Global Interactive Display Market Size, Share, and COVID-19 Impact Analysis, By Type (Interactive Kiosk, Interactive Video Wall, Interactive Table, Interactive Monitor, Interactive Whiteboard, Others), By Technology (LCD, LED, OLED), By End-use (Industrial, BFSI, Retail, Hospitality, Education, Healthcare, Transportation, Entertainment, Corporate & Government, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Electronics, ICT & MediaGlobal Interactive Display Market Size Insights Forecasts to 2032

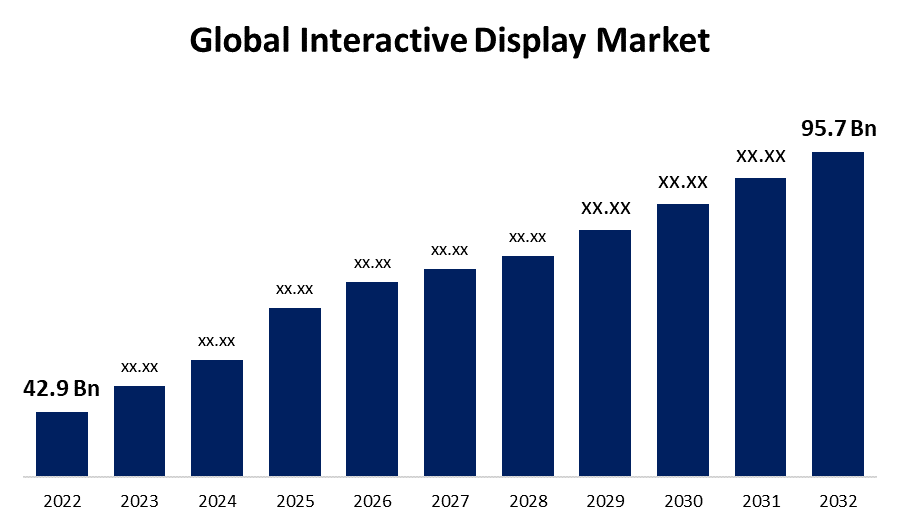

- The Global Interactive Display Market Size was valued at USD 42.9 billion in 2022.

- The Market Size is Growing at a CAGR of 8.4% from 2022 to 2032

- The Worldwide Interactive Display Market Size is expected to reach USD 95.7 billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Interactive Display Market Size is expected to reach USD 95.7 Billion by 2032, at a CAGR of 8.4% during the forecast period 2022 to 2032.

Market Overview

An interactive display, sometimes known as a mounted device, allows for functions like self-checkout, product information lookup, inventory availability, and personalized suggestions. These displays allow users to participate in digital content, make selections, edit images, and conduct a variety of operations via touch, gestures, or other input modalities. The market contains a diverse range of expertise and products designed for numerous applications, such as educational institutions, enterprises, entertainment, retail, transportation, healthcare, and others. Interactive displays can accept input via human touch while also displaying the computed output on the screen. The market is expected to grow significantly in the future years, owing to rising demand for digital classrooms and increased usage of various displays, such as video walls and tables. These video walls and tables are commonly utilized in transit areas/public transportation, such as train stations and airports. Furthermore, investments in the education sector are increasing tremendously to boost modern education. In contrast, interactive display plays a critical role in laying the groundwork for digital classroom infrastructure. These gadgets enhance content visualization through smart watching, which allows users to display two or more materials on the same screen at the same time. In addition, the growing popularity of touch-based devices is expected to drive market growth.

Global Interactive Display Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 42.9 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.4% |

| 2032 Value Projection: | USD 95.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Technology, By End-use, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Crystal Display Systems, Sharp, ViewSonic, Horizon Display, Panasonic Corporation, HORIZON DISPLAY INC., TableConnect, eyefactive GmbH, Samsung Electronics, LG Display, NEC Corporation, Elo Touch Solutions, Box Light corporation, MMT GmbH & Co. KG., Marvel Technology Co., Ltd., and other ley vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The usage of up-to-date technology in classrooms, such as mobiles, projectors, tablets, computers, and interactive boards, is serving to make education more participatory. The education industry is a major driver of growth in interactive displays. Schools and universities are gradually introducing these displays into classrooms to promote participatory learning. These displays serve an important role in improving teaching, boosting teamwork, and encouraging active engagement among students. The shift to remote work has accelerated the adoption of interactive displays for virtual collaboration. Furthermore, internet penetration and shifting technological preferences have had a favorable impact on the adoption of interactive displays. In addition, the healthcare industry is implementing interactive displays to improve patient education, expedite medical training, and increase healthcare provider productivity. Interactive displays allow clinicians to graphically explain medical issues, include patients in treatment plans, and provide real-time data. The need for interactive exhibitions in hospitals, clinics, and medical training institutions is rising, driven by the desire for improved communication and patient involvement. These factors are driving the growth of the global interactive display market.

