Global IoT For Cold Chain Monitoring Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By Industry (Healthcare & Pharma, Retail & CPG, Food & Beverage, Chemicals, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal IoT For Cold Chain Monitoring Market Analysis

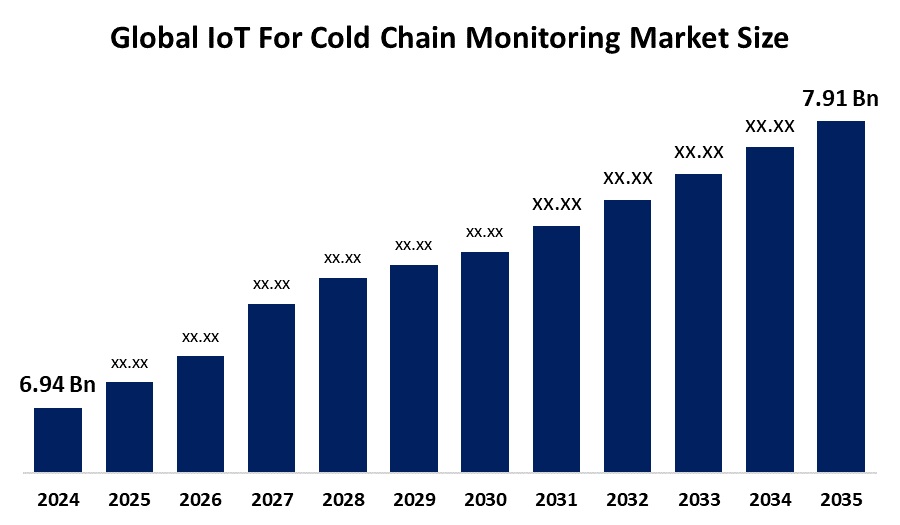

- The Global IoT For Cold Chain Monitoring Market Size Was Estimated at USD 6.94 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.72% from 2025 to 2035

- The Worldwide IoT For Cold Chain Monitoring Market Size is Expected to Reach USD 28.56 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global IoT For Cold Chain Monitoring Market Size was worth around USD 6.94 Billion in 2024, growing to USD 7.91 Billion in 2025, and is predicted to grow to around USD 28.56 Billion by 2035 with a compound annual growth rate (CAGR) of 13.72% from 2025 to 2035. The IoT for cold chain monitoring market is growing rapidly due to increasing demand for temperature-sensitive product integrity across the pharma and food industries. With evolving IoT sensors, real-time temperature, humidity, and location tracking are possible, along with instant alerts, automated reporting, enhanced compliance, and lesser spoilage along the supply chain.

Global IoT For Cold Chain Monitoring Market Forecast and Revenue Outlook

- 2024 Market Size: USD 6.94 Billion

- 2025 Market Size: USD 7.91 Billion

- 2035 Projected Market Size: USD 28.56 Billion

- CAGR (2025-2035): 13.72%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The cold chain monitoring IoT market refers to the usage of Internet of Things (IoT) technologies in cold chain logistics for tracking and monitoring temperature-sensitive products during storage and transportation. The system uses intelligent sensors, data loggers, GPS, and cloud-based systems to provide real-time temperature, humidity, and location information to confirm product integrity. IoT cold chain solutions are widely used across industries such as pharmaceuticals, food and beverages, chemicals, and agriculture, where protection of particular environmental conditions is vital for product safety and compliance with regulations. Industry expansion is driven by increased demand for efficient temperature-sensitive product logistics, increased awareness of food and drug safety regulations, and sophisticated sensor and connectivity technologies.

There are opportunities for growth in expanding e-commerce, rising vaccine distribution needs, and enhanced usage of cloud-based analytics and artificial intelligence in the supply chain. Market leaders are Sensitech, ORBCOMM, IBM, Emerson, Berlinger & Co. AG, and Controlant, which offer end-to-end visibility and data-driven solutions. Governments across the globe are also launching programs to enhance cold chain infrastructure and conformity. In 2025, the Ministry of Food Processing Industries (MoFPI) floated Expressions of Interest (EoI) under the PMKSY scheme, calling for interested entities to prepare cold chain projects, with revised guidelines for reducing involvement and speeding up infrastructure development.

Key Market Insights

- North America is expected to account for the largest share in the IoT for cold chain monitoring market during the forecast period.

