Global Inertial Navigation System Market Size By Component (Accelerometers, Gyroscopes, and Others), By Technology (Mechanical Gyro, Ring Laser Gyro, Fiber Optics Gyro, MEMS, and Others), By Platform (Airborne, Ground, Maritime, and Space), By End-User (Commercial and Military), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Inertial Navigation System Market Insights Forecasts to 2033

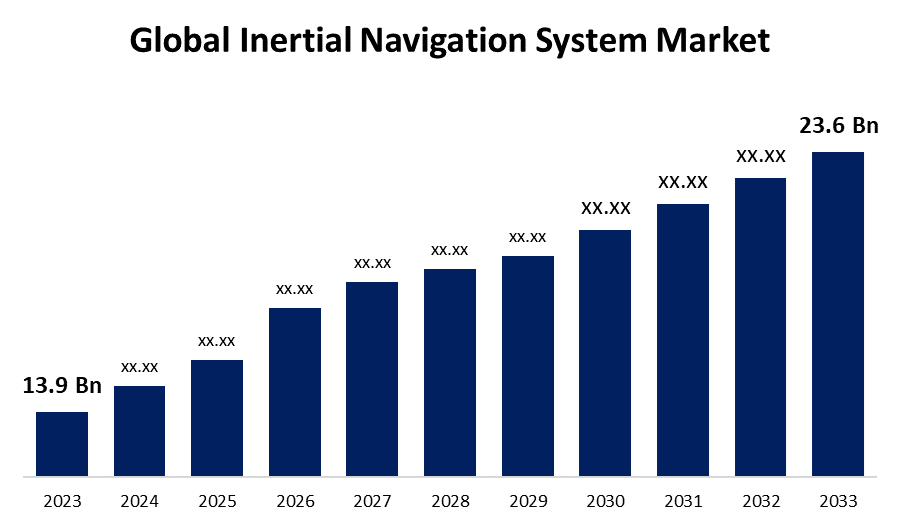

- The Inertial Navigation System Market Size was valued at USD 13.9 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.44% from 2023 to 2033

- The Worldwide Inertial Navigation System Market Size is expected to reach USD 23.6 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Inertial Navigation System Market Size is expected to reach USD 23.6 Billion by 2033, at a CAGR of 5.44% during the forecast period 2023 to 2033.

The INS industry has been expanding mostly due to military applications. For navigation and targeting, military aircraft, ships, armoured cars, and missiles all use INS. The demand for cutting edge INS technology has been fueled by the upgrading of defence systems and rising defence budgets of several nations worldwide. For both human and unmanned aerial aircraft, reliable navigation data is essential in the aviation industry, and this is where INS comes in. The need for INS has increased as unmanned aerial vehicles (UAVs) are being used more often for military, commercial, and civilian purposes. Marine vessels make heavy use of INS for location, navigation, and stabilisation.

Inertial Navigation System Market Value Chain Analysis

The necessary hardware and software components needed to construct inertial navigation systems are supplied by component providers. Gyroscopes, accelerometers, magnetometers, GPS receivers, microprocessors, and other electrical parts are some of these parts. The process of manufacturing entails putting together full INS systems from the parts provided by different manufacturers. Manufacturers of INS systems may run specialised production facilities where this operation is carried out. In order to provide inertial navigation systems to end users in a variety of industries, such as the military, aerospace, marine, automotive, and industrial sectors, distributors are essential. As a part of larger systems or platforms, including aeroplanes, ships, vehicles, and drones, inertial navigation systems frequently need to be linked with other navigation, communication, and control systems. For navigation, positioning, stabilisation, guidance, and control in a variety of settings and applications—from aeroplanes and ships to unmanned vehicles, robotics, and wearable technology—end users depend on inertial navigation system (INS) technology.

Inertial Navigation System Market Opportunity Analysis

Many nations are making investments to modernise their defence capabilities, which includes improving ground vehicles, naval vessels, and military aircraft's navigation systems. Manufacturers of INS systems have the opportunity to take part in defence contracts and offer sophisticated navigation systems that satisfy military standards for precision, dependability, and durability. Significant prospects exist for inertial navigation technology due to the growing usage of robotic systems, autonomous vehicles, drones, and unmanned aerial vehicles (UAVs) in a variety of industries. Unmanned systems requiring accurate navigation and control, like delivery drones, aerial surveys, agricultural drones, and surveillance missions, depend on INS systems. For ship, offshore vessel, and underwater vehicle navigation, location, and stabilisation, the maritime industry uses inertial navigation systems.

