Global Industrial Fine Grinding Mills Market Size, Share, and COVID-19 Impact Analysis, By Mill Type (Ball Mills, Jet Mills, Hammer Mills, Attrition Mills, Roller Mills, and Stirred Media Mills), By Operation Mode (Dry Grinding and Wet Grinding), By End-Use (Mining & Minerals, Chemicals, Pharmaceuticals, Food & Beverages, Cement & Construction, Paints, and Coatings & Pigments), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Machinery & EquipmentGlobal Industrial Fine Grinding Mills Market Size Insights Forecasts to 2035

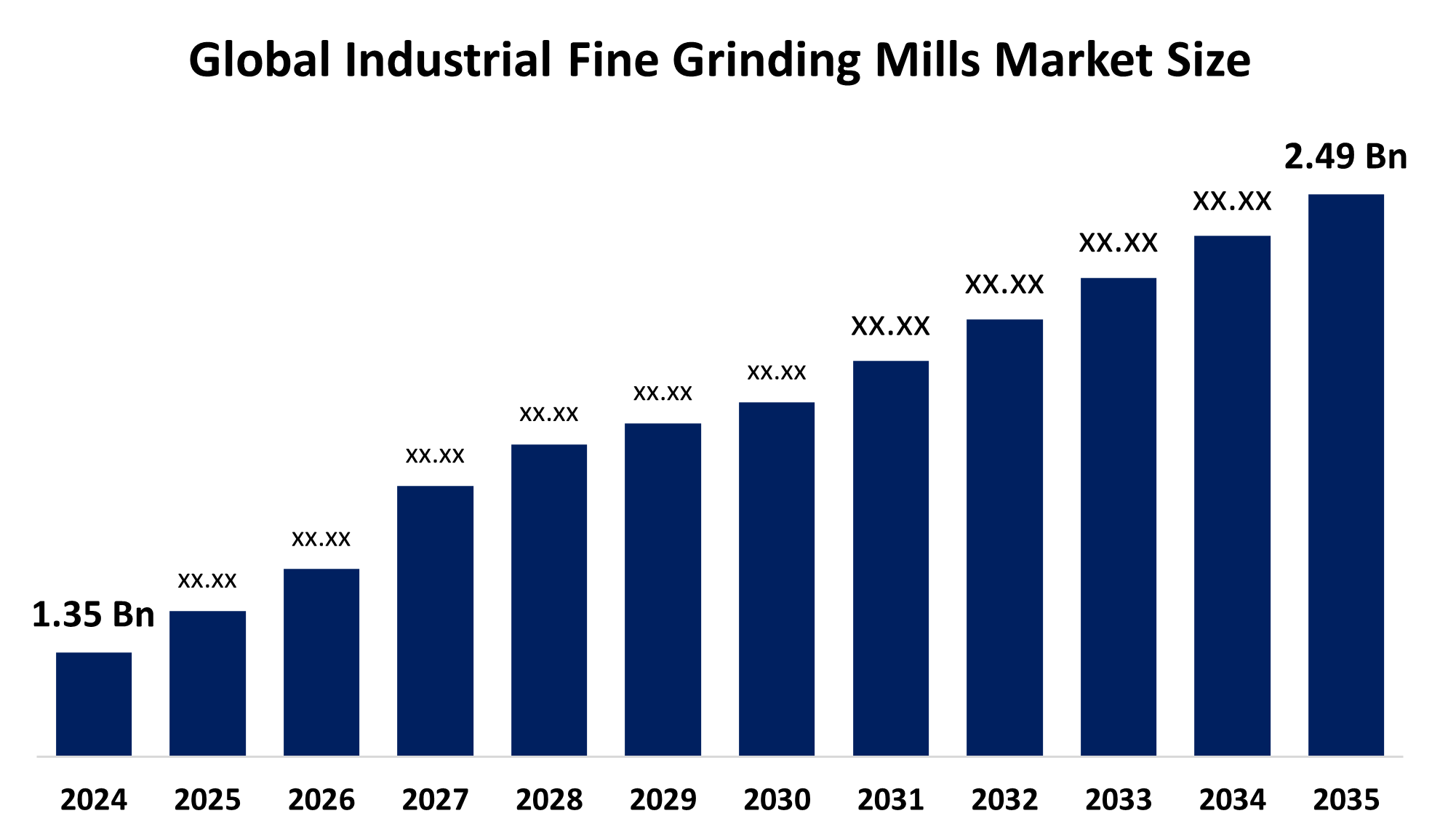

- The Global Industrial Fine Grinding Mills Market Size Was Estimated at USD 1.35 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.72% from 2025 to 2035

