Global Intelligent Warehouse Market Size, Share, and COVID-19 Impact Analysis, By Technology (Automated Storage & Retrieval Systems, Autonomous Mobile Robots, Automated Guided Vehicles, and IoT (Internet of Things) & RFID), By Application (Inventory Management, Order Fulfilment & Picking, and Packaging & Sorting), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Intelligent Warehouse Market Size Insights Forecasts to 2035

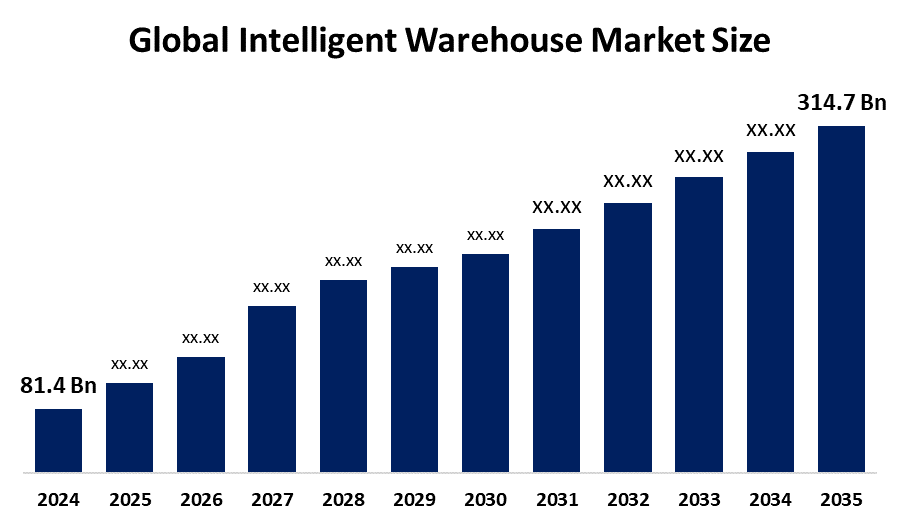

- The Global Intelligent Warehouse Market Size Was Estimated at USD 81.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.08% from 2025 to 2035

- The Worldwide Intelligent Warehouse Market Size is Expected to Reach USD 314.7 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Intelligent Warehouse Market Size was worth around USD 81.4 Billion in 2024 and is predicted to Grow to around USD 314.7 Billion by 2035 with a compound annual growth rate (CAGR) of 13.08% from 2025 to 2035. The need for effective inventory management and real-time operational visibility, the growing demand for e-commerce, the development of robotics and IoT technologies, and the growing adoption of automation are the main factors propelling the global intelligent warehouse market.

Market Overview

The global intelligent warehouse market refers to technology-driven storage and logistics solutions that use automation, robotics, artificial intelligence, and the Internet of Things to improve inventory management, efficiency, error reduction, and supply chain performance. The e-commerce industry's explosive growth and the rise in online buyers worldwide, more than 2.14 billion people, or roughly 27% of the world's population, are driving the intelligent warehousing market's robust expansion. Businesses are being forced to implement intelligent warehousing systems for more efficient order handling as a result of growing customer expectations for precise, timely deliveries. Automation technologies, such as robotic arms, conveyor systems, and autonomous mobile robots (AMRs), are being used more and more to increase productivity, decrease manual labour, and improve operational efficiency. By providing real-time data monitoring, demand forecasting, and optimised inventory management, the combination of artificial intelligence (AI) and machine learning (ML) is revolutionising warehouse operations through advanced analytics.

These technologies let warehouses quickly adjust to shifting market needs by enhancing their agility, responsiveness, and decision-making skills. Additionally, as businesses look to reduce costs and increase accuracy, the trend towards automation is being accelerated by growing labour prices. In general, the market for smart warehousing is developing towards increased automation, intelligence, and efficiency in order to satisfy the ever-changing demands of global supply chains.

Report Coverage

This research report categorizes the intelligent warehouse market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the intelligent warehouse market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the intelligent warehouse market.

