Global Industrial Insulation Market Size By Form (Pipe, Blanket, Board), By Material (Mineral Wool, Calcium Silicate, Plastic foams), By End-Use Industry (Power, Oil & Gas, Cement), By Region, And Segment Forecasts, By Geographic Scope And Forecast 2022 - 2032

Industry: Advanced MaterialsGlobal Industrial Insulation Market Insights Forecasts to 2032

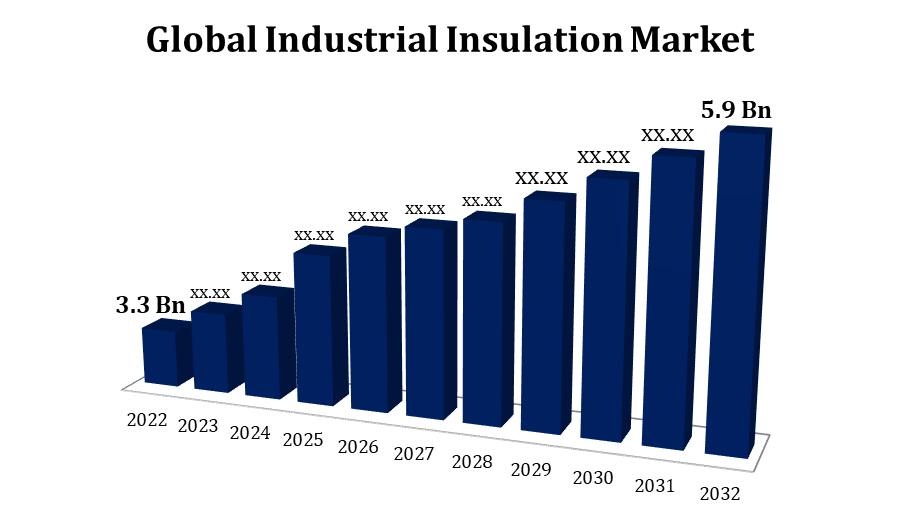

- The Industrial Insulation Market Size was valued at USD 3.3 Billion in 2022.

- The Market Size is Growing at a CAGR of 7.1% from 2022 to 2032

- The Global Industrial Insulation Market is expected to reach USD 5.9 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Industrial Insulation Market Size is expected to reach USD 5.9 Billion by 2032, at a CAGR of 7.1% during the forecast period 2022 to 2032.

In order to minimise heat transmission and preserve energy inside industrial facilities, industrial insulation uses a variety of materials and methods. The principal aim is establishing a thermal barrier that obstructs the transfer of heat, guaranteeing ideal functioning conditions for machinery and procedures. Often utilised due to its flexibility, resistance to corrosion, and thermal stability. Equipment, boilers, and pipes are frequently the subjects of it. Excellent fire resistance and thermal insulation; made from natural or synthetic materials. High-temperature applications make use of it. a strong insulating material that is rigid and resistant to fire, heat, and moisture. In harsh industrial environments, it is frequently utilised. By keeping fluids and air at a consistent temperature, insulation for pipes and ducts helps minimise energy loss during transportation.

Industrial Insulation Market Value Chain Analysis

Foamed polymers, cellular glass, fibreglass, and mineral wool are examples of raw materials used in industrial insulation. In the value chain, suppliers of these materials are essential. Manufacturers use techniques like melting, spinning (for fibreglass), or shaping (for mineral wool) to turn raw materials into insulating materials. From production sites to distribution hubs and ultimately to end users, insulation materials are transported. Timely delivery and preservation of product quality are contingent upon effective logistics management. Distributors and wholesalers serve as middlemen, delivering insulating products to contractors, stores, and other final consumers. To avoid damage and guarantee product integrity, insulating materials must be handled and stored properly. Due to their ability to install industrial insulation projects, contractors and installers are essential links in the value chain.

