Global Iron Ore Pellets Market Size, Share, and COVID-19 Impact Analysis, By Product (Blast Furnace and Direct Reduction), By Application (Steel Production, Iron Based Chemicals, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Iron Ore Pellets Market Insights Forecasts to 2035

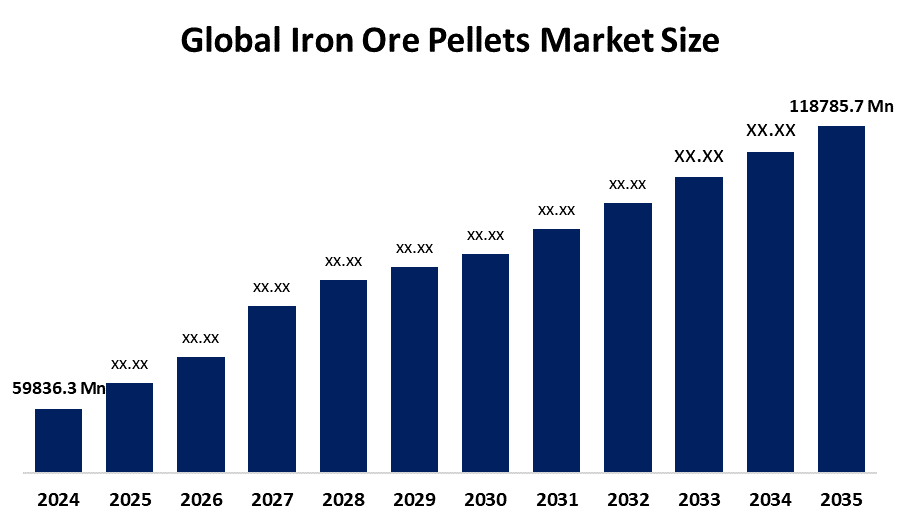

- The Global Iron Ore Pellets Market Size Was Estimated at USD 59836.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.43 % from 2025 to 2035

- The Worldwide Iron Ore Pellets Market Size is Expected to Reach USD 118785.7 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global iron ore pellets market size was worth around USD 59836.3 Million in 2024 and is predicted to grow to around USD 118785.7 Million by 2035 with a compound annual growth rate (CAGR) of 6.43% from 2025 to 2035. The global transition toward low-carbon steelmaking represents a major growth opportunity for the market. Conventional blast furnace–basic oxygen furnace (BF–BOF) processes are highly carbon-intensive, generating nearly 1.9 tons of CO2 per ton of steel. In response to climate commitments, steel producers are rapidly shifting toward Direct Reduced Iron (DRI) and hydrogen-based reduction technologies, both of which depend on high-quality DR-grade pellets with iron content above 67% and low silica and alumina levels.

Market Overview

Iron ore pellets, small spherical agglomerates of iron ore, are critical raw material used in the production of steel. They are created by mixing finely crushed concentrate sources of iron ore ('concentrates') (primarily magnetite or hematite) with binders (e.g., bentonite clay, limestone, organic additives) and placing them in a pellet furnace (or 'induration furnace') where they are heated to achieve the appropriate strength and characteristics. Drivers for growth include an upturn in steel demand, the continual evolution towards hydrogen-ready direct reduced iron (DRI) production methods and the tightening of environmental regulations that will increasingly encourage the use of high-grade pelletised feedstock. Within Asia-Pacific, the majority of the demand for iron ore pellets continues to be sustained by the heavy reliance on blast furnaces in China, as well as the ongoing expansion of production capacity by India, in conjunction with the national infrastructure initiatives underway within that country. The Middle East and North America are beginning to gain traction with an increased availability of low carbon DRI production capacity, increasing the demand and therefore the price for limited quantities of Direct-Reduced-Grade (DR-grade) pellets. Competition within the market for iron ore pellets is moderately concentrated, with a relatively small number of large players, including Vale, Rio Tinto, and Cleveland-Cliffs, benefitting from vertically integrated mining and pelletising operations while many of the mid-tier producers are merging to access high-grade reserves and limit their exposure to demand. Concurrently, the technology associated with the production of iron ore pellets is moving towards hybrid and low carbon induration techniques.

Report Coverage

This research report categorizes the iron ore pellets market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the iron ore pellets market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the iron ore pellets market.

Iron Ore Pellets Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 59836.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.43% |

| 2035 Value Projection: | USD 118785.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Samarco, Vale S.A., Ferrexpo PLC, Bahrain Steel (GIIC), Jindal Steel & Power Ltd. (JSPL), KIOCL Ltd., ArcelorMittal, Ansteel Group, China Baowu Steel Group, Severstal, and Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The iron ore pellets market is driven by rising global steel production, which reached over 1.9 billion tons, sustaining strong raw material demand. Pelletized feedstock lowers coke consumption by 8–10% and reduces CO2 emissions by up to 30% compared to sinter, supporting decarburization goals. Rapid adoption of DRI-based steelmaking, expected to grow at a CAGR above 7%, is boosting demand for DR-grade pellets (>67% Fe). Additionally, stricter environmental regulations and expanding infrastructure investments in Asia-Pacific are reinforcing market growth.

Restraining Factors

High capital and operating costs associated with pelletizing plants remain a significant market restraint. Establishing a pellet facility requires substantial upfront investment in beneficiation units, balling equipment, and induration furnaces. The pelletizing process is highly energy-intensive, particularly during drying and induration stages, with fuel expenses representing nearly 20–30% of total production costs. In high-energy-cost regions such as Europe, these elevated expenses undermine cost competitiveness and limit capacity expansion.

Market Segmentation

The iron ore pellets market share is classified into product and application.

