Global Interventional Oncology Market Size, Share, and COVID-19 Impact Analysis, By Type (Radiation Therapy Devices, Ablation Devices and Embolization Devices), By Cancer Type (Lung Cancer, Liver Cancer, Kidney Cancer, Others), By End User (Hospitals, Specialty Clinics and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Interventional Oncology Market Insights Forecasts to 2033

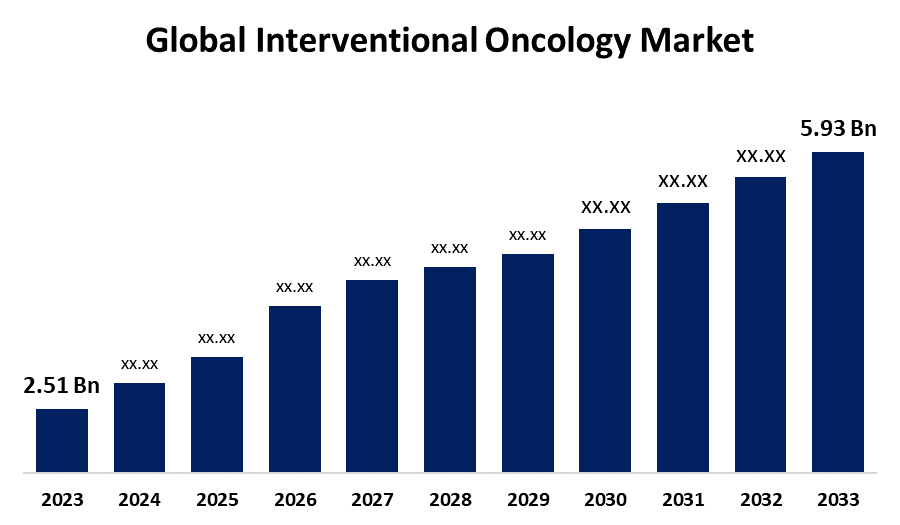

- The Global Interventional Oncology Market Size was estimated at USD 2.51 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 8.98% from 2023 to 2033

- The Worldwide Interventional Oncology Market Size is Expected to Reach USD 5.93 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Interventional Oncology Market size was worth around USD 2.51 Billion in 2023 and is Predicted to grow to around USD 5.93 Billion by 2033 with a compound annual growth rate (CAGR) of 8.98% between 2023 and 2033. The market for interventional oncology is fueled by increasing cancer rates, expanding demand for minimally invasive interventions, advancements in technology, growth in the aging population, rising healthcare spending, and enhanced imaging guidance systems promoting the accuracy of treatment, resulting in increased adoption throughout healthcare systems worldwide.

Market Overview

The interventional oncology industry is the area of medical technology and services that specializes in minimally invasive, image-guided treatments for cancer diagnosis and treatment. Interventional oncology is the application of minimally invasive, image-guided procedures to diagnose, treat, and manage cancer. With cancer incidence steadily increasing worldwide, demand is mounting for creative and minimally invasive treatment techniques. These treatments not only provide effective alternatives to conventional surgery or chemotherapy but also assist in lessening the overall healthcare burden. Consequently, interventional oncology is increasingly becoming a vital component of contemporary cancer treatment. In addition, initiatives aimed at developing more sophisticated cancer treatments have attracted significant investment from both public and private sources. For example, in June 2023, Royal Philips reported that the IMAGIO consortium led by Philips and consisting of clinical partners received a grant of approximately $25.97 million. The funding will be used for research on minimally invasive treatments for cancers such as liver cancer, lung cancer, and soft tissue sarcomas. Investments such as these are crucial to fueling innovation in interventional oncology and ultimately enhancing patient care and outcomes.

Report Coverage

This research report categorizes the interventional oncology market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the interventional oncology market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the interventional oncology market.

