Global Industrial Vehicles Market Size, Share, and COVID-19 Impact Analysis, By Type (Forklifts, Aisle Trucks, Tow Tractors, Container Handlers), By Drive Type (Internal Combustion Engine (ICE), Battery-Operated, Gas-Powered, Others), By Application (Industrial, Cargo, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Industry: Automotive & TransportationGlobal Industrial Vehicles Market Insights Forecasts to 2033

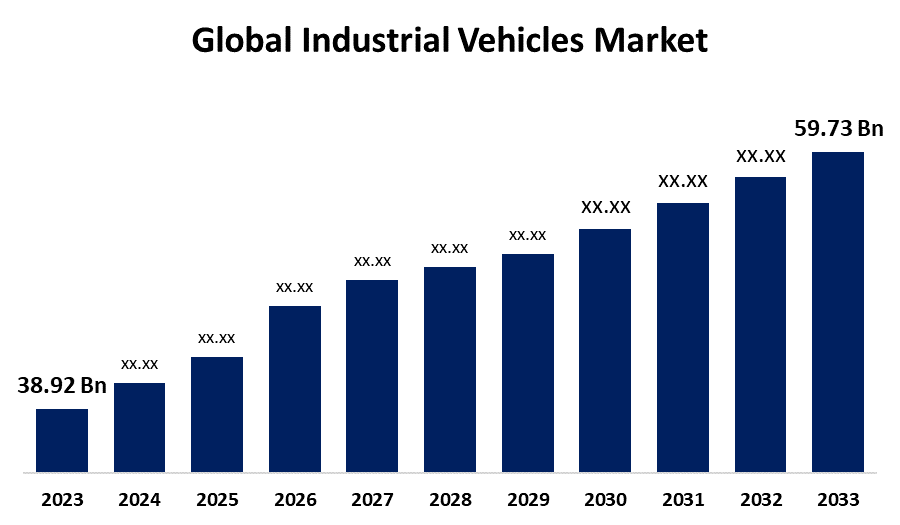

- The Global Industrial Vehicles Market Size was Valued at USD 38.92 Billion in 2023

- The Market Size is Growing at a CAGR of 4.38% from 2023 to 2033

- The Worldwide Industrial Vehicles Market Size is Expected to Reach USD 59.73 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Industrial Vehicles Market Size is Anticipated to Exceed USD 59.73 Billion by 2033, Growing at a CAGR of 4.38% from 2023 to 2033.

Market Overview

Industrial vehicles are used to move raw materials, completed items, and production materials across the industrial sector. These industrial vehicles come in a variety of sizes to transport different types of commodities and materials. Battery-powered industrial vehicles are rapidly being preferred over internal combustion engine-driven and gas-powered industrial vehicles due to their low cost, compact size, environmental friendliness, dependability, and efficiency. Furthermore, these vehicles are equipped with a variety of attachments, such as platforms and grippers, that enable the handling of products and save on operating expenses. The industrial vehicles market's revenue growth is anticipated to be boosted during the projected period by end-use industries' growing focus on battery-operated vehicles. For example, the demand for battery-powered industrial vehicles like forklifts and aisle trucks has surged due to their improved performance and productivity levels. Furthermore, electric lift trucks offer superior emission management and are often more cost-effective than internal combustion engine industrial vehicles. End users businesses often prefer electric industrial vehicles since they fulfill Tier 4 emission standards and produce zero in-plant emissions.

Report Coverage

This research report categorizes the market for the global industrial vehicles market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global industrial vehicles market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global industrial vehicles market.

