India Wiring Harness Market for Off-Highway Vehicles Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Construction Equipment Type (Earthmoving Equipment, Material Handling Equipment, Concrete Equipment, and Road Construction Equipment), By Construction Harness Type (Main Harness, Engine Harness, Chassis Harness, Body Harness, and Cab/Operator Cabin Harness), By Construction Demand Source (OEM and Aftermarket/Replacement), By Agriculture Equipment Type (Tractors, Harvesters, Transplanters, Power Tillers, and Other), By Agriculture Harness Type (Engine Harness, Main Chassis Harness, Dashboard Harness, and Implement Control Harness), By Agriculture Demand Source (OEM and Aftermarket/Replacement), Analysis and Forecast 2025 - 2035

Industry: Automotive & TransportationIndia Wiring Harness Market for Off-Highway Vehicles Summary, Size & Emerging Trends

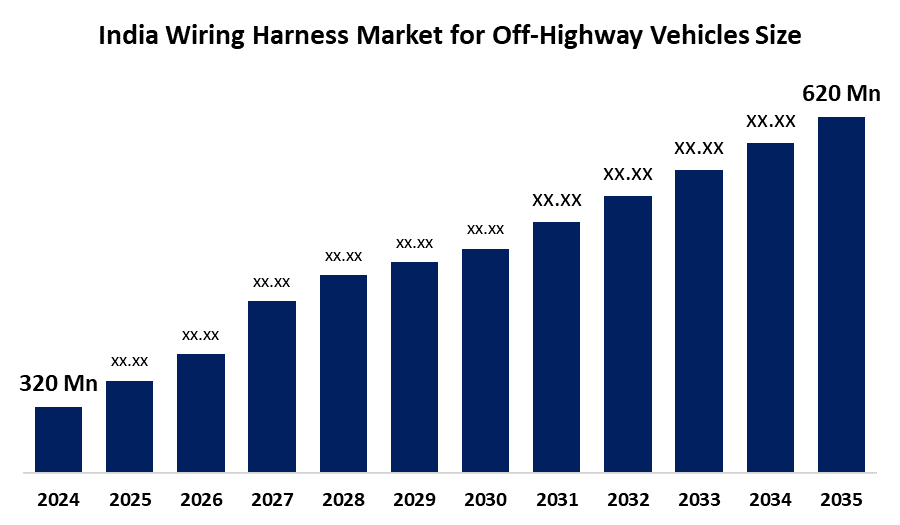

According to Spherical Insights, The India Wiring Harness Market for Off-Highway Vehicles Size is expected to grow from USD 320 Million in 2024 to USD 620 Million by 2035, at a CAGR of 6.2% during the forecast period 2025-2035. Increasing mechanization in agriculture, expanding infrastructure projects, and rising mining activities are key drivers boosting demand for wiring harnesses in off-highway vehicles across India.

Get more details on this report -

Key Market Insights

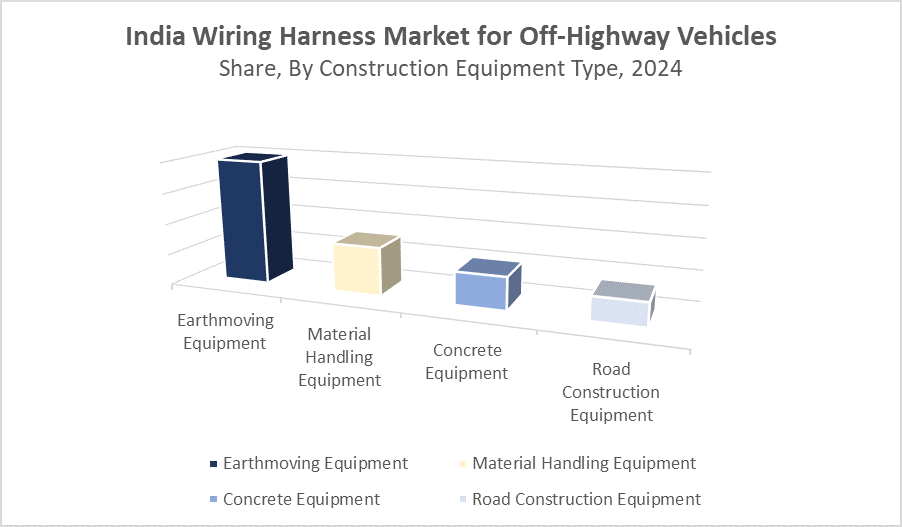

- Earthmoving equipment harnesses dominate the market share due to high demand in infrastructure projects.

