Global Injectable Suspensions Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Steroid Injectable Suspensions and Non-Steroid Injectable Suspensions), By Application (Oncology, Cardiovascular Diseases, Autoimmune Diseases, Infectious Diseases, and Others), By End-Use (Hospitals, Clinics, Ambulatory Surgical Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Injectable Suspensions Market Insights Forecasts to 2035

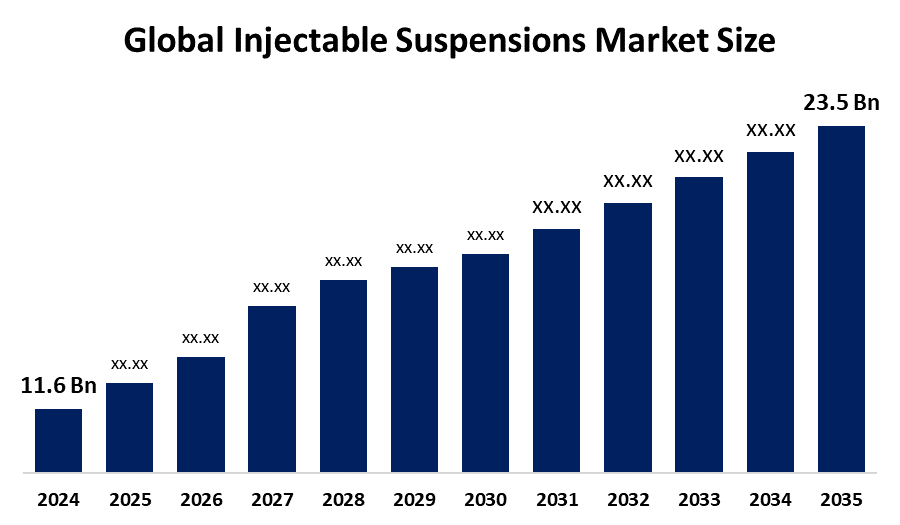

- The Global Injectable Suspensions Market Size Was Estimated at USD 11.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.63% from 2025 to 2035

- The Worldwide Injectable Suspensions Market Size is Expected to Reach USD 23.5 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Injectable Suspensions Market Size was worth around USD 11.6 Billion in 2024 and is predicted to grow to around USD 23.5 Billion by 2035 with a compound annual growth rate (CAGR) of 6.63% from 2025 and 2035. The market for injectable suspensions presents numerous opportunities for growth, driven by increasing innovation in long-acting formulations and novel drug delivery systems, as well as the rising incidence of chronic diseases that require more stable and patient-friendly formulations.

Market Overview

The global injectable suspension industry is focused on developing and selling pharmaceutical products where solid drug particles are suspended in a liquid medium for parenteral administration, such as injection. Injectable suspension refers to the parenteral preparations designed for injection into the body, consisting of finely divided insoluble particles (microsized or nanosized) dispersed in a liquid medium, with no release modifiers and no insoluble excipients in the solution phase. They usually contain a drug concentration in between 0.5-5.0% which passes easily through the hypodermic needle. For instance, Kenalog-40 injection is an injectable suspension, 40 mg/mL for intramuscular or intra-articular use.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and the strategic alliances among biopharmaceutical companies for advancing the delivery platform. For instance, in July 2025, Clearside Biomedical, Inc., a biopharmaceutical company, announced a plan to explore a full range of strategic alternatives to advance its SCS platform and drug development to enhance stockholder value. With an increasing advancement in nanomedicine, the integration of protein-bound nano-injectable solutions is anticipated to drive a huge surge in the global injectable suspensions market. For instance, Nanomi’s LAI platform is a proprietary particle control technology that has demonstrated efficacy and safety in drug delivery of Risperidone long-acting injectable, which was approved by the US FDA in September 2025.

Report Coverage

This research report categorizes the Injectable Suspensions market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Injectable Suspensions market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Injectable Suspensions market.

Injectable Suspensions Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.6 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.63% |

| 2035 Value Projection: | USD 23.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Product Type, By Application, By End-Use, and By Region |

| Companies covered:: | Pfizer Inc., GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd., Cipla Limited, Sanofi S.A., AstraZeneca plc, Merck & Co., Inc., Johnson & Johnson, Novartis AG, Bristol-Myers Squibb Company, Eli Lilly and Company, AbbVie Inc., Roche Holding AG, Others, and |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market demand for injectable suspensions is primarily driven by the growing prevalence of chronic disorders, including neurological disorders and other diseases like cancer. Technological innovations in drug delivery, along with the rise in R&D investment for novel drug therapies that are delivered via injectable suspensions, are anticipated to propel the market growth. In addition, the emphasis on biologics R&D for driving the use of nanoformulations for novel long-acting injectable products contributes to promoting the injectable suspensions market. For instance, protein-bound nano-injection solution is a cutting-edge advancement in nanomedicine for precise and controlled drug delivery.