Global Inertial Navigation System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 13.9 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.44% |

| 2033 Value Projection: | USD 23.6 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component , By Technology, By Platform, By End-User, By Region |

| Companies covered:: | Honeywell International Inc., Northrop Grumman Corporation, Collins Aerospace, Raytheon Technologies Corporation, Safran Electronics & Defense, Thales Group, Trimble Inc, iXblue SAS, VectorNav Technologies, LLC, and Inertial Sense LLC |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Inertial Navigation System Market Dynamics

Increasing demand of aircraft

Growing worldwide tourism, rising disposable incomes, and growing demand for air travel are all contributing to the steady rise of the commercial aviation industry. In order to fulfil passenger demand, airlines must grow their fleets and buy new aircraft, which necessitates the use of sophisticated navigation systems like INS to guarantee safe and effective operations. For commercial aircraft, INS offers essential navigation data that helps with route planning, precise landings, and collision avoidance. The need to improve national security, modernization initiatives, and geopolitical tensions are the main drivers of the continued increase in defence spending by different countries. In order for military aircraft to function properly in a variety of settings, such as war zones and isolated areas where GPS signals might not be available or dependable, they need advanced navigation systems.

Restraints & Challenges

Market penetration may be hampered by the expensive cost of creating and producing inertial navigation systems, particularly for smaller businesses and emerging economies. Encouraging a wider range of applications and users to employ INS requires cost reduction through manufacturing efficiencies, sensor technology breakthroughs, and economies of scale. Positioning accuracy in inertial navigation systems can be lowered by drift, an inaccuracy that can build up over time. It is still a technical challenge to increase the precision and dependability of INS systems, particularly for extended missions in highly dynamic environments. Techniques for error compensation and calibration are always being developed to lessen these problems. Particularly in multi-sensor fusion architectures, integrating inertial navigation systems with additional sensors, navigational aids, and control systems can be challenging.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Inertial Navigation System Market from 2023 to 2033. For military, commercial, and civilian uses, the North American region leads the world market for unmanned aerial vehicles (UAVs), drones, and robotic systems. In order to enable UAV missions including surveillance, reconnaissance, agricultural, and infrastructure inspection, INS is essential to autonomous navigation and control of UAVs. Leading airlines operate sizable fleets of aircraft in North America, which is a significant market for commercial aviation. For commercial aircraft to provide safe and effective navigation, particularly on long-haul flights, over remote areas, and in inclement weather, INS technology is vital.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, South Korea, Australia, and other nations in the Asia-Pacific area are among those whose defence budgets are being sharply increased in order to improve military capabilities and tackle security issues. The need for sophisticated navigation systems like INS for military aircraft, naval vessels, ground vehicles, and missile systems is fueled by defence modernization initiatives. The Asia Pacific region is experiencing rapid growth in the commercial aviation industry due to factors such as increased passenger demand, larger airline fleets, and improved accessibility for air travel. Commercial aeroplanes must be able to navigate safely and effectively, which is made possible by the use of INS technology, particularly in areas with inadequate ground-based navigation infrastructure and heavily congested airspace.

Segmentation Analysis

Insights by Component

The gyroscope segment accounted for the largest market share over the forecast period 2023 to 2033. Advanced gyroscope technology is becoming more and more necessary as sectors including robotics, aerospace, defence, marine, and automobile seek navigation systems with increased accuracy and dependability. Gyroscopes play a crucial role in giving accurate and consistent orientation data, particularly in scenarios where GPS signals are not always available or dependable. The need for sophisticated gyroscopes is fueled by the growth of autonomous systems, such as robots, drones, autonomous cars, and unmanned aerial vehicles (UAVs). Gyroscopes are essential to these systems' abilities to maintain stability, regulate direction, and navigate precisely without the need for human assistance. Global defence modernization initiatives drive the need for high-performance gyroscopes for military use. Gyroscopes provide navigation, targeting, and guidance functions and are essential parts of navigation systems for military aircraft, ships, armoured vehicles, missiles, and guided bombs.

