Global Industrial Cooling Systems Market Size, Share, and COVID-19 Impact Analysis, By Product (Hybrid Cooling, Air Cooling, Water Cooling, Evaporative Cooling), By Function (Stationary Cooling and Transport Cooling), By End Use (Utility & Power, Chemical, Food & Beverage, Pharmaceutical, Oil & Gas, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Information & TechnologyGlobal Industrial Cooling Systems Market Insights Forecasts to 2035

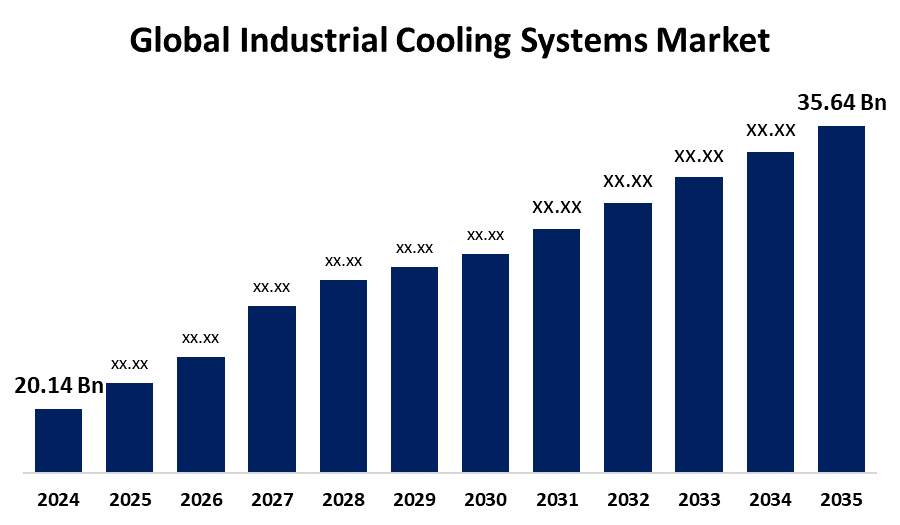

- The Global Industrial Cooling Systems Market Size Was Estimated at USD 20.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.33% from 2025 to 2035

- The Worldwide Industrial Cooling Systems Market Size is Expected to Reach USD 35.64 Billion by 2035

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Industrial Cooling Systems Market Size was worth around USD 20.14 Billion in 2024 and is Predicted to grow to around USD 35.64 Billion by 2035 with a compound annual growth rate (CAGR) of 5.33% from 2025 and 2035. The market growth is driven by the rising industrial demand and the push for sustainability is driving growth in the industrial cooling systems market. Innovation and IoT integration offer a strong competitive edge amid evolving industry needs.

Market Overview

The industrial cooling systems market refers to the tools and technologies used in manufacturing, energy, chemicals, and data centers to eliminate surplus heat from machinery, processes, and surroundings. Phase-change, water-cooled, air-cooled, and sophisticated cooling techniques are among the various system types that are included; each is designed to meet particular operational requirements.

Through funding, research projects, and strategic policies, governments around the world are significantly influencing advancements in cooling technologies for renewable energy. Governments seek to lower greenhouse gas emissions and encourage sustainable energy consumption by fostering the development and application of technology such as thermally driven chillers, solar-assisted cooling, and smart grid integration. Advanced cooling systems are being adopted more quickly because of national innovation grants, tax incentives for environmentally friendly infrastructure, and programs that promote public-private collaborations. These initiatives promote green economic growth, improve energy security, and combat climate change.

The increasing data center growth, industrialization, and the drive for energy-efficient solutions. Advanced cooling solutions are becoming more and more in demand across industries like electronics, petrochemicals, manufacturing, power generation, and food processing as they look to maximize operating efficiency and adhere to environmental standards. Industrial cooling is now a major focus of global infrastructure and energy policies due to emerging markets, technology advancements like IoT-enabled systems, and the move toward sustainable cooling techniques.

Report Coverage

This research report categorizes the industrial cooling systems market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the industrial cooling systems market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the industrial cooling systems market.

Global Industrial Cooling Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 20.14 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.33% |

| 2035 Value Projection: | USD 35.64 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Function, By End Use, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Baltimore Aircoil Company, Danfoss, Bell Cooling Tower, Alfa Laval, Brentwood Industries Inc., SPX Corporation, Hamon Group, SPIG S.p.A., Johnson Controls Inc., Paharpur Cooling Towers, Spig SPA, Hamon & Cie International SA, Evapco, Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for pharmaceuticals and the growth in other important sectors. These systems are necessary to guarantee continuous industrial operations and product stability. There is potential for eco-friendly and energy-efficient solutions despite obstacles such as a lack of knowledge about cutting-edge technologies. The market is changing as a result of the push for sustainability and the uptake of IoT-based technologies. Businesses that provide clever and creative cooling solutions stand to benefit from a competitive advantage. The market prognosis is nonetheless favorable overall, propelled by both technical advancement and necessity.

