Global Industrial Robotics Market Size, Share, and COVID-19 Impact Analysis, By Type (Articulated, Traditional Robots, Collaborative Robots, Cartesian, Others), By Payload (Heavy Payload, Light Payload), By Application (Handling, Welding & Soldering ,Assembling & Disassembling, Dispensing, Processing, Cleanrooms, Others) By End-User (Automotive, Electrical & Electronics, Metals & Machinery, Chemicals & Petrochemical, Plastics & Rubbers, Food & Beverages, Precision Engineering & Optics, Oil & Gas, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Electronics, ICT & MediaGlobal Industrial Robotics Market Insights Forecasts to 2032

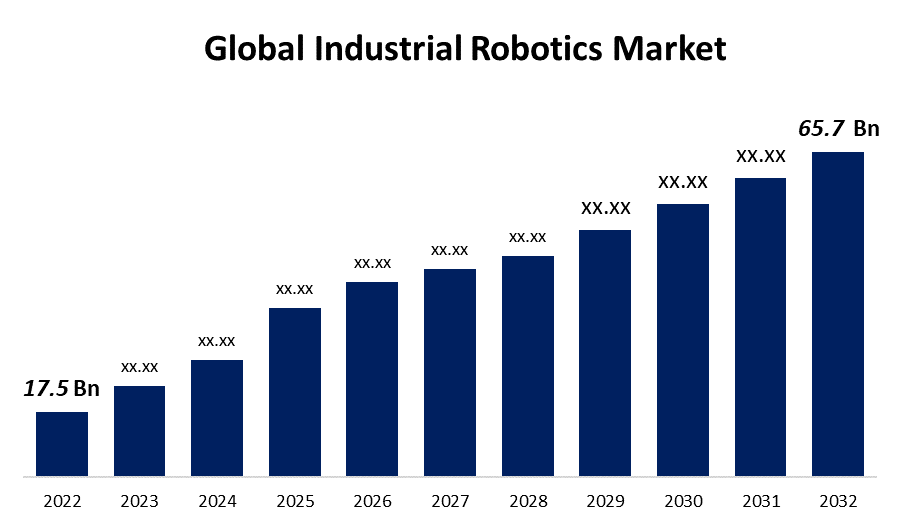

- The Global Industrial Robotics Market Size was valued at USD 17.5 Billion in 2022.

- The Market Size is Growing at a CAGR of 14.1% from 2022 to 2032

- The Worldwide Industrial Robotics Market Size is Expected to reach USD 65.7 Billion by 2032

- North America is Expected To Grow the significantly during the forecast period

Get more details on this report -

The Global Industrial Robotics Market Size is Expected To Reach USD 65.7 Billion by 2032, at a CAGR of 14.1% during the forecast period 2022 to 2032.

An industrial robot is one that has been designed to automate labour-intensive manufacturing tasks such as those required by a constantly moving assembly line. They are placed in fixed positions within an industrial plant as large, heavy robots, and all other worker tasks and processes depend around them. In automation applications, these robots help to increase productivity while lowering costs and producing high-quality goods. The majority of robots are made up of drives, end-effectors, robotic manipulators, sensors, and controls. The robotic controller is the brain of the robot that assists in command delivery. As robot sensors, microphones and cameras are used to keep the robot aware of its surroundings. Rising demand for high-quality products (which require proper end-to-end visibility in the manufacturing process), the need for energy conservation, and a growing emphasis on workplace safety are some of the major factors driving the market. This market is also expected to be driven by incremental technological advancements, as well as a sustained increase in the development of manufacturing facilities. Robots can be used throughout the entire manufacturing cycle, from assembly to palletizing, and advances in end effectors and vision systems are increasing demand for robots.

