Global Insurtech Market Size, Share, and COVID-19 Impact Analysis By Type (Auto, Business, Health, Home, Specialty, Travel, and Others), By Service ( Consulting, Support & Maintenance, and Managed Services), By Technology ( Blockchain, Cloud Computing , IoT, Machine Learning, Robo Advisory and Others ), By End- User ( Automotive, BFSI, Government, Healthcare, Manufacturing, Retail , Transportation and Others ), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030.

Industry: Information & TechnologyGlobal Insurtech Market Insights Forecasts to 2030

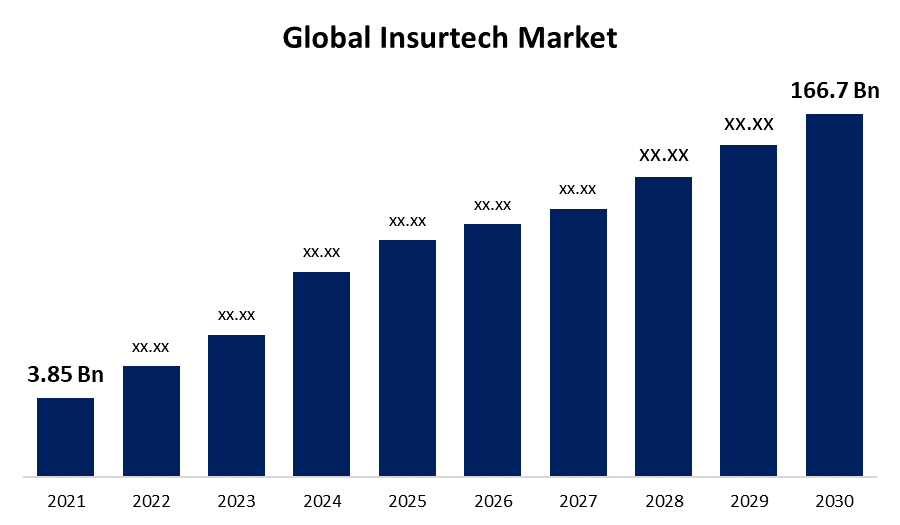

- The global insurtech market was valued at USD 3.85 billion in 2021.

- The market is growing at a CAGR of 52% from 2021 to 2030

- The global insurtech market is expected to reach USD 166.7 billion by 2030

- The Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The global insurtech market is expected to reach USD 166.7 billion by 2030, at a CAGR of 52% during the forecast period 2021 to 2030. Over the next few years, the global insurtech market is expected to grow a lot. This is because the claims process is getting easier, communication with customers is getting better, and automation is getting easier to use.

Market Overview:

The word "fintech" gave rise to the portmanteau "Insurtech," which is made up of the words "insurance" and "technology." The insurance industry is going through a lot of changes, which is why both insurtech companies and venture capitalists are investing in the field. Because of this, the industry is seen as ready for growth. Traditional insurance companies are less likely to go after opportunities like those that insurtech companies are going after. These opportunities include offering highly customized policies, social insurance, and dynamic pricing of premiums based on behavior observed by using new data streams from devices that can connect to the Internet. Several insurance technology companies are teaming up with traditional insurance companies to offer blockchain technology solutions. For example, Amodo, a company in the insurtech industry, announced in December 2020 that they would be partnering with Galileo Platforms Limited, a technology company. Due to this agreement, the companies want to use blockchain technology to help insurance companies offer new insurance products and change the way they work with customers. Insurance companies are becoming more open to accepting payments in the form of cryptocurrencies. For example, Metromile, a car insurance company, said in December 2021 that it planned to set up a system that would let policyholders pay both premiums and claims with cryptocurrencies. It is hoped that this move will help the organisation get a better reputation in its field. Also, in June 2021, the Universal Fire & Liability Insurance Company, which specialises in giving small businesses traditional property and casualty insurance, started accepting cryptocurrencies as payment for premiums. It is expected that this trend will help the insurtech industry grow. On-demand insurance is becoming more popular because it lets people buy coverage on their smartphones whenever it's most convenient for them. This has led to a rise in demand for this type of insurance. Businesses that offer on-demand insurance are using cutting-edge technologies like the internet of things, artificial intelligence, big data, and predictive maintenance more and more to rethink the underwriting process, the process of making on-demand insurance products, and the process of selling those products.

Global Insurtech Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 3.85 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 52% |

| 2030 Value Projection: | USD 166.7 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 182 |

| Segments covered: | By Type, By Service, By Technology, By End- User, By Region |

| Companies covered:: | Oscar Insurance, Quantemplate, Shift Technology, Trov Inc., Wipro Limited, ZhongAn Insurance, Acko, Coya |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the market for global based insurtech market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global insurtech market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global insurtech market sub-segments.

