India Wastewater Treatment Chemicals Market Size, Share, By End Use (Municipal Water Treatment, Power, Oil & Gas, Chemicals & Fertilizers, Others), India Wastewater Treatment Chemicals Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Wastewater Treatment Chemicals Market Insights Forecasts to 2035

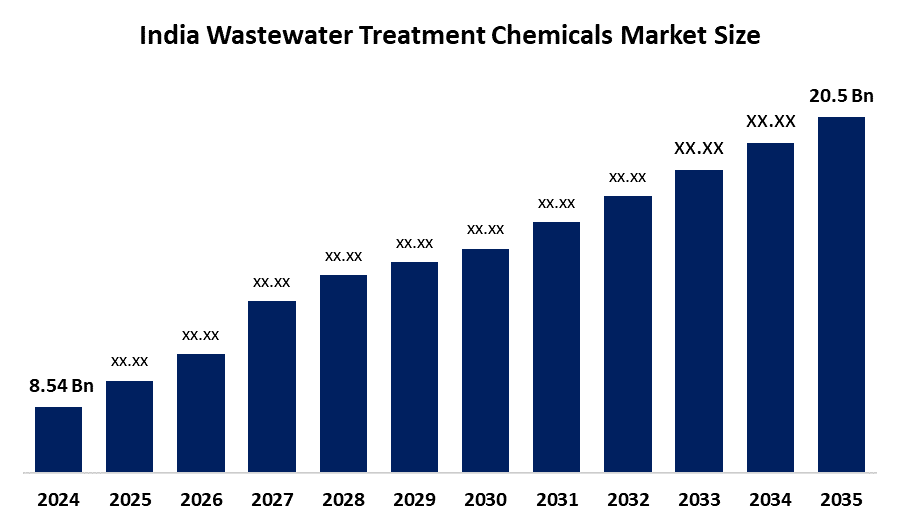

- India Wastewater Treatment Chemicals Market Size 2024: USD 8.54 Billon

- India Wastewater Treatment Chemicals Market Size 2035: USD 20.5 Billon

- India Wastewater Treatment Chemicals Market CAGR 2024: 8.29%

- India Wastewater Treatment Chemicals Market Segments: End-Use

Get more details on this report -

The market involves chemicals used to treat industrial and municipal wastewater to remove contaminants, pathogens, and impurities. These chemicals include coagulants, flocculants, disinfectants, and pH regulators, ensuring safe water discharge and reuse.

Thermax Limited inaugurated a manufacturing plant in Pune, which produces advanced water and wastewater treatment products that include treatment chemicals and systems designed for sustainable and efficient operations. The development enables superior domestic production capacity while introducing advanced treatment technologies, which enable efficient wastewater processing.

The Atal Mission for Rejuvenation and Urban Transformation (AMRUT) and Smart Cities Mission. The programs exist to improve urban wastewater management systems while developing superior sanitation facilities for urban areas. The government uses AMRUT and Smart Cities funding to support STPs and decentralized wastewater systems, together with monitoring and reuse-oriented projects, which drive equipment and chemical sector expansion.

The combination of increasing industrial activity and new discharge regulations, together with river restoration initiatives and rising water reuse requirements, creates major market possibilities for advanced treatment chemicals, eco-friendly products and innovative technologies used in municipal and industrial wastewater treatment facilities.

India Wastewater Treatment Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.54 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.29% |

| 2035 Value Projection: | USD 20.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By End Use |

| Companies covered:: | Thermax Limited, Ion Exchange (India) Limited, VA Tech Wabag Limited, Nalco Water (an Ecolab company), Chembond Chemicals Limited, Suez India, BASF SE, SNF, Kemira, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Wastewater Treatment Chemicals Market:

The India Wastewater Treatment Chemicals Market Size is driven by rapid industrial growth, increasing urbanization, and stringent government regulations on wastewater discharge, which are boosting demand for treatment chemicals. Rising awareness of water conservation, river rejuvenation programs like Namami Gange, and expansion of municipal and industrial sewage treatment infrastructure are also driving market growth, encouraging the adoption of advanced, eco-friendly chemical solutions for efficient water purification and reuse.

The India Wastewater Treatment Chemicals Market Size is restrained by the High costs of advanced treatment chemicals, lack of awareness in smaller industries, inconsistent wastewater infrastructure in rural areas, and fragmented market distribution limit widespread adoption, slowing overall growth despite rising environmental regulations and urbanization.

The future of India Wastewater Treatment Chemicals Market Size is bright and promising, with the Growing government initiatives, rising industrial and municipal wastewater treatment needs, technological innovations, and increasing adoption of sustainable, eco-friendly chemical solutions driving market expansion and long-term opportunities across India.

Market Segmentation

The India Wastewater Treatment Chemicals Market share is classified into end-use.

By End-Use:

The India Wastewater Treatment Chemicals Market Size is divided by end-use into municipal water treatment, power, oil & gas, chemicals & fertilizers, and others. Among these, the municipal water treatment segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to rising urbanization, strict discharge regulations, growing sewage volumes, and continuous government investment in wastewater treatment infrastructure across India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Wastewater Treatment Chemicals Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Wastewater Treatment Chemicals Market:

- Thermax Limited

- Ion Exchange (India) Limited

- VA Tech Wabag Limited

- Nalco Water (an Ecolab company)

- Chembond Chemicals Limited

- Suez India

- BASF SE

- SNF

- Kemira

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Wastewater Treatment Chemicals Market Size based on the below-mentioned segments:

India Wastewater Treatment Chemicals Market, By End Use

- Municipal Water Treatment

- Power

- Oil & Gas

- Chemicals & Fertilizers

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India wastewater treatment chemicals market size?A: India wastewater treatment chemicals market is expected to grow from USD 8.54 billion in 2024 to USD 20.5 billion by 2035, growing at a CAGR of 8.29% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the construction industry, automotive sector and wood panel manufacturing sector, which show strong demand, which drives the rising use of phenolic resins and bisphenol-A and the development of infrastructure and the increasing demand for plastics and the government initiatives that support domestic chemical production and industrial development.

-

Q: What factors restrain the India wastewater treatment chemicals market?A: Constraints include the market facing multiple challenges because of its dependence on imported crude oil and its labor costs, the environmental protection measures and safety protocols and its restricted ability to produce phenol at domestic facilities when compared to worldwide production capacity.

-

Q: How is the market segmented by end use?A: The market is segmented into municipal water treatment, power, oil & gas, chemicals & fertilizers, and others.

-

Q: Who are the key players in the India wastewater treatment chemicals market?A: Key companies include Thermax Limited, Ion Exchange (India) Ltd., VA Tech Wabag Limited, Nalco Water (Ecolab), Chembond Chemicals Limited, Suez India, BASF SE, SNF India, Kemira, Solenis, Acuro Organics Limited, Kurita Water Industries Ltd., Vasu Chemicals, Chemtex Speciality Limited, Sicagen India and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?