Indonesia Sulphuric Acid Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Elemental Sulfur, Base Metal Smelters, Pyrite Ore, and Others), By Application (Fertilizers, Petroleum Refining, Metal Processing, Drug Manufacturing, Chemical Manufacturing, Textile, Industrial, Automotive, Pulp & Paper, and Others), and Indonesia Sulphuric Acid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndonesia Sulphuric Acid Market Insights Forecasts to 2035

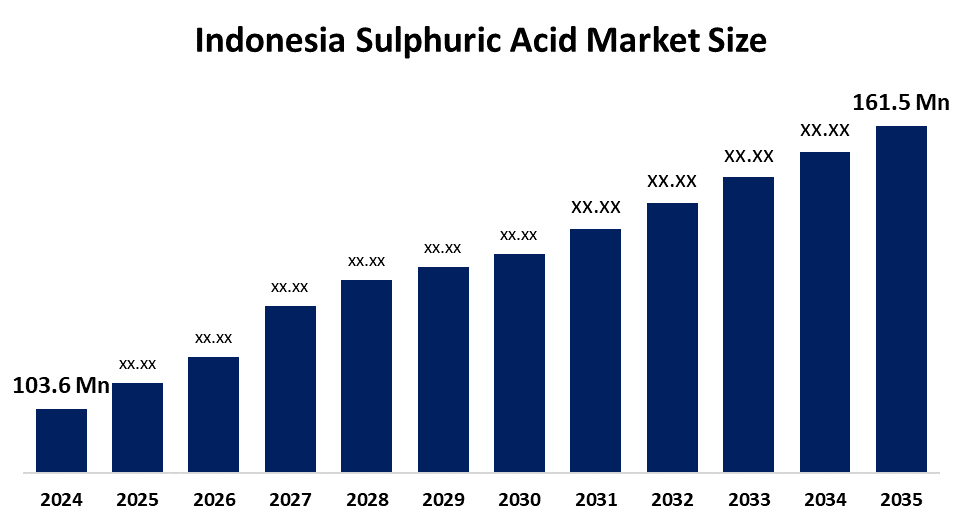

- The Indonesia Sulphuric Acid Market Size Was Estimated at USD 103.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.12% from 2025 to 2035

- The Indonesia Sulphuric Acid Market Size is Expected to Reach USD 161.5 Million by 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Indonesia Sulphuric Acid Market Size Is Anticipated To Reach USD 161.5 Million By 2035, Growing At A CAGR Of 4.12% From 2025 To 2035. The sulphuric acid market in Indonesia is driven by increased demand from fertilizer production, growing mining and metal processing operations, expansion in chemical manufacturing, infrastructure development, and increased government assistance for the industrial and agricultural sectors.

Market Overview

The Indonesia sulphuric acid market refers to the production, distribution, and consumption of sulphuric acid, a critical industrial chemical. The chemical finds extensive application in fertilizer production and mining operations, metal processing, petroleum refining, chemical manufacturing, and wastewater treatment. Sulphuric acid serves as a crucial component for battery manufacturing, pulp and paper production, and industrial cleaning purposes, which help to sustain Indonesia's expanding agricultural, industrial, and mining-based economy.

Government programs that promote import substitution and the development of domestic industries provide support for Indonesia's sulphuric acid market. The PT Freeport Indonesia project, which includes a 1.5 million-ton-per-year sulphuric acid facility at Gresik SEZ, together with mining downstream policies and fertilizer subsidies, and smelter incentives, will increase domestic production while decreasing import needs and establishing mining, chemical, and agricultural supply networks.

The Indonesian metal processing plant of PT Freeport Indonesia started its sulphuric acid production operations again after completing repairs in mid-2025, which resulted in increased domestic output and decreased need for imported sulphuric acid. The mining industry and chemical sector receive support from newly built smelters and expanded acid production facilities. The upcoming possibilities for development include establishing circular wet gas sulphuric acid production plants at refineries and increasing domestic production of HPAL and fertilizer products.

Report Coverage

This research report categorizes the market for the Indonesia sulphuric acid market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Indonesia sulphuric acid market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Indonesia sulphuric acid market.