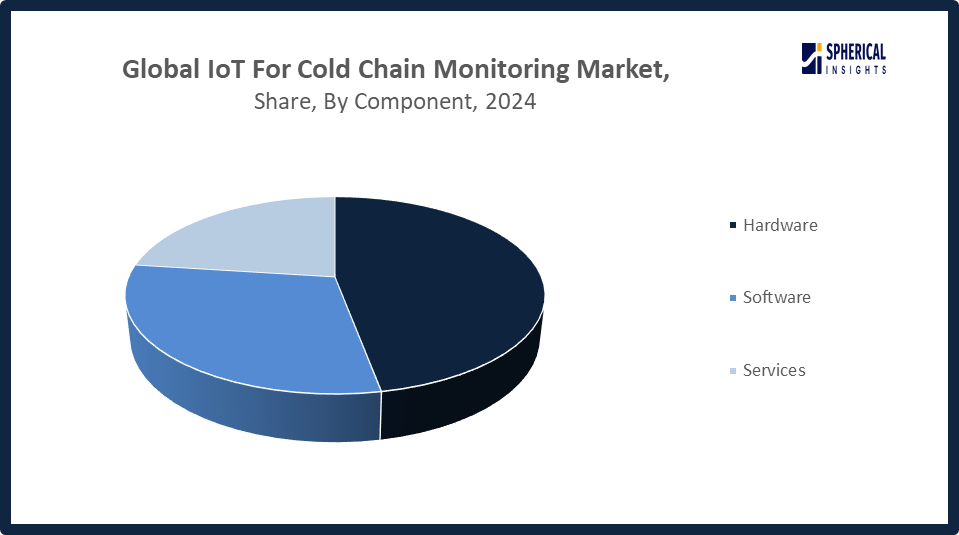

- In terms of component, the hardware segment is projected to lead the IoT for cold chain monitoring market throughout the forecast period

- In terms of industry, the healthcare & pharma segment captured the largest portion of the market

IoT For Cold Chain Monitoring Market Trends

- Increasing demand for real-time temperature and humidity tracking is driving IoT adoption in cold chains.

- Cloud-based platforms are becoming essential for remote monitoring and data analysis.

- Pharmaceutical and vaccine logistics are fueling rapid growth in cold chain IoT solutions.

- Integration of AI and machine learning enhances predictive maintenance and spoilage prevention.

- GPS-enabled IoT devices improve supply chain visibility and route optimization.

Report Coverage

This research report categorizes the IoT for cold chain monitoring market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the IoT for cold chain monitoring market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the IoT for cold chain monitoring market.

IoT For Cold Chain Monitoring Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.94 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 13.72% |

| 2035 Value Projection: | USD 28.56 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 129 |

| Segments covered: | By Component, By Industry, By Region |

| Companies covered:: | Berlinger & Co. AG, Huawei Technologies, Controlant, SenseGiz Inc., Zebra Technologies, Cisco Systems Inc, Laird Connectivity, Testo SE & Co. KGaA, Roambe Corporation, HC Technologies, Aeris Communication, Moschip Technologies Limited, Others, and |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving factors

The IoT cold chain monitoring market is primarily driven by increasing demand for temperature-sensitive items, strict regulations, and cost savings through real-time tracking and analytics. The increasing need for temperature-sensitive items, including pharmaceuticals and food, demands that to be controlled with precision at the time of storage and transit to maintain quality and safety. Strict regulations impose rigid adherence to safeguard consumers and uphold standards. In addition, cost savings are realized through real-time tracking and analytics, which streamline processes, avoid spoilage, and enhance supply chain efficiency, saving money and resources.

February 14, 2025, MOFPI launched the Pradhan Mantri Kisan Sampada Yojana (PMKSY) to reduce post-harvest losses and boost food processing. The scheme offers up to Rs 15 crore and subsidies of 35%-50% for projects, including cold chain infrastructure, benefiting farmers, FPOs, SC/ST groups, and promoting rural employment.

Restraining Factor

High expenses, integration complexity, security threats, and inadequate network infrastructure constrain cold chain monitoring IoT adoption. Sensor and initial setup expenses can be prohibitive to small organizations. It is complex to integrate IoT into legacy systems, while data security threats and spotty network coverage in distant locations limit constant, real-time monitoring, decreasing overall system effectiveness and reliability.

Market Segmentation

The global IoT for cold chain monitoring market is divided into component and industry.

Global IoT For Cold Chain Monitoring Market, By Component:

Why did the hardware segment dominate the IoT for cold chain monitoring market in 2024?

Hardware led the IoT for cold chain monitoring market in 2024, approximately 47% of market share, with growing demand for sensors, data loggers, and tracking devices for real-time temperature-sensitive products monitoring. Deployment grew across the pharmaceutical and food industries, leading to improved visibility, compliance, and product safety, which prompted major hardware uptake across the world.

