Global Infectious Disease Molecular Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Product (Instruments, Reagents, and Services), By Technology (Mass Spectrometry, PCR, In Situ Hybridization, and Others), By Application (Respiratory Diseases, Tuberculosis, Meningitis, Gastrointestinal Tract Infections, HPV, and Others), By End-use (Hospitals, Clinics, Diagnostics Laboratories, and Research Institutes), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: HealthcareGlobal Infectious Disease Molecular Diagnostics Market Insights Forecasts to 2035

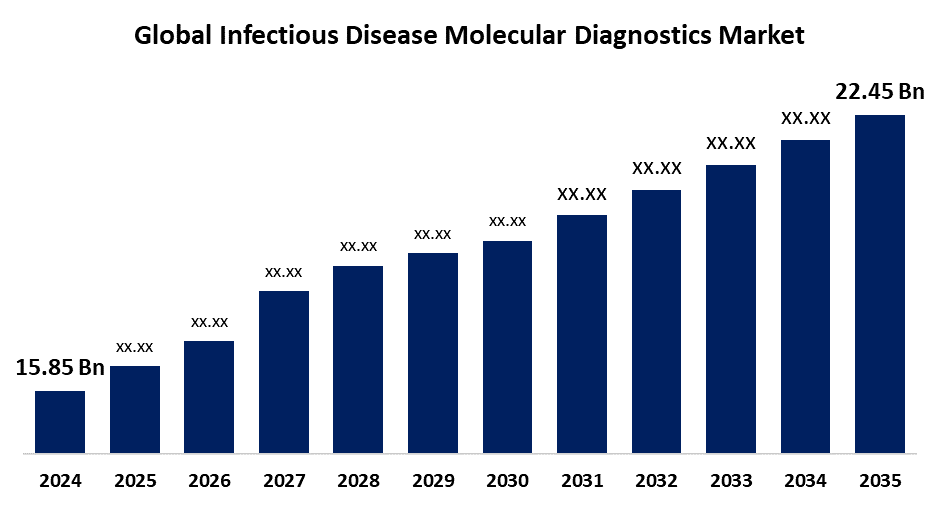

- The Global Infectious Disease Molecular Diagnostics Market Size Was Estimated at USD 15.85 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.22% from 2025 to 2035

- The Worldwide Infectious Disease Molecular Diagnostics Market Size is Expected to Reach USD 22.45 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Infectious Disease Molecular Diagnostics Market Size was worth around USD 15.85 Billion in 2024 and is predicted to Grow to around USD 22.45 Billion by 2035 with a compound annual growth rate (CAGR) of 3.22% from 2025 to 2035. The growing prevalence of infectious diseases and technological advancements in diagnostic techniques are driving the infectious disease molecular diagnostics market globally.

Market Overview

The infectious disease molecular diagnostics market is an industry emphasizing the use of molecular biology techniques for detecting and identifying infectious agents such as bacteria, viruses, and parasites. Infectious disease molecular diagnostics includes the use of laboratory techniques analysing the genetic material of pathogens to diagnose and characterize infections. Molecular diagnostic technologies are widely adopted due to upsurging efforts towards early diagnosis and treatment. Further, market innovation is bolstered with the support of regulations and funding for research and development. Miniaturized point-of-care (POC) devices are driving the accessibility of diagnostics, especially in resource-limited settings, for improving early disease detection and patient outcomes. Cutting-edge techniques, including polymerase chain reaction (PCR), nucleic acid amplification, and next-generation sequencing, significantly improve the pathogen detection with high precision is escalating the market growth opportunities.

Report Coverage

This research report categorizes the infectious disease molecular diagnostics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the infectious disease molecular diagnostics market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the infectious disease molecular diagnostics market.

Global Infectious Disease Molecular Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 15.85 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.22% |

| 2035 Value Projection: | USD 22.45 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 202 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Technology, By Application, By End-use, and By Region |

| Companies covered:: | Abbott, Danaher Corporation, Bio-Rad Laboratories, Inc., bioMerieux SA, F. Hoffmann-La Roche Ltd, Agilent Technologies, Inc., Becton, Dickinson and Company, Hologic, Inc. (Gen-Probe), Illumina, Inc., Grifols S.A., Qiagen, Siemens Healthineers AG, Sysmex Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing aging population is contributing to driving the infectious disease molecular diagnostics market, as older individuals are more susceptible to infections and require frequent diagnostic testing. Advancements in molecular diagnostics for enhancing the accuracy, speed, and accessibility are contributing to propel the market growth. Increasing government initiatives and public health campaigns for controlling the spread of infectious diseases are promoting the market. Further, an increasing advancement in PCR, CRISPR-based diagnostics, and AI-powered analysis is contributing to driving the market growth.

Restraining Factors

An increased cost associated with advanced technologies, uncertain reimbursement policies, and inadequate infrastructure are challenging the market growth. Further, the presence of an ambiguous regulatory framework slows down the market growth for infectious disease molecular diagnostics.

