India Yogurt and Probiotic Drink Market Size, Share, and COVID-19 Impact Analysis, By Product (Spoonable Yogurt, Drinkable Yogurt, Probiotic Shots, Kefir and Fermented Drinks, and Plant-based Probiotic Drinks), By Base (Dairy-based, Non-dairy, and Plant-based), By Category (Plain and Unsweetened, Flavoured, and Functional), and India Yogurt and Probiotic Drink Market, Insight, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesIndia Yogurt and Probiotic Drink Market Insights Forecasts to 2035

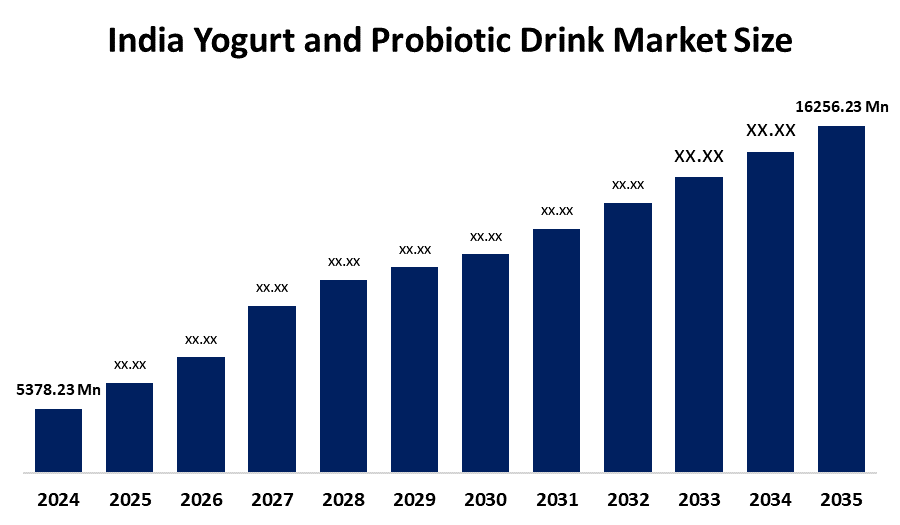

- India Yogurt and Probiotic Drink Market Size 2024: USD 5378.23 Million

- India Yogurt and Probiotic Drink Market Size 2035: USD 16256.23 Million

- India Yogurt and Probiotic Drink Market CAGR: 10.58%

- India Yogurt and Probiotic Drink Market Segments: Product, Base, and Category

Get more details on this report -

A yogurt probiotic drink is a dairy product that benefits the body by the addition of live probiotic cultures that contains it. It is produced from milk and probiotics, which are beneficial bacteria in the gut. It is used to help to balance the bacteria in the gut and should be taken regularly in a beneficial dose, which helps in a healthier gut, digestion, and a stronger immune system. The main raw material used to produce yogurt probiotic drink is cow or buffalo milk, or even certain types of plant source milk, probiotic starter culture, and some added sweeteners such as sugar or honey, etc. And flavour like fruit, vanilla, or extracts, etc. Then, the texture and texture fixing gels, such as pectin and gelatin. The stabilizer and gelling agents are used here to bring the texture and texture fixing effects. The yogurt probiotic drink is highly available in all markets, health clubs, online shops, etc.

A variety of factors contribute to the growth of the yogurt and probiotic beverage market in India. A major reason is that consumers have become increasingly aware of the connection between digestive health and overall wellness, leading to a heightened demand for these products. The market is largely driven by the desire for functional foods that provide digestive benefits to health-conscious individuals. Additionally, several studies indicate that the rising incidence of digestive disorders highlights the importance of probiotics, thereby creating a favorable environment for market expansion.

India yogurt probiotic drink sector is experiencing rapid expansion, which is mainly due to the increase in gut health awareness, urban lifestyles, and the familiarity with fermented dairy products. Recent product developments feature synbiotic formulations (probiotics + prebiotics), Indianised flavours such as mango and saffron, low sugar and immunity, focused variants, plant-based probiotic drinks, and longer shelf life aseptic formats that help to reduce cold, chain dependence. Major opportunities are available along the lines of functional health positioning, mass, market affordability, non-dairy options for lactose-intolerant consumers, tier, and e-commerce, led distribution, thus making the segment one of the most attractive parts of India's functional dairy market.

India Yogurt and Probiotic Drink Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5378.23 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 10.58% |

| 2035 Value Projection: | USD 16256.23 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product ,By Base |

| Companies covered:: | Yakult Danone India Pvt Ltd, Amul, Mother Dairy Fruits and Vegetables Pvt Ltd, Drums Food International (Epigamia), Heritage Foods Limited, Milkmantra Dairy Pvt Ltd, Milky Mist Dairy Food Ltd, Nestlé India Ltd, Dr. Reddy’s Laboratories Ltd, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Yogurt and Probiotic Drink Market:

Preventive healthcare has become an increasingly important factor, driven by the worldwide yogurt and probiotic drink market, to record growth levels. Recently, consumers have changed their point of view about health and wellness; more and more people are realizing that what they eat has a significant impact on their overall health. As a result of this change, people are not only searching for, but are actually demanding food and drinks that will give them real health benefits; therefore, yogurt and probiotic drinks are considered the first-choice products for the preventive healthcare, aware individuals. There is a growing trend among consumers to utilize these products to improve and maintain their digestive health. They are perceived not only as appetizing treats but also as functional foods that possess the capacity to strengthen the body against diseases.

