Global Industrial Wet Scrubber System Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Venturi Scrubbers, Packed Bed Scrubbers, Spray Tower Scrubbers, and Others), By Pollutant Type (Particulate Matter, Acid Gases (SO₂, NOₓ), VOCs, Odor Control, Heavy Metals, and Others), By Application (Chemical Processing, Power Generation, Oil & Gas, Food & Beverage, Pharmaceuticals, Metals & Mining, and Others), By Sales Channel (OEM and Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Advanced MaterialsGlobal Industrial Wet Scrubber System Market Size Insights Forecasts to 2035

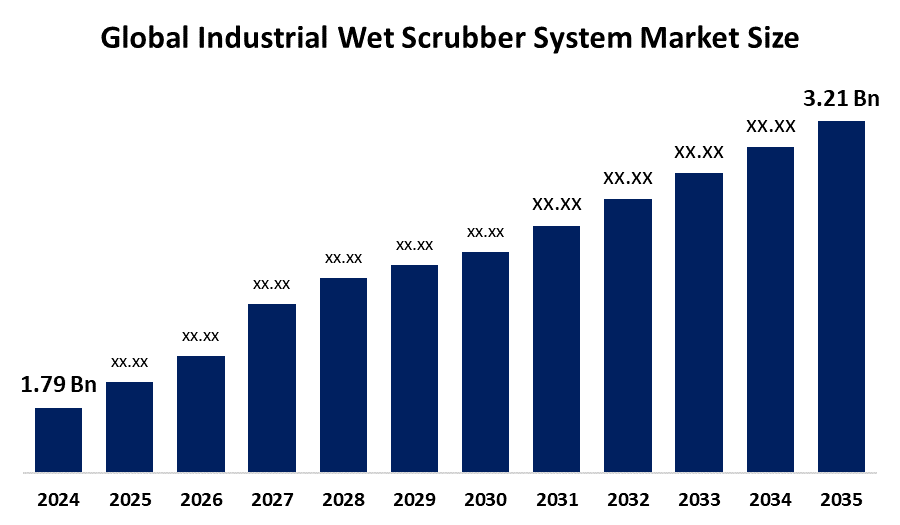

- The Global Industrial Wet Scrubber System Market Size Was Estimated at USD 1.79 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.45% from 2025 to 2035

- The Worldwide Industrial Wet Scrubber System Market Size is Expected to Reach USD 3.21 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Industrial Wet Scrubber System Market Size was worth around USD 1.79 Billion in 2024 and is predicted to Grow to around USD 3.21 Billion by 2035 with a compound annual growth rate (CAGR) of 5.45% from 2025 to 2035. The industrial wet scrubber system market is expanding with rising environmental regulations, industrial emissions, and demand for effective air pollution control. Industrialization and the need for cleaner production processes fuel greater adoption of wet scrubber technologies globally.

Market Overview

The industrial wet scrubber system market globally refers to the business of manufacturing and distributing wet scrubbers, air pollution control equipment that scrub away dangerous particulates and gases in industrial waste streams using liquid solutions. They find extensive application in industries such as chemical production, power generation, metal refining, pharmaceuticals, and cement production to manage air pollutants as well as meet environmental policies. Wet scrubbers are very efficient in dust, smoke, and toxic gas removal, therefore playing a key role in industrial emissions reduction and air pollution conservation. Growth in the market is being driven by increased government regulations and legislation, as well as stricter environmental regulations that focus on reducing industrial pollution. Growing urbanization and industrialization, especially in the developing world, drive demand for efficient emissions control systems. Technologies such as new scrubber types with higher efficiency, lower operating cost, and integration with digital monitoring systems enhance performance and attract industries' attention.

There are opportunities in growth opportunities for large infrastructure projects, increased investment in clean energy, and increased demand for retrofitting solutions to deliver improved pollution control equipment. The Asia Pacific and Latin America markets are regions with significant growth opportunities due to high industrial growth and evolving environmental policies. Market leaders such as Ducon Technologies, CECO Environmental Corp., FLSmidth, and Babcock & Wilcox lead the market through product innovation, strategic partnerships, and geographic expansion. On 11 December 2024, India's Ministry of Environment, Forests, and Climate Change (MoEFCC) eased environmental clearance by exempting those polluting sectors that are large, such as coal washeries, from obtaining dual clearances. It will reduce compliance problems, speed up establishment for operation, and encourage faster implementation of emission-regulating equipment such as wet scrubbers.

