Global Induction Furnace Market Size, Share, and COVID-19 Impact Analysis, By Type (Coreless Induction Furnace and Channel Induction Furnace), By Capacity (1 Ton, 1-100 Ton, and More Than 100 Ton), By End-Use Industry (Steel, Copper, Aluminum, Zinc, and Other Metal Manufacturing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Machinery & EquipmentGlobal Induction Furnace Market Insights Forecasts to 2035

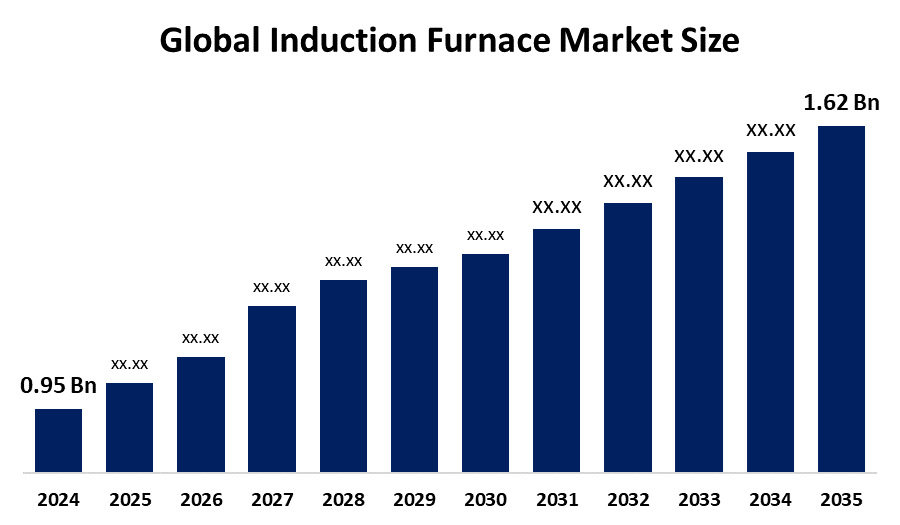

- The Global Induction Furnace Market Size Was Estimated at USD 0.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.97% from 2025 to 2035

- The Worldwide Induction Furnace Market Size is Expected to Reach USD 1.62 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Induction Furnace Market Size is Expected to Grow from USD 0.95 Billion in 2024 to USD 1.62 Billion by 2035, at a CAGR of 4.97% during the forecast period 2025-2035. The market for induction furnace has a number of opportunities to grow due to increasing development and innovation in induction technology.

Market Overview

The global induction furnace industry focuses on the manufacturing and sale of electrical furnaces that use electromagnetic induction to melt and refine metals such as steel, aluminum, and copper. An induction furnace is an electrical furnace in which the heat is applied by induction heating of metal. Capacities of induction furnaces range from less than one kilogram to one hundred tons, and are used to melt iron and steel, copper, aluminum, and precious metals. Further, its advantages include clean, energy-efficient and well-controlled melting processes compared to other metal melting.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and the expanding partnerships between national and international research institutions. A dramatic transformation in the area of furnace technology is driving a huge surge in the induction furnace market.

Report Coverage

This research report categorizes the induction furnace market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Induction Furnace market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the induction furnace market.

Global Induction Furnace Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.95 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.97% |

| 2035 Value Projection: | USD 1.62 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Type, By Capacity, By End-Use Industry, By Region |

| Companies covered:: | Electrotherm, Danieli Group, SMS Elotherm GmbH, Meltech Ltd, Tenova SpA, Doshi Technologies Pvt. Ltd, IHI Machinery and Furnace Co., Ltd, JP Steel Plantech Co., ECM Technologies, Agni Electrical Pvt. Ltd, ABP Induction System, Inductotherm Corporation, FOMET, Otto Junker, Pioneer Furnaces Pvt.Ltd, Saint-Gobain, Duca Manufacturing, ZZ Industrial (shanghai) Co., Ltd., Topcast Engineering, Wertli AG, HarbisonWalker International, Marx GmbH & Co. KG, |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Globalization and industrialization are transforming manufacturing, leading to increased competition and innovation, which is contributing to propelling the induction furnace market. Increasingly energy-efficient and sustainable metallurgical processes for melting and casting a wide variety of metals, such as steel, aluminium, copper, and brass, are driving market demand. The development and refinement of induction furnace technology are further promoting the market growth of induction furnace.