Restraining Factors

The injectable suspensions market is restricted by increased development costs and strict regulations like the US FDA and EMA. Further, patient-related factors like needle phobia and needlestick injuries are challenging the market growth.

Market Segmentation

The injectable suspensions market share is classified into product type, application, and end-use.

- The non-steroid injectable suspensions segment dominated the market with a major share of about 57.5% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the injectable suspensions market is divided into steroid injectable suspensions and non-steroid injectable suspensions. Among these, the non-steroid injectable suspensions segment accounted for a major share of about 57.5% in 2024 and is projected to grow at a substantial CAGR during the forecast period. For instance, procaine benzyl penicillin, Procaine penicillin G and Benzathine benzylpenicillin (benzathine penicillin G) are the antibiotics that are injected intramuscularly. The increasing use of injectable suspension for biologics and small molecule drugs is contributing to driving the segmental market growth.

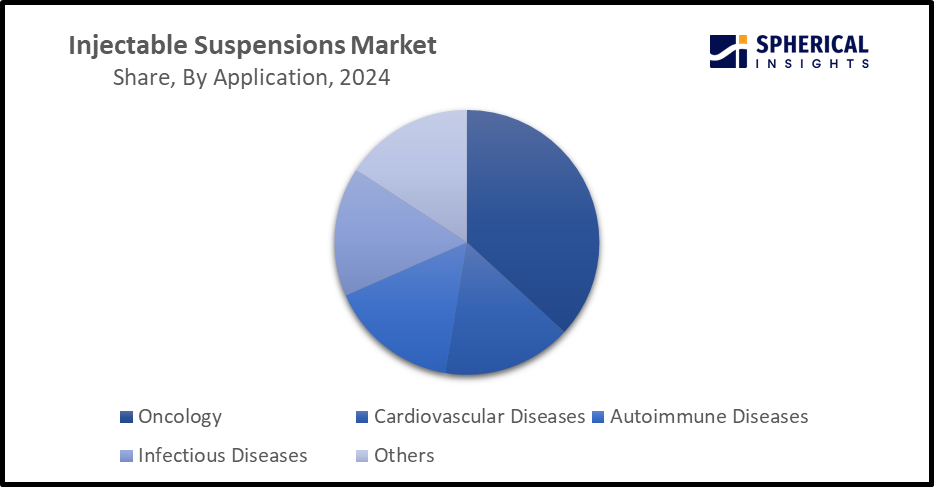

- The oncology segment is dominating the market with a significant revenue share of 34.6% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the injectable suspensions market is divided into oncology, cardiovascular diseases, autoimmune diseases, infectious diseases, and others. Among these, the oncology segment is dominating the market with a significant revenue share of 34.6% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. There is ongoing research on developing injectable delivery vehicle systems suitable for combined chemo and radiotherapy. For instance, protein-bound nano injectable suspensions are advanced nanomedicine that offer precise and controlled drug delivery for treating complicated diseases, including cancer.

Get more details on this report -

- The hospitals segment held the largest market share of 37.9% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the injectable suspensions market is divided into hospitals, clinics, ambulatory surgical centers, and others. Among these, the hospitals segment held the largest market share of 37.9% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Injectable suspensions are used in hospital settings for sustained drug release that cannot be taken orally, requiring specialized handling owing to the risk of particle settling and inconsistent dosing. In critical care treatment of oncology and CVD in hospitals, injectable suspension is used.

Regional Segment Analysis of the Injectable Suspensions Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the injectable suspensions market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of about 40.5%-47.5% in the injectable suspensions market over the predicted timeframe. The market demand for injectable suspensions has been driven by the region's advanced healthcare infrastructure and increased healthcare expenditure. An increasing emphasis on enhancing the accessibility and affordability of suspension-formulated injectables is contributing to driving the market for injectable suspension. For instance, in January 2025, Harrow is collaborating with Cencora Inc. to launch the ‘Harrow Cares’ program to provide accessibility and affordability services for its retina-based products, including ‘TRIESENCE suspension’, which is an injectable, synthetic corticosteroid. United States is dominating the North America injectable suspensions market with the largest share of about 30%, driven by the increasing approval for injectable suspensions for treating neurological & psychiatric diseases.