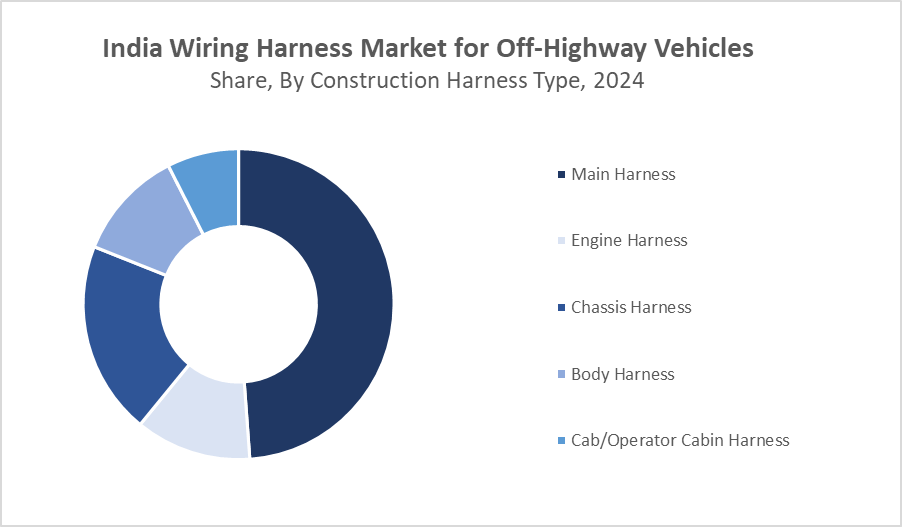

- Main harnesses are the largest revenue contributors as they form the core electrical network of construction vehicles.

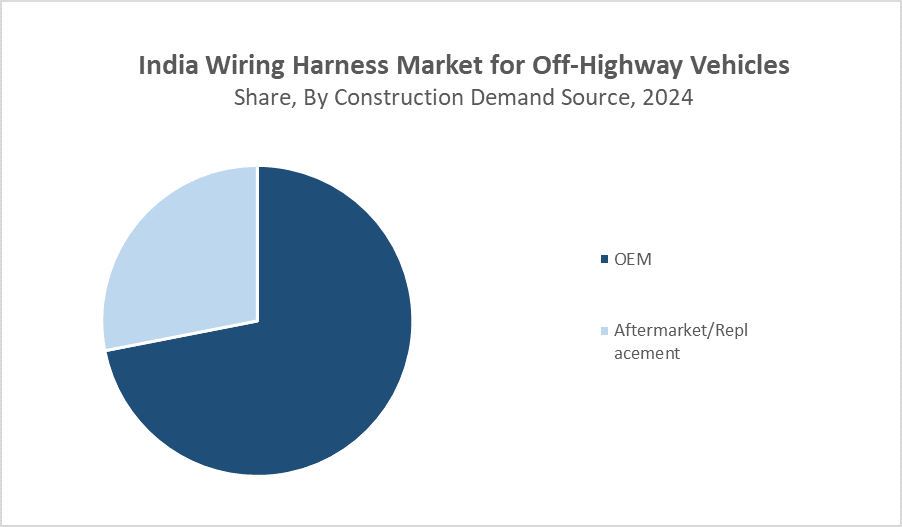

- OEM segment accounts for the majority of demand, driven by increasing production of new construction machinery.

- Tractors hold the largest market share supported by modernization of farming practices.

- Engine harnesses lead due to critical role in vehicle operation and safety.

- Aftermarket replacement demand is rising steadily as older fleets require maintenance and upgrades.

