Iran Hydrogen Market Size, Share, and COVID-19 Impact Analysis, By Sector (Generation Type, Storage, and Transportation), By Application (Methanol Production, Ammonia Production, Petroleum Refinery, Transportation, Power Generation, Industrial Heating, and Others), and Iran Hydrogen Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIran Hydrogen Market Insights Forecasts to 2035

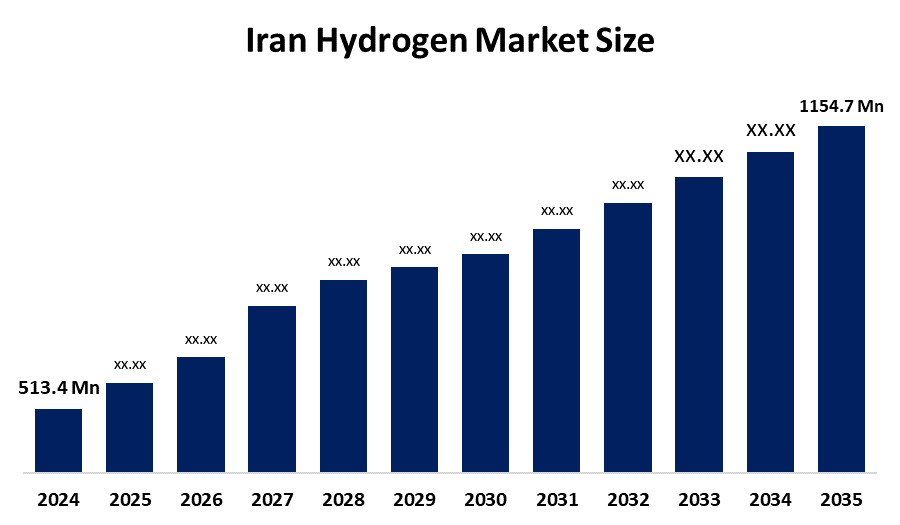

- The Iran Hydrogen Market Size Was Estimated at USD 513.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.65% from 2025 to 2035

- The Iran Hydrogen Market Size is Expected to Reach USD 1154.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Iran Hydrogen Market Size is Anticipated to Reach USD 1154.7 Million by 2035, Growing at a CAGR of 7.65% from 2025 to 2035. The hydrogen market in Iran is driven by energy diversification objectives, plentiful natural gas reserves, growing demand for clean fuels, government decarbonization programs, refinery modernization, export potential, and expanding investments in low-carbon and green hydrogen generation.

Market Overview

The Iran Hydrogen Market Size refers to the production, distribution, and use of hydrogen as an energy carrier and industrial input within Iran’s economy. Hydrogen production includes hydrogen generated from natural gas reforming, electrolysis, and other processes. The hydrogen produced through these methods serves essential industries, which include ammonia synthesis, oil refining, methanol production, fuel consumption, and new clean energy technologies. Hydrogen supports decarbonization while it supports industrial activities and energy transition objectives.

The hydrogen market in Iran receives support from government energy transition initiatives, which include SATBA's draft national hydrogen strategy, renewable energy incentives, tax exemptions, subsidized loans, and National Development Fund financing. The existing hydrogen production from refineries, which amounts to approximately 260000 tons annually, together with pilot solar-hydrogen projects, demonstrates the progress of market development through policy backing and the establishment of necessary infrastructure.

Recent Iranian developments include the commissioning of the largest refinery hydrogen production unit at Abadan using advanced Khwarizmi catalysts, which will increase local hydrogen production capabilities and operational efficiency. Iran also pilots solar-hydrogen systems like Taleghan. Future opportunities lie in green hydrogen projects and electrolyzer technology adoption and hydrogen fuel implementation in steelmaking and the export potential, which will increase as global demand for these products grows.

Report Coverage

This research report categorizes the market for the Iran hydrogen market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Iran hydrogen market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Iran hydrogen market.