Global Interventional Oncology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.51 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.98% |

| 2033 Value Projection: | USD 5.93 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By Cancer Type, By End User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Medtronic plc, Boston Scientific Corporation, Johnson & Johnson (Ethicon), Teleflex Incorporated, Cook Medical, AngioDynamics Inc., Stryker Corporation, Profound Medical, Terumo Corporation, Siemens Healthineers, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising incidence of cancer, particularly liver, lung, kidney, and bone cancers, is a key driver for the interventional oncology market. The growing burden fuels a high demand for more efficient, localized, and less invasive treatment options such as interventional oncology procedures. Advances in imaging technologies and interventional devices have greatly improved the safety, precision, and outcomes of interventional oncology procedures. These technological advancements are broadening the scope and efficacy of treatments, driving higher adoption rates worldwide.

Restraining Factors

Interventional oncology treatments, including embolization, ablation, and radiation therapy, tend to be costly because of the high technology and specialized expertise involved. High costs of treatment may restrict access, particularly in countries with lower healthcare budgets, or for those without adequate insurance coverage. This could deter widespread use, especially in developing markets.

Market Segmentation

The interventional oncology market share is classified into type, cancer type, and end user.

- The embolization devices segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the interventional oncology market is divided into radiation therapy devices, ablation devices, and embolization devices. Among these, the embolization devices segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to embolization procedures being less invasive, involving small cuts and catheter-based methods. This results in reduced recovery periods, fewer complications, and lower total healthcare expenses compared to conventional surgery, which makes it a choice for most patients.

- The liver cancer segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the cancer type, the interventional oncology market is divided into lung cancer, liver cancer, kidney cancer, and others. Among these, the liver cancer segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is attributed to liver cancer, primarily hepatocellular carcinoma (HCC), which ranks among the most prevalent and life-threatening cancers globally. With high prevalence triggered by infections from hepatitis B and C, cirrhosis, and alcohol intake, the rise raises a greater demand for viable forms of treatment, rendering it the most common form of cancer addressed with interventional oncology.

- The hospitals segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the interventional oncology market is divided into hospitals, specialty clinics and others. Among these, the hospitals segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growth is driven by hospitals see more patients than specialty clinics, thereby creating more demand for interventional oncology treatments. This higher patient volume generates the segment's leading market share.

Regional Segment Analysis of the Interventional Oncology Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the interventional oncology market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the interventional oncology market over the predicted timeframe. North America, especially the U.S., has a high prevalence of different cancers. This creates robust demand for cutting-edge, targeted treatments such as interventional oncology, which offers effective, minimally invasive alternatives to conventional cancer treatments. Large medical technology firms like Medtronic, Boston Scientific, and Varian are based in North America. Their ongoing innovation, robust distribution channels, and physician training initiatives contribute to market expansion and product uptake.

Asia Pacific is expected to grow at a rapid CAGR in the interventional oncology market during the forecast period. The Asia-Pacific region is seeing a drastic rise in the incidence of cancers owing to changes in lifestyle, pollution, and an aging population. This emerging burden is encouraging more demand for newer, minimally invasive techniques such as interventional oncology to enhance recovery and minimize side effects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the interventional oncology market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic plc

- Boston Scientific Corporation

- Johnson & Johnson (Ethicon)

- Teleflex Incorporated

- Cook Medical

- AngioDynamics Inc.

- Stryker Corporation

- Profound Medical

- Terumo Corporation

- Siemens Healthineers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, Angiodynamics received FDA 510(k) approval for its NanoKnife System for the ablation of prostate tissue. The technology, which is non-thermal and radiation-free, presents a minimally invasive treatment solution for prostate cancer patients.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the interventional oncology market based on the below-mentioned segments:

Global Interventional Oncology Market, By Type

- Radiation Therapy Devices

- Ablation Devices

- Embolization Devices

Global Interventional Oncology Market, By Cancer Type

- Lung Cancer

- Liver Cancer

- Kidney Cancer

- Others

Global Interventional Oncology Market, By End User

- Hospitals

- Specialty Clinics

- Others

Global Interventional Oncology Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the interventional oncology market over the forecast period?The global interventional oncology market is projected to expand at a CAGR of 8.98% during the forecast period.

-

2. What is the market size of the interventional oncology market?The global interventional oncology market size is expected to grow from USD 2.51 Billion in 2023 to USD 5.93 Billion by 2033, at a CAGR of 8.98% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the interventional oncology market?North America is anticipated to hold the largest share of the interventional oncology market over the predicted timeframe.

Need help to buy this report?