Global Inpatient Services Market Size, Share, and COVID-19 Impact Analysis, By Treatment (Cardiovascular Disorders, Cancer, and Others), By Ownership (Publicly/Government-Owned, For-Profit Privately Owned, and For-profit privately owned), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Inpatient Services Market Insights Forecasts to 2035

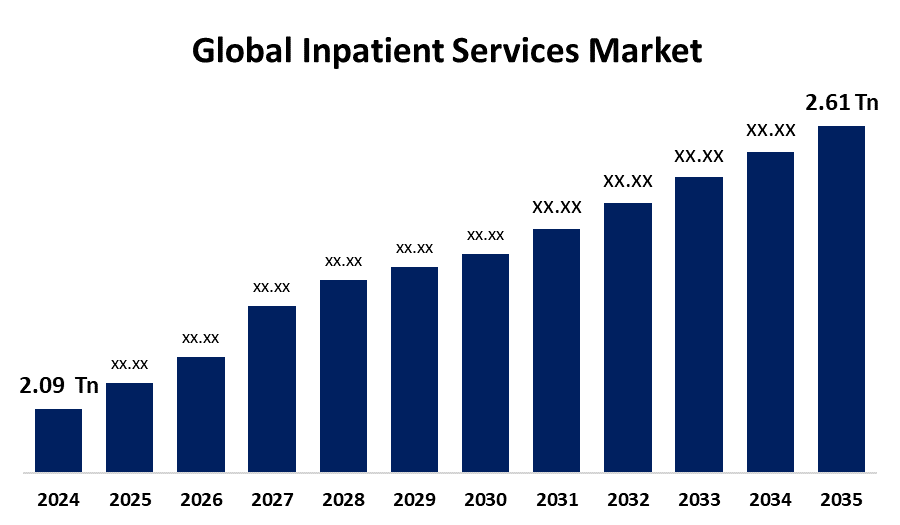

- The Global Inpatient Services Market Size Was Estimated at USD 2.09 Trillion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.04% from 2025 to 2035

- The Worldwide Inpatient Services Market Size is Expected to Reach USD 2.61 Trillion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global inpatient services market size was worth around USD 2.09 trillion in 2024 and is predicted to grow to around USD 2.61 trillion by 2035 with a compound annual growth rate (CAGR) of 2.04% from 2025 to 2035. The growing prevalence of chronic diseases, an aging population, and growing healthcare spending are all contributing to driving the inpatient services market worldwide.

Market Overview

The inpatient services market encompasses the healthcare services provided to patients who require an overnight stay or longer in a hospital or other inpatient facility. Inpatient services, also known as indoor patients department or hospital-based care, involve the medical treatment and care provided at a hospital or inpatient facility where a patient stays overnight or for multiple days. There is a growing emphasis on patient-centric care, which is responsible for driving the market growth. Further, high-quality, personalized care to patients is provided by the hospitals that require extended hospital stays and specialized inpatient care. Telemedicine in the inpatient services enables remote consultation, pre-admission evaluation, and post-discharge care so that the healthcare providers can observe the condition of their patients with better efficacy and minimize available admissions. Introduction of telemedicine for improving coordination of care before and after hospital stay is providing a growth opportunity in the inpatient services market.

Report Coverage

This research report categorizes the Inpatient Services market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Inpatient Services market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the inpatient services market.

Inpatient Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.09 Trillion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.04% |

| 2035 Value Projection: | USD 2.61 Trillion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Treatment, By Ownership, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Apollo Hospitals Enterprise Ltd., Max Healthcare, West Suffolk NHS Foundation Trust, Royal Papworth Hospital NHS Foundation Trust, Cedars-Sinai, UCLA Medical Centers, The Johns Hopkins Hospital, Mayo Clinic, Keio University (Medical Services), THE ROYAL MELBOURNE HOSPITAL, Burjeel Holdings, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing cases of chronic diseases among patients are driving the demand for inpatient services to provide ongoing, comprehensive care for individuals with long-term health conditions such as diabetes, hypertension, and heart disease, which is ultimately propelling the market for inpatient services. An increasing need for inpatient services, including geriatric care, rehabilitation, and palliative care for managing an increasing number of aging adults with chronic conditions and complex healthcare needs, is driving the market demand. Further, the rising healthcare spending contributes to propelling the market growth. For instance, in 2021, global spending on health reached a staggering $9.8 trillion, accounting for 10.3% of global GDP

Restraining Factors

Economic instability, challenges with insurance reimbursements, concerns regarding patient safety & quality of care are restraining the inpatient services market. Further, the lack of trained & experienced healthcare professionals, which limits the capacity to provide quality inpatient care, may hinder the market growth.

