining Factors

High manufacturing costs, strict environmental restrictions, supply chain interruptions, fluctuating raw material prices, low awareness, competition from substitutes, and demand volatility across industries are some of the factors that are restraining the isononanoic acid market.

Market Segmentation

The isononanoic acid market share is classified into grade and application.

- The industrial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the grade, the isononanoic acid market is divided into industrial, cosmetic, and food. Among these,the industrial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The widespread application in lubricants, coatings, and metalworking fluids accounts for the industrial-grade category. A major factor in its market dominance was the growing need for corrosion-resistant coatings and high-performance lubricants in sectors including manufacturing, aerospace, and automobiles.

- The skin-conditioning agents segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the isononanoic acid market is divided into skin-conditioning agents, cleansing agents, corrosion inhibitor, alkyd resin, plasticizer, detergents, lubricants, herbicides, synthetic flavoring agent, and others. Among ]these, the skin-conditioning agents segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Skin conditioning agents are segmented under application due to the compound's superior emollient qualities, which make it a popular ingredient in cosmetics and personal care products. In skincare applications, a light, non-greasy finish is especially desired in the texture and feel of compositions improved by isononanoic acid.

Regional Segment Analysis of the Isononanoic Acid Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the isononanoic acid market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the isononanoic acid market over the predicted timeframe. Asia Pacific boasts a robust industrial foundation, a quickly expanding automotive sector, and a burgeoning market for cosmetics and personal care products. Countries like China, India, and Japan have become major consumers in the production of consumer and automotive products, which further increases the demand for isononanoic acid in industrial and personal care applications. The use of sophisticated formulations, including isononanoic acid, is driven by the cosmetics industry due to its growing consumer base, rising disposable incomes, and increased concerns about skincare.

North America is expected to grow at a rapid CAGR in the isononanoic acid market during the forecast period. The market expansion is anticipated to be driven by the growing need for lubricants, coatings, and adhesives from the automotive sector. The adoption of ecologically friendly and sustainable materials as regular industry practices has led to a significant demand for natural isononanoic acid. The need for building supplies like pipes, where isononanoic acid is crucial, is increasing due to the increase in construction activity. The market is growing due to the region's well-established chemical sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the isononanoic acid market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- OQ Chemicals GmbH

- Isatis Corporation

- BOC Sciences

- Perstorp Holding AB

- JYT Chemical

- PT Justus Kimiaraya

- BASF SE

- Haihang Group

- TCI Chemicals

- Hairui Chemical

- Angchen Co Ltd

- KH Neochem Co., Ltd.

- Matrix Fine Chemicals

- Santa Cruz Biotechnology

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2023, OQ Chemicals announced that it had increased the capacity of its Oberhausen carboxylic acid production facility. In 2024, the upgraded capacity was anticipated to go commercial. In order to increase productivity, upgrade infrastructure, and fortify production capacities, the company recently disclosed its investment in a partial redesign of its global network of multipurpose production units.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the isononanoic acid market based on the below-mentioned segments:

Global Isononanoic Acid Market, By Grade

- Industrial

- Cosmetic

- Food

Global Isononanoic Acid Market, By Application

- Skin-Conditioning Agents

- Cleansing Agents

- Corrosion Inhibitor

- Alkyd Resin

- Plasticizer

- Detergents

- Lubricants

- Herbicides

- Synthetic Flavoring Agent

- Others

Global Isononanoic Acid Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the isononanoic acid market over the forecast period?The global isononanoic acid market is projected to expand at a CAGR of 5.25% during the forecast period.

-

2. What is the market size of the isononanoic acid market?The global isononanoic acid market size is expected to grow from USD 350.95 Million in 2024 to USD 615.84 Million by 2035, at a CAGR of 5.25% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the isononanoic acid market?Asia Pacific is anticipated to hold the largest share of the isononanoic acid market over the predicted timeframe.

Need help to buy this report?