Global Infectious Disease In Vitro Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Product (Instruments, Reagents, and Software), By Technology (Immunoassay, Molecular diagnostics, Microbiology, and Others), By Application (MRSA, Streptococcus, Clostridium difficile, VRE, CRE, Respiratory Virus, Candida, COVID-19, and Others), By Test Location (Point of Care, Central Laboratories, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: HealthcareGlobal Infectious Disease In Vitro Diagnostics Market Insights Forecasts to 2035

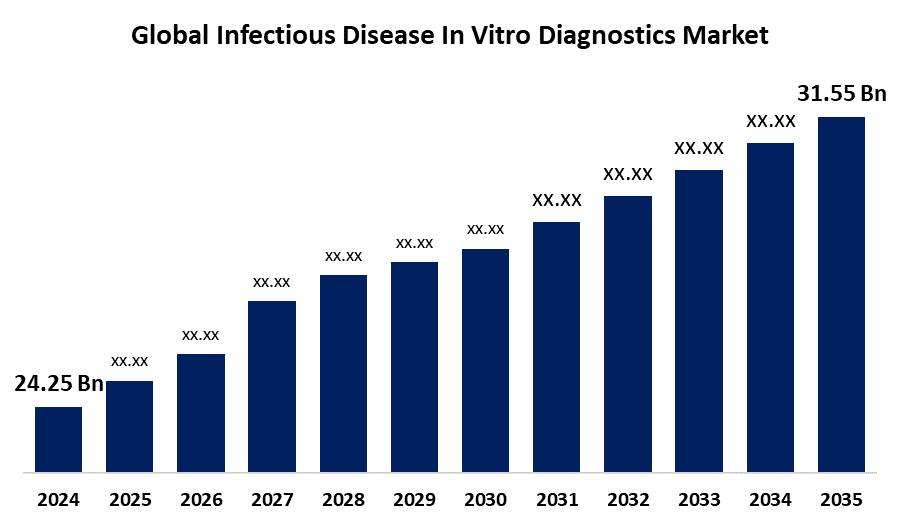

- The Global Infectious Disease In Vitro Diagnostics Market Size Was Estimated at USD 24.25 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.42% from 2025 to 2035

- The Worldwide Infectious Disease In Vitro Diagnostics Market Size is Expected to Reach USD 31.55 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Infectious Disease In Vitro Diagnostics Market Size was worth around USD 24.25 Billion in 2024 and is predicted to Grow to around USD 31.55 Billion by 2035 with a compound annual growth rate (CAGR) of 2.42% from 2025 to 2035. The government's emphasis on improving regulatory reforms and reimbursement is primarily responsible for driving the infectious disease in vitro diagnostics market globally.

Market Overview

The infectious disease in vitro diagnostics market refers to the market encompassing the development, production, and distribution of diagnostic tools used for detecting infectious diseases. In vitro diagnostics (IVDs) tests may be done in laboratories, health care facilities, on the body itself, or on a variety of instruments ranging from small, handheld tests to complex laboratory instruments. There is an increasing geriatric population susceptible to infectious diseases, along with an increasing awareness about early detection and demand for PoC testing in the infectious disease in vitro diagnostics market. Further, the growing frequency of infections caused by fungi, bacteria, viruses, and parasites is driving the demand for diagnostic tests for identifying pathogens swiftly and accurately. Development of diagnostic technologies, along with an integration of AI and ML for enhancing diagnostic accuracy and speed, is escalating the market growth opportunities for infectious disease in vitro diagnostics.

Report Coverage

This research report categorizes the infectious disease in vitro diagnostics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the infectious disease in vitro diagnostics market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the infectious disease in vitro diagnostics market.

Global Infectious Disease In Vitro Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 24.25 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.42% |

| 2035 Value Projection: | USD 31.55 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 202 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Technology, By Application, By Test Location and By Region |

| Companies covered:: | QIAGEN, BD, bioMerieux SA, F. Hoffmann-La Roche, Ltd., Hologic, Inc. (Gen Probe), Abbott, Quidel Corporation, Siemens Healthineers AG, Bio-Rad Laboratories, Inc., Danaher, OraSure Technologies, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The concerns regarding the increased prevalence of infectious diseases are anticipated to drive the market demand for infectious disease in vitro diagnostics. Infectious disease is considered one of the leading causes of morbidity and mortality around the world, accounting for more than 52 million (33%) annual deaths worldwide. Further, the awareness about the early detection diagnostics, as well as the surging need for PoC testing, in the pandemic era, is significantly contributing to driving the market growth. In addition, the shift towards home testing & telemedicine, as well as the developments in molecular diagnostic techniques, are escalating the market growth.

Restraining Factors

An increased price and stringent regulatory frameworks are challenging the infectious disease in vitro diagnostics market. Further, the lack of a skilled workforce is hampering the market growth. In addition, challenges associated with securing reimbursement policies that discourage innovation and decrease the uptake of novel diagnostic tools are restraining the market growth.

Market Segmentation

The infectious disease in vitro diagnostics market share is classified into product, technology, application, and test location.