Market Forecast and Revenue Outlook

- 2024 Market Size: USD 320 Million

- 2035 Projected Market Size: USD 620 Million

- CAGR (2025-2035): 6.2%

India Wiring Harness Market for Off-Highway Vehicles

The wiring harness market for off-highway vehicles in India focuses on the production and integration of complex electrical cable assemblies used to interconnect various electrical and electronic components in vehicles such as tractors, excavators, and mining trucks. Wiring harnesses are critical for vehicle safety, operational efficiency, and durability, providing organized and secure electrical connections resistant to vibration, moisture, and extreme environmental conditions. Growing investments in agricultural mechanization, construction infrastructure, and mining sectors drive the demand for reliable wiring solutions. Government initiatives supporting rural mechanization and infrastructure development further bolster the market. Technological advancements such as the integration of advanced sensors and telematics in off-highway vehicles enhance the complexity and demand for sophisticated wiring harnesses.

India Wiring Harness Market for Off-Highway Vehicles Trends

- Increasing adoption of lightweight aluminum wiring harnesses to improve fuel efficiency and reduce vehicle weight.

- Growing integration of smart and IoT-enabled off-highway vehicles requiring complex wiring systems.

- Expansion of local manufacturing capabilities and government ‘Make in India’ initiatives supporting domestic production.

India Wiring Harness Market for Off-Highway Vehicles Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 320 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.2% |

| 2035 Value Projection: | USD 620 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 171 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Construction Harness Type, By Construction Demand Source, By Agriculture Equipment Type, By Agriculture Demand Source |

| Companies covered:: | Motherson Sumi Systems Limited (MSSL), Supreme Industries, Tata AutoComp Systems, Spark Minda, LKQ Industries, Yazaki India, Lear Corporation India, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

India Wiring Harness Market for Off-Highway Vehicles Dynamics

Driving Factors: Mechanization in agriculture and infrastructure development

Key growth factors include rising mechanization of Indian agriculture and booming infrastructure and mining activities requiring robust off-highway vehicles equipped with advanced wiring harnesses. The push towards vehicle electrification and safety compliance also drives wiring harness adoption. Increasing customization of vehicles for specialized applications necessitates sophisticated wiring solutions. Additionally, government subsidies and support for rural development and mining exploration promote market growth.

Restrain Factors: High raw material costs and competition from imported components

High costs of copper and other raw materials impact production expenses. The availability of low-cost imported wiring harnesses challenges local manufacturers. Fragmented supply chains and inconsistent quality in domestic production can limit market growth. Stringent safety and quality standards require continuous innovation and investment, posing challenges for smaller manufacturers.

Opportunity: Growth of electric and autonomous off-highway vehicles

The growing adoption of electric and autonomous off-highway vehicles opens new avenues for advanced wiring harnesses integrating power electronics and sensor networks. Expansion into untapped rural markets and increased government focus on infrastructure provide opportunities. Technological innovation in harness design to improve durability and reduce assembly time offers competitive advantages. Collaboration with global OEMs to manufacture customized wiring solutions enhances market potential.

Challenges: Supply chain disruptions and skilled labor shortages

Disruptions in raw material supply due to geopolitical tensions and fluctuating global copper prices create volatility. Shortage of skilled labor and technical expertise in wiring harness design and assembly affects production efficiency. Rapid technological changes demand continuous workforce upskilling. Compliance with evolving safety and environmental regulations adds complexity and cost.

India Wiring Harness Market for Off-Highway Vehicles Ecosystem Analysis

The ecosystem comprises raw material suppliers, wiring harness manufacturers, vehicle OEMs, and aftermarket service providers. Major wiring harness manufacturers collaborate closely with construction and agriculture equipment OEMs to deliver customized solutions meeting Indian market requirements. Regulatory bodies enforce quality and safety standards. Growing emphasis on sustainability drives innovation in manufacturing and recycling practices.

India Wiring Harness Market for Off-Highway Vehicles, By Construction Equipment Type

Earthmoving equipment includes heavy machinery like excavators, bulldozers, backhoes, and loaders used primarily in construction, mining, and large-scale infrastructure projects. This segment leads in revenue share within the construction equipment wiring harness market because of the massive demand for these machines in India’s rapidly growing infrastructure sector. Road building, urban development, and government-backed projects such as highway expansions and metro rail construction require a substantial fleet of earthmoving equipment. Wiring harnesses in these machines are critical for controlling engines, hydraulics, lighting, and electronic safety systems, ensuring operational efficiency and durability in harsh working environments.