- The Worldwide Industrial Fine Grinding Mills Market Size is Expected to Reach USD 2.49 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Industrial Fine Grinding Mills Market Size was worth around USD 1.35 Billion in 2024 and is Predicted to Grow to around USD 2.49 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 5.72% from 2025 to 2035. The global industrial fine grinding mills market is growing due to the increasing demand for quality powder in industries that are pharmaceuticals, chemicals, and mining sectors. The drivers of this industry are energy-efficient technology adoption, Industry 4.0 and industrialization in the Asia-Pacific region.

Market Overview

The Global Industrial Fine Grinding Mills Market Size is defined as the industry that concentrates on the machinery needed for the reduction of solids into fine and ultra-fine particles using a grinding process. This machinery is commonly utilized as a means of enhancing the properties of materials for the purposes of improving the efficiency of recovery in the mining, cement, chemicals, pharmaceutical, food, pigment, and ceramics industries. The expansion of the industrial fine grinding mills industry is fueled by the rising demand for fine and ultra-fine materials, the increase in the number of mineral processing operations carried out globally, the rapid growth of industrialization, and the development of infrastructural projects across the continents of the world.

Growth opportunities are found in emerging countries, which have yet to develop strong industrial bases and are finding ways to process and refine basic chemicals. The key players dealing in innovation and having a global presence include Metso Outotec, FLSmidth & Co., NETZSCH Group, Hosokawa Micron Group, Union Process, and Retsch GmbH, among others, that focus on smart and efficient grinding solutions for meeting diverse industrial needs. China's Industrial Equipment Upgrade Plan was officially launched in April 2024 and aspires to more than a 25% increase in investment towards industrial equipment through 2027. It aims at digitalization and automation across manufacturing to support modernization and drive the adoption of advanced milling and grinding technologies for increased efficiency and productivity.

Report Coverage

This research report categorizes the Global Industrial Fine Grinding Mills Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the industrial fine grinding mills market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the industrial fine grinding mills market.

Global Industrial Fine Grinding Mills Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.35 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.72% |

| 2035 Value Projection: | USD 2.49 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Companies covered:: | Hosokawa Micron Group, FLSmidth & Co., NETZSCH Group, Metso Outotec, Stedman, Retsch GmbH, Union Process, Inc., Buhler Group, CPM Holdings, Inc., Loesche GmbH, ThyssenKrupp Industrial Solutions, Hockmeyer Equipment Corp., Eirich Group, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The Global Industrial Fine Grinding Mills Market Size is mainly driven by the increase in the demand for ultra-fine materials for various applications such as the mining, cement, chemical, pharmaceutical, and food processing industries. The growth of the mineral processing and metal recovery processes, especially in emerging countries, is a significant driving factor for the industrial fine grinding mills, as fine grinding enables higher recovery and better-quality production. Use of advanced materials and special chemical products also accelerates the growth of the industrial fine grinding mills market. Additionally, the increase in the need for special comminution technologies that are low on energy also drives the industrial fine grinding mills market.

Restraining Factors

High initial investment and maintenance costs, high energy consumption, and frequent wear of the equipment are some of the factors restraining the growth of the Global Industrial Fine Grinding Mills Market Size. Further, the tight environmental regulations, noise and dust control norms, complicated procedures for installation, and requirement for skilled labor for operation make their adoption further limited, particularly for small and medium enterprises.

Market Segmentation

The industrial fine grinding mills market share is classified into mill type, operation mode, and end-use.

