Global Internet Service Providers Market Size, Share, and COVID-19 Impact Analysis, By Type (Installation Service, and System Integration), By Application (Online E-Trading, Entertainment, Global Corporations, and Corporations), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Internet Service Providers Market Insights Forecasts to 2035

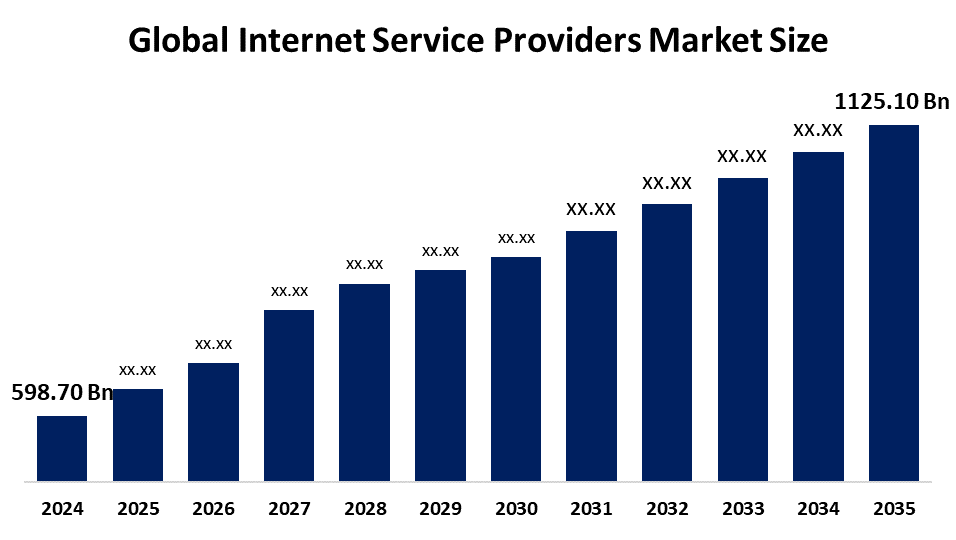

- The Global Internet Service Providers Market Size Was Estimated at USD 598.70 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.9% from 2025 to 2035

- The Worldwide Internet Service Providers Market Size is Expected to Reach USD 1125.10 Billion by 2035

- Asia Pacific is Expected to Grow the Fastest During the forecast period.

Get more details on this report -

The Global Internet Service Providers Market Size was Worth around USD 598.70 Billion in 2024 and is Predicted to Grow to around USD 1125.10 Billion by 2035 with a compound annual growth rate (CAGR) of 5.9% from 2025 and 2035. The market for internet service providers presents opportunities for growing 5G networks, fiber-optic infrastructure, cloud-based services, smart city integration, and AI-driven traffic management for high-speed, scalable digital connections.

Market Overview

The industry made up of enterprises that provide internet connectivity and associated services to people, organizations, and corporations is known as the internet service providers (ISP) market. These service providers facilitate connectivity to the digital world using a variety of technologies, including fiber optics, cable, DSL, satellite, and wireless networks. The market is essential to the development of digital infrastructure, data interchange, and international communication. The market for internet service providers is a thriving industry that is essential to digital communication and worldwide connectivity.

The growing need for high-speed internet brought on by the growing digital transformation of many industries and the development of 5G networks, which improve data transmission speeds and network dependability, are the main factors driving the internet service providers market. The residential portion of the ISP market is primarily driving demand since houses need more bandwidth for smart home gadgets, streaming services, and remote work settings. The increasing use of cloud services and streaming video, which necessitate reliable and quick internet connections, is another factor propelling the growth internet service providers market.

Report Coverage

This research report categorizes the internet service providers market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the internet service providers market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the internet service providers market.

