Global Industrial Ethernet Market Size, Share, and COVID-19 Impact Analysis, By Offering (Hardware, Software, Services), By Protocol (EtherCAT, EtherNet/IP, PROFINET, POWERLINK, SERCOS III, CC-Link IE, Others), By End-Use (Automotive & Transportation, Electrical & Electronics, Aerospace & Defense, Oil & Gas, Chemical & Fertilizer, Food & Beverages, Pharmaceutical & Medical Devices, Energy & Power, Mining & Metals, Engineering/Fabrication, Water & Wastewater, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Semiconductors & ElectronicsGlobal Industrial Ethernet Market Insights Forecasts to 2030

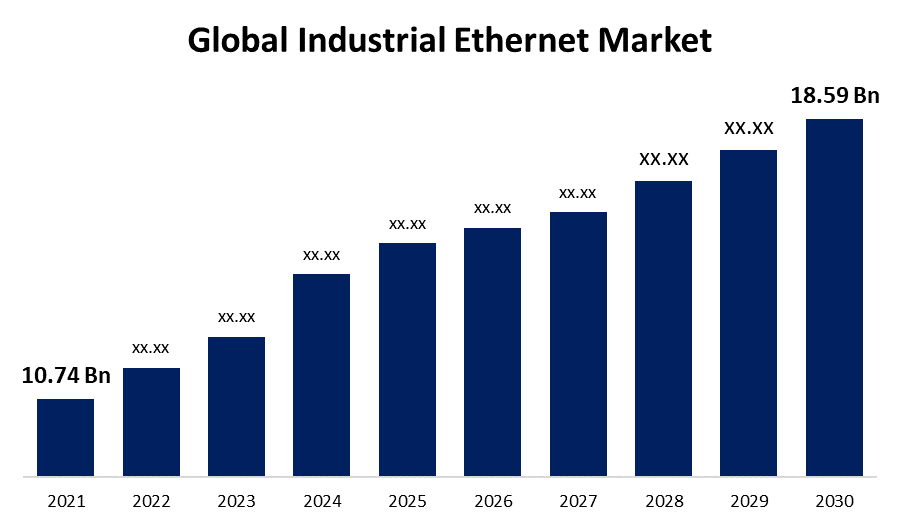

- The Industrial Ethernet Market Size was valued at USD 10.74 Billion in 2021.

- The Market is Growing at a CAGR of 7.4% from 2022 to 2030

- The Worldwide Industrial Ethernet Market is expected to reach USD 18.59 Billion by 2030

- Europe is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Industrial Ethernet Market Size is expected to reach USD 18.59 Billion by 2030, at a CAGR of 7.4% during the forecast period 2022 to 2030. Rising adoption of industrial automation and industrial IoT as well as increasing technological advancement of network infrastructure are driving the demand for the industrial ethernet market. Furthermore, the widespread adoption of Industry 4.0 in developing markets is a key driver of market revenue growth. Governments all over the world are encouraging the implementation of industry 4.0 and Smart manufacturing technologies, which is propelling the industrial ethernet market globally.

Ethernet is a Local Area Network (LAN) system that employs Ethernet routers and switches to access network devices like computers, printers, and other peripherals. The utilization of Ethernet in an industrial setting with protocols that offer determinism and real-time control is known as industrial Ethernet (IE). Industrial Ethernet is a more complex version of Ethernet that has been developed further. Industrial Ethernet has approximately 20 protocols that are oriented to IEEE 802.3 standards. There are over 20 protocols for Industrial Ethernet that are focused on IEEE 802.3 specifications.

Industrial Ethernet has several advantages over other types of industrial networks, including increased data speed of up to 1 Gbit/s with Gigabit Ethernet, the ability to use standard networking hardware for wired and wireless communication, improved interoperability, as well as the option to use optical fiber for increased distance, and many more. Industrial Ethernet might also correspond to the usage of standard Ethernet protocols in an industrial environment, including durable connectors and prolonged thermal switches, for automated processes or control systems. The utilization of fiber-optic Ethernet alternatives lowers electrical noise concerns and offers electrical isolation.

