India Virtual Reality Headset Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Hardware, Software, and Services), By Application (Gaming & Entertainment, Education, Healthcare, Retail, Industrial & Manufacturing, and Others), By End User (Individual Consumers, Enterprises, and Government & Defence), and India Virtual Reality Headset Market, Insight, Industry Trend, Forecasts to 2035

Industry: Electronics, ICT & MediaIndia Virtual Reality Headset Market Insights Forecasts to 2035

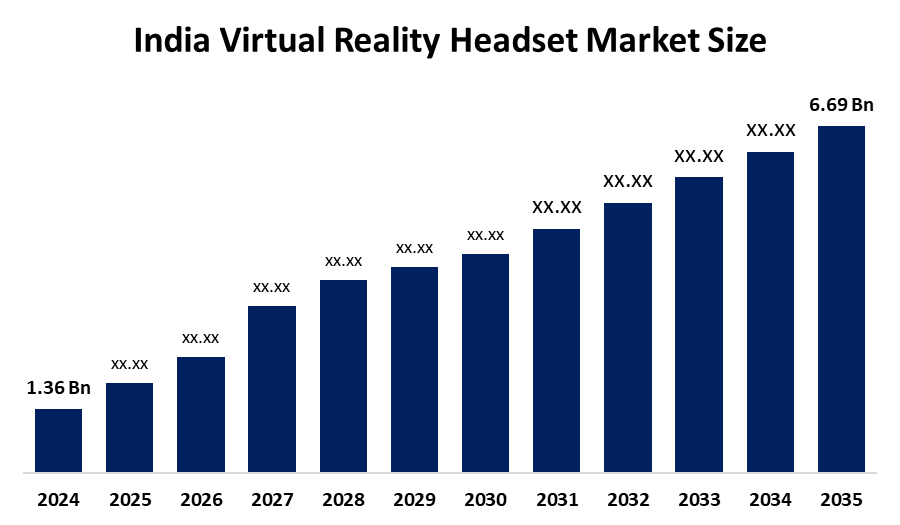

- India Virtual Reality Headset Market Size 2024: USD 1.36 Billion

- India Virtual Reality Headset Market Size 2035: USD 6.69 Billion

- India Virtual Reality Headset Market CAGR: 15.58%

- India Virtual Reality Headset Market Segments: Product Type, Application, and End User

Get more details on this report -

The virtual reality (VR) headset industry mainly comprises companies that produce and sell the wearable devices, which are capable of generating immersive digital environments. A virtual reality (VR) headset is a type of head-mounted device (HMD) that is worn over the eyes and completely covers them in order to block out the real world and replace it with a simulated, 3D, computer-generated environment. Customers use such devices for various purposes, like playing highly immersive games, practicing surgeries or pilot training in an absolutely safe environment, attending virtual classes, experiencing the buildings even before they are constructed, preparing workers for dangerous tasks, and even helping patients to relax, control pain, or get rid of their fears. Virtual Reality (VR) is revolutionizing how we interact with digital content by blending the physical and digital worlds. This specialized training program is designed to equip learners with the skills and tools needed to design, develop, and deploy immersive VR applications.

Reliance Jio invested US$ 15 million in two Silicon Valley-based startups focused on the VR sector. The Prime Minister of India inaugurated Pradhan Mantri Sangrahalay (PM Museum) in New Delhi. Indian startup, Tagbin, along with other technology partners, digitised the museum at an estimated cost of US$ 40 million (Rs. 300 crore) by leveraging technologies such as AR/VR. In India, smartphone penetration was 54% in 2020 and is expected to reach 96% by 2040, further improving access to VR-based technologies. IIT Guwahati is developing India's first VR-enabled metaverse platform, Gyandhara, for PM SHRI schools in Assam. In collaboration with the Ministry of science and Technology and the Assam government, the project will be piloted in 56 schools, offering immersive learning in maths, science, and social science for classes 8 to 12.

Latest innovations are bringing to the market such products as wireless and lighter headsets, ultra-sharp displays, eye and hand tracking, mixed reality passthrough, AI-driven interactions, and more affordable standalone devices, all of which contribute to increased comfort and realism. Opportunities are booming across sectors such as gaming, healthcare training, education, virtual meetings, real estate tours, industrial safety, therapy, and enterprise collaboration, as the business world and educational institutions embrace VR to enable cost-effective training, facilitate remote work, and deliver immersive customer experiences.

Market Dynamics of the India Virtual Reality Headset Market:

The market is mainly influenced by the following factors that is firstly, there has been an increase in the demand from the gaming, entertainment, education, and healthcare sectors for more realistic training and interactive experiences which is thus, leading to an increased demand for VR headsets; moreover, several technological advancements such as high, resolution displays, enhanced motion tracking, wireless designs, and reduction in the prices of the hardware, are making VR headsets more comfortable, affordable, and widely used not only among consumers but also in the enterprise sectors.