Restraining Factors

The rising cost of display technologies is projected to impede industry expansion. In addition, the interactive display market is expected to face challenges from rising maintenance costs. Furthermore, ensuring data security is an essential component of self-service device deployment to preserve user trust and comply with data protection rules. Organizations should invest in strong security measures such as encryption, firewalls, secure payment processing, and regular software updates to solve security issues. Proper security standards must be followed throughout the kiosk's lifecycle, from development and deployment to continuous maintenance and support. Furthermore, increased market competition produces saturation among industry participants due to competitive pricing and features provided by developing firms, which have an impact on market sales. Due to these factors, the expansion of the worldwide interactive display market might be hampered.

Market Segmentation

By Type Insights

The interactive kiosk segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global interactive display market is segmented into interactive kiosks, interactive video walls, interactive tables, interactive monitors, interactive whiteboards, and others. Among these, the interactive kiosk segment is dominating the market with the largest revenue share of 32.6% over the forecast period. The growing need for complementary self-services in the retail, transportation, and healthcare sectors is driving the expansion of this segment. Smart vending machines, Automated Teller Machines (ATMs), and other touch-enabled independent service devices could help businesses provide good customer service even during peak business hours. Furthermore, the growing usage of interactive kiosks in the product/service delivery field has enabled corporations to provide customized programs to their clients at cheap delivery rates. Moreover, the regular installation of interactive kiosks is being recorded in order to increase efficiency in various businesses.

By Technology Insights

The LCD segment is expected to hold the largest share of the Global Interactive Display Market during the forecast period.

Based on the technology, the global interactive display market is classified into LCD, LED, and OLED. Among these, the LCD segment is expected to hold the largest share of the interactive display market during the forecast period. The segment is predicted to continue to expand as the supply-demand ratio shifts and average selling prices for LCD display panels fall. LCD technology is commonly employed in interactive display products. Many businesses, including retail, corporate offices, and banks, are currently employing LCD-based products. One of the key elements driving the widespread use of LCD interactive displays is the decreasing production costs of LCDs. Furthermore, the OLED category is predicted to grow at a much faster rate than the overall market during the projection period. OLED panels are becoming increasingly prevalent and as their prices fall, an increasing number of consumers will be able to purchase them.

By End-Use Insights

The BFSI segment accounted for the largest revenue share of more than 31.8% over the forecast period.

On the basis of end-use, the global interactive display market is segmented into industrial, BFSI, retail, hospitality, education, healthcare, transportation, entertainment, corporate & government, and others. Among these, the BFSI segment is dominating the market with the largest revenue share of 31.8% over the forecast period. In the past decade, the banking and finance industry firms have experienced a tremendous increase in the deployment of interactive displays. Because of their capacity to boost consumer interaction, enrich the customer experience, and raise the efficiency of business processes, interactive displays are growing increasingly common in the BFSI marketplace. The rising need for digital transformation is one of the primary drivers of the expansion of interactive displays in BFSI. Customers are searching for easier and more user-friendly alternatives to communicate with their financial service providers as digital banking and Internet transactions become more popular.