Global Industrial Vehicles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 38.92 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.38% |

| 2033 Value Projection: | USD 59.73 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Drive Type, By Application, By Region |

| Companies covered:: | Cargotec Corporation, CLARK, Crown Equipment Corporation, Doosan Industrial Vehicle, Anhui Heli Co., Ltd., KION GROUP AG, Komatsu Ltd., Konecranes, Linde Material Handling, Manitou.com, MITSUBISHI LOGISNEXT CO., LTD, Motrec International Inc., Raymond Corporation, Sany Group, TOYOTA INDUSTRIES CORPORATION, Hangcha Forklift, Hyster-Yale Materials Handling, Inc., Hyundai Construction Equipment Co., Ltd., Jungheinrich AG, and Others Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increased worldwide rivalry needs the integration of smart production systems with flexible logistical solutions. This generates the need for improved autonomous indoor transit vehicles. As a result, several automotive manufacturers have adopted autonomous vehicles because of their high efficiency, productivity, adaptability, and other benefits. For instance, in November 2020, Toyota Material Handling, a subsidiary of Toyota Industries Corporation, introduced the Toyota High-Capacity Core IC Pneumatic forklift in five different models with capacities ranging from 22,000 to 30,000 pounds. These forklifts are ideal for lumber, steel, and automotive customers, but they are also designed to perform all heavy-duty tasks that require significant strength. Such innovations are expected to propel market growth over the predicted period.

Restraining Factors

The absence of R&D facilities, as well as severe rules, limit the expansion of the industrial vehicle market. Industrial vehicles necessitate a lot of R&D and inventiveness. OEMs must make major R&D efforts to improve industrial vehicles' ability to lift high loads and increase productivity to speed up recovery. To prevent forklifts from tipping over, sliding sideways, or spilling their load, a leading R&D facility is essential. Industrial vehicles require a lot of upkeep to perform properly. As a result, industrial vehicle owners are required to conduct periodic inspections and preventative maintenance. A qualified maintenance professional should execute this task to keep industrial vehicles operating safely.

Market Segmentation

The global industrial vehicles market share is classified into type, drive type, and application.

- The forklifts segment is expected to hold the largest share of the global industrial vehicles market during the forecast period.

Based on the type, the global industrial vehicles market is categorized into forklifts, aisle trucks, tow tractors, container handlers. Among these, the forklifts segment is expected to hold the largest share of the global industrial vehicles market during the forecast period. The rapidly growing e-commerce business necessitates the establishment of several warehouses, as well as the necessity to effectively manage the warehouse supply chain. In addition, warehouse owners are concentrating on improving transparency, lowering operational expenses, and enhancing efficiency in warehouses and offices. These considerations will drive up demand for forklifts with high operational precision and effective navigation in confined aisles, floors, and mezzanines. The rising demand for electric forklifts among recycling plant operators and chemical industries is likely to drive the forklift sector forward.

- The battery-operated segment is expected to grow at the fastest CAGR during the forecast period.

Based on the drive type, the global industrial vehicles market is categorized into internal combustion engine (Ice), battery-operated, gas-powered, and others. Among these, the battery-operated segment is expected to grow at the fastest CAGR during the forecast period. Concerns about climate change's adverse effects and rising carbon emissions in major cities have increased demand for electric automobiles. The development of a new market for industrial electric cars is projected to boost demand in the battery-operated segment. Lithium-ion batteries have various advantages, including battery acid control, that make them suited for data centers. Furthermore, various government measures promote market expansion. For instance, the Indian government plans to convert all two- and three-wheelers to electric cars by 2030.

- The industrial segment is expected to hold a significant share of the global industrial vehicles market during the forecast period.

Based on the application, the global industrial vehicles market is categorized into industrial, cargo, and others. Among these, the industrial segment is expected to hold a significant share of the global industrial vehicles market during the forecast period. The increased usage of transportation in industries such as vehicles, chemicals, food and drinks, and healthcare. These vehicles are used in the industries mentioned above to transport inventory from the production line to storage. The benefits of these vehicles, such as reduced downtime, cost savings, fewer ground accidents, and increased efficiency, have prompted businesses to invest in these innovative products, resulting in increased industrial vehicle market demand by the end of 2032.