Global Industrial Robotics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 17.5 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 14.1% |

| 2032 Value Projection: | USD 65.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Payload, By Application, By End-User, By Region, and COVID-19 Impact Analysis. |

| Companies covered:: | Siemens, ABB Group, Schneider Electric, Rockwell Automation, Emerson Electric, Mitsubishi Electric, Fanuc Corporation, Yaskawa Electric Corporation, Bosch Rexroth, Caterpillar Inc., Komatsu Ltd., Atlas Copco, IRS Robotics, Hyundai Robotics, Saisun Robotics, RobotWorx, Rethink Robotics GmbH, Techman Robot Inc., Universal Robots, Kawasaki Heavy Industries, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Industrial robots are in high demand in a wide range of industries, including automotive, pharmaceuticals, consumer electronics, packaging, and equipment. This requirement, however, is based on the type of robot that they need to place throughout their facilities in order to harness industrial activity and cut costs. Additionally, Industry 4.0 has accelerated the development of new technologies such as AI-enabled robots and collaborative robots, which enable industries to use robots to simplify various processes, increase productivity, and reduce errors. These robots improve the accuracy, efficiency, and safety of data collection in remote areas, allowing for real-time monitoring and effective mitigation strategies. Additional R&D is required to address climate change challenges. The increasing adoption of Industry 4.0 in manufacturing across the globe is one of the major drivers driving the growth of robotics in various industries and thus driving the growth of the industrial robotics market during the forecast period.

Restraining Factors

The higher initial investment required for small organizations with little or no relevant expertise. A large capital investment is required for procurement, integration, programming, accessories, and maintenance, among other things. This could restrain market growth. Small and medium-sized businesses find it difficult to park large sums of money (ROI) due to low-volume manufacturing and a poor return on investment.

Market Segmentation

By Type Insights

The articulated segment dominates the market with the largest revenue share over the forecast period.

Based on type, the global industrial robotics market is segmented into articulated, traditional robots, collaborative robots, cartesian, and others. Among these, the articulated segment is dominating the market with the largest revenue share over the forecast period. Articulated robots are extremely adaptable and can perform a wide range of tasks. They are easily reprogrammable and can be programmed to perform complex movements. As a result, they are well-suited for use in a variety of industries, including manufacturing, assembly, and logistics. They are easily reprogrammable to perform complex movements.

By Payload Insights

The heavy payload segment is witnessing significant CAGR growth over the forecast period.

Based on payload, the global paper cup market is segmented into heavy payload and light payload. Among these, the heavy payload segment is witnessing significant CAGR growth over the forecast period. Industrial robots with heavy payload capacities have also been widely used in the pharmaceutical and cosmetics industries for assembling and packaging medical devices and implants, as well as blood sample testing. During the forecast period, the growing demand for machines in the agriculture, packaging, and manufacturing sectors is expected to drive demand for industrial robots with heavy payloads in the metals & machinery industry.

By End-User Insights

The electrical & electronics segment is expected to hold the largest share of the global industrial robotics market during the forecast period.

Based on the end-user, the global industrial robotics market is classified into automotive, electrical & electronics, metals & machinery, chemicals & petrochemical, plastics & rubbers, food & beverages, precision engineering & optics, oil & gas, and others. Among these, the electrical & electronics segment is expected to hold the largest share of the industrial robotics market during the forecast period. The segment driving market due to its ability to perform a variety of tasks with high repeatability, such as dispensing, insertion, labeling, and screw driving. Increased adoption of such industrial robots will be driven by innovations, as well as increased R&D efforts by market players to improve productivity, cost-efficiency, and low manufacturing expenses. The emergence of various technology disruptors, as well as increased market competition, is expected to strengthen the segment outlook over the forecast period.