- The blast furnace segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the iron ore pellets market is divided into blast furnace and direct reduction. Among these, the blast furnace segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The blast furnace segment dominated in 2024 due to the large installed base of BF–BOF steel plants, particularly in Asia-Pacific. However, the direct reduction segment is projected to grow rapidly, driven by decarbonization goals and rising adoption of DRI–EAF steelmaking routes.

- The steel production segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the iron ore pellets market is divided into steel production, iron based chemicals, and others. Among these, the steel production segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The steel production segment led market revenue in 2024 due to the extensive use of iron ore pellets in blast furnace and DRI steelmaking. Ongoing infrastructure development, urbanization, and the shift toward low-carbon steel technologies are driving strong future growth.

Regional Segment Analysis of the Iron Ore Pellets Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

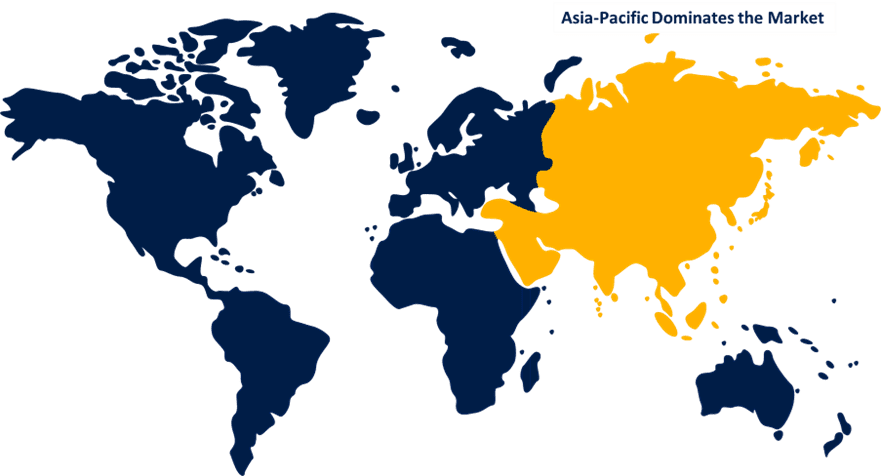

Asia Pacific is anticipated to hold the largest share of the iron ore pellets market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the iron ore pellets market over the predicted timeframe. Asia Pacific is expected to dominate the iron ore pellets market due to its massive steel production base, accounting for over 70% of global crude steel output. China alone produces more than 1 billion tons of steel annually, sustaining strong pellet demand for blast furnace operations. India’s steel capacity is projected to exceed 300 million tons by 2030, boosting pellet consumption. Rapid infrastructure development, urbanization, and rising investments in DRI-based steelmaking further reinforce regional demand growth.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the iron ore pellets market during the forecast period. North America is projected to grow at a rapid CAGR in the iron ore pellets market due to increasing adoption of DRI–EAF steelmaking, which requires high-grade DR pellets. The region benefits from abundant natural gas, rising investments in low-carbon steel projects, and capacity expansions by integrated producers. Additionally, stricter emission regulations and strong demand from the automotive and construction sectors are accelerating the shift toward pelletized feedstock.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the iron ore pellets market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samarco

- Vale S.A.

- Ferrexpo PLC

- Bahrain Steel (GIIC)

- Jindal Steel & Power Ltd. (JSPL)

- KIOCL Ltd.

- ArcelorMittal

- Ansteel Group

- China Baowu Steel Group

- Severstal

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Platts (S&P Global) plans to revise its Atlantic iron ore blast furnace pellet premium pricing by introducing a new monthly assessment based on 65% Fe iron ore fines and discontinuing the all-in contract price. The existing premium will shift to reference 61% Fe fines, aligning with updated market benchmarks, effective January 2, 2026.

- In June 2025, Fastmarkets has launched a new Iron Ore 61% Fe fines, CFR Qingdao index to better reflect spot pricing for mid-grade iron ore traded in China’s seaborne market. The index tracks 61% Fe content fines, aligning benchmarks with current trade quality and improving price discovery in a shifting market environment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the iron ore pellets market based on the below-mentioned segments:

Global Iron Ore Pellets Market, By Product

- Blast Furnace

- Direct Reduction

Global Iron Ore Pellets Market, By Application

- Steel Production

- Iron Based Chemicals

- Others

Global Iron Ore Pellets Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the iron ore pellets market over the forecast period?The global iron ore pellets market is projected to expand at a CAGR of 6.43% during the forecast period.

-

2. What is the market size of the iron ore pellets market?The global iron ore pellets market size is expected to grow from USD 59836.3 Million in 2024 to USD 118785.7 Million by 2035, at a CAGR of 6.43 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the iron ore pellets market?Asia Pacific is anticipated to hold the largest share of the iron ore pellets market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global iron ore pellets market?Samarco, Vale S.A., Ferrexpo PLC, Bahrain Steel (GIIC), Jindal Steel & Power Ltd., KIOCL Ltd., ArcelorMittal, Ansteel Group, China Baowu Steel Group, and Severstal.

-

5. What factors are driving the growth of the iron ore pellets market?The iron ore pellets market is driven by rising global steel production, which reached over 1.9 billion tons, sustaining strong raw material demand.

-

6. What are the market trends in the iron ore pellets market?Current trends in the iron ore pellets market include a strong shift toward direct reduced iron (DRI) and low-carbon steelmaking, rising demand for high-grade pellets, adoption of energy-efficient and hybrid technologies, and increasing focus on sustainability and CO₂ emission reduction.

-

7. What are the main challenges restricting the wider adoption of the Iron Ore Pellets market?The iron ore pellets market faces notable challenges that may constrain growth despite increasing demand. A major concern is the limited supply of high-grade iron ore needed for pellet production. In countries like India, most reserves are medium- to low-grade (55–62% Fe), necessitating expensive beneficiation processes before pelletizing.

Need help to buy this report?