Get more details on this report -

Material handling equipment encompasses machinery such as forklifts, cranes, conveyors, and stackers used to transport, store, and manage materials in warehouses, manufacturing plants, ports, and logistics hubs. This segment is witnessing growing demand due to the rapid expansion of India’s warehousing and logistics sectors, driven by the rise of e-commerce, retail, and manufacturing industries. Efficient material handling improves productivity and safety, and the wiring harnesses in these vehicles connect critical systems like engine controls, sensors, safety alarms, and automation modules.

India Wiring Harness Market for Off-Highway Vehicles, By Construction Harness Type

The main harness segment holds the largest share in the construction harness market, accounting for approximately 40% of the total revenue in 2024. This dominance is due to the main harness’s critical function as the central electrical backbone of construction vehicles. It connects major electronic systems including the engine control unit (ECU), power distribution, lighting, and communication systems. Because it integrates and manages the vehicle’s entire electrical network, the main harness must be highly reliable and durable to withstand harsh environmental and operational conditions typical in construction sites. The increasing complexity of vehicle electronics, coupled with the rising adoption of automation and safety features in construction equipment, continues to drive demand for sophisticated main harnesses.

Get more details on this report -

The chassis harness segment is witnessing strong growth, contributing about 25% of the construction harness market revenue in 2024, with a projected CAGR higher than the market average over the forecast period. This segment benefits from the integration of advanced vehicle dynamics and control systems, such as anti-lock braking systems (ABS), electronic stability control (ESC), and advanced driver assistance systems (ADAS) in off-highway construction vehicles. The chassis harness connects sensors, actuators, and control modules distributed throughout the vehicle’s frame and suspension, enhancing operational safety and performance. Growing focus on improving ride comfort, safety, and compliance with evolving regulatory standards is fueling the rising demand for chassis harnesses.

India Wiring Harness Market for Off-Highway Vehicles, By Construction Demand Source

The OEM segment dominates the construction demand source category, accounting for approximately 70% of the market revenue in 2024. This dominance is driven by the strong growth in new vehicle production across India’s construction equipment sector. Rapid infrastructure development, government initiatives like the National Infrastructure Pipeline, and increasing private investments in construction projects are fueling demand for new earthmoving, material handling, and road construction equipment. OEMs require high-quality wiring harnesses integrated during vehicle assembly to meet stringent safety, performance, and durability standards. The adoption of advanced electronics and smart vehicle technologies further increases wiring harness complexity, boosting OEM demand.

Get more details on this report -

The aftermarket/replacement segment holds around 30% of the construction wiring harness market revenue in 2024 and is growing steadily. As construction vehicles age, wiring harnesses can suffer wear and tear due to harsh operating conditions, necessitating maintenance and replacement. The aftermarket segment includes repair shops, service centers, and third-party suppliers providing wiring harnesses to extend vehicle life and ensure operational reliability. The steady growth of this segment is supported by the expanding fleet of aging construction equipment in India, along with increasing awareness about preventive maintenance to avoid costly downtime. Additionally, the rising availability of cost-effective aftermarket wiring harness solutions is contributing to segment growth.

India Wiring Harness Market for Off-Highway Vehicles, By Agriculture Equipment Type

The tractors segment is the largest in the agriculture equipment wiring harness market, accounting for approximately 55% of the revenue share in 2024. This leadership is primarily driven by the ongoing mechanization of Indian agriculture, as tractors remain the most widely used equipment for tilling, planting, and hauling in farms across the country. Government subsidies and rural development programs encouraging tractor adoption further boost demand. Wiring harnesses in tractors play a crucial role in integrating engine controls, lighting, sensors, and operator interface systems, which are becoming increasingly sophisticated with the introduction of GPS, automation, and emission control technologies. As a result, the demand for reliable, high-quality wiring harnesses in tractors continues to grow steadily.

The harvester segment holds a moderate share of about 20% of the agriculture equipment wiring harness market revenue in 2024. Growth in this segment is supported by the rise in commercial and large-scale farming practices in India, which rely on harvesters for efficient crop collection and processing. The wiring harnesses in harvesters are vital for controlling complex machinery components such as threshers, conveyors, and cutting mechanisms, along with electronic monitoring and safety systems. Although not as large as the tractor segment, harvesters are seeing increasing adoption in key crop-producing regions, driving consistent demand growth for specialized wiring harnesses adapted to these machines.