India Yogurt and Probiotic Drink Market Size have largely expanded, yet regulatory hurdles and locally inconsistent quality standards continue to be limiting factors that deserve to be thoroughly looked at. The food and beverage industry is under very strict regulations in terms of probiotic utilization, health claims, and product labelling. The rules may differ considerably from one country to another, thus creating a complicated situation for manufacturers and slowing down the development of their markets.

Yogurt probiotic drinks are highly recommended for several reasons. Firstly, they are an excellent source of natural ingredients that support digestive health. Secondly, they can be easily consumed by anyone on a daily basis. Additionally, these drinks are deeply rooted in Indian culture due to the everyday use of fermented milk. Moreover, yogurt probiotic drinks provide live beneficial bacteria, combining health benefits with a refreshing taste. They fit well into busy lifestyles and are available in a variety of options, such as low-sugar, immunity-boosting, and plant-based versions. This variety makes them appealing to people of all age groups while promoting preventive health over time.

Market Segmentation

The India Yogurt and Probiotic Drink Market share is classified into product, base, and category.

By Product:

The India Yogurt and Probiotic Drink Market Size is divided by product into spoonable yogurt, drinkable yogurt, probiotic shots, kefir and fermented drinks, and plant-based probiotic drinks. Among these, the spoonable yogurt segment controlled the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The spoonable yogurt segment dominated due to its widespread daily consumption, affordability, strong presence of established dairy brands, and consumer trust in traditional curd-like formats, supporting sustained demand and steady growth.

By Base:

The India Yogurt and Probiotic Drink Market Size is divided by base into dairy-based, non-dairy, and plant-based. Among these, the dairy-based segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment dominance is driven by strong consumer familiarity with dairy, widespread availability, cost-effectiveness, and established cold-chain infrastructure, while its proven suitability for probiotic cultures supports continued demand and robust growth.

By Category:

The India Yogurt and Probiotic Drink Market Size is divided by category into plain and unsweetened, flavoured, and functional. Among these, the flavoured segment accounted for the highest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This growth is supported by strong consumer preference for more palatable, taste-driven options that help mask the natural tanginess of fermented products, making probiotic drinks more appealing and driving repeat purchases.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Yogurt and Probiotic Drink Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Yogurt and Probiotic Drink Market:

- Yakult Danone India Pvt Ltd

- Amul

- Mother Dairy Fruits and Vegetables Pvt Ltd

- Drums Food International (Epigamia)

- Heritage Foods Limited

- Milkmantra Dairy Pvt Ltd

- Milky Mist Dairy Food Ltd

- Nestlé India Ltd

- Dr. Reddy’s Laboratories Ltd

- Others

Recent Developments in India Yogurt and Probiotic Drink Market:

In November 2024, MilkyMist, a renowned dairy innovator from South India, has teamed up with SIG and AnaBio Technologies to introduce the world’s first long-life probiotic buttermilk in aseptic carton packs.

In July 2024, Yakult, renowned for its probiotic health drinks, is setting ambitious goals for its market in India, planning to boost sales by approximately 50% in the coming years. This surge is expected to be driven by the introduction of its new mango flavour, capitalizing on the fruit's widespread appeal in India.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Yogurt and Probiotic Drink Market Size based on the below-mentioned segments:

India Yogurt and Probiotic Drink Market, By Product

- Spoonable Yogurt

- Drinkable Yogurt

- Probiotic Shots

- Kefir And Fermented Drinks

- Plant-based Probiotic Drinks

India Yogurt and Probiotic Drink Market, By Base

- Dairy-based

- Non-dairy And

- Plant-based

India Yogurt and Probiotic Drink Market, By Category

- Plain And Unsweetened

- Flavored

- Functional

Frequently Asked Questions (FAQ)

-

Q: What is the projected India yogurt and probiotic drink market size and growth rate?A: The market is expected to grow from USD 5378.23 million in 2024 to USD 16256.23 million by 2035, at a CAGR of 10.58% during 2025-2035.

-

Q: What drives the India yogurt and probiotic drink market's expansion?A: Rising awareness of gut health, demand for functional foods, urban lifestyles, and increasing digestive disorders fuel growth, alongside innovations like low-sugar and plant-based options.

-

Q: What are the main product segments of India yogurt and probiotic drink market?A: Segments include spoonable yogurt, drinkable yogurt, probiotic shots, kefir and fermented drinks, and plant-based probiotic drinks. Spoonable yogurt led in 2024 due to daily consumption and brand trust.

-

Q: How is the India yogurt and probiotic drink market segmented by base?A: Divided into dairy-based, non-dairy, and plant-based. Dairy-based products dominated in 2024 thanks to familiarity, affordability, and strong infrastructure.

-

Q: What categories exist, and which is the largest in India yogurt and probiotic drink market?A: Plain and unsweetened, flavoured, and functional. Flavoured held the top share in 2024, driven by consumer preference for tasty options that mask tanginess.

-

Q: Who are the top companies in India yogurt and probiotic drink market?A: Key players include Yakult Danone India, Amul, Mother Dairy, Epigamia, Heritage Foods, Milkmantra Dairy, Milky Mist, Nestle India, and Dr. Reddy’s laboratories.

-

Q: What recent developments highlight in India yogurt and probiotic drink market?A: In July 2024, Yakult aimed for 50% sales growth with a new mango flavour. MilkyMist partnered with SIG and AnaBio Technologies to launch the world's first long-life probiotic buttermilk in aseptic cartons.

Need help to buy this report?