Ireland Draught Beer Market Size, Share, By Type (Keg Beer, Cask Beer), By Category (Super Premium, Premium, and Regular), and Ireland Draught Beer Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesIreland Draught Beer Market Insights Forecasts to 2035

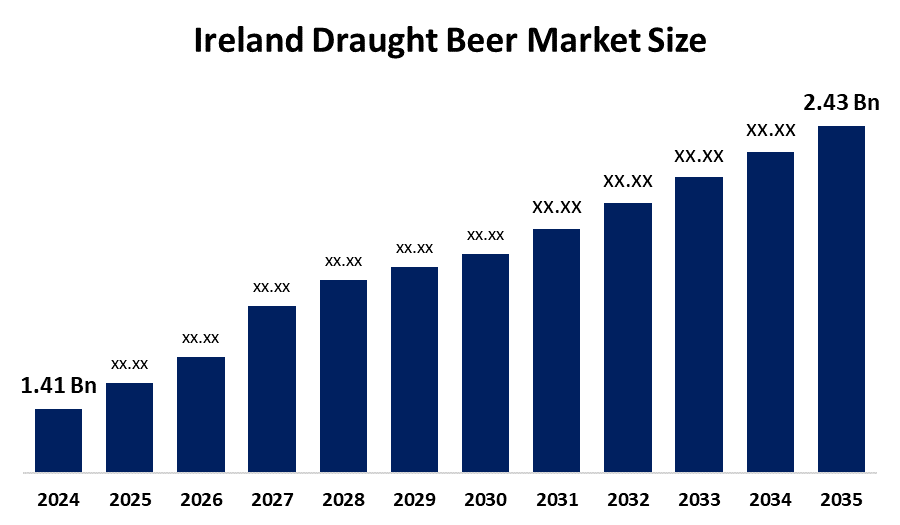

- Ireland Draught Beer Market Size 2024: USD 1.41 Billion

- Ireland Draught Beer Market Size 2035: USD 2.43 Billion

- Ireland Draught Beer Market CAGR: 5.07%

- Ireland Draught Beer Market Segments: Type and Category

Get more details on this report -

Ireland's draught beer market continues to be an essential part of the nation's larger beer sector, making a substantial contribution to both domestic consumption and cultural legacy. The market for alcoholic beverages is dominated by beer, and growing interest in premium and non-alcoholic options is a reflection of changing consumer tastes and tendencies toward responsible drinking. Sales of non-alcoholic beer increased by almost 25% in 2024, while production increased by 77% as brewers responded with capacity expansion and innovation.

The Deposit Return Scheme (DRS), which enhances recycling and sustainability in beverage packaging, and industry agitation for tax and excise support for rural pubs to maintain on-trade outlets are two examples of government policies that have an impact on the market.

Through the National Centre for Brewing and Distilling, a joint research and training center between Teagasc and SETU, Ireland is developing brewery innovation in terms of technology, improving malting and brewing technique, product development, and industry skills.

Ireland Draught Beer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.41 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.07% |

| 2035 Value Projection: | USD 2.43 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Type, By Category |

| Companies covered:: | Heineken Ireland, Molson Coors Beverage Company, Anheuser-Busch InBev., Carlsberg, Diageo, Guinness & Co, Others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Ireland Draught Beer Market:

Ireland's draught beer industry is fueled by consumers' strong affinity for beer as a social beverage. It is still the most popular alcoholic beverage in the nation, and its premium and non-alcoholic varieties are continuing to rise, reflecting changing tastes and a culture of moderation. Innovation in product options and brewing capacity, such as craft types and non-alcohol draught beers, also increases demand and expands appeal across age groups.

However, the market is constrained by a number of factors, such as growing operating expenses for breweries and bars as a result of inflation, rising energy costs, and greater excise and taxation, all of which put pressure on margins and could result in higher consumer pricing. While total per-capita beer consumption has decreased over time, regulatory limitations on alcohol distribution and promotion present further challenges to growth.

Opportunities include growing the premium draught and non-alcohol segments, appealing to health-conscious customers, utilizing tourist and export potential, and encouraging microbreweries' innovation to draw in specialized drinkers looking for genuine and regional experiences.

Market Segmentation

The Ireland Draught Beer Market share is classified into type and category.

By Type:

The Ireland Draught Beer Market is categorized by type into keg beer and cask beer. Among these, the keg beer segment held the majority market share in 2024 and is predicted to grow at a remarkable rate. Longer shelf life, constant quality, growing demand from pubs, bars, and restaurants, and expanding on-trade consumption are the main drivers of growth.

By Category:

The Ireland Draught Beer Market is divided by category into super premium, premium, and regular. Among these, the premium segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. Changing consumer preferences toward greater flavour, higher-quality ingredients, craft-style options, and a willingness to spend more for distinctive beer products are driving this segment's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Ireland draught beer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the Ireland Draught Beer Market:

- Heineken Ireland

- Molson Coors Beverage Company

- Anheuser-Busch InBev.

- Carlsberg

- Diageo

- Guinness & Co

- Others

Recent Developments in the Ireland Draught Beer Market:

- In December 2024, Heineken expanded its Heineken 0.0 draught beer availability to around 3000 Irish venues by the end of the year, reinforcing its presence in the non-alcoholic draught segment.

- In April 2025, Blarney Brewing Co entered the Irish Beer market with a $1 million investment, launching three new beers aimed at pubs and local distribution.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Ireland, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Ireland draught beer market based on the following segments:

Ireland Draught Beer Market, By Type

- Keg Beer

- Cask Beer

Ireland Draught Beer Market, By Category

- Super Premium

- Premium

- Regular

Frequently Asked Questions (FAQ)

-

1. What is the base year for the Ireland Draught Beer Market report?The base year for the Ireland Draught Beer Market report is 2024.

-

2. What historical period is covered in the report?The report includes historical data from 2020 to 2023.

-

3. What is the market size of the Ireland Draught Beer Market in 2024?In 2024, the Ireland Draught Beer Market was valued at USD 1.41 billion.

-

4. What is the projected market size by 2035?The market is expected to reach USD 2.43 billion by 2035.

-

5. What is the expected CAGR of the Ireland Draught Beer Market?The market is forecast to grow at a CAGR of 5.07% during 2025–2035.

Need help to buy this report?