Regional Segment Analysis of the Global Industrial Vehicles Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global industrial vehicles market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global industrial vehicles market over the forecast period. China, Japan, India, South Korea, and the Rest of Asia Pacific are the five regions that make up Asia Pacific. This region is the major producer of industrial vehicles such as forklifts, aisle trucks, tow tractors, and so on, as well as home to some of the world's fastest-growing economies, including China and India. Manufacturers and suppliers in China are increasing their expenditures in automation technology to help them perform effective operations. China's major sectors, such as automotive, manufacturing, and aerospace, are likely to contribute to the development of industrial vehicles. Furthermore, cutting-edge industrial infrastructure is luring a large number of new players into China's industrial vehicle industry. Japan is known for its automation. Daifuku is a major player in warehouse automation in Japan.

Europe is expected to grow at the fastest CAGR growth of the global industrial vehicles market during the forecast period. Europe is seeing a surge in the use of industrial electric vehicles as a result of rising manufacturing demand. The requirement for efficient and automated manufacturing, warehousing, and logistics processes has increased demand for industrial electric vehicles like AGV and AMR, which streamline operations, boost productivity, and save costs. Sustainability also influences the adoption of AGV and AMR in Europe. Automated systems can help businesses achieve their sustainability goals by lowering waste, energy consumption, and carbon emissions, resulting in more sustainable and environmentally friendly operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global industrial vehicles market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargotec Corporation

- CLARK

- Crown Equipment Corporation

- Doosan Industrial Vehicle

- Anhui Heli Co., Ltd.

- KION GROUP AG

- Komatsu Ltd.

- Konecranes

- Linde Material Handling

- Manitou.com

- MITSUBISHI LOGISNEXT CO., LTD

- Motrec International Inc.

- Raymond Corporation

- Sany Group

- TOYOTA INDUSTRIES CORPORATION

- Hangcha Forklift

- Hyster-Yale Materials Handling, Inc.

- Hyundai Construction Equipment Co., Ltd.

- Jungheinrich AG

- Others

Key Market Developments

- In May 2022, Tata Motors introduced e-transport freight solutions with the Ace EV, a new electric commercial vehicle with a commitment to attaining zero carbon footprint emissions. Tata Motors also announced the signing of a strategic pact with Amazon, BigBasket, MoEVing, and a few others.

- In June 2022, Mitsubishi Logisnext has unveiled a new Uni-Carriers forklift 80-Volt E-pneumatics truck. The forklifts are outfitted with long-lasting batteries that give optimal performance while reducing the need for frequent battery replacement/change.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global industrial vehicles market based on the below-mentioned segments:

Global Industrial Vehicles Market, By Type

- Forklifts

- Aisle Trucks

- Tow Tractors

- Container Handlers

Global Industrial Vehicles Market, By Drive Type

- Internal Combustion Engine (ICE)

- Battery-Operated

- Gas-Powered

- Others

Global Industrial Vehicles Market, By Application

- Industrial

- Cargo

- Others

Global Industrial Vehicles Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global industrial vehicles market over the forecast period?The global industrial vehicles market size is expected to grow from USD 38.92 billion in 2023 to USD 59.73 billion by 2033, at a CAGR of 4.38% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global industrial vehicles market?Asia Pacific is anticipated to hold the largest share of the global industrial vehicles market over the predicted timeframe.

-

3. Who are the top key players in the industrial vehicles market?Cargotec Corporation, CLARK, Crown Equipment Corporation, Doosan Industrial Vehicle, Anhui Heli Co., Ltd., KION GROUP AG, Komatsu Ltd., Konecranes, Linde Material Handling, Manitou.com, MITSUBISHI LOGISNEXT CO., LTD, Motrec International Inc., Raymond Corporation, Sany Group, TOYOTA INDUSTRIES CORPORATION, Hangcha Forklift, Hyster-Yale Materials Handling, Inc., Hyundai Construction Equipment Co., Ltd., Jungheinrich AG and Others

Need help to buy this report?