- The reagents segment dominated the market with the largest revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the infectious disease in vitro diagnostics market is divided into instruments, reagents, and software. Among these, the reagents segment dominated the market with the largest revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Infectious disease in vitro diagnostics are used for performing tests on samples like blood, urine, or tissue for detecting diseases, infections, or other medical conditions, providing accurate and timely information for guiding clinical decision making. An increased adoption of advanced molecular techniques in clinical microbiology labs, along with the growing use of reagents, is propelling the market growth in the reagents segment.

- The immunoassay segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the infectious disease in vitro diagnostics market is divided into immunoassay, molecular diagnostics, microbiology, and others. Among these, the immunoassay segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. It includes enzyme-linked immunosorbent assays (ELISA), radioimmunoassays (RIA), chemiluminescent immunoassays (CLIA), and lateral flow assays (LFA), sharing a common goal for detecting infectious agents accurately. An increasing emphasis on the development and commercialization of immunoassays for infectious diseases and rapid tests is boosting the market growth.

- The COVID-19 segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the infectious disease in vitro diagnostics market is divided into MRSA, streptococcus, clostridium difficile, VRE, CRE, respiratory virus, candida, COVID-19, and others. Among these, the COVID-19 segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. It includes the use of RT-PCR (reverse transcriptase polymerase chain reaction). An increasing adoption of SARS-CoV-2 testing, with upsurging government initiatives for enhancing public testing, is propelling the market in the COVID-19 segment.

- The central laboratories segment dominated the market with a major share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the test location, the infectious disease in vitro diagnostics market is divided into point of care, central laboratories, and others. Among these, the central laboratories segment dominated the market with a major share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Laboratory-based tests are more reliable due to their higher accuracy. The increasing adoption of outsourcing laboratory services by pharmaceutical and biotechnology companies to reduce the cost of research activities is enhancing the market growth in the central laboratories segment.

Regional Segment Analysis of the Infectious Disease In Vitro Diagnostics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the infectious disease in vitro diagnostics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the infectious disease in vitro diagnostics market over the predicted timeframe. The growing incidence of target diseases and the introduction of cutting-edge technologies, providing novel ways for detecting these infectious diseases, are driving the market for infectious disease in vitro diagnostics. In addition, the presence of robust infrastructure and key market players in the region is responsible for propelling the regional market for infectious disease in vitro diagnostics.

Asia Pacific is expected to grow at a rapid CAGR in the infectious disease in vitro diagnostics market during the forecast period. The increasing prevalence of infectious diseases, along with a rising need for point-of-care (PoC) and rapid diagnostics, is anticipated to drive the market demand. Further, the region’s rapid economic development and presence of emerging market players are driving the adoption of novel tests for diagnostics, thereby enhancing market growth.

Europe is anticipated to hold a significant share of the infectious disease in vitro diagnostics market during the projected timeframe. The emergence of new IVD regulations presenting a more robust and sustainable framework for compliance with IVD devices is contributing to driving the infectious disease in vitro diagnostics market. An increasing geriatric population, driving the need for ongoing monitoring owing to the high risk of both chronic infectious diseases, is responsible for propelling the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the infectious disease in vitro diagnostics market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- QIAGEN

- BD

- bioMerieux SA

- F. Hoffmann-La Roche, Ltd.

- Hologic, Inc. (Gen Probe)

- Abbott

- Quidel Corporation

- Siemens Healthineers AG

- Bio-Rad Laboratories, Inc.

- Danaher

- OraSure Technologies, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, OraSure Technologies, Inc., a leader in point-of-need and home diagnostic tests and sample management solutions, announced the acquisition of Sherlock Biosciences, Inc., a global health company bringing next-generation diagnostics to consumers and healthcare providers.

- In October 2024, Quest Diagnostics, a leading provider of diagnostic information services, announced that it had been awarded several contracts by the U.S. Centers for Disease Control and Prevention (CDC) to support testing and sustained laboratory readiness.

- In March 2024, SEKSUI Diagnostics, a global medical diagnostics manufacturer, received EUA clearance for the OSOM Flu SARS-CoV-2 Combo test for use in professional and home testing settings.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the infectious disease in vitro diagnostics market based on the below-mentioned segments:

Global Infectious Disease In Vitro Diagnostics Market, By Product

- Instruments

- Reagents

- Software

Global Infectious Disease In Vitro Diagnostics Market, By Technology

- Immunoassay

- Molecular diagnostics

- Microbiology

- Others

Global Infectious Disease In Vitro Diagnostics Market, By Application

- MRSA

- Streptococcus

- Clostridium difficile

- VRE

- CRE

- Respiratory Virus

- Candida

- COVID-19

- Others

Global Infectious Disease In Vitro Diagnostics Market, By Test Location

- Point of Care

- Central Laboratories

- Others

Global Infectious Disease In Vitro Diagnostics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the infectious disease in vitro diagnostics market over the forecast period?The global infectious disease in vitro diagnostics market is projected to expand at a CAGR of 2.42% during the forecast period.

-

2. What is the market size of the infectious disease in vitro diagnostics market?The global infectious disease in vitro diagnostics market size is expected to grow from USD 24.25 Billion in 2024 to USD 31.55 Billion by 2035, at a CAGR of 2.42% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the infectious disease in vitro diagnostics market?North America is anticipated to hold the largest share of the infectious disease in vitro diagnostics market over the predicted timeframe.

Need help to buy this report?