Get more details on this report -

The software segment in the IoT for cold chain monitoring market is expected to grow at the fastest CAGR over the forecast period. The software segment held approximately 30% of market share, rapidly growing due to rising demand for data analytics, real-time monitoring platforms, and cloud-based services. These solutions improve decision-making, boost supply chain efficiency, and maintain compliance with safety regulations.

Global IoT For Cold Chain Monitoring Market, By Industry:

How does the healthcare & pharma industry benefit from IoT in cold chain monitoring?

The pharma and healthcare industry holds approximately 28.50% of the market share. Profits are extremely high due to IoT applications in cold chain monitoring through accurate temperature management for products that are sensitive, such as vaccines, drugs, and biologics. IoT facilitates real-time monitoring, automatic alerts, and data logging that minimize the loss of products due to spoilage, promote regulatory compliance, and increase patient safety. It results in increased supply chain reliability and decreased economic losses.

The food & beverage segment in the IoT for cold chain monitoring market is expected to grow at the fastest CAGR over the forecast period. The food & beverage industry is anticipated to develop with approximately 21.80% of market share, due to growing demand for perishable items globally, increased food safety regulations, and the requirement for real-time monitoring for minimizing spoilage, guaranteeing freshness, and preserving quality throughout the supply chain.

Regional Segment Analysis of the Global IoT For Cold Chain Monitoring Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America IoT For Cold Chain Monitoring Market Trends

Get more details on this report -

What makes North America a key region for the growth of IoT in cold chain monitoring?

North America is a prominent area for IoT development in the cold chain monitoring market, accounting for approximately 34% of market share, owing to its superior technological infrastructure, robust healthcare and food sectors, and stringent regulatory standards for product security. The large-scale use of smart technologies and real-time tracking systems investments by the region improves supply chain efficiencies. Moreover, growing demand from consumers for fresh and superior-quality products fuels innovation. All these factors combined have made North America a frontrunner in the adoption of IoT for efficient cold chain tracking.

Why are certain IoT technologies gaining popularity in the U.S. cold chain monitoring market?

Some IoT technologies are becoming increasingly popular for use in the U.S. cold chain monitoring market owing to they allow for real-time data reporting, improve product safety, allow for regulatory compliance, cut waste, and ultimately improve supply chain efficiency within temperature-sensitive sectors such as food and pharmaceuticals.

Asia Pacific IoT For Cold Chain Monitoring Market Trends

What factors are driving the rapid growth of the IoT for cold chain monitoring market in the Asia Pacific?

The Asia Pacific region held approximately 21.4% of the cold chain monitoring market share for IoT is growing at a steady rate due to rising demand for temperature-sensitive commodities such as pharmaceuticals and perishable food products, along with heightened awareness regarding the safety and quality of products. Developing healthcare infrastructure, the support of government policies toward smart logistics, and increasing investments in innovative technologies further boost adoption. Also, the booming e-commerce market in the region and enhanced cold storage facilities provide immense demand for real-time monitoring solutions. Fast urbanization and increased disposable incomes further play their part, allowing enhanced supply chain management and less product wastage, driving overall market growth.

What are the key growth trends in India’s IoT for cold chain monitoring market?

Some of the main trends for growth in India's IoT cold chain monitoring market are increasing demand for fresh food and pharmaceuticals, government favor for cold chain infrastructure, rising use of real-time tracking technologies, and growing e-commerce, all leading to enhanced supply chain efficiency and product safety.

What are the current trends in China’s IoT for the cold chain monitoring market?

Trends in China's IoT cold chain monitoring market currently involve widespread adoption of intelligent sensors, convergence with AI and big data analysis, food safety promotion by the government, increasing demand for pharmaceutical cold chain, and greater investments in advanced logistics for the sake of real-time temperature monitoring.

Why is the IoT for cold chain monitoring market growing in Japan?

The IoT cold chain monitoring market is expanding in Japan owing to stringent food safety laws, demands of an aging population, adoption of advanced technology, and the growing need to minimize food loss using effective real-time temperature monitoring and supply chain management.

Europe IoT For Cold Chain Monitoring Market Trends

What factors are driving the growth of IoT cold chain monitoring in Europe?

The expansion of IoT cold chain monitoring in Europe is fueled by robust regulatory requirements, rising demand for fresh and pharmaceutical products, as well as mounting consumer awareness of product safety. Moreover, improvements in IoT technology, smart logistics support from the government, and demands to contain waste and enhance supply chain transparency are the foremost drivers of market growth.

How is IoT adoption influencing the growth of cold chain monitoring in the U.K.?