Restraining Factors

The induction furnace market is restricted by the increased installation and setup costs of induction furnaces, which restrict their adoption in small-scale manufacturers. Further, the stringent emission norms and strict regulations are hampering the market growth of the induction furnace.

Market Segmentation

The induction furnace market share is classified into type, capacity, and end-use industry.

- The coreless induction furnace segment dominated the market with a substantial share of about 45% in 2024 and is projected to grow at a significant CAGR during the forecast period.

Based on the type, the induction furnace market is divided into coreless induction furnace and channel induction furnace. Among these, the coreless induction furnace segment dominated the market with a substantial share of about 45% in 2024 and is projected to grow at a significant CAGR during the forecast period. A coreless induction furnace is a high-frequency induction furnace that is a refractory-lined vessel surrounded by an electrically energized current-carrying, water-cooled copper coil. An increasing demand for coreless induction furnaces in the automotive, aerospace, and construction sectors is driving the market growth.

- The 1-100 ton segment accounted for the leading market share of about 50% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the capacity, the induction furnace market is divided into up to 1 ton, 1-100 ton, and more than 100 ton. Among these, the 1-100 ton segment accounted for the leading market share of about 50% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Furnace capacity range up to 100 tons is used to melt iron and steel, copper, aluminum, and precious metals. An increased use of 1-100 ton capacity induction furnaces in the industries, especially in metal production, along with their flexibility in small and medium scale operation, is contributing to driving the segmental market growth.

Get more details on this report -

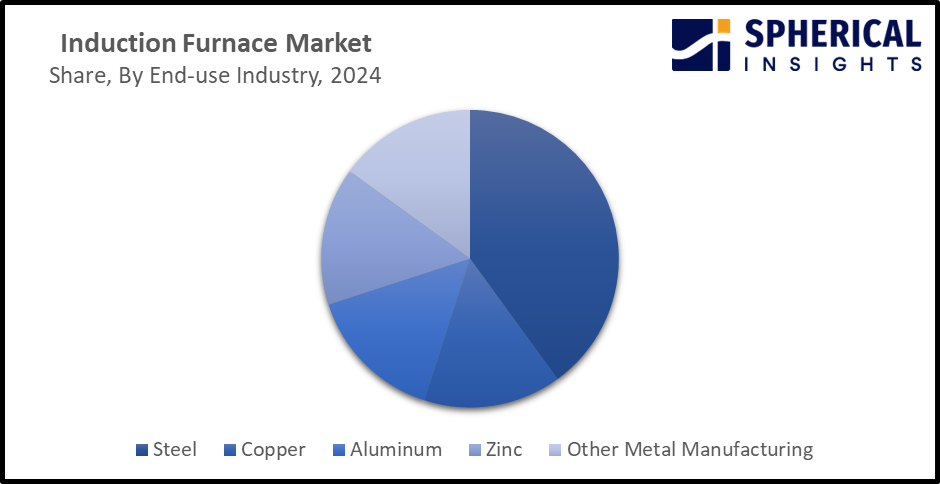

- The steel segment accounted for the largest revenue share of nearly 40% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use industry, the induction furnace market is divided into steel, copper, aluminum, zinc, and other metal manufacturing. Among these, the steel segment accounted for the largest revenue share of nearly 40% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. An induction furnace is a type of furnace used for steelmaking by the use of electrical energy for its operation. Further, the electric arc furnace (EAF) is used in other processes of electrical steel making. The increased use of induction furnaces for producing high-quality steel, along with its widespread application in melting scrap steel, is propelling the market.

Regional Segment Analysis of the Induction Furnace Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the induction furnace market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of about 25-40% in the induction furnace market over the predicted timeframe. The market ecosystem in North America is strong, due to increasing strategic moves towards advancements in graphitisation furnace technology. For instance, in January 2025, NOVONIX Limited entered a Licensing Agreement with Harper International for Advanced Graphitization Furnace Technology. The market for induction furnace has been driven by the region’s growing industrialization and need for efficient melting technology. Further, the introduction of advanced induction heaters is contributing to propel the market. For instance, in November 2023, Bega Special Tools introduced the MF Quick-Heater 3.0-3.5 kW, a portable, versatile induction heater in the North American market. The U.S. is leading the North America induction furnace market, accounting for a 60-80% share during the forecast period. This is attributed to the growing need for efficient, eco-friendly and advanced melting solutions across diverse sectors.