Segmentation Analysis

- In 2021, the health segment dominated the market with the largest market share of 25% and market revenue of 0.96 billion.

Based on the type, the insurtech market is categorized into Auto, Business, Health, Home, Specialty, Travel, and Others. In 2021, the health segment dominated the market with the largest market share of 25% and market revenue of 0.96 billion. The growing need for digital platforms in the health insurance industry is expected to boost demand for the health sector. These platforms link health insurance exchanges, brokers, providers, and carriers. Using advanced analytics is becoming more and more important for the success of life and health insurers who want to better serve and understand their clients. More and more health insurance companies are using different insurtech solutions to make the steps involved in processing claims easier. Insurance companies are also trying to combine their health insurance services with mobility features to make things easier for their customers.

- In 2021, the managed services segment accounted for the largest share of the market, with 40% and market revenue of 1.54 billion.

Based on the services, the insurtech market is categorized into Consulting, Support & Maintenance, and Managed Services. In 2021, managed services dominated the market with the largest market share of 40% and market revenue of 1.54 billion. Managed service providers can help insurance companies make the transition to digital by giving them a step-by-step plan based on the knowledge and skills of experienced professionals and the latest tools. The managed service providers can also give insurers advice on the best procedures, policies, and regulatory considerations. At the same time, managed services give insurers the ability to solve IT and operations problems and take advantage of opportunities. Recently, the insurance industry has started to understand and value the benefits of improved business models. This has opened up new growth opportunities for the managed services sector.

- In 2021, the cloud computing segment accounted for the largest share of the market, with 33% and market revenue of 1.27 billion.

Based on the technology, the insurtech market is categorized into Blockchain, Cloud Computing , IoT, Machine Learning, Robo Advisory and Others. In 2021, cloud computing dominated the market with the largest market share of 33% and market revenue of 1.27 billion. Cloud computing has completely changed the insurance industry because it is flexible, easy to set up, and uses many different resources. It is expected that the growth will be fueled by the popularity of Bring Your Own Device (BYOD) policies and the fact that insurance companies are collecting more and more data. Cloud computing solutions are becoming increasingly popular with insurance companies because they have so many benefits, such as being easy to set up, less expensive, and easier to scale.

Regional Segment Analysis of the Insurtech Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, the U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

Among all regions, North America emerged as the largest market for the global insurtech market, with a market share of around 38.4% and 3.85 billion of the market revenue in 2021.

- In 2021, North America emerged as the largest market for the global insurtech market, with a market share of around 38.4% and 3.85 billion of the market revenue. Because people are spending more money on insurance-related products, the use of insurtech solutions is rising, which is a good thing. Also, these solutions' health and property insurance plans are very flexible and can be changed to fit your needs. The overall growth of the market in the area is also helped by the growth of the insurtech startup community across the area.

- The Asia Pacific market is expected to grow at the fastest CAGR between 2022 and 2030. Because Singapore, India, and Hong Kong are all places with growing economies and financial hubs, the area is expected to grow a lot in the coming years. The goal of the insurance companies in the area is to offer insurance with more reasonable premiums. The growing use of smartphones in Asia-Pacific countries is expected also to help the region's market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global insurtech market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Oscar Insurance

- Quantemplate

- Shift Technology

- Trov Inc.

- Wipro Limited

- ZhongAn Insurance

- Acko

- Coya

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Recent Development

- In April 2022, Shift Technology will tap into legendary data in order to assist insurers in making more informed decisions on questionable claims.

- In March 2022, DXC Technology has announced that they would be increasing their focus on insurance software and business process solutions starting.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2030. Spherical Insights has segmented the global insurtech market based on the below-mentioned segments:

Global Insurtech Market, By Type

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

Global Insurtech Market, By Service

- Consulting

- Support & Maintenance

- Managed Services

Global Insurtech Market, By Technology

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

Global Insurtech Market, By End User

- Automotive

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Transportation

- Others

Global Insurtech Market, Regional Analysis

- North America

- The US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- The Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Insurtech market?As per Spherical Insights, the size of the Insurtech market was valued at USD 3.85 billion in 2021 to USD 166.7 billion by 2030.

-

What is the market growth rate of the Insurtech market?The Insurtech market is growing at a CAGR of 52% from 2021 to 2030.

-

Which country dominates the Insurtech market?North America emerged as the largest market for Insurtech.

-

Who are the key players in the Insurtech market?Key players in the Insurtech market are Oscar Insurance, Quantemplate, Shift Technology, Trov Inc., Wipro Limited, ZhongAn Insurance, Acko, and Coya.

-

Which factor drives the growth of the Insurtech market?Consumer benefits is expected to drive the market's growth over the forecast period.

Need help to buy this report?