Global Industrial Tapes Market Size By Product (Filament Tapes, Aluminum Tapes, Duct Tapes), By Backing Material (Polypropylene, Paper, Polyvinyl Chloride), By End-User (Manufacturing Industry, Automotive Industry, Logistics Industry), By Geographic Scope And Forecast, 2023 - 2032

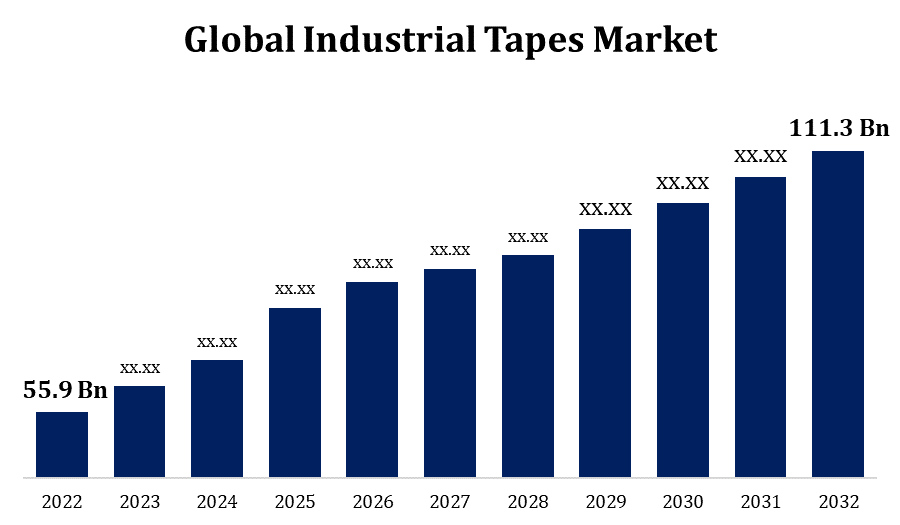

Industry: Construction & ManufacturingGlobal Industrial Tapes Market Size to Grow from USD 55.9 Billion in 2022 to USD 111.3 Billion by 2032, at a CAGR of 6.1% during the forecast period.

Industrial tapes are sticky substances created especially for a range of industrial purposes. These tapes are designed to offer solid adhesion, long-lasting use, and resistance to environmental elements like temperature, moisture, chemicals, and UV rays. They are used for a variety of tasks in the manufacturing, building, automotive, aerospace, and electronics sectors. Insulating tape is used to cover electrical wires and other components. In addition to offering electrical insulation, it also shields against moisture and abrasion. Foam tapes are used in construction, automotive, and electronics industries to fill gaps, reduce vibrations, and offer cushioning or insulation. They also feature a foam-like backing. Due to the rising need for effective and affordable bonding solutions across industries, the industrial tapes market has been expanding steadily over the years. The market is growing as a result of factors like industrialization, urbanisation, and technological improvements. The many end-user sectors are intimately related to the need for industrial tapes. For instance, the construction industry relies on tapes for sealing and insulation while the car industry employs them to bond interior components. Speciality tapes are used by the electronics and aerospace sectors for their specific needs.

Get more details on this report -

Global Industrial Tapes Market Size to Grow from USD 55.9 Billion in 2022 to USD 111.3 Billion by 2032, at a CAGR of 6.1% during the forecast period.

Impact of COVID 19 On Global Industrial Tapes Market

Industrial tape manufacturing and distribution were delayed as a result of the pandemic's disruption of global supply lines. The capacity to produce and supply cassettes as well as the availability of raw materials were impacted by lockdowns, industrial closures, and transportation limitations. Lockdowns and economic uncertainty reduced demand for industrial tapes in some key industrial users, including the automobile and construction sectors. As a result, these industries placed less orders for industrial tapes. For tape makers, managing costs was made more difficult by fluctuations in the price of raw materials, notably petrochemical-based components used in adhesives. The pandemic enhanced people's awareness of cleanliness and hygiene, which led to an increase in the usage of adhesive tapes in cleaning and sanitation-related applications, particularly in the healthcare and food processing industries.

Global Industrial Tapes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 55.9 Billion |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 6.1% |

| 2032 Value Projection: | USD 111.3 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Backing Material, By End-User, By Geographic Scope and COVID 19 Impact |

| Companies covered:: | 3M Company, Avery Dennison Corporation, Tesa SE, Nitto Denko Corporation, Intertape Polymer Group Inc., Shurtape Technologies, LLC, Scapa Group plc, Lintec Corporation, Berry Global, Inc., Saint-Gobain S.A. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Industrial Tapes Market Dynamics

Emergence of e-commerce in developing nations augmenting the growth

Manufacturers and sellers of industrial tape now have access to customers in isolated or underserved regions of developing nations through to e-commerce platforms. This has made a broader variety of industrial tape goods available to businesses and consumers in these areas. E-commerce has made it easier for foreign manufacturers of industrial tape to enter emerging markets. Now, these manufacturers can offer their goods directly to clients in these areas, frequently at affordable costs. Industrial tape purchases are now simpler for enterprises thanks to e-commerce. They no longer need to meet suppliers or distributors in person to place orders, track shipments, or obtain customer assistance. Logistics problems, such as a lack of suitable transportation infrastructure, are common in developing nations. Logistics problems, such as a lack of suitable transportation infrastructure, are common in developing nations. To help customers receive their items quickly, e-commerce platforms may make investments in enhancing last-mile delivery options. Industrial tape teaching materials and tutorials are frequently made available on e-commerce platforms, assisting clients in developing nations in learning more about the items and their uses.

