India Wound Therapy Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Electric Stimulation Devices, Negative Pressure Wound Therapy, Oxygen and Hyperbaric Oxygen Equipment, Pressure Relief Devices, and Other Product), By Application (Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, Surgical & Traumatic Wounds, Burns, and Others), By End User (Hospitals, Specialty Clinics, Home Healthcare, and Other End User), and India Wound Therapy Devices Market, Insight, Industry Trend, Forecasts to 2035

Industry: HealthcareIndia Wound Therapy Devices Market Insights Forecasts to 2035

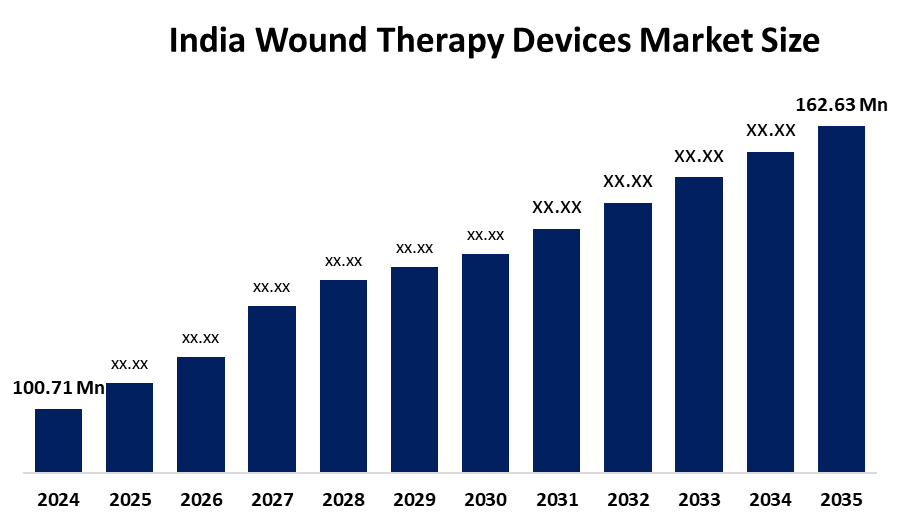

- India Wound Therapy Devices Market Size 2024: USD 100.71 Million

- India Wound Therapy Devices Market Size 2035: USD 162.63 Million

- India Wound Therapy Devices Market CAGR: 4.45%

- India Wound Therapy Devices Market Segments: Product, Application, and End User

Get more details on this report -

The wound therapy devices sector is part of healthcare that refers to medical devices that are intended to help, quicken, and control the healing process of both acute and chronic wounds by managing moisture, pressure, oxygen, or electrical stimulation at the wound area. These devices are made using raw materials such as medical-grade polymers and plastics, silicone, polyurethane foams, hydrocolloids, stainless steel components, sensors, tubing, and electronic modules. They are commonly used for healing diabetic foot ulcers, pressure ulcers, venous leg ulcers, surgical wounds, burns, and traumatic injuries in hospitals, clinics, and home care environments for infection control, tissue regeneration, and obtaining better healing outcomes

.

The medical devices sector in India is expected to be expanded by Government support through the National Medical Devices Policy 2023 from approximately USD 11 billion to USD 50 billion by 2030, which will encourage domestic manufacturing, R&D, and reduced import, advanced wound therapy technologies like negative pressure wound therapy systems will be the direct beneficiaries. In line with this, the government has introduced a 500 crore medical devices support scheme and set up medical device parks in several states to increase infrastructure and innovation capacity, whereas CDSCO regulatory reforms are making it easier to get approvals and enter the market.

Device approval regulatory pathways are being simplified to encourage innovation and commercialization of wound care technologies by the government and regulatory agencies. Electric stimulation devices are getting recognized and accepted more in clinics, which are helping the doctors embed such solutions in the treatment protocols more easily, thus resulting in better patient outcomes and backing the market growth. The market for wound therapy devices has a lot of room for growth and innovations as it is backed by an increasing patient population, continuous technological advances, and a regulatory landscape that is supportive of the healthcare industry.

Market Dynamics of the India Wound Therapy Devices Market:

The Indian wound therapy devices market is mainly driven by the growing occurrence of chronic wounds, diabetes, trauma injuries, and the aging population. The increasing number of surgical procedures and the expanding healthcare infrastructure are additionally helping the demand to rise. Some of the positive factors are the supportive government policies for medical device manufacturing, the increasing usage of advanced and cost-effective wound care technologies, the heightened awareness by clinicians, and the greater application of wound therapy devices in hospitals, clinics, and home care settings in both urban and semi-urban areas.

Wound therapy devices restrain from gaining extensive use among the larger population, especially in healthcare markets that are very sensitive to price. The elevated price of the state, of, the, art wound care devices and the consumables that go along with them put such goods out of the reach of smaller hospitals and also of patients who receive their treatment at home.

India has a huge population suffering from diabetes, which results in a high number of patients with DFUs. Therefore, the demand for modern wound care management devices, including NPWT systems, to reduce the risk of amputations is constantly growing. Besides, the severe number of road traffic accidents, industrial accidents, and household incidents (burn injuries in particular) in India requires the use of specialized, advanced wound care products. Furthermore, the rise in the number of elderly people leads to an increase in the prevalence of chronic wounds like pressure ulcers.