Asia Pacific is expected to grow at a rapid CAGR of 4.8% in the injectable suspensions market during the forecast period. The Asia Pacific area has a thriving market for injectable suspensions due to the biopharmaceutical industry presence and growing prevalence of chronic diseases. An increasing novel drug approvals is contributing to driving the market growth for injectable suspensions. For instance, in April 2025, Cipla received final approval from the US FDA for an Abbreviated New Drug Application (ANDA) submitted for Paclitaxel protein-bound particles for injectable suspension (albumin-bound), 100 mg/vial, single-dose vial (‘Protein Bound Paclitaxel’). China is leading the injectable suspensions market in the Asia Pacific region, owing to the growing demand for long-term injectable therapies and technological innovations. For instance, in June 2024, Luye Pharma Group announced that its Jinyouping (rotigotine microspheres for injection) approved for marketing by China's National Medical Products Administration (NMPA) with a priority review designation for the treatment of Parkinson’s disease (PD).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the injectable suspensions market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer Inc.

- GlaxoSmithKline plc

- Teva Pharmaceutical Industries Ltd.

- Cipla Limited

- Sanofi S.A.

- AstraZeneca plc

- Merck & Co., Inc.

- Johnson & Johnson

- Novartis AG

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- AbbVie Inc.

- Roche Holding AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Teva Pharmaceuticals, a U.S. affiliate of Teva Pharmaceutical Industries Ltd., and Medincell, announced that the U.S. Food and Drug Administration has approved UZEDY (risperidone) as a once-monthly extended release injectable suspension as monotherapy or as adjunctive therapy to lithium or valproate for the maintenance treatment of bipolar I disorder (BD-I) in adults.

- In October 2025, Lupin Limited announced the launch of a strategic partnership program aimed at expanding the reach of PrecisionSphere-the long-acting injectable (LAI) platform developed by its subsidiary, Nanomi B.V. (Nanomi).

- In June 2025, Hikma Pharmaceuticals PLC, the multinational pharmaceutical company has launched Triamcinolone Acetonide Injectable Suspension, USP, in a 40mg/mL dose in the US.

- In May 2025, the Medicine and Healthcare products Regulatory Agency (MHRA) approved a subcutaneous injectable version of the cancer drug nivolumab (Opdivo, Bristol Myers Squibb).

- In October 2024, Teva Pharmaceuticals, a U.S. affiliate of Teva Pharmaceutical Industries Ltd., announced the launch of the first and only generic version of Sandostatin LAR Depot, in the United States.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the injectable suspensions market based on the below-mentioned segments:

Global Injectable Suspensions Market, By Product Type

- Steroid Injectable Suspensions

- Non-Steroid Injectable Suspensions

Global Injectable Suspensions Market, By Application

- Oncology

- Cardiovascular Diseases

- Autoimmune Diseases

- Infectious Diseases

- Others

Global Injectable Suspensions Market, By End-Use

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

Global Injectable Suspensions Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the injectable suspensions market?The global injectable suspensions market size is expected to grow from USD 11.6 Billion in 2024 to USD 23.5 Billion by 2035, at a CAGR of 6.63% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the injectable suspensions market?North America is anticipated to hold the largest share of the injectable suspensions market over the predicted timeframe

-

3. What is the forecasted CAGR of the Global Injectable suspensions Market from 2024 to 2035?The market is expected to grow at a CAGR of around 6.63% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Injectable Suspensions Market?Key players include Pfizer Inc., GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd., Cipla Limited, Sanofi S.A., AstraZeneca plc, Merck & Co., Inc., Johnson & Johnson, Novartis AG, Bristol-Myers Squibb Company, Eli Lilly and Company, AbbVie Inc., and Roche Holding AG.

-

5. Can you provide company profiles for the leading injectable suspensions manufacturers?Yes. For example, Pfizer Inc. is an American multinational pharmaceutical and biotechnology corporation headquartered at The Spiral in Manhattan, New York City, and develops and produces medication and vaccines. GlaxoSmithKline plc is a biopharmaceutical company that discovers, develops, and delivers medicines and vaccines.

-

6. What are the main drivers of growth in the injectable suspensions market?An increasing prevalence of chronic diseases and emphasis on biologics R&D are major market growth drivers of the injectable suspensions market.

-

7. What challenges are limiting the injectable suspensions market?An increased development costs and strict regulations remain key restraints in the injectable suspensions market.

Need help to buy this report?