Report Coverage

This research report categorizes the industrial wet scrubber system market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the industrial wet scrubber system market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the industrial wet scrubber system market.

Global Industrial Wet Scrubber System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.79 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.45% |

| 2035 Value Projection: | USD 3.21 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product Type, By Pollutant Type, By Application, By Sales Channel |

| Companies covered:: | CECO Environmental Corp., Ducon Technologies Inc., Evoqua Water Technologies LLC, FLSmidth & Co. A/S, GEA Group AG, Hamon Group, Hitachi Zosen Corporation, Honeywell International Inc., John Wood Group PLC, KCH Services Inc., Mitsubishi Heavy Industries, Ltd., Nederman Holding AB, Parker Hannifin Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The industrial wet scrubber system market is propelled by rising environmental policies to manage air pollution and limit hazardous emissions from industrial operations. Industrialization and urbanization, particularly in developing nations, drive demand for air pollution control technologies. Awareness regarding occupational health and safety and policies by governments spur industries to implement wet scrubber systems. Also, growing uses across industries such as chemical, power generation, metal processing, and pharmaceuticals drive market growth. Advances in technology enhancing scrubber efficiency, and increased investments in green and sustainable industrial solutions, also drive market growth.

Restraining Factors

The market for industrial wet scrubber systems is hindered by the high installation and maintenance costs, which may discourage small and medium-sized businesses. Also limiting adoption is the complicated operation and the requirement of skilled operators. Wastewater disposal issues and access to substitute pollution control technology also constrain market expansion.

Market Segmentation

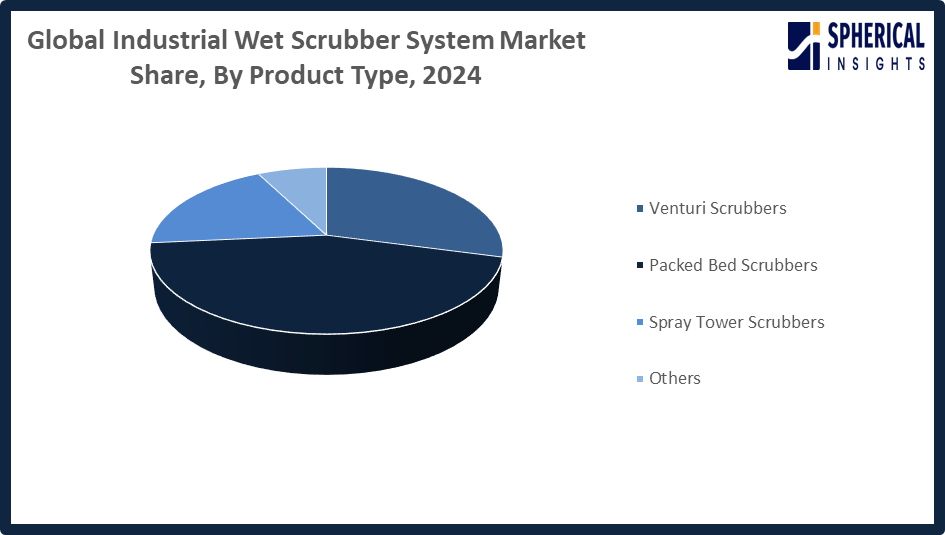

The industrial wet scrubber system market share is classified into product type, pollutant type, application, and sales channel.

- The packed bed scrubbers segment dominated the market in 2024, approximately 44% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the industrial wet scrubber system market is divided into venturi scrubbers, packed bed scrubbers, spray tower scrubbers, and others. Among these, the packed bed scrubbers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Packed bed scrubbers use columns with packing materials that provide optimum gas-to-liquid contact for maximum removal of acid gases and soluble impurities. Widely used in the chemical process industry, they efficiently handle high gas flows. Owing to their high efficiency and reliability, they are a sought-after choice in many industries demanding accurate gas pollutant control.