Industrial Insulation Market Opportunity Analysis

There is a big chance for industrial insulation because energy efficiency is becoming more and more important. Efficient insulation solutions are becoming increasingly appealing as governments and industry worldwide are investing in projects aimed at reducing energy usage. Sustainable and environmentally friendly insulating materials are in greater demand. Manufacturers that create and market insulation solutions with low environmental impact might profit from this trend. Innovation can be facilitated by incorporating smart technologies into insulation systems to provide real-time monitoring and control. End users can receive additional value from smart insulation by receiving data on thermal performance, possible problems, and energy efficiency. Industrial insulation has unrealized potential due to the construction and industrialization of emerging markets. Businesses can increase their market share in these areas by providing specialised services.

Global Industrial Insulation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.3 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.1% |

| 2032 Value Projection: | USD 5.9 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Form, By Material, By End-Use Industry and By Region |

| Companies covered:: | Armacell International S. A., Cabot Corporation, Insulcon B. V., Johns Manville, Kingspan Group PLC, Knauf Insulation, Owens Corning, Promat (Etex Group), Rockwool Group and Saint Gobain, and Others. |

| Growth Drivers: | Growing need for performing many industrial operations |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Industrial Insulation Market Dynamics

Growing need for performing many industrial operations

The significance of energy conservation and cost efficiency in their operations is being acknowledged by industries more and more. Industrial insulation is essential for minimising heat gain or loss, which lowers operating costs and energy usage. One major factor influencing the adoption of efficient insulating systems is the demand for energy efficiency. Precise temperature management is necessary for many industrial processes in order to maintain both operational efficiency and high-quality products.Industrial insulation aids in preserving constant temperatures in processing facilities, pipelines, and equipment. This is essential for sectors like petrochemicals, where chemical processes depend on particular temperature ranges. Temperature swings are avoided by properly insulated systems and equipment, which promotes stable operating conditions. For sectors like manufacturing and power generation, this is essential.

Restraints & Challenges

Industry may find it difficult to afford the high initial expenditures of high-quality insulating materials and installation, particularly for small and medium-sized businesses (SMEs). Even while thorough insulation solutions might save energy over the long run, some firms may be discouraged from making the initial expenditure. Over time, elements like moisture, physical damage, or exposure to adverse environments can cause insulation materials to deteriorate. It can present logistical and economical difficulties to retrofit insulation in already-existing industrial structures. The entire market potential may be limited if industries are deterred from improving insulation in older structures due to the complexity of retrofitting. The significant variations in industrial processes across industries make it difficult to provide universally applicable insulating solutions. Adoption of full insulating methods may be restricted in some industrial sectors.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Industrial Insulation market from 2023 to 2032. Businesses must spend money on industrial insulation in order to abide with rules, cut energy use, and improve overall energy efficiency. There is a growing need for insulation in a variety of applications due to the development of new manufacturing facilities, infrastructure projects, and industrial facilities. The market for industrial insulation is expanding as a result of the oil and gas sector's need for insulation for processing facilities, refineries, and pipelines. The industrial sector's need for insulation materials is influenced by the use of insulation in manufacturing facilities for thermal efficiency. In order to promote the market's expansion, industrial insulation is crucial for the effectiveness and performance of renewable energy installations. In order to increase energy efficiency and preserve the longevity of infrastructure, industries engage in insulation for retrofitting projects.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. The need for industrial insulation solutions is growing due to the expansion of several industries, including as manufacturing, energy, and construction. The need for insulation materials is driven by the development of infrastructure projects, commercial buildings, and industrial facilities. Insulation for building envelopes and HVAC systems is required in a growing number of residential, commercial, and industrial structures. The market for industrial insulation is expanding as a result of manufacturing facilities looking for insulation to increase thermal efficiency. The need for industrial insulation materials is fueled in part by the electricity sector, which needs insulation to operate efficiently. In petrochemical plants, pipelines, and oil refineries, there is a strong need for insulation materials.