U.K. IoT adoption supports cold chain monitoring by allowing real-time tracking, better regulatory compliance, less product spoilage, and more efficient logistics. This promotes market growth through the assurance of product quality and safety in the pharmaceutical and perishable foodstuffs industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global IoT for cold chain monitoring market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The IoT For Cold Chain Monitoring Market Include

- Berlinger & Co. AG

- Huawei Technologies

- Controlant

- SenseGiz Inc.

- Zebra Technologies

- Cisco Systems Inc

- Laird Connectivity

- Testo SE & Co. KGaA

- Roambe Corporation

- HC Technologies

- Aeris Communication

- Moschip Technologies Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In August 2025, Frost & Sullivan recognized Cisco as the 2025 Global Company of the Year in Mobile IoT Platforms, honoring its leadership, innovation, and customer focus in a fast-evolving, digitally transforming IoT landscape.

- In July 2025, Bridge Alliance and Aeris Communications announced a partnership to offer Aeris IoT Watchtower, providing full cyber risk visibility and protection for enterprise IoT devices. This extends their collaboration, with Aeris supplying cellular IoT connectivity management through the Aeris IoT Accelerator platform to Bridge Alliance members.

- In February 2025, Aeris launched IoT Watchtower, the first fully integrated security solution for cellular IoT, offering enhanced visibility, breach prevention, operational efficiency, and regulatory compliance for enterprise IoT environments.

- In August 2024, Roambee partnered with Rogers to leverage IoT technologies, enabling businesses to create smarter, more agile supply chains and enhance connected operations for improved efficiency and visibility.

- In April 2024, Avery Dennison partnered with Controlant to enhance real-time, comprehensive visibility and sustainability in pharma supply chains. Together, they launched the Saga Card, featuring LTE M, NB IoT, nuSIM, sensors, and a zinc-based battery, enabling advanced IoT-powered monitoring and connectivity.

- In September 2021, Laird Connectivity launched the BL5340 Series Bluetooth 5.2 and 802.15.4 modules, based on Nordic Semiconductor’s nRF5340 SoC, offering the most advanced, secure, and high-performance dual-core MCU wireless solution, now available from distribution.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the IoT for cold chain monitoring market based on the following segments:

Global IoT For Cold Chain Monitoring Market, By Component

- Hardware

- Software

- Services

Global IoT For Cold Chain Monitoring Market, By Industry

- Healthcare & Pharma

- Retail & CPG

- Food & Beverage

- Chemicals

- Others

Global IoT For Cold Chain Monitoring Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the IoT for cold chain monitoring market over the forecast period?The global IoT for cold chain monitoring market is projected to expand at a CAGR of 13.72% during the forecast period.

-

2. What is the market size of the IoT for cold chain monitoring market?The global IoT for cold chain monitoring market size is expected to grow from USD 6.94 billion in 2024 to USD 28.56 billion by 2035, at a CAGR 13.72% of during the forecast period 2025-2035.

-

3. What is the IoT for cold chain monitoring market?The IoT for cold chain monitoring market involves using Internet of Things (IoT) technology, such as sensors, software, and cloud platforms, to track and manage the temperature and environmental conditions of temperature-sensitive products throughout the supply chain, ensuring quality and compliance in industries such as pharmaceuticals and food.

-

4. What are the market trends in the IoT for the cold chain monitoring market?Key trends in the IoT for cold chain monitoring include strong market growth driven by pharmaceuticals and food & beverages, increased adoption of AI and machine learning for predictive analytics, a focus on real-time data and alerts for improved efficiency and reduced spoilage, and a significant shift towards sustainable and energy-efficient solutions to meet stricter global regulations.

-

5. Which region holds the largest share of the IoT for cold chain monitoring market?North America is anticipated to hold the largest share of the IoT for cold chain monitoring market over the predicted timeframe.

-

6. Who are the top 10 companies operating in the global IoT for cold chain monitoring market?The major players operating in the IoT for cold chain monitoring market are Berlinger & Co. AG, Huawei Technologies, Controlant, SenseGiz Inc., Zebra Technologies, Cisco Systems Inc., Laird Connectivity, Testo SE & Co. KGaA, Roambe Corporation, HC Technologies, Aeris Communication, Moschip Technologies Limited, and Others.

-

7. What factors are driving the growth of the IoT for cold chain monitoring market?The growth of IoT for cold chain monitoring is driven by increasing demand for temperature-sensitive pharmaceuticals and vaccines, the expansion of e-commerce and online grocery delivery, and a global effort to reduce food wastage

-

8. What are the main challenges restricting the wider adoption of the IoT for the cold chain monitoring market?The main challenges restricting the wider adoption of the internet of things (IoT) for cold chain monitoring include high costs, connectivity issues, data management complexities, and security risks.

Need help to buy this report?