Regional Insights

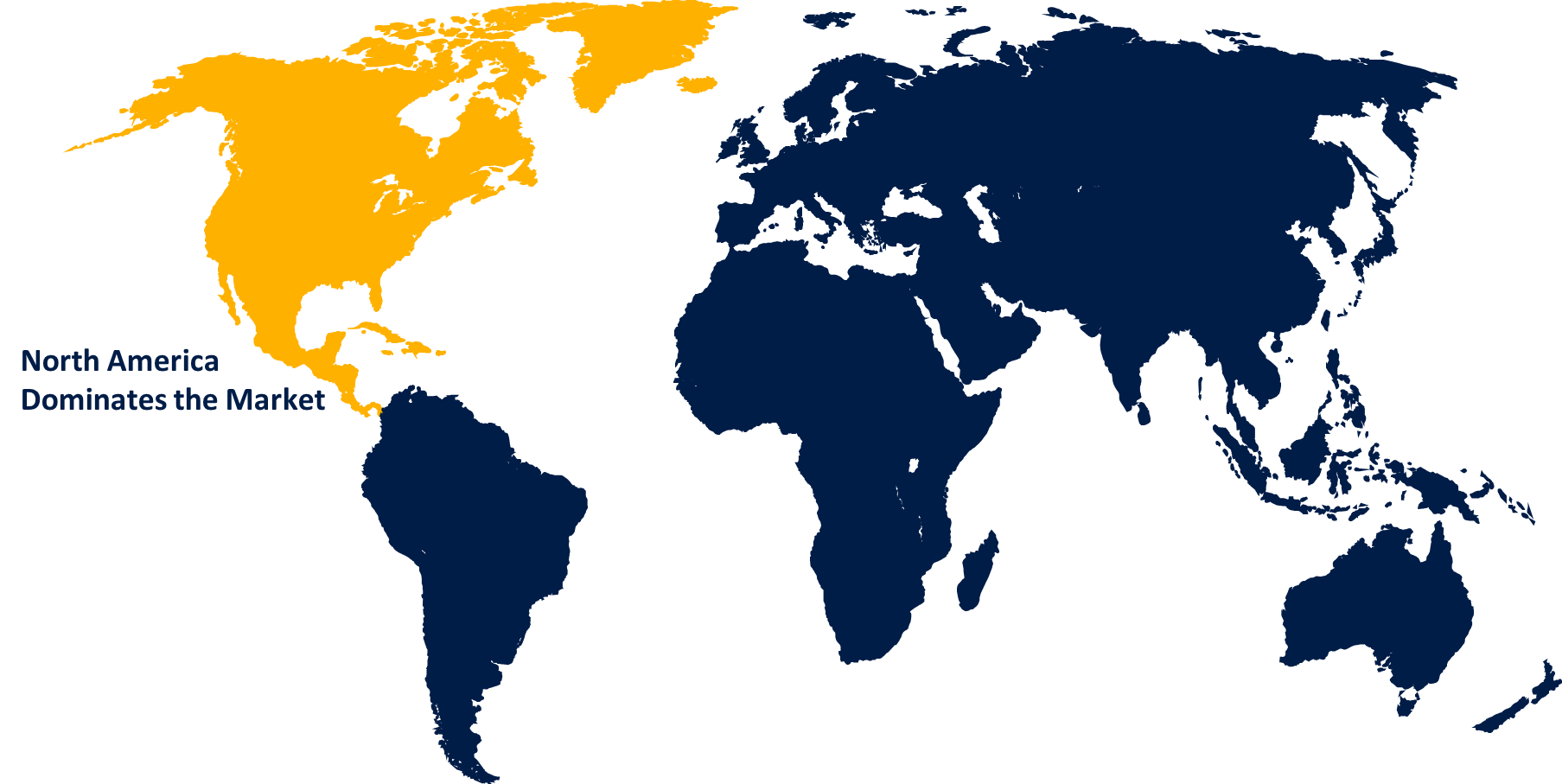

North America is anticipated to hold the largest share of the global interactive display market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global interactive display market over the predicted timeframe. Interactive displays have grown in popularity in North America over the last decade, owing to the increased desire for immersive and engaging technologies in a variety of industries. Advancements in touch technology have spurred the emergence of interactive displays, allowing users to engage with them more intuitively and efficiently. The market for interactive displays is quickly expanding in North America, with many corporations, educational institutions, and government agencies embracing the technology to improve communication and collaboration capabilities. The education sector has been a key driver of the rise of interactive displays in North America. Many schools and universities in the region have implemented interactive screens to increase classroom participation and learning outcomes.