Indonesia Sulphuric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 161.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.12% |

| 2035 Value Projection: | USD 161.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Raw Material, By Application |

| Companies covered:: | PT Pupuk Indonesia, PT Petrokimia Gresik, PT Smelting, PT Freeport Indonesia, PT Pupuk Kujang Cikampek, PT Multi Nitrotama Kimia, PT Amman Mineral Industri (AMIN), QMB New Energy Materials, PT Halmahera Persada Lygend, Morowali Multi Mandiri, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The sulphuric acid market in Indonesia is driven by the mining and metal processing industries, which create strong demand for sulphuric acid because these industries extract nickel and copper while operating HPAL projects that support electric vehicle supply chains. The market experiences higher demand because fertilizer production expands, chemical manufacturing grows, and petroleum refining operations increase. The government supports domestic sulphuric acid production through its programs, which promote downstream mineral processing and import substitution, and its initiatives for industrial self-sufficiency.

Restraining Factors

The sulphuric acid market in Indonesia is mostly constrained by the expensive capital and operational expenses, rigorous environmental and safety standards, and transportation difficulties throughout the archipelago and its reliance on mining and industrial operations, which create unpredictable demand patterns.

Market Segmentation

The Indonesia sulphuric acid market share is classified into raw material and application.

- The base metal smelters segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Indonesia sulphuric acid market is segmented by raw material into elemental sulfur, base metal smelters, pyrite ore, and others. Among these, the base metal smelters segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to Indonesia's quickly growing copper, nickel, and other base metal smelting industries, which produce sulfuric acid as a by-product. High volumes, reduced production costs, and a dominant revenue share for this segment are guaranteed by significant government assistance for mineral downstreaming, significant expenditures in smelters, and growing demand from hydrometallurgical processing.

- The metal processing segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Indonesia sulphuric acid market is segmented by application into fertilizers, petroleum refining, metal processing, drug manufacturing, chemical manufacturing, textile, industrial, automotive, pulp & paper, and others. Among these, the metal processing segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Indonesia's sizable and growing mining and smelting industry, especially for nickel, copper, and other base metals, is the main driver of this supremacy. Due to the widespread use of sulfuric acid in leaching, refining, and hydrometallurgical processes, particularly in HPAL projects that feed the supply chain for electric car batteries, demand has grown significantly and steadily.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Indonesia sulphuric acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PT Pupuk Indonesia

- PT Petrokimia Gresik

- PT Smelting

- PT Freeport Indonesia

- PT Pupuk Kujang Cikampek

- PT Multi Nitrotama Kimia

- PT Amman Mineral Industri (AMIN)

- QMB New Energy Materials

- PT Halmahera Persada Lygend

- Morowali Multi Mandiri

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2025, Metals manufacturers such as QMB New Energy Materials started using new sulfur burner capacity, which increased domestic acid equivalents and decreased dependency on imported sulfuric acid.

- In May 2025, the rehabilitation of Freeport's Manyar smelting sulfuric acid facility was reportedly finished ahead of schedule, and activities will gradually increase until late 2025.

- In June 2025, following repairs from a fire in the sulfuric acid plant in October 2024, PT Freeport Indonesia's Manyar smelter started up again, gradually increasing production to full capacity.

Market Segment

This study forecasts revenue at the Indonesia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Indonesia sulphuric acid market based on the below-mentioned segments:

Indonesia Sulphuric Acid Market, By Raw Material

- Elemental Sulfur

- Base Metal Smelters

- Pyrite Ore

- Others

Indonesia Sulphuric Acid Market, By Application

- Fertilizers

- Petroleum Refining

- Metal Processing

- Drug Manufacturing

- Chemical Manufacturing

- Textile

- Industrial

- Automotive

- Pulp & Paper

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Indonesia sulphuric acid market size?A: Indonesia sulphuric acid market size is expected to grow from USD 103.6 million in 2024 to USD 161.5 million by 2035, growing at a CAGR of 4.12% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by mining and metal processing industries, which create strong demand for sulphuric acid because these industries extract nickel and copper while operating HPAL projects that support electric vehicle supply chains. The market experiences higher demand because fertilizer production expands, chemical manufacturing grows, and petroleum refining operations increase.

-

Q: What factors restrain the Indonesia sulphuric acid market?A: Constraints include the expensive capital and operational expenses, rigorous environmental and safety standards, and transportation difficulties throughout the archipelago and its reliance on mining and industrial operations, which create unpredictable demand patterns.

-

Q: How is the market segmented by raw material?A: The market is segmented into elemental sulfur, base metal smelters, pyrite ore, and others.

-

Q: Who are the key players in the Indonesia sulphuric acid market?A: Key companies include PT Pupuk Indonesia, PT Petrokimia Gresik, PT Smelting, PT Freeport Indonesia, PT Pupuk Kujang Cikampek, PT Multi Nitrotama Kimia, PT Amman Mineral Industri (AMIN), QMB New Energy Materials, PT Halmahera Persada Lygend, Morowali Multi Mandiri, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?