Restraints & Challenges

Fluctuations in raw material prices hampering the market growth

Manufacturers of industrial tape may experience pressure to reduce costs as a result of fluctuations in the price of raw materials, particularly petroleum-based goods like adhesives. Manufacturers may choose to pass on higher costs to consumers or absorb them when raw material costs rise, which could have an impact on product pricing and profitability. The consistency and effectiveness of industrial tapes can be impacted by variations in the quality and availability of raw materials. Raw material inconsistencies could cause to differences in tape performance and quality, which would be unsatisfactory to customers. The competitive environment of the industrial tapes market can be impacted by changes in the cost of raw materials. Businesses who are proficient at controlling the cost of raw materials may benefit from price competition or investments in superior product design and innovation.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Industrial Tapes market from 2023 to 2032. Due to the existence of a strong manufacturing sector, construction activity, and demand from sectors like the automotive and aerospace, it has seen consistent expansion throughout time. Industrial tapes are used in a variety of sectors throughout North America. Packaging, building, manufacture of automobiles, electronics, aerospace, healthcare, and other industries are among these applications. Tapes are used for many different things, including bonding, insulation, and sealing. Trade ties between North America and other regions, including Europe and Asia, have an impact on the import and export of industrial tapes. Tariffs and trade agreements may have an impact on market dynamics.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. Construction work, the region's thriving manufacturing and industrial sectors, and its increasing electronics and automotive sectors all contribute to its expansion. Automotive, electronics, construction, packaging, healthcare, and other industries use industrial tapes throughout the Asia-Pacific region. These tapes are used for insulating, masking, sealing, bonding, and sealing. China and Japan are two of the biggest actors in the car manufacturing industry in the Asia-Pacific area. For purposes including assembly, bonding, noise reduction, and vibration dampening, industrial tapes are widely utilised in the automotive sector. Industrial tapes are used in construction applications including joint sealing, insulation, and bonding as a result of the rapid urbanisation and infrastructure development occurring in nations like China and India.

Segmentation Analysis

Insights by Product

The duct tapes segment accounted for the largest market share over the forecast period 2023 to 2032. In the building and maintenance sectors, duct tape is frequently used for sealing, mending, and holding diverse materials together. The expansion of these industries, fueled by construction and infrastructure projects, adds to the demand for duct tapes. Access to a wide selection of duct tapes has been simpler for customers and businesses thanks to the expansion of e-commerce platforms. Online stores provide a practical way to buy these tapes in a range of sizes and hues. In order to entice customers to learn more about the applications of duct tape, producers and merchants frequently offer educational materials and tutorials. In the medical field, duct tape is employed for things like holding down medical equipment and tubing. The need for specialised, medical-grade duct tapes may change depending on how quickly the healthcare sector expands.

Insights by Backing Material

The Paper segment accounted for the largest market share over the forecast period 2023 to 2032. Paper tapes are frequently employed in the packaging sector to seal cartons and boxes. The market for paper tape is expanding as a result of the expansion of e-commerce and the rising demand for eco-friendly packaging options. Some paper tapes, like painter's tape or masking tape, are made for particular tasks like painting and masking. The need for these tapes may increase as the construction and home improvement sectors expand. The ability to endure high temperatures makes some paper tapes appropriate for industrial, automotive, and electrical applications where heat resistance is needed. Rolls of paper are joined and held together by paper tapes in the printing business. The demand for these tapes may be impacted by the expansion of the printing and publishing industries.

Insights by End User

The Paper segment accounted for the largest market share over the forecast period 2023 to 2032. The market for construction-related tapes is driven by ongoing infrastructure development initiatives, such as those involving roads, bridges, airports, and public buildings. Applications for these tapes include insulation, bonding materials, and sealing joints. Tapes are used during the construction of both residential and commercial structures for a variety of purposes, including insulation, waterproofing, and the sealing of windows, doors, and HVAC (heating, ventilation, and air conditioning) systems. Construction tape demand is rising as the real estate market expands.

Recent Market Developments

- In January 2022, The 3M Company has introduced new double-coated tape that is intended for use in interior car applications.

Competitive Landscape

Major players in the market

- 3M Company

- Avery Dennison Corporation

- Tesa SE

- Nitto Denko Corporation

- Intertape Polymer Group Inc.

- Shurtape Technologies, LLC

- Scapa Group plc

- Lintec Corporation

- Berry Global, Inc.

- Saint-Gobain S.A.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Industrial Tapes Market, Product Analysis

- Filament Tapes

- Aluminum Tapes

- Duct Tape

Industrial Tapes Market, Backing Material Analysis

- Polypropylene

- Paper

- Polyvinyl Chloride

Industrial Tapes Market, End User Analysis

- Manufacturing Industry

- Automotive Industry

- Logistics Industry

Industrial Tapes Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Industrial Tapes Market?The global Industrial Tapes Market is expected to grow from USD 55.9 Billion in 2023 to USD 111.3 Billion by 2032, at a CAGR of 6.1% during the forecast period 2023-2032.

-

1.What is the market size of the Industrial Tapes Market?The global Industrial Tapes Market is expected to grow from USD 55.9 Billion in 2023 to USD 111.3 Billion by 2032, at a CAGR of 6.1% during the forecast period 2023-2032.

-

1.What is the market size of the Industrial Tapes Market?The global Industrial Tapes Market is expected to grow from USD 55.9 Billion in 2023 to USD 111.3 Billion by 2032, at a CAGR of 6.1% during the forecast period 2023-2032.

-

1.What is the market size of the Industrial Tapes Market?The global Industrial Tapes Market is expected to grow from USD 55.9 Billion in 2023 to USD 111.3 Billion by 2032, at a CAGR of 6.1% during the forecast period 2023-2032.

Need help to buy this report?