Iran Hydrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 513.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.65% |

| 2035 Value Projection: | USD 1154.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application ,By Sector |

| Companies covered:: | National Iranian Oil Company (NIOC), Persian Gulf Petrochemical Industries Development & Investment Group (PGPIDIG), Arvand Petrochemical Company, Petrol Company, Nasim Sobh Farda Company, Atiye Pardaz Sharif Company, Mapna Group, Turbo Tech Compressor Tak, Khwarizmi Technology Development Company, Iran Catalyst, and Other Key Players |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The Iran Hydrogen Market Size is driven by the heavy reliance on hydrogen by businesses (particularly within the chemical sector), vast quantities of natural gas available to produce hydrogen, and the development of alternative energy sources to lessen dependency on fossil fuels. Iran has substantial potential as an emerging hydrogen market. Additionally, the Iranian government is actively pursuing hydrogen policy development as well as the integration of renewable energy. There is also a growing interest from investors in cleaner hydrogen utilization and aligning with the current trends toward global decarbonization.

Restraining Factors

The Iran Hydrogen Market Size is mostly constrained by the high production costs and the absence of ready electrolyzer and storage solutions, the restricted hydrogen transport and refueling infrastructure, the incomplete regulatory systems, and the low investment levels due to economic sanctions and fossil fuel dependency. All combine to obstruct commercial operations and decrease investor trust.

Market Segmentation

The Iran Hydrogen Market share is classified into sector and application.

- The generation type segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Iran Hydrogen Market Size is segmented by sector into generation type, storage, and transportation. Among these, the generation type segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Iran's large natural gas reserves, well-established refinery and petrochemical hydrogen production, and growing investments in low-carbon and green hydrogen generation to fulfill industrial demand and energy diversification are the reasons for this.

- The petroleum refinery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Iran Hydrogen Market Size is segmented by application into methanol production, ammonia production, petroleum refinery, transportation, power generation, industrial heating, and others. Among these, the petroleum refinery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Iran's substantial refining capacity, high hydrogen consumption for hydrocracking and desulfurization, and continuous refinery renovations to satisfy fuel quality and efficiency criteria are the main factors driving this dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Iran Hydrogen Market Size , along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- National Iranian Oil Company (NIOC)

- Persian Gulf Petrochemical Industries Development & Investment Group (PGPIDIG)

- Arvand Petrochemical Company

- Petrol Company

- Nasim Sobh Farda Company

- Atiye Pardaz Sharif Company

- Mapna Group

- Turbo Tech Compressor Tak

- Khwarizmi Technology Development Company

- Iran Catalyst

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In April 2024, Abadan Refinery's largest hydrogen production unit, which uses cutting-edge Khwarizmi catalysts and has a daily capacity of about 75 million cubic feet, is put into service.

Market Segment

This study forecasts revenue at the Iran, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Iran Hydrogen Market Size based on the below-mentioned segments:

Iran Hydrogen Market, By Sector

- Generation Type

- Storage

- Transportation

Iran Hydrogen Market, By Application

- Methanol Production

- Ammonia Production

- Petroleum Refinery

- Transportation

- Power Generation

- Industrial Heating

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Iran hydrogen market size?A: Iran hydrogen market size is expected to grow from USD 513.4 million in 2024 to USD 1154.7 million by 2035, growing at a CAGR of 7.65% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by heavy reliance on hydrogen by businesses (particularly within the chemical sector), vast quantities of natural gas available to produce hydrogen, and the development of alternative energy sources to lessen dependency on fossil fuels.

-

Q: What factors restrain the Iran hydrogen market?A: Constraints include the high production costs and the absence of ready electrolyzer and storage solutions, the restricted hydrogen transport and refueling infrastructure.

-

Q: How is the market segmented by sector?A: The market is segmented into generation type, storage, and transportation.

-

Q: Who are the key players in the Iran hydrogen market?A: Key companies include National Iranian Oil Company (NIOC), Persian Gulf Petrochemical Industries Development & Investment Group (PGPIDIG), Arvand Petrochemical Company, Petrol Company, Nasim Sobh Farda Company, Atiye Pardaz Sharif Company, Mapna Group, Turbo Tech Compressor Tak, Khwarizmi Technology Development Company, Iran Catalyst, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?