Asia Pacific is expected to grow at the fastest pace in the global interactive display market during the forecast period. In recent years, interactive displays have grown dramatically in Asia Pacific, owing to increased demand from a variety of sectors like education, corporate, and healthcare. The Asia Pacific area has some of the world's fastest-growing economies, and the adoption of interactive displays is being driven by reasons such as technical improvements, increased investment in education, and rising demand for interactive communication tools. Countries with some of the world's greatest technological industries, such as China, Japan, and South Korea, have seen robust adoption of interactive displays. These countries have been at the forefront of technical innovation, with investments in R&D yielding some of the world's most advanced interactive display technology.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. The existence of a number of competitive and continually developing businesses and companies in the region is an essential driver propelling the interactive display market expansion. Furthermore, the increasing trend of conventional media outlets adopting the interactive display market to seek future possibilities for marketing campaigns, as well as Europe's ever-expanding hospitality industry, are all contributing to market growth in Europe.

List of Key Market Players

- Crystal Display Systems

- Sharp

- ViewSonic

- Horizon Display

- Panasonic Corporation

- HORIZON DISPLAY INC.

- TableConnect

- eyefactive GmbH

- Samsung Electronics

- LG Display

- NEC Corporation

- Elo Touch Solutions

- Box Light corporation

- MMT GmbH & Co. KG.

- Marvel Technology Co., Ltd.

Key Market Developments

- In September 2023, Elo Touch Solutions plans to launch the 2799L open frame display for the retail and associated industries. It includes a 27-inch screen designed for outdoor use. It is designed for industrial applications that demand temperature resistance and 24-hour availability.

- On July 2023, SMART Technologies, the prominent interactive display company, has announced that its newest interactive display solutions will have Google EDLA Certification, with choices for Google EDLA Certification throughout its existing lineup coming soon. These solutions include a new generation of iQ-powered interactive displays for education, which will be available in 2024, as well as an appliance-based solution designed to be used in conjunction with SMART displays.

- On June 2023, GLOBUS INFOCOM LIMITED, the largest EdTech brand in India, announced the release of its next generation of interactive displays. Globus Interactive Display has brought learning to a whole new level by offering a whole new variety of Interactive Display G-classic series, making classrooms more personalized, interactive, collaborative, and convenient. It features a wide range of innovative USPs that make it crucial for meeting modern digital requirements.

- On March 2023, Samsung Electronics revealed a new interactive display with updated capabilities and a robust software solution at Bett 2023, in London. With the cutting-edge Samsung Interactive Display and the Samsung Whiteboard App, the more than 30,000 guests at Bett have the opportunity to explore the future of education. The simple-to-use display enables teachers to design their home screen user interface (UI), activate multiple screens, share up to nine displays at once independent of operating system or device, and employ intelligent education apps to enhance student learning. Users can also benefit from the built-in Wi-Fi and Bluetooth connectivity.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Interactive Display Market based on the below-mentioned segments:

Interactive Display Market, Type Analysis

- Interactive Kiosk

- Interactive Video Wall

- Interactive Table

- Interactive Monitor

- Interactive Whiteboard

- Others

Interactive Display Market, Technology Analysis

- LCD

- LED

- OLED

Interactive Display Market, End-use Analysis

- Industrial

- BFSI

- Retail

- Hospitality

- Education

- Healthcare

- Transportation

- Entertainment

- Corporate & Government

- Others

Interactive Display Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the interactive display market?The Global Interactive Display Market is expected to grow from USD 42.9 billion in 2022 to USD 95.7 billion by 2032, at a CAGR of 8.4% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?Crystal Display Systems, Sharp, ViewSonic, Horizon Display, Panasonic Corporation, HORIZON DISPLAY INC., TableConnect, eyefactive GmbH, Samsung Electronics, LG Display, NEC Corporation, Elo Touch Solutions, Box Light corporation, MMT GmbH & Co. KG., Marvel Technology Co., Ltd.

-

3. Which segment dominated the interactive display market share?The BFSI segment in end-use type dominated the interactive display market in 2022 and accounted for a revenue share of over 31.8%.

-

4. What are the elements driving the growth of the interactive display market?The rising need for online learning environments, as well as the increased utilization of interactive displays such as video walls and tables, are the main drivers boosting the interactive display market expansion.

-

5. Which region is dominating the interactive display market?North America is dominating the interactive display market with more than 38.7% market share.

-

6. Which segment holds the largest market share of the interactive display market?The interactive kiosk segment based on type holds the maximum market share of the interactive display market.

Need help to buy this report?