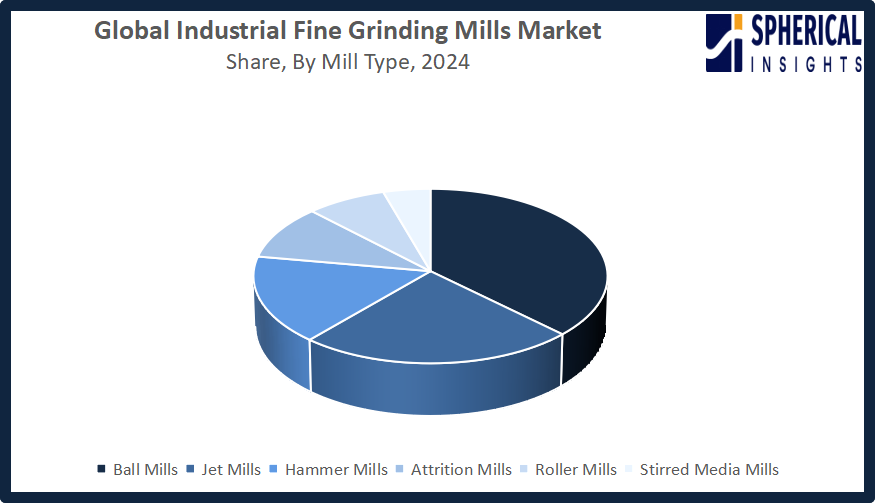

- The ball mills segment dominated the market in 2024, approximately 37% and is projected to grow at a substantial CAGR during the forecast period.

Based on the mill type, the Global Industrial Fine Grinding Mills Market Size is divided into ball mills, jet mills, hammer mills, attrition mills, roller mills, and stirred media mills. Among these, the ball mills segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Ball mills held a leading market share in industrial fine-grinding mills due to their versatility in processing a variety of materials and their efficiency in grinding hard materials such as minerals. Its reliability and cost-effectiveness further led to a prominent position in the global market.

Get more details on this report -

- The dry grinding segment accounted for the largest share in 2024, approximately 62% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the operation mode, the Global Industrial Fine Grinding Mills Market Size is divided into dry grinding and wet grinding. Among these, the dry grinding segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dry grinding industry growth owing to it can process the material without the use of water, thus reducing the costs of operation. It finds several applications in industries such as the mineral, cement, and chemical industries; thus, the growth in the industry can be attributed to the versatility of the process, which can be used in industries where the end product can be affected by the use of water.

- The mining & minerals segment accounted for the highest market revenue in 2024, approximately 42% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the Global Industrial Fine Grinding Mills Market Size is divided into mining & minerals, chemicals, pharmaceuticals, food & beverages, cement & construction, paints, and coatings & pigments. Among these, the mining & minerals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The mining & minerals industry growth in the market, which can be attributed to the rising demand for metals & minerals worldwide, the growth of mining operations, and the requirement for optimized ore processing. Finer grinding enables higher rates of recovery, higher qualities, and better efficiencies in the processes, hence the abundance of industrial mills used in the industry.

Regional Segment Analysis of the Industrial Fine Grinding Mills Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the industrial fine grinding mills market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of theGlobal Industrial Fine Grinding Mills Market Size over the predicted timeframe. Asia Pacific is projected to account for the 48% share of the industrial fine grinding mills market, driven by the growth of the industrialized and mining processes, as well as key infrastructural developments. Growth is primarily driven by the Chinese Industrial Equipment Upgrade Plan and the Make in India campaign initiated in India. With raw materials and chemical and cement production bases easily accessible, the Asia Pacific also offers ample opportunities for the development of fine powder with advanced grinding processes. As of April 2025, the capital goods industry in India, including machinery and electrical machinery, registered double-digit growth.

North America is expected to grow at a rapid CAGR in the industrial fine grinding mills market during the forecast period. The North American market is predicted to have a 25% share of the industrial fine grinding mills market due to the increasing investments in the mining and minerals processing and advanced manufacturing technologies in the region. The United States primarily accounts for the growth because of the 2025 executive order, Immediate Measures to Increase American Mineral Production. Growing construction projects, manufacturing sector enhancements, and advancements in energy-efficient and sustainable processes increase the demand for finer grinding equipment, thus adding to U.S. competitiveness and fueling overall regional expansion.

The market for industrial fine grinding mills is witnessing incremental growth in the European market. This is primarily due to the technological modernization and environmental regulations being imposed. The leaders of the European market for industrial fine grinding mills include Germany. It leads due to its prominent manufacturing base and adoption of innovation and Industry 4.0. Green manufacturing and innovative materials and production strategies also contribute to the expansion of the European market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Global Industrial Fine Grinding Mills Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hosokawa Micron Group

- FLSmidth & Co.