Global Intelligent Warehouse Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 81.4 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 13.08% |

| 2035 Value Projection: | USD 314.7 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 161 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Technology, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Dematic, Daifuku Co., Ltd., Honeywell Intelligrated, SSI Schaefer, Körber, Blue Yonder, Swisslog, Vanderlande Industries, KNAPP AG, Fortna Inc., TGW Logistics Group, Bastian Solutions, Locus Robotics, Amazon Robotics, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

E-commerce's explosive expansion is driving the worldwide intelligent warehouse industry by raising demand for quicker order fulfilment and more effective inventory control. Logistics labour shortages are hastening the deployment of automation to sustain productivity. The demand for cost effectiveness, real-time inventory visibility, and fewer manual errors all contribute to the expansion of the industry. Scalability, predictive analytics, and operational precision are improved by developments in IoT, AI, and robotics. The focus on improving supply chain performance and growing customer expectations for same-day delivery are also major drivers of industry expansion.

Restraining Factors

The intelligent warehouse sector faces challenges such as high costs of implementation and ongoing upkeep, complex integrations with existing legacy systems, and limited staff with the qualifications to carry out integration. The connected IoT devices also present cybersecurity threats and potential system downtime, which hinder adoption. Meeting regional compliance regulations, particularly for small and medium-sized enterprises (SMEs) and larger global organizations looking for effective and scalable automation options, puts even greater operational pressure on SMEs with limited resources.

Market Segmentation

The Intelligent Warehouse market share is classified intotechnology and application.

- The automated storage & retrieval systems segment dominated the market in 2024 with approximately 34.5% and is projected to grow at a substantial CAGR during the forecast period.

Based on the technology, the intelligent warehouse market is divided into automated storage & retrieval systems, autonomous mobile robots, automated guided vehicles, and IoT (Internet of Things) & RFID. Among these, the automated storage & retrieval systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Increased demand for automation, better inventory accuracy, and more efficient use of space are the main factors driving its growth. AS/RS solutions are crucial to contemporary warehousing and logistics management because they facilitate quicker operations, less labour dependency, and maximized storage efficiency. The market is dominated by AS/RS technology because of its capacity to minimize labour costs and optimize storage density. These systems are also reducing human error in warehouse operations and increasing inventory management accuracy.

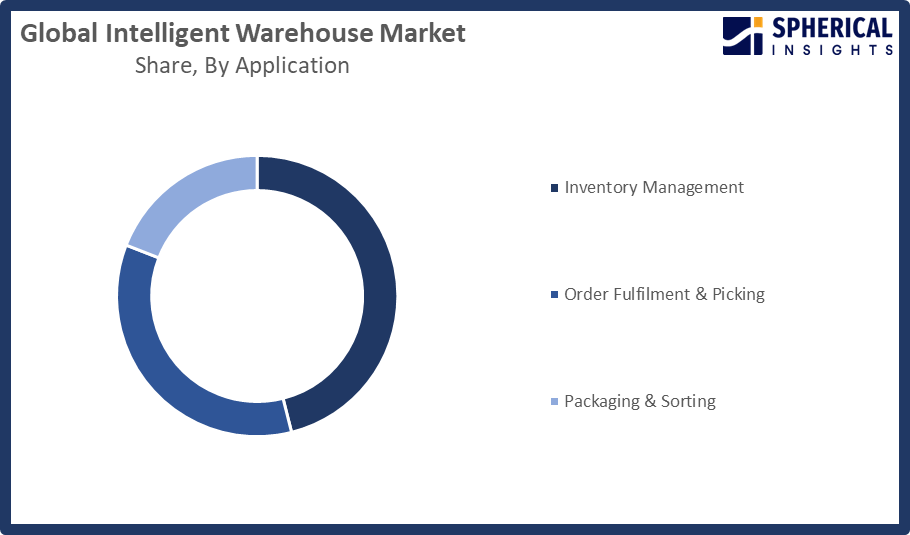

- The inventory management segment accounted for the largest share in 2024, approximately 32% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the intelligent warehouse market is divided into inventory management, order fulfilment & picking, and packaging & sorting. Among these, the inventory management segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Its growth is supported by the rising adoption of AI and IoT technologies, which help accuracy and efficiency in modern warehouse management by providing real-time tracking, optimized inventory levels, and greater supply chain visibility. The inventory management software is dominating the market due to the urgent need for precise stock tracking and optimization, while automated tracking and replenishment practices are also reducing carry costs and minimizing stockouts.

Get more details on this report -

Regional Segment Analysis of the Intelligent Warehouse Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share with approximately 37.5% of the Intelligent Warehouse market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the intelligent warehouse market over the predicted timeframe. The area's advanced logistics framework, rapid growth of e-commerce, and early implementation of automation, artificial intelligence, and Internet of Things systems are contributing factors to the region's dominance. Companies are increasingly employing intelligent warehouse solutions to streamline supply chain and inventory management, reduce labour reliance, and apply more efficient processes. North America is leading the market due to established e-commerce infrastructure and early implementation of modern warehouse solutions, and significant investment in supply chain modernisation within the manufacturing and retail sectors.