COVID-19 Impact Industrial Ethernet Market

However, during the COVID-19 pandemic, the industrial sector saw the rapid implementation of ethernet. The virus's appearance accelerated market dynamics and increased the penetration of industrial IoT. Similarly, in the post-pandemic time, manufacturing technology has shifted due to the arrival of improved technologies that enable remote operations. Market acceptance has also increased as a result of the increasing popularity of industry 4.0 technologies, consequently supporting market growth.

Global Industrial Ethernet Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 10.74 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 7.4% |

| 2030 Value Projection: | USD 18.59 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Offering, By Protocol, By End-Use, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Cisco, ABB, Siemens, Schneider Electric, Rockwell Automation, SICK, OMRON, Dynalog India Ltd., Moxa, Innovasic Inc., Huawei Technologies, Belden, Eaton Corporation, Barta-Schoenewald, Inc., Monnit Corporation, B&R Automation, Parker Hannifin Corporation, Yokogawa Electric Corporation |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Key Market Drivers

Growing efforts by developing-country governments to boost industrial automation effective implementation

Globally, developing-country governments are assisting in the development of numerous industries in order to attain sustainable development. As a result, the establishment of different automation and network infrastructure and technologies for the organizational improvement of industries has developed. Local authorities are concentrating their efforts on manufacturing and specialized sectors. India is a developing country with a rapidly expanding industrial industry. The national government's introduction of the National Manufacturing Policy has contributed to the rapid growth of its manufacturing sector. In addition, the government has launched the Make in India initiative to encourage enterprises to automate processes in existing manufacturing facilities.

Key Market Challenges

Market adoption is hampered by high initial investment.

High capital setup costs, operational hurdles, and compatibility challenges are important factors limiting market share revenue progression. Industrial Ethernet networks necessitate a considerable initial expenditure on network infrastructure and types of equipment, which may inhibit certain medium and small-sized companies from deploying them. Furthermore, the establishment of industrial ethernet networks can be complex and requires specific knowledge and skills, which can be difficult for businesses lacking the requisite resources.

Key Market Opportunities

Adoption of sophisticated Ethernet technology in Industrial IoT

Companies have progressed further in standardization and interoperability certification due to the development and widespread acceptance of technologies such as audio-visual bridging (AVB) and time-sensitive networking (TSN). Today's industrial Ethernet networks have reached a new phase that necessitates new types of testing, such as system-level validation using realistic application mixes. Only with real-world test workloads can you ensure that your network meets the needs of each operation, independent of the traffic mix, which may include robotics components, motors, sensors, human-machine interface (HMI), PLCs, and other devices. Thus, industrial communication is an essential component of Industry IoT. The demand for industrial ethernet technology is growing in the manufacturing industry, as it helps to overcome the shortcomings of other wireless systems.

Market Segmentation

Offering Type Insights

The services segment accounted the largest market share over the forecast period.

On the basis of offering type, the global industrial ethernet market is segmented into hardware, software, and services. Among these, the services segment is dominating the market and is going to continue its dominance over the forecast period. Emerging trends in the communication network, combined with the expanding usage of IIoT, have resulted in the use of the cloud and networking. This has considerably raised the strain on network managers to manage communications infrastructure. As a result, industrial firms are outsourcing network services to assure improved network management quality and lower operational expenses. Businesses are implementing remote network monitoring services, which are projected to increase the services market throughout the forecast period.

Protocol Type Insights

The EtherNet/IP segment is dominating the market with the largest revenue share over the forecast period.

On the basis of protocol type, the global industrial ethernet market is segmented into EtherCAT, EtherNet/IP, PROFINET, POWERLINK, SERCOS III, CC-Link IE, and others. Among these, the EtherNet/IP segment is dominating the market with the largest revenue share of 26.5% over the forecast period. It is one of the world's major industrial protocols, and it is extensively used in a variety of industries, including factory, hybrid, and process. EtherNet/IP is a standard Ethernet-based industrial network protocol that extends the Common Industrial Protocol (CIP). EtherNet/IP defines the characteristics and functions of its transport, network, data connection, and physical layers using both of the most extensively used sets of Ethernet standards, the Internet Protocol suite and IEEE 802.3. As a result, EtherNet/IP offer real-time communication.