Market Segmentation

The infectious disease molecular diagnostics market share is classified into product, technology, application, and end-use.

- The reagents segment dominated the market in 2024 and is projected to grow at the fastest CAGR during the forecast period.

Based on the product, the infectious disease molecular diagnostics market is divided into instruments, reagents, and services. Among these, the reagents segment dominated the market in 2024 and is projected to grow at the fastest CAGR during the forecast period. It includes enzymes such as DNA polymerase for PCR-based techniques, primers & probes, and nucleic acid extraction & purification reagents. An increased production and commercialization of innovative reagent formulations is contributing to driving the market growth in the reagents segment.

- The PCR segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the infectious disease molecular diagnostics market is divided into mass spectrometry, PCR, in situ hybridization, and others. Among these, the PCR segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. PCR has widespread application for detecting a broad range of infectious diseases, including HIV, hepatitis, and tuberculosis. An increasing application of PCR in research and forensic labs, along with the driving need for advanced diagnostics, is contributing to the market growth in the PCR segment.

- The respiratory diseases segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the infectious disease molecular diagnostics market is divided into respiratory diseases, tuberculosis, meningitis, gastrointestinal tract infections, HPV, and others. Among these, the respiratory diseases segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Molecular diagnostic techniques are introduced in the routine laboratory diagnosis of viral respiratory tract infections. The growing prevalence of respiratory diseases, with increased hospitalization rates for urgent demand for diagnosis, is propelling the market.

- The diagnostics laboratories segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the infectious disease molecular diagnostics market is divided into hospitals, clinics, diagnostics laboratories, and research institutes. Among these, the diagnostics laboratories segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Diagnostic laboratories are equipped with advanced infrastructure and expertise for efficiently handling the high test volumes. An increasing prevalence of chronic diseases, including cancer, diabetes, and cardiovascular conditions driving the need for diagnostic tests, thereby escalating the market growth.

Regional Segment Analysis of the Infectious Disease Molecular Diagnostics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the infectious disease molecular diagnostics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the infectious disease molecular diagnostics market over the predicted timeframe. Technological advancements in diagnostic methodologies and automation are driving the infectious disease molecular diagnostics market growth. Further, the incorporation of AI and machine learning for enhancing the accuracy and reducing turnaround times contributes to bolstering the market growth. An increasing prevalence of communicable and non-communicable disease, with an increasing population of geriatric population, also contributes to propelling the market demand.

Asia Pacific is expected to grow at a rapid CAGR in the infectious disease molecular diagnostics market during the forecast period. Advancements in molecular diagnostics for improving the accuracy and speed of diagnosis are contributing to driving the market growth for infectious disease molecular diagnostics. Further, increasing healthcare expenditure along with an increasing use of PoC diagnostics tests are contributing to propelling the market. The development of novel approaches for detecting SARS-CoV-2 for faster results at a cost-effective price is promoting the market growth.

Europe is anticipated to hold a significant share of the infectious disease molecular diagnostics market during the projected period. The adoption of molecular diagnostic technologies for detecting and identifying infectious diseases at the genetic level is driving the infectious disease molecular diagnostics market. In addition, the strong investments in diagnostic infrastructure & technology, as well as emphasis on healthcare system improvement, contribute to promoting the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the infectious disease molecular diagnostics market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

- Abbott

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- bioMerieux SA

- F. Hoffmann-La Roche Ltd

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Hologic, Inc. (Gen-Probe)

- Illumina, Inc.

- Grifols S.A.

- Qiagen

- Siemens Healthineers AG

- Sysmex Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Advanced Biological Laboratories (ABL), a diagnostics company, announced that the licensing and transfer agreement of know-how and IP rights from Fast Track Diagnostics Luxembourg (FTD) had been inked with Siemens Healthineers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the infectious disease molecular diagnostics market based on the below-mentioned segments:

Global Infectious Disease Molecular Diagnostics Market, By Product

- Instruments

- Reagents

- Services

Global Infectious Disease Molecular Diagnostics Market, By Technology

- Mass Spectrometry

- PCR

- In Situ Hybridization

- Others

Global Infectious Disease Molecular Diagnostics Market, By Application

- Respiratory Diseases

- Tuberculosis

- Meningitis

- Gastrointestinal Tract Infections

- HPV

- Others

Global Infectious Disease Molecular Diagnostics Market, By End-use

- Hospitals

- Clinics

- Diagnostics Laboratories

- Research Institutes

Global Infectious Disease Molecular Diagnostics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the infectious disease molecular diagnostics market over the forecast period?The global infectious disease molecular diagnostics market is projected to expand at a CAGR of 3.22% during the forecast period.

-

2. What is the market size of the infectious disease molecular diagnostics market?The global infectious disease molecular diagnostics market size is expected to grow from USD 15.85 Billion in 2024 to USD 22.45 Billion by 2035, at a CAGR of 3.22% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the infectious disease molecular diagnostics market?North America is anticipated to hold the largest share of the infectious disease molecular diagnostics market over the predicted timeframe.

Need help to buy this report?