Global Industrial Absorbent Market Size, Share, and COVID-19 Impact Analysis, By Material (Natural, Inorganic, and Synthetic), By Type (Universal, Hazmat, Oily-only, and Others), By Product (Pads, Pillows, Rolls, Sheets & mats, and Others), By End User (Oil & Gas, Chemical, Food Processing, Healthcare, Manufacturing, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Industrial Absorbent Market Size Insights Forecasts to 2035

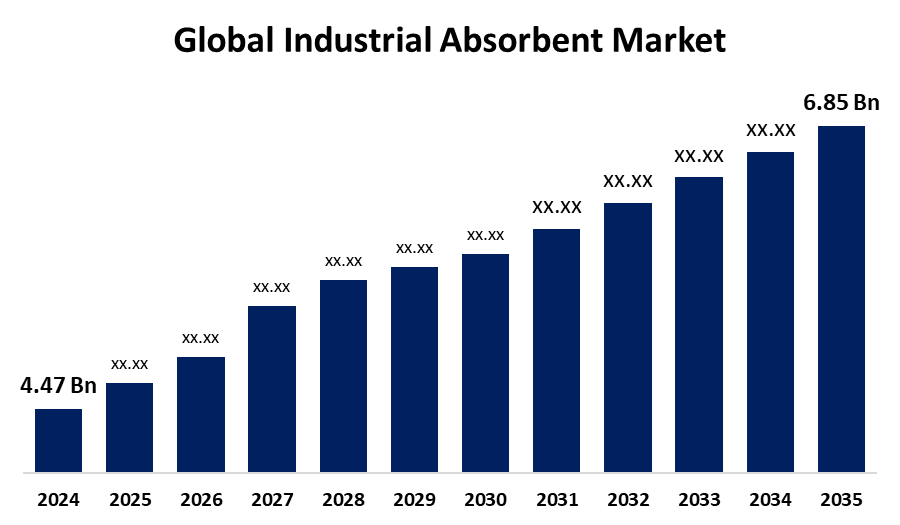

- The Global Industrial Absorbent Market Size Was Estimated at USD 4.47 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.96% from 2025 to 2035

- The Worldwide Industrial Absorbent Market Size is Expected to Reach USD 6.85 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Industrial Absorbent Market Size was worth around USD 4.47 Billion in 2024 and is predicted to grow to around USD 6.85 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 3.96% from 2025 to 2035. The increasing environmental regulations and awareness about workplace safety & hygiene, along with an increasing industrial activity, are driving the industrial absorbent market globally.

Market Overview

The industrial absorbent market refers to the industry encompassing materials used across industrial settings for absorbing and containing spilled or leaked liquids such as oil, chemicals, and water. Industrial absorbents are the materials that are specifically designed for soaking up and containing liquids in industrial settings. These are used in the chemical industries for aggressive chemicals such as acids and bases that neutralize the chemical and encapsulate the liquid. Further, these are used for surgical dressings, cosmetic purposes, and sanitary products in the healthcare industry. The trend towards increasing adoption of biodegradable absorbents is escalating the market growth for industrial absorbent. An expansion of oil refineries for the increasing demand for absorbents is escalating the market growth opportunities.

Report Coverage

This research report categorizes the industrial absorbent market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the industrial absorbent market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the industrial absorbent market.

Global Industrial Absorbent Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.47 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.96% |

| 2035 Value Projection: | USD 6.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 298 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Material, By Type, By Product, By End User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | TOLSA, Johnson Matthey, Kimberly-Clark, Meltblown Technologies Inc., EP Minerals, ANSELL LTD, Fentex Ltd., Complete Environmental Products, UES Promura, Jaycot Industries, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

An increasing demand for high-quality absorbents, owing to the environmental regulations that drive the need for effective spill contamination and cleanup methods, is propelling the market for industrial absorbent market. Spill absorbents play a vital role in maintaining safety and hygiene in diverse industrial, commercial, and domestic environments. Increasing industrial activities, including spill response, leak containment, and waste management, are contributing to driving the market demand for industrial absorbent.

Restraining Factors

The increased initial cost of eco-friendly alternatives and fluctuation in raw material prices are hampering the industrial absorbent market. Further, the concerns regarding the environmental impact of certain synthetic absorbents are challenging the market growth.