End-Use Type Insights

The automotive & transportation segment accounted the largest revenue share of more than 42.6% over the forecast period.

On the basis of end-use, the global industrial ethernet market is segmented into automotive & transportation, electrical & electronics, aerospace & defense, oil & gas, chemical & fertilizer, food & beverages, pharmaceutical & medical devices, energy & power, mining & metals, engineering/fabrication, water & wastewater, and others. Among these, the automotive & transportation segment accounted for the largest revenue share of over 42.6% over the forecast period owing to the growing need for hybrid connectivity, as well as significant technological advancements in the automobile industry, which are major factors driving this segment's revenue growth. Industrial ethernet is becoming a more inventive technique and is expected to be a major shift in the transport industry. Real-time applications including such sophisticated Driver Assistance Systems (ADAS), as well as characteristics such as low delay and flexibility, are important factors driving market volume growth. Furthermore, low-latency vehicles can transmit information and react to scenarios considerably faster, enabling driving safer and more economical.

Regional Insights

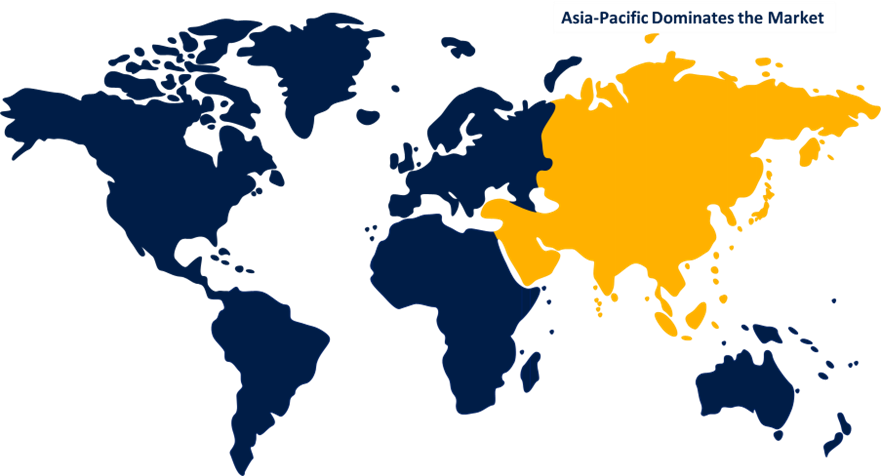

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 56.8% market share over the forecast period. Asia Pacific is currently considered the most important manufacturing region for automakers and electronics manufacturers. As a result of increased government measures to develop China into a high-technology manufacturing hub, the Chinese market accounted for the region's greatest revenue share. Also, growing public understanding of the advantages of applying automation technologies in the manufacturing, electronics, aviation, and defense industries are important factors driving China's market revenue development. Furthermore, rapid growth for automation technologies in the oil and gas sector, as well as growing adoption of sophisticated innovations that enhance efficiency and productivity, lower costs, and boost productivity, are significant considerations driving revenue expansion throughout the region. This is also another important driver driving market revenue growth.

Europe, on the contrary hand, is expected to grow the fastest during the forecast period. Europe has a robust manufacturing industry that makes extensive use of industrial ethernet connections. Industrial ethernet is used in industries such as automotive, aerospace, and food and beverage to ensure dependable and efficient communication with machines and control mechanisms. Furthermore, energy efficiency is a major challenge for companies in these industries, and industrial ethernet is a vital source of Industry 4.0, providing the connection required for industrial automation and digitalized manufacturing processes. Germany had the highest revenue share due to the presence of important enterprises in a variety of verticals and strong experience in automation technology and manufacturing in the region. Furthermore, the large-scale industries such as Siemens, Beckhoff Automation, and others are a vital elements leading to the country's demand market growth.