Restraining Factors

The market for industrial cooling systems is hampered by high investment prices and substantial water requirements. Market stability is further impacted by supply chain interruptions and fluctuations in the price of raw materials. Despite rising demand, these factors can impede market expansion. For further advancement, cost and resource efficiency must be addressed.

Market Segmentation

The industrial cooling systems market share is classified intoproduct, function, and end use.

- The water cooling segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the industrial cooling systems market is divided into hybrid cooling, air cooling, water cooling, and evaporative cooling. Among these, the water cooling segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by their exceptional heat transfer efficiency, water-cooled systems are essential for high-load industrial applications. They are perfect for industries like petrochemicals and power because of their capacity to handle high thermal loads. Their adoption is aided by water availability and well-established infrastructure. This establishes water-cooled systems as a crucial industrial cooling market segment.

- The stationary cooling segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the function, the industrial cooling systems market is divided into stationary cooling and transport cooling. Among these, the stationary cooling segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to installing a permanent cooling system at a fixed place allows for the cooling of a specific area or process within an industrial complex. Stationary cooling systems are widely used in many industries, including the food and beverage, power, oil and gas, and pharmaceutical sectors. Furthermore, perishable commodities must be transported using a transport refrigeration unit, often known as a transport cooling system.

- The utility and power segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the industrial cooling systems market is divided into utility & power, chemical, food & beverage, pharmaceutical, oil & gas, and others. Among these, the utility and power segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to the need for sophisticated cooling solutions in power generation is being driven by the upgrading of power infrastructure and the growing electricity demand. For thermal, nuclear, and renewable energy plants to remain safe and operate effectively, efficient cooling is essential. Investment in sustainable cooling solutions is further encouraged by environmental legislation. The expansion of the energy sector's cooling systems segment is substantially supported by this trend.

Regional Segment Analysis of the Industrial Cooling Systems Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the industrial cooling systems market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the industrial cooling systems market over the predicted timeframe. The region's growth is expanded by the growing need for energy-efficient cooling solutions in data centers, manufacturing, and power generation, among other sectors. Additionally, the need for specialized cooling solutions in energy production is growing as a result of the transition toward renewable energy sources like solar and wind. Developments in digitalization and the incorporation of smart cooling technologies are also contributing to the market's expansion.

Europe is expected to grow at a rapid CAGR in the industrial cooling systems market during the forecast period. In this region, strict environmental laws and the rising need for sustainable and energy-efficient cooling options. Because of the region's growing emphasis on lowering carbon footprints, enterprises are implementing cooling technologies that use less energy and have less environmental impact. Furthermore, Europe's need for sophisticated and dependable cooling systems is being increased by the continuous industrial modernization and digitization of data centers, manufacturing, and power generation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the industrial cooling systems market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Baltimore Aircoil Company

- Danfoss

- Bell Cooling Tower

- Alfa Laval

- Brentwood Industries Inc.

- SPX Corporation

- Hamon Group

- SPIG S.p.A.

- Johnson Controls Inc.

- Paharpur Cooling Towers

- Spig SPA

- Hamon & Cie International SA

- Evapco, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Alfa Laval launched the TS25 semi-welded plate heat exchanger, which is intended to improve energy efficiency in the renewable energy and process sectors.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the industrial cooling systems market based on the below-mentioned segments:

Global Industrial Cooling Systems Market, By Product

- Hybrid Cooling

- Air Cooling

- Water Cooling

- Evaporative Cooling

Global Industrial Cooling Systems Market, By Function

- Stationary Cooling

- Transport Cooling

Global Industrial Cooling Systems Market, By End Use

- Utility & Power

- Chemical

- Food & Beverage

- Pharmaceutical

- Oil & Gas

- Others

Global Industrial Cooling Systems Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the industrial cooling systems market over the forecast period?The global industrial cooling systems market is projected to expand at a CAGR of 5.33% during the forecast period.

-

2. What is the market size of the industrial cooling systems market?The global Industrial Cooling Systems market size is expected to grow from USD 20.14 Billion in 2024 to USD 35.64 Billion by 2035, at a CAGR of 5.33% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the industrial cooling systems market?North America is anticipated to hold the largest share of the industrial cooling systems market over the predicted timeframe.

Need help to buy this report?