Global Injectable Drug Delivery Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Devices and Formulations), By Therapeutic Use (Autoimmune disorders, Hormonal disorders, Oncology, and Others), By End-use (Hospitals, Homecare Settings, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Injectable Drug Delivery Devices Market Insights Forecasts to 2035

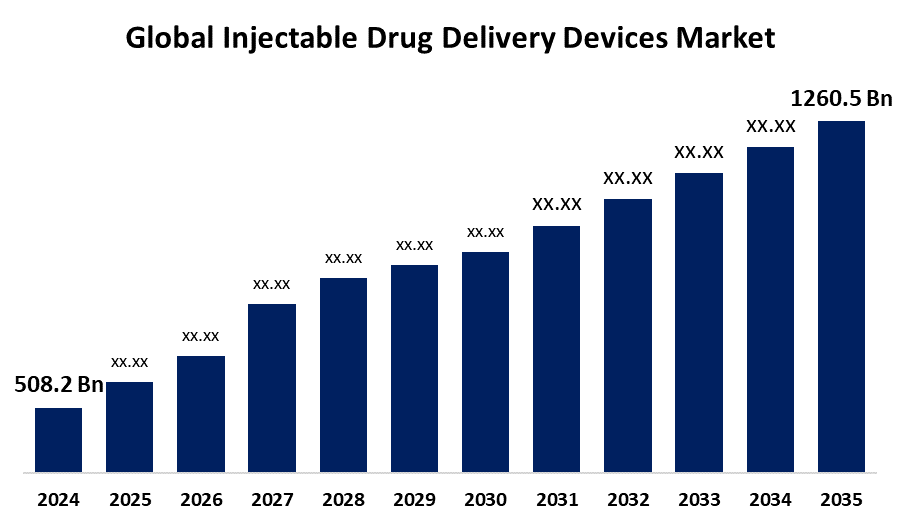

- The Global Injectable Drug Delivery Devices Market Size Was Estimated at USD 508.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.61% from 2025 to 2035

- The Worldwide Injectable Drug Delivery Devices Market Size is Expected to Reach USD 1260.5 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Injectable Drug Delivery Devices Market Size was worth around USD 508.2 Billion in 2024 and is Predicted to Grow to around USD 1260.5 Billion by 2035 with a compound annual growth rate (CAGR) of 8.61% from 2025 to 2035. The growing prevalence of chronic diseases, aging population, and demand for personalized medicine and self-administration are driving the injectable drug delivery devices market worldwide.

Market Overview

The injectable drug delivery devices market refers to the industry of devices designed for administering medications through injections, such as syringes, autoinjectors, and pen injectors. Injectable drug delivery systems are used mainly in hospitals and in emergency care, especially when the oral route is not feasible due to impaired consciousness. Injectable drug delivery devices are critical tools in the modern healthcare landscape, ensuring the accurate administration of medications directly into the bloodstream, muscles, or tissues, bypassing the digestive system. They are needed for the rapid onset of drug action, utilized for the critical care of pediatric patients. The market is primarily driven by the increasing prevalence of chronic diseases, including diabetes, cancer, and autoimmune disorders, along with a rising demand for biologics. Move towards personalized medicine and combination therapies, encouraging device manufacturers to create tailored solutions for complex drug regimes. Further, an increasing investment in sustainable and reusable injection systems in order to comply with environmental regulations is responsible for escalating the market growth for injectable drug delivery devices. Advancements in novel drug delivery systems, demand for self-injection devices, and partnerships & collaborations among major players are the factors that are creating lucrative market growth opportunities.

Report Coverage

This research report categorizes the injectable drug delivery devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the injectable drug delivery devices market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the injectable drug delivery devices market.

Global Injectable Drug Delivery Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 508.2 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.61% |

| 2035 Value Projection: | USD 1260.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Therapeutic Use, By End-use and COVID-19 Impact Analysis. |

| Companies covered:: | Baxter, Schott AG, BD, Eli Lilly and Company, Terumo Corporation, Elcam Medical, Unilife Corporation, Ypsomed AG, Gerresheimer AG, Sanofi and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The upsurging need for advanced drug delivery systems, owing to the increasing prevalence of diabetes, cancer, and cardiovascular diseases, is driving the market demand. There is increasing demand for injectable therapies as older adults often require medications for age-related ailments. The improved healthcare access and government-backed immunization and chronic disease management programs are significantly contributing to promoting the market growth. An adoption of advanced delivery technologies, including wearable injectors, autoinjectors, and needle-free systems, is escalating the market growth. In addition, emphasis on patient compliance and home-based treatment options is contributing to bolster the market demand.

