India Wallpaper Market Size, Share, and COVID 19 Impact Analysis, By Product Type (Vinyl Wallpapers, Non Woven Wallpapers, Paper Wallpapers, Fabric Wallpapers, Others), By Distribution Channel (Offline Retail, Online Platforms), By End User (Residential, Commercial) and India Wallpaper Market Insights, Industry Trend, Forecast to 2035

Industry: Consumer GoodsIndia Wallpaper Market Insights Forecasts to 2035

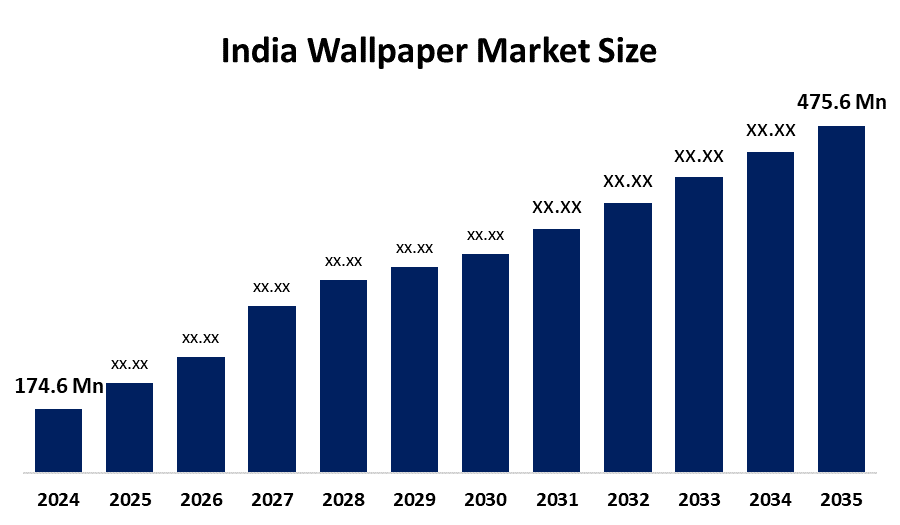

- India Wallpaper Market Size Was Estimated at USD 174.6 Million in 2024.

- The Market Size is Expected to Grow at a CAGR of 9.54% from 2025 to 2035.

- India Wallpaper Market Size is Expected to Reach USD 475.6 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the India Wallpaper Market size is anticipated to reach USD 475.6 million by 2035, growing at a CAGR of 9.54% during the forecast period. The market is driven by increasing consumer spending on home decor, rising real estate and renovation activity, and growing preference for aesthetic wall solutions.

Market Overview

Wallpaper is a decorative wall covering that is used to make the interiors of any space more attractive. These spaces can be residential, commercial, hospitality, or institutional. It is basically a product that is both printed and coated or made from a textured material that not only enhances the look of a wall but also conceals the defects. Moreover, it offers themes and customizable design choices that a mere paint cannot provide. The use of wallpapers has become so popular that they are now found in homes, offices, hotels, retail stores, and even in public places where they serve the purpose of beautification, giving a wall a different look, and branding.

The expanding market is a result of the increasing rate of urbanization, rise in disposable incomes, and more investments in housing and commercial infrastructures. The industry is also witnessing a number of technological breakthroughs like spectacular digital printing, 3D textured finishes, and pattern customization which is not only widening the design options but also shortening the production lead times. Government, funded projects for affordable housing and urban development, e.g., Pradhan Mantri Awas Yojana (PMAY) and Smart Cities Mission are some of the factors contributing to the demand for interior decor products. Some of the opportunities existing in the area of future market include, the increased use of wallpapers in Tier, II and Tier, III cities, the demand for environmentally friendly and sustainable wallpapers, and the digitally personalized designs. The sustained demand will emanate from the continuous growth of real estate, renovation of interiors that have been trending, and the modernization of people's lifestyle, thus, there will be a great market potential for the long term.

Report Coverage

This research report categorizes the market for the India Wallpaper Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India wallpaper market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India wallpaper market.

India Wallpaper Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 174.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 9.54% |

| 2035 Value Projection: | USD 475.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Product Type, By End User |

| Companies covered:: | Marshalls Wallcoverings, Nilaya by Asian Paints, Elementto Lifestyle Wallcoverings Pvt. Ltd, Excel Wallcoverings, D’Decor Home Fabrics Pvt. Ltd., Wallskin (UDC Homes / Green Apple Design Pvt. Ltd), Goodrich Global India Pvt. Ltd., Murlidhar Decor Pvt. Ltd., Muraspec India Wallcoverings Pvt. Ltd., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

India Wallpaper Market Size expands as the lifestyle gets more modern and people become more aware of the design. The adoption is being boosted by the DIY trends, renter, friendly solutions, and health, conscious eco, friendly materials. Consumers are being attracted by technological innovations such as quick, install wallpapers and custom patterns. The demand for the market is being further increased by the expansion of the organized retail and online channels along with the commercial interior upgrades.

Restraining Factors

The usage of premium wallpapers and their installation is being limited by their high costs. The price of the raw materials affects the quality and so does the humidity. The most significant threat to wallpapers is still a competition from cheap paints. The consumer perception of wallpaper as an old thing, VOC regulations, and limited eco, friendly options being combined, are the factors that slow down the market growth.