Get more details on this report -

The acid gases (SO2, NOx) segment accounted for the largest share in 2024, approximately 60% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the pollutant type, the industrial wet scrubber system market is divided into particulate matter, acid gases (SO2, NOx), VOCs, odor control, heavy metals, and others. Among these, the acid gases (SO2, NOx) segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment is growing due to stringent environmental control regulations for sulfur and nitrogen oxide emissions, particularly in power generation and industries. Rising concerns about air pollution control and the use of effective wet scrubber technology also stimulate the growth of the market.

- The power generation segment accounted for the largest share in 2024, approximately 35% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the industrial wet scrubber system market is divided into chemical processing, power generation, oil & gas, food & beverage, pharmaceuticals, metals & mining, and others. Among these, the power generation segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Power generation is a large user of industrial wet scrubber systems, particularly in fossil fuel power plants that have high emissions of particulate matter, sulfur dioxide, and nitrogen oxides. Wet scrubbers control these emissions in a way that they are environmentally and pollution control standards compliant, and minimize environmental footprints. Increased electricity demand, tighter air quality standards, and the focus on reducing greenhouse gas emissions are contributing to the increased use of wet scrubbers in this industry.

- The OEM segment accounted for the highest market revenue in 2024, approximately 40% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the sales channel, the industrial wet scrubber system market is divided into OEM and aftermarket. Among these, the OEM segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The OEM segment is attributed to rising new industrial installations, infrastructure growth, and an increase in demand for sophisticated emission control systems. Moreover, tough environmental laws and increasing pollution control technology investments enhance the demand for OEM wet scrubber systems.

Regional Segment Analysis of the Industrial Wet Scrubber System Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the industrial wet scrubber system market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the industrial wet scrubber system market over the predicted timeframe. Asia Pacific is predicted to hold about 36% of the industrial wet scrubber system market throughout the forecast period due to strong industrialization, urbanization, and strict environmental regulations in major countries such as China, India, Japan, and South Korea. The power generation, chemical processing, and manufacturing industries in the region are growing strongly and thus contribute enormously to increasing demand for efficient emission control systems such as wet scrubbers. Furthermore, government efforts to curb air pollution and investments in sustainable infrastructure also enhance market growth. Increased environmental consciousness and the enforcement of more stringent air quality measures also complement the region's leadership.

North America is expected to grow at a rapid CAGR in the industrial wet scrubber system market during the forecast period. North America is rapidly growing in the industrial wet scrubber system market over the forecast period, with an approximate 25% market share, due to stringent environmental legislation, such as the Clean Air Act and state emissions standards. The United States and Canada, being the largest contributors, are investing heavily in the upgradation of industrial plants, specifically power generation, chemical processing, and marine, to cut emissions. Increasing realization of air pollution's health effects and government incentives for cleaner technology further drive adoption. Moreover, technological developments and a greater focus on sustainable industrial practices underpin strong market growth.

The growth of Europe's industrial wet scrubber system market is fueled by stringent environmental regulations such as the Industrial Emissions Directive (IED) and the EU's Green Deal. Major countries in the region, including Germany, France, and the UK, are committed to minimizing industrial pollution through sophisticated emission management technologies. Rising investments in clean power, green manufacturing, and stringent air quality standards in the chemical, power, and manufacturing industries further drive market growth throughout the region.

On June 27, 2025, Europe’s OSPAR Convention banned the discharge of scrubber wash water from ships to reduce marine pollution. This regulation promotes the use of environmentally friendly closed-loop scrubber systems, which are expected to gain widespread adoption among maritime operators for sustainable shipping practices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the industrial wet scrubber system market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CECO Environmental Corp.

- Ducon Technologies Inc.

- Evoqua Water Technologies LLC

- FLSmidth & Co. A/S

- GEA Group AG

- Hamon Group

- Hitachi Zosen Corporation

- Honeywell International Inc.

- John Wood Group PLC

- KCH Services Inc.

- Mitsubishi Heavy Industries, Ltd.