List of Key Market Players

- Cisco

- ABB

- Siemens

- Schneider Electric

- Rockwell Automation

- SICK

- OMRON

- Dynalog India Ltd.

- Moxa

- Innovasic Inc.

- Huawei Technologies

- Belden

- Eaton Corporation

- Barta-Schoenewald, Inc.

- Monnit Corporation

- B&R Automation

- Parker Hannifin Corporation

- Yokogawa Electric Corporation

Key Market Developments

- On November 2022, Analog Devices, Inc. unveiled the world's first Single-pair Power over Ethernet (SPoE) Power Sourcing Equipment (PSE) and Power Device (PD) solutions to assist clients deliver higher levels of intelligence into smart buildings, industrial automation, and other applications at the network's edge. Analog Devices' SPoE solutions eliminate dependency on localized power and batteries by utilizing a single twisted pair of Ethernet cables to deliver efficient, reliable, easily installed power in a smaller and lighter package. Customers may reliably carry both power and data across one kilometer when combined with ADI ChronousTM ADIN1100 and ADIN1110 10BASE-T1L Industrial Ethernet solutions - a considerable increase over prior Ethernet standards.

- On August 2022, Belden, a global leader in speciality networking solutions, acquired macmon secure GmbH. This acquisition expands Belden's portfolio of solutions by adding reliable and proven Network Access Control (NAC) and Secure Defined Perimeter (SDP) technologies to safeguard networks and cloud services.

- On July 2021, SICK introduced the InspectorP61x, an ultra-compact and ultra-powerful all-in-one 2D vision sensor that can be quickly set up to conduct highly-reliable inline machine vision inspections even in the tightest of machine areas or when placed on robot arms. A wide range of communications interfaces including Ethernet TCP/IP, FTP, EtherNET/IP®, and PROFINET fieldbuses ensure its adaptability for many applications.

- On November 2019, Analog Devices, Inc. announced the availability of new industrial Ethernet physical layer (PHY) products to assist manufacturers in addressing key Industry 4.0 and smart factory communication challenges such as data integration, synchronization, edge connectivity, and system interoperability. The ADIN1300 is designed to work successfully in tough industrial circumstances over extended ambient temperature ranges as industrial automation expands the adoption of Ethernet and pushes the bounds of data speeds.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Global Industrial Ethernet Market based on the below-mentioned segments:

Industrial Ethernet Market, Offering Type Analysis

- Hardware

- Software

- Services

Industrial Ethernet Market, Protocol Type Analysis

- EtherCAT

- EtherNet/IP

- PROFINET

- POWERLINK

- SERCOS III

- CC-Link IE

- Others

Industrial Ethernet Market, End-Use Analysis

- Automotive & Transportation

- Electrical & Electronics

- Aerospace & Defense

- Oil & Gas

- Chemical & Fertilizer

- Food & Beverages

- Pharmaceutical & Medical Devices

- Energy & Power

- Mining & Metals

- Engineering/Fabrication

- Water & Wastewater

- Others

Industrial Ethernet Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the industrial ethernet market?The Global Industrial Ethernet Market is expected to grow from USD 10.74 Billion in 2021 to USD 18.59 Billion by 2030, at a CAGR of 7.4% during the forecast period 2021-2030.

-

2. Which are the key companies in the market?Cisco, ABB, Siemens, Schneider Electric, Rockwell Automation, SICK, OMRON, Dynalog India Ltd., Moxa, Innovasic Inc., Huawei Technologies, Belden, Eaton Corporation, Barta-Schoenewald, Inc.

-

3. Which segment dominated the industrial ethernet market share?The automotive & transportation segment in end-use dominated the Industrial Ethernet market in 2021 and accounted for a revenue share of over 42.6%.

-

4. Which region is dominating the industrial ethernet market?Asia Pacific is dominating the industrial ethernet market with more than 56.8% market share.

-

5. Which segment holds the largest market share of the industrial ethernet market?Services segment based on offering type holds the maximum market share of the industrial ethernet market.

Need help to buy this report?