- NETZSCH Group

- Metso Outotec

- Stedman

- Retsch GmbH

- Union Process, Inc.

- Buhler Group

- CPM Holdings, Inc.

- Loesche GmbH

- ThyssenKrupp Industrial Solutions

- Hockmeyer Equipment Corp.

- Eirich Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, CPM introduced the 1200 Direct Drive pellet mill, the first of its kind for the alternative fuel industry. Eliminating the gearbox and V-belt, it delivers unmatched energy efficiency, reliability, and performance, processing diverse biomass feedstocks from agricultural residues to woody materials with advanced, cost-effective technology.

- In October 2025, Buhler launched the Cenomic Horizon 3 bead mill, designed to enhance wet grinding efficiency. Offering improved temperature control, reduced wear, and higher throughput, the mill helps industries like paints, inks, and agrochemicals improve product quality, lower energy consumption, and achieve cost-effective fine grinding and dispersion.

- In November 2025, Metso launched Metso Power Transmission (MPT) solutions, featuring H Series and R-Series gearboxes for horizontal and vertical grinding mills. Designed for reliability, serviceability, and OEM integration, the systems enhance performance, extend wear life, minimize downtime, and optimize operations, supporting long-term efficiency in mineral processing.

- In December 2024, CPM acquired Jacobs Global, a leading provider of customized milling solutions and aftermarket parts for hammermills and pellet mills. The acquisition expands CPM’s product offerings, strengthens its global market reach, and enhances its capacity to serve animal feed, oilseed, and biomass processing customers sustainably.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Global Industrial Fine Grinding Mills Market Size based on the below-mentioned segments:

Global Industrial Fine Grinding Mills Market, By Mill Type

- Ball Mills

- Jet Mills

- Hammer Mills

- Attrition Mills

- Roller Mills

- Stirred Media Mills

Global Industrial Fine Grinding Mills Market, By Operation Mode

- Dry Grinding

- Wet Grinding

Global Industrial Fine Grinding Mills Market, By End-Use

- Mining & Minerals

- Chemicals

- Pharmaceuticals

- Food & Beverages

- Cement & Construction

- Paints

- Coatings & Pigments

Global Industrial Fine Grinding Mills Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the industrial fine grinding mills market over the forecast period?The global industrial fine grinding mills market is projected to expand at a CAGR of 5.72% during the forecast period.

-

2.What is the industrial fine grinding mills market?The industrial fine grinding mills market involves equipment used to grind materials into fine or ultra-fine particles for various industries.

-

3.What is the market size of the industrial fine grinding mills market?The global Industrial Fine Grinding Mills market size is expected to grow from USD 1.35 billion in 2024 to USD 2.49 billion by 2035, at a CAGR of 5.72% during the forecast period 2025-2035.

-

4.Which region holds the largest share of the industrial fine grinding mills market?Asia Pacific is anticipated to hold the largest share of the industrial fine grinding mills market over the predicted timeframe.

-

5.Who are the top 10 companies operating in the global industrial fine grinding mills market?Hosokawa Micron Group, FLSmidth & Co., NETZSCH Group, Metso Outotec, Stedman, Retsch GmbH, Union Process, Inc., Buhler Group, CPM Holdings, Inc., Loesche GmbH, and Others.

-

6.What factors are driving the growth of the industrial fine grinding mills market?The industrial fine grinding mills market is driven by rising demand for ultra-fine materials, expanding mining, cement, chemical, and pharmaceutical industries, technological advancements, automation, energy efficiency, and infrastructure development globally.

-

7.What are the market trends in the industrial fine grinding mills market?Key trends include automation, energy‑efficient designs, digital monitoring, demand for ultra‑fine powders, sustainability focus, and adoption of advanced grinding technologies across industries.

-

8.What are the main challenges restricting wider adoption of the industrial fine grinding mills market?Main challenges include high capital and maintenance costs, significant energy consumption, equipment wear, complex installation, skilled labor shortages, and strict environmental regulations on noise, dust, and emissions, limiting broader market adoption.

Need help to buy this report?