- Nederman Holding AB

- Parker Hannifin Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, Tri Mer Corporation introduced a standard line of packed tower scrubbers designed to manage fumes from bulk storage tank vents and filling operations. The new product line maximizes surface contact between scrubbing liquid and gas, enhancing efficiency while reducing required packing depth.

- In March 2023, Babcock and Wilcox launched a new dry scrubber system for power plants, designed to remove 99% of sulfur dioxide from flue gas, enhancing emission control efficiency.

- In January 2023, Babcock & Wilcox Enterprises acquired Hamon Research Cottrell (HRC), expanding its emission control solutions portfolio. This acquisition enabled the company to offer advanced air quality control systems, including wet and dry electrostatic precipitators, spray dryer absorbers, and wet flue gas desulfurization systems for oil and gas refineries.

- In May 2021, CECO Environmental secured a USD 3.5 million contract to supply over a dozen HEE-Duall Scrubber and Exhaust Systems for a global semiconductor manufacturer. The systems remove 98% of acidic and gaseous emissions, reflecting rising demand for pollution control technologies and stricter environmental compliance in the semiconductor industry.

- In September 2020, Mitsubishi Shipbuilding, part of MHI Group, announced the successful installation of DIA SOx marine SOx scrubbers on 22 ships across three types. Despite COVID-19 challenges, installations were completed on schedule through remote commissioning with local engineers in China and Singapore.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the industrial wet scrubber system market based on the belowvmentioned segments:

Global Industrial Wet Scrubber System Market, By Product Type

- Venturi Scrubbers

- Packed Bed Scrubbers

- Spray Tower Scrubbers

- Others

Global Industrial Wet Scrubber System Market, By Pollutant Type

- Particulate Matter

- Acid Gases (SO2, NOx)

- VOCs

- Odor Control

- Heavy Metals

- Others

Global Industrial Wet Scrubber System Market, By Application

- Chemical Processing

- Power Generation

- Oil & Gas

- Food & Beverage

- Pharmaceuticals

- Metals & Mining

- Others

Global Industrial Wet Scrubber System Market, By Sales Channel

- OEM

- Aftermarket

Global Industrial Wet Scrubber System Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the industrial wet scrubber system market over the forecast period?The global industrial wet scrubber system market is projected to expand at a CAGR of 5.45% during the forecast period.

-

2. What is the market size of the industrial wet scrubber system market?The global industrial wet scrubber system market size is expected to grow from USD 1.79 billion in 2024 to USD 3.21 billion by 2035, at a CAGR of 5.45% during the forecast period 2025-2035.

-

3. What is the industrial wet scrubber system market?The industrial wet scrubber system market is a global sector focused on the manufacturing and sale of equipment that removes pollutants from industrial exhaust streams using liquid-based scrubbing processes.

-

4. Which region holds the largest share of the industrial wet scrubber system market?Asia Pacific is anticipated to hold the largest share of the industrial wet scrubber system market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global industrial wet scrubber system market?The major players operating in the industrial wet scrubber system market are CECO Environmental Corp., Ducon Technologies Inc., Evoqua Water Technologies LLC, FLSmidth & Co. A/S, GEA Group AG, Hamon Group, Hitachi Zosen Corporation, Honeywell International Inc., John Wood Group PLC, KCH Services Inc., Mitsubishi Heavy Industries, Ltd., Nederman Holding AB, Parker Hannifin Corporation, and Others.

-

6. What factors are driving the growth of the industrial wet scrubber system market?The growth of the industrial wet scrubber system market is driven by stricter environmental regulations, increasing industrial expansion (especially in power generation and manufacturing), and technological advancements.

-

7. What are the market trends in the industrial wet scrubber system market?Market trends in industrial wet scrubber systems include stricter environmental regulations driving demand, integration of advanced technologies such as IoT and AI, a focus on sustainability and energy efficiency, and the development of hybrid systems.

-

8. What are the main challenges restricting the wider adoption of the industrial wet scrubber system market?The main challenges restricting wider adoption of industrial wet scrubber systems are high costs, water and waste management issues, technical complexities, and competition from alternative technologies.

Need help to buy this report?