Regional Insights

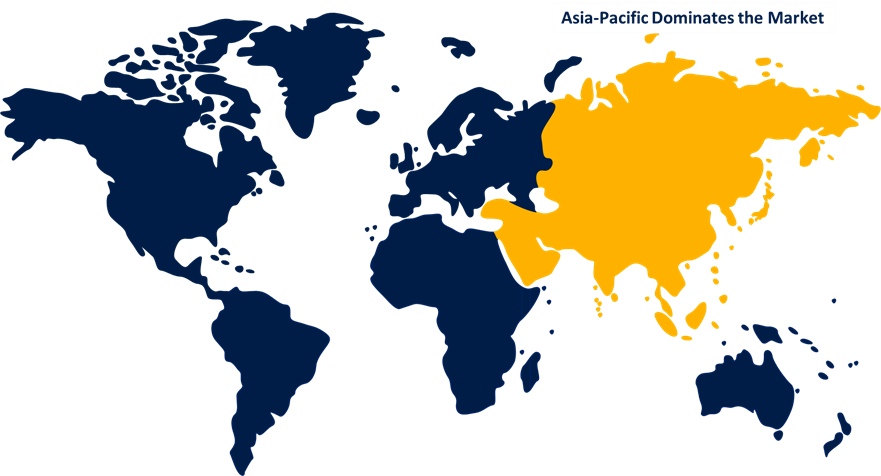

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the largest market share over the forecast period. Rising automation, particularly in Japan, China, and India, is expected to fuel growth in the Asia Pacific region. Furthermore, as the population and disposable income of people rise, so does the demand for consumer goods and other items, resulting in increased production capacity, which contributes to the industry's growth. Similarly, there is an increasing demand for customized machinery and automobiles, which necessitates high precision and rapid capacity for production. To maintain growing demand, the use of robots in industrial applications is increasing, further increasing the global industrial robotics market share during the forecast period.

North America is expected to grow significantly as the global industrial robotics market is fueled by the introduction of smart factories and Industry 4.0, which will result in increased demand for customized and small robotic systems. Furthermore, as the manufacturing process is accelerated and production capacity is increased, manufacturers receive an early return on investment (ROI). The region's government is also encouraging the use of robotics by supporting the development of modern technologies in the robotics market. For example, the US federal government has launched the National Robotics Initiative (NRI) program to improve the capabilities of domestic robot builders and encourage research in the field.

List of Key Market Players

- Siemens

- ABB Group

- Schneider Electric

- Rockwell Automation

- Emerson Electric

- Mitsubishi Electric

- Fanuc Corporation

- Yaskawa Electric Corporation

- Bosch Rexroth

- Caterpillar Inc.

- Komatsu Ltd.

- Atlas Copco

- IRS Robotics

- Hyundai Robotics

- Saisun Robotics

- RobotWorx

- Rethink Robotics GmbH

- Techman Robot Inc.

- Universal Robots

- Kawasaki Heavy Industries

Key Market Developments

- In May 2023, FANUC CORPORATION, At Automate 2023, America debuted two new high-payload capacity collaborative robots. The event highlighted the CRX and CR cobot lines' expanded payload capacities, with variations capable of handling products weighing 4 to 50kg. The CRX-25iA cobot with a 30 kg payload capacity and the CR-35iB cobot with a 50 kg payload capacity were demonstrated, demonstrating their capabilities in handling heavy products. FANUC CORPORATION emphasized the CRX cobots' dependability, flexibility, and maintenance-free operation, as well as the CR-35iB cobot's industry-leading strength and small footprint.

- In May 2023, Yaskawa Electric Corporation Electric Corporation announced a capital and business alliance with Oishii Farm Corporation, a strawberry production start-up based in the United States. By providing Oishii with automation systems based on Yaskawa Electric Corporation's "i3-Mechatronics" solution concept, the partnership aimed to establish Yaskawa Electric Corporation as a global agricultural and food automation leader. They hoped to contribute to a more sustainable society by ensuring a stable food supply and realizing fully automated strawberry production.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global Industrial Robotics market based on the below-mentioned segments:

Industrial Robotics Market, Type Analysis

- Articulated

- Traditional Robots

- Collaborative Robots

- Cartesian

- Others

Industrial Robotics Market, Payload Analysis

- Heavy Payload

- Light Payload

Industrial Robotics Market, Application Analysis

- Handling

- Welding & Soldering

- Assembling & Disassembling

- Dispensing

- Processing

- Cleanrooms

- Others

Industrial Robotics Market, End-User Analysis

- Automotive

- Electrical & Electronics

- Metals & Machinery

- Chemicals & Petrochemical

- Plastics & Rubbers

- Food & Beverages

- Precision Engineering & Optics

- Oil & Gas

- Others

Industrial Robotics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the industrial robotics market over the forecast period?The industrial robotics market is projected to expand at a CAGR of 14.1% during the forecast period.

-

2. What is the projected market size & growth rate of the industrial robotics market?The industrial robotics market was valued at USD 17.5 Billion in 2022 and is projected to reach USD 65.7 Billion by 2032, growing at a CAGR of 14.1% from 2022 to 2032.

-

3. Which region is expected to hold the highest share in the industrial robotics market?The Asia Pacific region is expected to hold the highest share in the industrial robotics market.

Need help to buy this report?