Global Internet Service Providers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 598.70 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.9% |

| 2035 Value Projection: | USD 1125.10 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Type, By Application and By Region. |

| Companies covered:: | IBM, Dell, TCS, EMC, Atmel, Cisco, Bosch, Hitachi, Ericsson, Google, Huawei, Accenture, General Electric, Amazon Web Services and Other. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for ISP installation services is being driven by people's increased reliance on the internet for communication, employment, education, and entertainment. The internet service providers industry is a vital component of contemporary economic and social activity, and it is growing as digital transformation picks up speed due to advancements in 5G, cloud computing, and smart technologies. Providing widespread, dependable, and fast internet access is the primary goal of the ISP market in order to facilitate improved connections and meet the growing demands of contemporary technology use in homes and enterprises. Reliable and fast internet connections are becoming more and more necessary due to the growth of e-commerce platforms and online activities, which also increases the demand for effective ISP installations.

Restraining Factors

Strict government regulations, supply chain disruptions, high infrastructure costs, cybersecurity threats, and shifting customer preferences that impact service scalability and profitability are among the issues restraining the growth of the internet service provider market.

Market Segmentation

The internet service providers market share is classified into type and application.

- The system integration segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the internet service providers market is divided into installation service and system integration. Among these, the system integration segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Combining distinct additives or subsystems into a single, useful device is the specialty of system integration. The growing need for smooth connectivity, cutting-edge networking solutions, and effective integration of new digital technologies is what propels system integration.

- The online E-trading segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the internet service providers market is divided into online E-trading, entertainment, global corporations, and corporations. Among these, the online E-trading segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. A major factor driving the online e-trading market is the explosive expansion of e-commerce, which has increased demand for fast Internet connections. Businesses and people who trade online need reliable and fast Internet connections in order to complete transactions quickly.

Regional Segment Analysis of the Internet Service Providers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the internet service providers market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the internet service providers market over the predicted timeframe. The strong need for stable, fast internet services in both urban and rural areas has led to North America's ISP market share being among the most developed in the world. The extensive use of high-speed internet connections creates consistent demand in the area. North American ISPs concentrate on providing cutting-edge network technology, such as 5G and fiber optics, to satisfy the growing need for dependable and quicker connections. The market for ISP installation services is still very competitive in North America.

Asia Pacific is expected to grow at a rapid CAGR in the internet service providers market during the forecast period. The growing internet penetration and company digital transformation in the Asia-Pacific region are credited with this. Serving a variety of markets with differing degrees of infrastructure development is a problem for ISPs in this area. Advanced technology is typically found in urban regions, but there are also chances for infrastructure expansion in rural locations. Asia-Pacific emerging economies have significant economic potential and draw investments from both domestic and foreign ISPs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the internet service providers market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBM

- Dell

- TCS

- EMC

- Atmel

- Cisco

- Bosch

- Hitachi

- Ericsson

- Huawei

- Accenture

- General Electric

- Amazon Web Services

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Airtel announced an agreement with SpaceX to bring Starlink’s high-speed internet services to its customers in India. This is the first agreement to be signed in India, which is subject to SpaceX receiving its authorizations to sell Starlink in India. It enables Airtel and SpaceX to further explore how Starlink can complement and expand Airtel’s offerings, and how Airtel’s expertise in the Indian market complements SpaceX’s direct offerings to consumers and businesses.

- In July 2024, Atria Convergence Technologies Fibernet (ACT), a private wireline internet service provider (ISP), launched a range of solutions on Wednesday to meet the connectivity requirements of Indian MSMEs and companies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the internet service providers market based on the below-mentioned segments:

Global Internet Service Providers Market, By Type

- Installation Service

- System Integration

Global Internet Service Providers Market, By Application

- Online E-Trading

- Entertainment

- Global Corporations

- Corporations

Global Internet Service Providers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the internet service providers market over the forecast period?The global internet service providers market is projected to expand at a CAGR of 5.9% during the forecast period.

-

2. What is the market size of the internet service providers market?The global internet service providers market size is expected to grow from USD 598.70 billion in 2024 to USD 1125.10 billion by 2035, at a CAGR of 5.9% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the internet service providers market?North America is anticipated to hold the largest share of the internet service providers market over the predicted timeframe.

Need help to buy this report?