Market Segmentation

The industrial absorbent market share is classified into material, type, product, and end user.

- The synthetic segment dominated the market with the largest share in 2024 and is projected to grow at a significant CAGR during the forecast period.

Based on the material, the industrial absorbent market is divided into natural, inorganic, and synthetic. Among these, the synthetic segment dominated the market with the largest share in 2024 and is projected to grow at a significant CAGR during the forecast period. The rising environmental awareness towards hazardous chemicals, demand for effective spill clean-up solutions across diverse end-use industries, and demand for reusable absorbents are propelling the market in the synthetic segment.

- The oily-only segment accounted for the largest share of the industrial absorbent market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the industrial absorbent market is divided into universal, hazmat, oily-only, and others. Among these, the oily-only segment accounted for the largest share of the industrial absorbent market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. It is a specialized absorbent material designed for selectively absorbing oil-based fluids, such as hydraulic oil, motor oil, or cooking oil, and repelling water and other non-oil substances.

- The pads segment accounted for the largest share of the industrial absorbent market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the industrial absorbent market is divided into pads, pillows, rolls, sheets & mats, and others. Among these, the pads segment accounted for the largest share of the industrial absorbent market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Industrial absorbent pads are designed as flat, sheet-like materials for absorbing and containing various types of liquids such as oils, coolants, solvents, chemicals, and water.

- The oil & gas segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the industrial absorbent market is divided into oil & gas, chemical, food processing, healthcare, manufacturing, and others. Among these, the oil & gas segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment includes liquid hydrocarbons such as crude oil and refined petroleum products. Industrial absorbents aid in immediate cleanup and containment of spills across diverse sectors like offshore platforms, drilling rigs, and pipelines.

Regional Segment Analysis of the Industrial Absorbent Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the industrial absorbent market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the industrial absorbent market over the predicted timeframe. The expanding oil & gas, chemicals, and food processing industries, along with an increasing environmental & work safety regulations, are responsible for propelling the industrial absorbent market demand. Further, an increasing number of drilling operations, driving demand for industrial absorbent, thereby escalating the market.

Asia Pacific is expected to grow at a rapid CAGR in the industrial absorbent market during the forecast period. The growing demand for industrial absorbents in oil & gas, chemicals, food processing, and healthcare sectors is propelling the market in the region. An increase in the incidence of oil spillage, chemical spillage during the transportation of stored chemicals is driving the industrial absorbent market demand.

Europe is anticipated to hold a significant share of the industrial absorbent market during the projected timeframe. The rising demand for effective spill control and cleanup across industries such as oil & gas, chemicals, food processing, and the healthcare sector is driving the market demand for industrial absorbent.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the industrial absorbent market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TOLSA

- Johnson Matthey

- Kimberly-Clark

- Meltblown Technologies Inc.

- EP Minerals

- ANSELL LTD

- Fentex Ltd.

- Complete Environmental Products

- UES Promura

- Jaycot Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2023, Kimberly-Clark Professional, a global leader in contamination control solutions for cleanrooms and laboratories, expanded The RightCycle Programme to the Netherlands and Switzerland.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the industrial absorbent market based on the below-mentioned segments:

Global Industrial Absorbent Market, By Material

- Natural

- Inorganic

- Synthetic

Global Industrial Absorbent Market, By Type

- Universal

- Hazmat

- Oily-only

- Others

Global Industrial Absorbent Market, By Product

- Pads

- Pillows

- Rolls

- Sheets & mats

- Others

Global Industrial Absorbent Market, By End User

- Oil & Gas

- Chemical

- Food Processing

- Healthcare

- Manufacturing

- Others

Global Industrial Absorbent Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the industrial absorbent market over the forecast period?The global industrial absorbent market is projected to expand at a CAGR of 3.96% during the forecast period.

-

2.What is the market size of the industrial absorbent market?The global industrial absorbent market size is expected to grow from USD 4.47 Billion in 2024 to USD 6.85 Billion by 2035, at a CAGR of 3.96% during the forecast period 2025-2035.

-

3.Which region holds the largest share of the industrial absorbent market?North America is anticipated to hold the largest share of the industrial absorbent market over the predicted timeframe.

Need help to buy this report?