Market Segmentation

The inpatient services market share is classified into treatment and ownership.

- The cardiovascular disorders segment dominated the market with the largest revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the treatment, the inpatient services market is divided into cardiovascular disorders, cancer, and others. Among these, the cardiovascular disorders segment dominated the market with the largest revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period. It involves a multifaceted approach, such as acute interventions, chronic care, and lifestyle modifications, which emphasizes improving patient care and lifestyle quality of life. The growing prevalence of cardiovascular diseases owing to an aging population, obesity, reduced physical activity, and smoking is propelling the market in the cardiovascular disorders segment.

- The publicly/government-owned segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the ownership, the inpatient services market is divided into publicly/government-owned, for-profit privately owned, and for-profit privately owned. Among these, the publicly/government-owned segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Publicly/government-owned institutions provide healthcare at subsidized or low costs, making them accessible to the wider population. The specialized medical procedures provided at relatively minimal expense, as well as the availability of patient beds catering to various medical conditions, are propelling the market growth in the publicly/government-owned segment.

Regional Segment Analysis of the Inpatient Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the inpatient services market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the inpatient services market over the predicted timeframe. The presence of key market players like HCA Healthcare, Cleveland Clinic, and John Hopkins across the region, along with the strong focus on providing high-quality care, is significantly contributing to driving the inpatient services market. Further, the adoption of e-prescribing, telehealth, mHealth, and other HCIT solutions in the inpatient services is propelling the market growth.

Asia Pacific is expected to grow at a rapid CAGR in the inpatient services market during the forecast period. The increasing prevalence of chronic diseases among the growing regional population, as well as increasing investment in healthcare infrastructure, are driving the inpatient services market. The upsurging innovation in hospital and specialty care services, as well as digital health models integrating omnichannel patient journeys, is propelling the market growth.

Europe is anticipated to hold a significant share of the inpatient services market during the projected timeframe. The growing need for healthcare services and medical technology advancements, along with supportive government policies, are driving the inpatient services market. The heightened demand for specialized treatments among patients is responsible for driving market demand for inpatient services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the inpatient services market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

Apollo Hospitals Enterprise Ltd.

Max Healthcare

West Suffolk NHS Foundation Trust

Royal Papworth Hospital NHS Foundation Trust

Cedars-Sinai

UCLA Medical Centers

The Johns Hopkins Hospital

Mayo Clinic

Keio University (Medical Services)

THE ROYAL MELBOURNE HOSPITAL

Burjeel Holdings

Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, UCSF Health is moving ahead with a project to build a new, $4.3 billion hospital that would be significantly bigger and designed with an eye on innovative care. The new, 15-story Helen Diller Hospital is being planned to meet existing needs for more specialty care, and anticipated growth in demand in the future.

- In February 2024, King’s Global Health Partnerships announced an ambitious new partnership in the Gambia, adding to their well-established health partnership in Somaliland, Sierra Leone, the Democratic Republic of Congo and Zambia.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the inpatient services market based on the below-mentioned segments:

Global Inpatient Services Market, By Treatment

- Cardiovascular Disorders

- Cancer

- Others

Global Inpatient Services Market, By Ownership

- Publicly/Government-Owned

- For-Profit Privately Owned

- For-profit privately owned

Global Inpatient Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the inpatient services market over the forecast period?The global inpatient services market is projected to expand at a CAGR of 2.04% during the forecast period.

-

2. What is the market size of the inpatient services market?The global inpatient services market size is expected to grow from USD 2.09 Trillion in 2024 to USD 2.61 Trillion by 2035, at a CAGR of 2.04% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the inpatient services market?North America is anticipated to hold the largest share of the inpatient services market over the predicted timeframe.

Need help to buy this report?