India Wiring Harness Market for Off-Highway Vehicles, By Agriculture Harness Type

The engine harness segment is the leading category in the agriculture wiring harness market, accounting for approximately 45% of the revenue share in 2024. This segment is crucial as it directly supports engine performance, fuel efficiency, and safety systems in agricultural equipment like tractors and harvesters. The engine harness connects critical components such as sensors, fuel injectors, ignition systems, and emission control units, ensuring optimal engine operation under demanding field conditions. With increasing regulatory focus on emission standards and the integration of electronic engine management systems, the demand for advanced and durable engine harnesses continues to rise steadily in the Indian agriculture sector.

Get more details on this report -

The aftermarket/replacement segment holds about 35% of the agriculture wiring harness market revenue in 2024 and is experiencing steady growth. This growth is driven by farmers increasing focus on maintaining and upgrading their existing machinery to enhance performance and extend operational life. Harsh working conditions and frequent use in rural areas necessitate regular maintenance, inclusing wiring harness repairs or replacements. Additionally, availability of cost effective aftermarket solutions and rising awareness about preventive maintenance contribute to this segments expansion. The growing base of aging agricultural equipment in India makes the aftermarket an important segment for wiring harness suppliers.

WORLDWIDE TOP KEY PLAYERS IN THE INDIA WIRING HARNESS MARKET FOR OFF-HIGHWAY VEHICLES INCLUDE

- Motherson Sumi Systems Limited (MSSL)

- Supreme Industries

- Tata AutoComp Systems

- Spark Minda

- LKQ Industries

- Yazaki India

- Lear Corporation India

- Others

Market Segment

This study forecasts revenue at global, regional and country levels from 2020 to 2035. Spherical Insights has segmented the India wiring harness market for off-highway vehicles based on the below-mentioned segments:

India Wiring Harness Market for Off-Highway Vehicles, By Construction Equipment Type

- Earthmoving Equipment

- Material Handling Equipment

- Concrete Equipment

- Road Construction Equipment

India Wiring Harness Market for Off-Highway Vehicles, By Construction Harness Type

- Main Harness

- Engine Harness

- Chassis Harness

- Body Harness

- Cab/Operator Cabin Harness

India Wiring Harness Market for Off-Highway Vehicles, By Construction Demand Source

- OEM

- Aftermarket/Replacement

India Wiring Harness Market for Off-Highway Vehicles, By Agriculture Equipment Type

- Tractors

- Harvesters

- Transplanters

- Power Tillers

- Other

India Wiring Harness Market for Off-Highway Vehicles, By Agriculture Harness Type

- Engine Harness

- Main Chassis Harness

- Dashboard Harness

- Implement Control Harness

India Wiring Harness Market for Off-Highway Vehicles, By Agriculture Demand Source

- OEM

- Aftermarket/Replacement

Frequently Asked Questions (FAQ)

-

Q: What is the market size of the India Wiring Harness Market for Off-Highway Vehicles in 2024?A: The India Wiring Harness Market for Off-Highway Vehicles was estimated at USD 450 million in 2024.

-

Q: What is the forecasted CAGR of the India Wiring Harness Market for Off-Highway Vehicles from 2025 to 2035?A: The market is expected to grow at a CAGR of around 7.8% during the period 2025–2035.

-

Q: Which construction equipment type holds the largest share in the India wiring harness market?A: Earthmoving equipment holds the largest share due to its extensive use in road building and infrastructure projects.

-

Q: What is the revenue share of OEM demand source in the agriculture segment of the India wiring harness market?A: The OEM segment accounts for approximately 65% of the revenue share in the agriculture wiring harness market.

-

Q: Who are the top companies operating in the India Wiring Harness Market for Off-Highway Vehicles?A: Key players include Minda Industries Ltd., Aptiv PLC, Dura Automotive Systems, Leoni AG, and Sumitomo Wiring Systems Ltd.

-

Q: What are the main drivers of growth in the India wiring harness market for off-highway vehicles?A: Mechanization of agriculture, rising infrastructure development, increasing vehicle production, and adoption of advanced vehicle electronics are key drivers.

-

Q: What challenges could limit the growth of the India wiring harness market?A: Raw material price volatility, stringent regulatory norms, supply chain disruptions, and competition from alternative wiring technologies are major challenges.

Need help to buy this report?