India Wound Therapy Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 100.71 Million i |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.45% |

| 2035 Value Projection: | USD 162.63 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product |

| Companies covered:: | 3M India Ltd., Abbott India Ltd., B. Braun Medical India Pvt. Ltd., Coloplast India Pvt. Ltd., ConvaTec India, Hollister Medical India, Johnson & Johnson Pvt. Ltd., Medtronic India Pvt. Ltd., Molnlycke Health Care India, Smith & Nephew, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India wound therapy devices market share is classified into product, application, and end user.

By Product:

The India wound therapy devices market is divided by product into electric stimulation devices, negative pressure wound therapy, oxygen and hyperbaric oxygen equipment, pressure relief devices, and other products. Among these, the negative pressure wound therapy segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance is driven by their active promotion of faster wound healing, removing excess fluids, reducing infection risk, and can be used for many types of wounds, including chronic, surgical, and traumatic.

By Application:

The India wound therapy devices market is divided by application into diabetic foot ulcers, pressure ulcers, venous leg ulcers, surgical & traumatic wounds, burns, and others. Among these, the diabetic foot ulcers segment controlled the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The diabetic foot ulcers segment dominated due to the country’s high diabetes prevalence, increased risk of infections, poor natural healing, and the critical need for effective advanced wound care solutions.

By End User:

The India wound therapy devices market is divided by end user into hospitals, specialty clinics, home healthcare, and other end users. Among these, the hospitals segment accounted for the highest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This growth is supported by the high volume of chronic, surgical, and trauma-related wound cases treated in hospitals, where advanced wound therapy devices are most commonly used.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India wound therapy devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Wound Therapy Devices Market:

- 3M India Ltd.

- Abbott India Ltd.

- B. Braun Medical India Pvt. Ltd.

- Coloplast India Pvt. Ltd.

- ConvaTec India

- Hollister Medical India

- Johnson & Johnson Pvt. Ltd.

- Medtronic India Pvt. Ltd.

- Molnlycke Health Care India

- Smith & Nephew

- Others

Recent Developments in India Wound Therapy Devices Market:

In January 2026, Kerala-based Alicorn Medical announced the official launch of CholeDerm. This is a significant milestone of India’s first indigenously manufactured extracellular matrix (ECM)-based Class D wound healing medical device, at Sree Chitra Tirunal Institute for Medical Sciences and Technology. This launch represents the successful translation of indigenous research into clinical reality, made possible through the unwavering support of DST, BIRAC, SCTIMST, and the collaborative spirit between scientists, policymakers, and industry.

In May 2025, MedVital’s flagship product, NoWound, is a digitally enabled Negative Pressure Wound Therapy (NPWT) device designed for precise wound healing in hospitals, clinics, and home care. The startup plans to introduce liquid chitosan-based dressings for hard-to-heal wounds and expand into dermal and hair regeneration, enabling new therapeutic and aesthetic treatment options. Different conventional NPWT systems, NoWound is compact, made in India, and suitable for deployment in resource-limited environments.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the India wound therapy devices market based on the below-mentioned segments:

India Wound Therapy Devices Market, By Product

- Electric Stimulation Devices

- Negative Pressure Wound Therapy

- Oxygen and Hyperbaric Oxygen Equipment

- Pressure Relief Devices

- Other Products

India Wound Therapy Devices Market, By Application

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Surgical & Traumatic Wounds

- Burns

- Others

India Wound Therapy Devices Market, By End User

- Hospitals

- Specialty Clinics

- Home Healthcare

- Other End User

Frequently Asked Questions (FAQ)

-

What is the projected growth of the India wound therapy devices market from 2024 to 2035?The market is expected to grow from USD 100.71 million in 2024 to USD 162.63 million by 2035, at a CAGR of 4.45% during 2025-2035

-

What materials are commonly used in wound therapy devices?Devices use medical-grade polymers, plastics, silicone, polyurethane foams, hydrocolloids, stainless steel, sensors, tubing, and electronic modules to manage wound healing

-

Which end-use segment dominated the wound therapy devices market in 2024?Hospitals held the largest share in 2024 and are projected to grow at a strong CAGR, due to high volumes of chronic, surgical, and trauma wound cases treated there.

-

What drives the dominance of negative pressure wound therapy (NPWT)?NPWT led product share in 2024 with expected high CAGR growth; it speeds healing by removing fluids, cutting infection risks, and treating chronic, surgical, and traumatic wounds

-

How does India's diabetes prevalence impact the wound therapy devices market?High diabetes rates make diabetic foot ulcers the top application segment in 2024, with significant CAGR ahead, as they raise infection risks and demand advanced healing solutions.

-

What government initiatives support the medical devices sector?The National Medical Devices Policy 2023 targets USD 50 billion by 2030 via manufacturing boosts, an INR 500 crore scheme, device parks, and CDSCO reforms easing approvals.

-

Who are the top key companies in this (WTD) market?Leading players include Smith & Nephew, Abbott India Ltd., Johnson & Johnson Pvt. Ltd., 3M India Ltd., Medtronic India Pvt. Ltd., Mölnlycke Health Care India, ConvaTec India, Coloplast India Pvt. Ltd., B. Braun Medical India Pvt. Ltd., and Hollister Medical India.

Need help to buy this report?