The virtual reality (VR) headset market is subject to numerous restricting aspects that hinder its development. High upfront costs for the devices and the requirement of powerful supporting hardware limit the uptake among consumers who are sensitive to prices. Discomfort at a physical level, such as nausea, eye strain, and short battery life, also discourage long, term usage.

Concerning the competitive landscape, the share of the Indian virtual reality market indicates that major and minor companies have been set up in the country. Besides, the focus on increased investments in such products and the backing of the government have made it possible for the enterprises to offer unique virtual reality experiences. As digital engagement deepens, VR technology is increasingly seen as an integral part of next-generation entertainment solutions, pushing its adoption across various segments, from mainstream gaming to high-budget film productions.

India Virtual Reality Headset Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.36 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 15.58% |

| 2035 Value Projection: | USD 6.69 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product |

| Companies covered:: | AjnaLens, SmartVizX, Dimension NXG, Tata Consultancy Services, Infosys, Tech Mahindra, Wipro, Zensar Technologies, Carmatec IT Solutions, Whodat, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Virtual Reality Headset market share is classified into product type, application, and end user.

By Product Type:

The India virtual reality headset market is divided by product type into hardware, software, and services. Among these, the hardware segment controlled the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hardware segment dominated due to VR headsets, which are essential for accessing virtual reality, and growing sales of standalone, wireless, and affordable devices drove market revenue.

By Application:

The India virtual reality headset market is divided by application into gaming & entertainment, education, healthcare, retail, industrial & manufacturing, and others. Among these, the gaming & entertainment segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment dominance is driven by high demand from young consumers, growth of immersive gaming and VR zones, wider content availability, and increasing access to affordable VR headsets across India.

By End User:

The India virtual reality headset market is divided by end user into individual consumers, enterprises, and government & defence. Among these, the individual consumer segment accounted for the highest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This growth is supported by the fact that most VR headset purchases were for personal use in gaming, entertainment, and media. Rising interest in immersive experiences, affordable devices, and accessible VR content fueled strong demand and market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India virtual reality headset market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Virtual Reality Headset Market:

- AjnaLens

- SmartVizX

- Dimension NXG

- Tata Consultancy Services

- Infosys

- Tech Mahindra

- Wipro

- Zensar Technologies

- Carmatec IT Solutions

- Whodat

- Others

Recent Developments in India Virtual Reality Headset Market:

In September 2024, VIVE Focus Vision launched its new cutting-edge headset. The new Extended Reality (XR) headset is the latest in HTC VIVE's highly popular VIVE Focus Series, with a wealth of improvements and new features to give gamers and enterprise users alike the best possible immersive experience for PCVR and standalone gaming, as well as Location-Based Experiences (LBE), industrial training, collaboration, and mixed reality applications.

In May 2024, India launched a Mixed Reality headset under the scheme of Make in India with novelty.

For instance, Indian pioneers in Extended Reality (XR), AjnaLens, recently announced that their AjnaXR Pro headset is now designed, developed, and manufactured in India. This marks an unprecedented move in the technology industry for the country, where Indian tech is standing alongside foreign giants on a global scale.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India virtual reality headset market based on the below-mentioned segments:

ndia Virtual Reality Headset Market, By Product Type

- Hardware

- Software

- Services

India Virtual Reality Headset Market, By Application

- Gaming & Entertainment

- Education

- Healthcare

- Retail

- Industrial & Manufacturing

- Others

India Virtual Reality Headset Market, By End User

- Individual Consumers

- Enterprises

- Government & Defence

Frequently Asked Questions (FAQ)

-

What is the projected size of the India VR headset market?The market is expected to grow from USD 1.36 billion in 2024 to USD 6.69 billion by 2035

-

What is the CAGR for the India VR headset market?It will grow at a CAGR of 15.58% during the forecast period from 2025 to 2035.

-

What are the main product type segments of the India VR headset market?Segments include hardware, software, and services, with hardware dominating in 2024 due to sales of standalone and wireless devices

-

Which application segment leads the India VR headset market?Gaming & Entertainment holds the largest share in 2024, driven by demand from young consumers and immersive content availability.

-

What end-user segment has the highest market share?Individual consumers lead in 2024, fueled by personal use in gaming, entertainment, and media consumption

-

What drives growth in the India VR headset market?Key drivers include demand from gaming, education, and healthcare; tech advancements like high-resolution displays and wireless designs; and rising smartphone penetration (from 54% in 2020 to 96% by 2040).

-

What are the main challenges for the India VR headset market?High costs, need for powerful hardware, physical discomfort (like nausea and eye strain), and short battery life limit adoption

Need help to buy this report?