Market Segmentation

The India Wallpaper Market share is categorized by product type, distribution channel, and end user.

- The vinyl wallpapers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Wallpaper Market Size is segmented by product type into vinyl wallpapers, nonwoven wallpapers, paper wallpapers, fabric wallpapers, and others. Among these, the vinyl wallpapers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Vinyl wallpaper is an ideal way to keep your home looking good and protecting your walls from moisture, which is passed through the walls by the high humidity levels found in most of India. The low cost of Vinyl Wallpaper, along with a wide variety of textures and designs available in many of India's major metropolitan areas, allows for a high amount of both residential renovations and commercial projects to be completed with Vinyl Wallpaper due to high demand for its long-lasting, low-maintenance properties.

- The offline retail segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Wallpaper Market Size is segmented by distribution channel into offline retail and online platforms. Among these, the offline retail segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The majority of wallpaper purchases are made through a physical retail location. This allows consumers to see and feel the texture of the wallpaper before they buy it, as well as providing the ability to consult with a professional about what will look best in a certain area of the home or workplace. The availability of professional installation services and the availability of products in large bulk sizes allows for easy delivery to both metropolitan and tier-two cities across India, particularly for the high number of middle-class homebuyers and many interior designers working on projects.

- The residential segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Wallpaper Market Size is segmented by end user into residential and commercial. Among these, the residential segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Residential demand is driven by increasing home renovation trends, DIY décor projects, and personalization preferences. Consumers use wallpapers to enhance aesthetics in living rooms, bedrooms, and kitchens. Urbanization, higher disposable income, and lifestyle modernization motivate homeowners to adopt versatile, easy-to-install, and eco-friendly wallpaper options.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The India Wallpaper Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Marshalls Wallcoverings

- Nilaya by Asian Paints

- Elementto Lifestyle Wallcoverings Pvt. Ltd

- Excel Wallcoverings

- D’Decor Home Fabrics Pvt. Ltd.

- Wallskin (UDC Homes / Green Apple Design Pvt. Ltd)

- Goodrich Global India Pvt. Ltd.

- Murlidhar Decor Pvt. Ltd.

- Muraspec India Wallcoverings Pvt. Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In March 2025, Asian Paints Ltd has launched Nilaya Anthology, a place to experience premium wall coverings and curated interiors under the Nilaya brand name in Mumbai. The addition of luxury wall coverings and design installations to the experience of home owners, designers and professionals allows users to see the possibilities when using luxury wall coverings. Asian Paints Ltd is providing the opportunity for consumers to become more engaged with the market by offering quality wallpapers and reinforcing the emphasis placed on the way a person experiences their interior environment in India

• In February 2025, Nilufar Gallery makes its India debut at Nilaya Anthology by Asian Paints, primarily displaying both vintage and modern design pieces that are part of the varying collections of various designers, along with wallpaper and textile displays that have been curated. The collaboration has brought the influence of international design to the wall covering landscape of India, while at the same time expanding the exposure to new aesthetics for the user and promoting design excellence in the Indian wallpaper industry.

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Wallpaper Market based on the below-mentioned segments:

India Wallpaper Market, By Product Type

- Vinyl Wallpapers

- Non-Woven Wallpapers

- Paper Wallpapers

- Fabric Wallpapers

- Others

India Wallpaper Market, By Distribution Channel

- Offline Retail

- Online Platforms

India Wallpaper Market, By End User

- Residential

- Commercial

Frequently Asked Questions (FAQ)

-

What is the India wallpaper market size?India wallpaper market size is expected to grow from USD 174.6 million in 2024 to USD 475.6 million by 2035, growing at a CAGR of 9.54% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by lifestyle modernization, rising disposable incomes, urbanization, home renovation trends, DIY décor adoption, eco-friendly wallpapers, technological innovations like quick-install and custom patterns, and expanding organized retail and online channels.

-

What factors restrain the India wallpaper market?Constraints include high costs of premium wallpapers, raw material price volatility, humidity-induced durability issues, competition from cheaper paint alternatives, consumer perception of wallpaper as outdated, VOC regulations, and limited eco-friendly options.

-

How is the market segmented by product type, distribution channel, and end user?The market is segmented by product type into Vinyl, Non-Woven, Paper, Fabric, and Others; by distribution channel into Offline Retail and Online Platforms; and by end user into Residential and Commercial.

-

Who are the key players in the India wallpaper market?Key companies include Marshalls Wallcoverings, Nilaya by Asian Paints, Elementto Lifestyle Wallcoverings Pvt. Ltd, Excel Wallcoverings, D’Decor Home Fabrics Pvt. Ltd., Wallskin (UDC Homes / Green Apple Design Pvt. Ltd), Goodrich Global India Pvt. Ltd., Murlidhar Decor Pvt. Ltd., and Muraspec India Wallcoverings Pvt. Ltd.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

-

What are the recent developments in the India wallpaper market?In March 2025, Asian Paints Ltd launched Nilaya Anthology in Mumbai, an immersive design space showcasing premium wallcoverings and décor experiences, enhancing market engagement. In February 2025, Nilufar Gallery debuted in India at Nilaya Anthology, integrating vintage and contemporary designs with curated wallpapers, elevating design standards in the market.

Need help to buy this report?