Asia Pacific is expected to grow market share with approximately 30% at a rapid CAGR in the intelligent warehouse market during the forecast period. Growing industrialisation, the quick growth of e-commerce, and the growing use of automation, robots, and artificial intelligence technologies are the main drivers of growth. The region's market expansion is being further accelerated by investments in cutting-edge warehouse infrastructure in nations like China, India, and Japan. Asia Pacific's rapid industrialisation and developing manufacturing capabilities are making it the region with the greatest rate of growth. Additionally, the region is seeing a rise in expenditures in warehouse automation due to expanding consumer markets and the expansion of logistical infrastructure.

Europe is expected to grow at a rapid CAGR in the intelligent warehouse market during the forecast period. Europe is experiencing strong growth as a result of Industry 4.0 initiatives and strict labour laws that are encouraging automation use. Additionally, the area is emphasising automated systems that use less energy and sustainable warehouse operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the intelligent warehouse market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dematic

- Daifuku Co., Ltd.

- Honeywell Intelligrated

- SSI Schaefer

- Körber

- Blue Yonder

- Swisslog

- Vanderlande Industries

- KNAPP AG

- Fortna Inc.

- TGW Logistics Group

- Bastian Solutions

- Locus Robotics

- Amazon Robotics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, the first 5G smart warehouse in the United Arab Emirates was introduced by Huawei. This was a component of a larger endeavour to revolutionise the nation's logistics and warehouse space by developing the ability to process data more quickly and more effectively connect all facets of inventory monitoring and operational procedures.

- In March 2024, Telkomsel and Huawei launched Indonesia's first 5G smart warehouse and innovation center. The center was aimed at encouraging technological innovation in logistics by showing the potential of 5G technology to drive automation in warehouse management.

- In February 2024, CelcomDigi and ZTE partnered to develop some advanced technologies in smart manufacturing and smart warehousing. CelcomDigi’s national aim to bolster operational efficiency and enable digital transformation across many sectors was facilitated by putting advanced technologies in the hands of manufacturers and importers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the intelligent warehouse market based on the below-mentioned segments:

Global Intelligent Warehouse Market, By Technology

- Automated Storage & Retrieval Systems

- Autonomous Mobile Robots

- Automated Guided Vehicles

- IoT (Internet of Things) & RFID

Global Intelligent Warehouse Market, By Application

- Inventory Management

- Order Fulfilment & Picking

- Packaging & Sorting

Global Intelligent Warehouse Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Intelligent Warehouse market over the forecast period?The global Intelligent Warehouse market is projected to expand at a CAGR of 13.08% during the forecast period.

-

2. What is the market size of the Intelligent Warehouse market?The global Intelligent Warehouse market size is expected to grow from USD 81.4 Billion in 2024 to USD 314.7 Billion by 2035, at a CAGR of 13.08% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Intelligent Warehouse market?North America is anticipated to hold the largest share of the Intelligent Warehouse market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Intelligent Warehouse market?Dematic, Daifuku Co., Ltd., Honeywell Intelligrated, SSI Schaefer, Körber, Blue Yonder, Swisslog, Vanderlande Industries, KNAPP AG, and Fortna Inc.

-

5. What factors are driving the growth of the Intelligent Warehouse market?Rapid expansion in e-commerce, increased demand for quicker order fulfilment, labour constraints, and the requirement for real-time inventory visibility are the main factors propelling the intelligent warehouse industry. Furthermore, supply chain activities are optimised, errors are decreased, and efficiency is increased through the use of automation, robotics, AI, and IoT technology.

-

6. What are the market trends in the Intelligent Warehouse market?Growing use of automation and robotics, incorporation of AI and machine learning for predictive analytics, IoT-based real-time inventory tracking, energy-efficient and sustainable operations, and the emergence of cloud-based warehouse management systems to improve operational efficiency, scalability, and flexibility.

-

7. What are the main challenges restricting wider adoption of the Intelligent Warehouse market?High implementation and maintenance costs, complicated connection with legacy systems, a lack of skilled workers, cybersecurity threats, and adherence to various regional rules are the primary obstacles impeding the adoption of intelligent warehouses.

Need help to buy this report?