Segmentation Analysis

Insights by Material

The mineral wool segment accounted for the largest market share over the forecast period 2023 to 2032. Rock and slag wool are examples of mineral wool that has good thermal insulation qualities. Mineral wool is useful to industries because it can effectively insulate pipelines, machinery, and industrial buildings by reducing heat transfer. Because mineral wool naturally resists fire, it helps keep industrial facilities safer. Mineral wool insulation is preferred in safety-conscious industries like petrochemical and manufacturing because it can resist high temperatures and help prevent fires. Mineral wool insulation is adaptable and good for many different industrial uses. It can be applied in a variety of ways, including as boards, blankets, and loose-fill insulation, to accommodate different industrial installation needs. Mineral wool is frequently regarded as an eco-friendly insulating material.

Insights by Form

Pipe segment is witnessing the fastest market growth over the forecast period 2023 to 2032. The importance of energy efficiency in industrial processes is growing. Pipe insulation lowers heat gain or loss in pipelines, which promotes energy efficiency and conservation. Sectors look for solutions that are both economical and yield a good return on investment. Pipe insulation is a desirable investment for enterprises since it lowers energy consumption and results in long-term cost benefits. Fluids at various temperatures are frequently transported during industrial processes. The stability of transported fluids is ensured by pipe insulation, which reduces heat gain in cold pipelines and inhibits heat loss in hot pipelines. For industries to produce high-quality goods, they need steady, reliable working conditions. Pipe insulation contributes to steady temperature maintenance, guaranteeing industrial operations remain consistent. Many industries, including petrochemicals, electricity generating, chemical manufacture, and food processing, can benefit from pipe insulation.

Insights by End User

The power segment accounted for the largest market share over the forecast period 2023 to 2032. Energy efficiency is emphasised by the power sector in order to maximise the production and distribution of electricity. Industrial insulation in power plants lowers heat loss, enhancing total energy conservation and efficiency. Boilers, turbines, and heat exchangers are examples of equipment used in power generation where thermal performance is essential. Power generation equipment operates more efficiently and has a longer lifespan when industrial insulation is used to maintain ideal operating temperatures. Long-distance electrical transmission and distribution are common uses for these systems. Power distribution systems that are insulated reduce heat loss that occurs during transmission, guaranteeing effective electricity supply. Condensation in equipment and pipelines can occur during power generation processes. By preventing condensation, insulation lowers the chance of corrosion and preserves the structural integrity of power generation equipment.

Recent Market Developments

- In August 2020, FOAMULAR NGX (Next Generation Extruded), a new product line from Owens Corning, is now available.

Competitive Landscape

Major players in the market

- Armacell International S. A.

- Cabot Corporation

- Insulcon B. V.

- Johns Manville

- Kingspan Group PLC

- Knauf Insulation

- Owens Corning

- Promat (Etex Group)

- Rockwool Group and Saint Gobain

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Industrial Insulation Market, Form Analysis

- Pipe

- Blanket

- Board

Industrial Insulation Market, Material Analysis

- Mineral Wool

- Calcium Silicate

- Plastic foams

Industrial Insulation Market, End Use Analysis

- Power

- Oil & Gas

- Cement

Industrial Insulation Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Industrial Insulation Market?The global Industrial Insulation Market is expected to grow from USD 3.3 Billion in 2023 to USD 5.9 Billion by 2032, at a CAGR of 7.1% during the forecast period 2023-2032.

-

2. Who are the key market players of the Industrial Insulation Market?Some of the key market players of market are Armacell International S. A., Cabot Corporation, Insulcon B. V., Johns Manville, Kingspan Group PLC, Knauf Insulation, Owens Corning, Promat (Etex Group), Rockwool Group and Saint Gobain.

-

3. Which segment holds the largest market share?Mineral wool segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Industrial Insulation Market?North America is dominating the Industrial Insulation Market with the highest market share.

Need help to buy this report?