Asia Pacific is expected to grow at a rapid CAGR of 7-10% in the induction furnace market during the forecast period. The Asia Pacific area has a thriving market for induction furnace due to the integration of AI-powered systems for analysing a vast amount of data from sensors within the furnace. China is holding the largest market share of around 57% share and is anticipated to grow at a CAGR of 5.7% during the forecast period, driven by continuous industrial modernization, energy-efficient melting solutions, and material processing technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the induction furnace market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Electrotherm

- Danieli Group

- SMS Elotherm GmbH

- Meltech Ltd

- Tenova SpA

- Doshi Technologies Pvt. Ltd

- IHI Machinery and Furnace Co., Ltd

- JP Steel Plantech Co.

- ECM Technologies

- Agni Electrical Pvt. Ltd

- ABP Induction System

- Inductotherm Corporation

- FOMET

- Otto Junker

- Pioneer Furnaces Pvt.Ltd

- Saint-Gobain

- Duca Manufacturing

- ZZ Industrial (shanghai) Co., Ltd.

- Topcast Engineering

- Wertli AG

- HarbisonWalker International

- Marx GmbH & Co. KG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, Tenovo hosted its first Sustainable Heating Technologies Summit and officially unveiled TenovoLAB, an innovative testing facility for the development of combustion systems.

- In August 2020, Otto Junkar supplied a pusher furnace for aluminium ingots to the USA. Otto Junker delivered a new furnace for heating and homogenising aluminium ingots to Logan Aluminum Inc. in Kentucky, USA.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the induction furnace market based on the below-mentioned segments:

Global Induction Furnace Market, By Type

- Coreless Induction Furnace

- Channel Induction Furnace

Global Induction Furnace Market, By Capacity

- 1 Ton

- 1-100 Ton

- More Than 100 Ton

Global Induction Furnace Market, By End-Use Industry

- Steel

- Copper

- Aluminum

- Zinc

- Other Metal Manufacturing

Global Induction Furnace Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the induction furnace market?The global induction furnace market size is expected to grow from USD 0.95 Billion in 2024 to USD 1.62 Billion by 2035, at a CAGR of 4.97% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the induction furnace market?North America is anticipated to hold the largest share of the induction furnace market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Induction Furnace Market from 2024 to 2035?The market is expected to grow at a CAGR of around 4.97% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Induction Furnace Market?Key players include Electrotherm, Danieli Group, SMS Elotherm GmbH, Meltech Ltd, Tenova SpA, Doshi Technologies Pvt. Ltd, IHI Machinery and Furnace Co., Ltd, JP Steel Plantech Co., ECM Technologies, Agni Electrical Pvt. Ltd, ABP Induction System, Inductotherm Corporation, FOMET, Otto Junker, Pioneer Furnaces Pvt.Ltd, Saint-Gobain, Duca Manufacturing, ZZ Industrial (shanghai) Co., Ltd., Topcast Engineering, Wertli AG, HarbisonWalker International, and Marx GmbH & Co. KG.

-

5. Can you provide company profiles for the leading induction furnace manufacturers?Yes. For example, Electrotherm provides induction furnace for ferrous metals (iron & steel) that gives you superior performance & minimizes the heat loss during the process. Danieli Group is an Italian supplier of equipment and physical plants to the metal industry, and is one of the world leaders in the production of steel plants, in particular in the long products segment, where it owned 30% market share in 1999.

-

6. What are the main drivers of growth in the induction furnace market?Globalization and industrialization, along with an increasing energy-efficient and sustainable metallurgical processes, are major market growth drivers of the induction furnace market.

-

7. What challenges are limiting the induction furnace market?An increased installation and setup cost of induction furnaces, which restricts their adoption in small-scale manufacturers, remains a key restraint in the induction furnace market.

Need help to buy this report?