Insights by Technology

The MEMS segment accounted for the largest market share over the forecast period 2023 to 2033. Compared to conventional mechanical or fiber-optic gyroscopes, MEMS-based accelerometers and gyroscopes have advantages in terms of miniaturisation, low power consumption, and lightweight design. Because of this, MEMS sensors are very well suited for uses like wearables, portable electronics, and unmanned aerial vehicles (UAVs) where weight, space, and power limitations are crucial factors. The need for MEMS-based navigation solutions is driven by the growth of wearable technologies, Internet of Things (IoT) devices, and autonomous systems. The market for MEMS-based INS systems is growing because MEMS sensors allow precise motion tracking, gesture recognition, indoor navigation, augmented reality, and virtual reality applications. The automotive sector is progressively using MEMS-based sensors into navigation systems, driverless cars, and advanced driver assistance systems (ADAS).

Insights by Platform

The airborne segment accounted for the largest market share over the forecast period 2023 to 2033. Global demand for air travel, rising disposable incomes, and expanding airline fleets are driving the steady rise of the commercial aviation sector. Because they offer precise location, attitude, and velocity information necessary for safe and effective flight operations, airborne inertial navigation systems are crucial for commercial aircraft navigation. The need for cutting-edge airborne INS solutions is rising in tandem with airlines' acquisition of new aircraft and fleet modernization initiatives. Worldwide defence organisations are spending money to update their fleets of fighter jets, transport aircraft, and reconnaissance platforms. Military aircraft rely heavily on airborne inertial navigation systems (INS) for mission execution, weapon delivery, targeting, and navigation in a variety of operational settings. High-performance aerial in-flight navigation systems are becoming more and more in demand as defence budgets keep rising.

Insights by End User

The military segment accounted for the largest market share over the forecast period 2023 to 2033. Many nations are investing in modernising their armed forces due to advances in technology, shifting security concerns, and geopolitical conflicts. Military agencies purchase advanced navigation systems, such as the Inertial Navigation System (INS), as part of defence modernization initiatives to improve the navigation, targeting, and mission capabilities of military assets, including ships, aircraft, ground vehicles, and missiles. Numerous countries' defence budgets have been rising over time, funding the purchase of cutting-edge defence equipment including navigation systems. Modern INS technologies satisfy the demanding needs of modern military operations with their better accuracy, dependability, and performance thanks to increased defence spending that enables military agencies to invest in them.

Recent Market Developments

- In May 2023, the aerospace division of Honeywell International Inc. was given a contract by the U.S. Navy to supply ring laser gyros for the AN7/WSN inertial navigation system.

Competitive Landscape

Major players in the market

- Honeywell International Inc.

- Northrop Grumman Corporation

- Collins Aerospace

- Raytheon Technologies Corporation

- Safran Electronics & Defense

- Thales Group

- Trimble Inc

- iXblue SAS

- VectorNav Technologies, LLC

- Inertial Sense LLC

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Inertial Navigation System Market, Component Analysis

- Accelerometers

- Gyroscopes

- Others

Inertial Navigation System Market, Technology Analysis

- Mechanical Gyro

- Ring Laser Gyro

- Fiber Optics Gyro

- MEMS

- Others

Inertial Navigation System Market, Platform Analysis

- Airborne

- Ground

- Maritime

- Space

Inertial Navigation System Market, End User Analysis

- Commercial

- Military

Inertial Navigation System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Inertial Navigation System Market?The global Inertial Navigation System Market is expected to grow from USD 13.9 billion in 2023 to USD 23.6 billion by 2033, at a CAGR of 5.44% during the forecast period 2023-2033.

-

2. Who are the key market players of the Inertial Navigation System Market?Some of the key market players of the market are Honeywell International Inc., Northrop Grumman Corporation, Collins Aerospace, Raytheon Technologies Corporation, Safran Electronics & Defense, Thales Group, Trimble Inc, iXblue SAS, VectorNav Technologies, LLC, Inertial Sense LLC.

-

3. Which segment holds the largest market share?The military segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Inertial Navigation System Market?North America is dominating the Inertial Navigation System Market with the highest market share.

Need help to buy this report?