Restraining Factors

An increased cost of advanced devices, regulatory hurdles, and the risk of needle-related complications are challenging the market of injectable drug delivery devices. Further, volatility in raw material prices affecting the manufacturing costs and profit margins is hampering the market growth.

Market Segmentation

The injectable drug delivery devices market share is classified into product, therapeutic use, and end-use.

- The formulations segment dominated the market with a major revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the injectable drug delivery devices market is divided into devices and formulations. Among these, the formulations segment dominated the market with a major revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Injectable drug formulations are crucial for delivering medications when rapid absorption, oral route bypass, or patient adherence is needed. Innovation in formulation technology, including long-lasting injectables and depot formulation for more convenient dosing schedules, is driving the market in the formulations segment.

- The autoimmune disorders segment dominated the market with a significant revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the therapeutic use, the injectable drug delivery devices market is divided into autoimmune disorders, hormonal disorders, oncology, and others. Among these, the autoimmune disorders segment dominated the market with a significant revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Injectable drug delivery devices aid in self-injecting the immunosuppressive medications at home, improving adherence and reducing the need for frequent clinic visits. An increased adoption of self-injection and demand for biologics, as well as innovation in formulation technologies, aids in propelling the market.

- The hospitals segment accounted for a major revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the injectable drug delivery devices market is divided into hospitals, homecare settings, and others. Among these, the hospitals segment accounted for a major revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. An increased adoption of advanced injectable devices, owing to their ability to provide rapid therapeutic effects in emergency and critical situations, is driving the market in the hospitals segment.

Regional Segment Analysis of the Injectable Drug Delivery Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the injectable drug delivery devices market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the injectable drug delivery devices market over the predicted timeframe. An increasing number of people suffering from chronic diseases like diabetes, cancer, and autoimmune disorders are driving the market demand. The demand for advanced delivery devices, owing to the need for long-term treatment with injectable medications, is propelling the market growth.

Asia Pacific is expected to grow at a rapid CAGR in the injectable drug delivery devices market during the forecast period. Increasing healthcare spending, along with the growing prevalence of chronic diseases and the elderly population, are responsible for driving the injectable drug delivery devices market. The growing healthcare investments and demand for advanced treatment solutions across diverse therapeutic areas are propelling the regional market growth.

Europe is anticipated to hold a significant share of the injectable drug delivery devices market during the projected timeframe. An increasing burden of chronic diseases as well as benefits & convenience of self-injectors, are significantly contributing to driving the injectable drug delivery devices market growth. Further, inclination towards feasible routes of administration drives the market for injectable drug delivery devices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the injectable drug delivery devices market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Baxter

- Schott AG

- BD

- Eli Lilly and Company

- Terumo Corporation

- Elcam Medical

- Unilife Corporation

- Ypsomed AG

- Gerresheimer AG

- Sanofi

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, SCHOTT Pharma, a pioneer in pharma drug containment solutions and delivery systems, expanded its ready-to-use (RTU) platform with 10 ml RTU cartridges. This large-format solution is specifically designed to protect and administer highly sensitive biologics, which are transforming the treatment landscape for numerous diseases, including cancer, metabolic disorders, cardiovascular conditions, genetic disorders, and immunological diseases.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the injectable drug delivery devices market based on the below-mentioned segments:

Global Injectable Drug Delivery Devices Market, By Product

- Devices

- Formulations

Global Injectable Drug Delivery Devices Market, By Therapeutic Use

- Autoimmune disorders

- Hormonal disorders

- Oncology

- Others

Global Injectable Drug Delivery Devices Market, By End-use

- Hospitals

- Homecare Settings

- Others

Global Injectable Drug Delivery Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the injectable drug delivery devices market over the forecast period?The global injectable drug delivery devices market is projected to expand at a CAGR of 8.61% during the forecast period.

-

2. What is the market size of the injectable drug delivery devices market?The global injectable drug delivery devices market size is expected to grow from USD 508.2 Billion in 2024 to USD 1260.5 Billion by 2035, at a CAGR of 8.61% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the injectable drug delivery devices market?North America is anticipated to hold the largest share of the injectable drug delivery devices market over the predicted timeframe.

Need help to buy this report?